The trading code is $ETH.

Wall Street is experiencing a highlight moment for cryptocurrencies.

Traditional Finance (TradFi) is running out of growth narrative resources. Artificial Intelligence has become the market's hot spot, but attention to it has been excessive, and software companies are no longer as attractive as they were in the 2000s and 2010s.

At a deeper level, growth investors who raise capital for innovative stories and Total Addressable Market (TAM) know well that most AI-related companies are valued at ridiculous premium levels, and other so-called "growth" narratives are no longer easy to find. The once-revered FAANG stocks are gradually transforming into "high-quality, profit-maximizing, medium-growth" composite assets.

For example, the median Enterprise Value to Revenue (EV/Rev) multiple for software companies has dropped below 2.0 times.

At this moment, cryptocurrencies enter the stage.

Bitcoin ($BTC) breaks through its historical high point, the US President strongly promotes our assets at a press conference, and a wave of regulatory benefits brings the cryptocurrency asset class back into the spotlight for the first time since 2021.

BTC, COIN, HOOD, CIRCLE vs. SPY and QQQ (Source: Artemis)

This time, the protagonists are not Non-Fungible Tokens and Doge. This time, it's the era of digital gold, stablecoins, "tokenization", and payment reform. Stripe and Robinhood are claiming that cryptocurrencies will be their next core growth focus; $COIN (Coinbase) successfully joins the S&P 500 index; Circle shows the world that cryptocurrencies are attractive enough to make growth stocks ignore earnings multiples again.

But how is this related to $ETH?

For us crypto natives, the smart contract platform domain looks very fragmented. There's Solana, Hyperliquid, and dozens of emerging high-performance blockchains and Rollups (on-chain scaling solutions).

We know Ethereum's leading position has truly been challenged, and it faces an existential threat. We also know it has not yet solved the value capture problem.

But I highly doubt Wall Street understands these nuances. In fact, I can boldly say that most Wall Street investors know almost nothing about Solana. If we're honest, XRP, Litecoin, Chainlink, Cardano, and Dogecoin probably have higher external market recognition than $SOL. After all, these people have been indifferent to the entire crypto asset class for years.

What Wall Street knows is that $ETH represents the "Lindy Effect" (indicating that things that have long existed are more likely to continue existing), has been battle-tested, and has been the primary "beta investment choice" for $BTC over the years. Wall Street sees that $ETH is the only other crypto asset with a liquidity ETF. Wall Street is passionate about upcoming catalysts and classic relative value investing.

Those suit-wearing investors may not know much about cryptocurrencies, but they know that Coinbase, Kraken, and now Robinhood have all decided to "build on Ethereum". With minimal due diligence, they can discover that Ethereum has the largest stablecoin pool. They will start calculating "moon mathematics" and quickly realize that while $BTC has reached a historical new high, $ETH is still over 30% below its 2021 peak.

You might think the relative underperformance looks pessimistic, but these people have different investment approaches. They are more willing to buy assets with lower prices and clear objectives, rather than chasing high assets that make them question whether they have "missed the opportunity".

I believe they have arrived. Investment authorization is not an issue; any fund can drive crypto exposure through appropriate incentives. Although Crypto Twitter (CT) has claimed for over a year that they won't touch $ETH, the trading code has performed consistently well over the past month.

As of this year, $SOLETH has dropped nearly 9%. Ethereum's market dominance bottomed in May and has since created its longest upward trend since mid-2023.

If the entire Crypto Twitter (CT) has marked $ETH as a "cursed coin", why is it still performing excellently?

The answer is: It's attracting new buyers.

Since March this year, spot ETF capital inflows have been consistently unidirectional.

Similar to $ETH Microstrategy clones are heavily adding positions, introducing early structural leverage to the market.

Perhaps some crypto natives realize their $ETH exposure is insufficient and are starting to rebalance positions, possibly exiting from the outstanding performers of the past two years, $BTC and $SOL, to layout Ethereum.

I'm not saying Ethereum has solved its existing problems. I think what might happen at this stage is that $ETH as an asset begins to decouple from the Ethereum network itself.

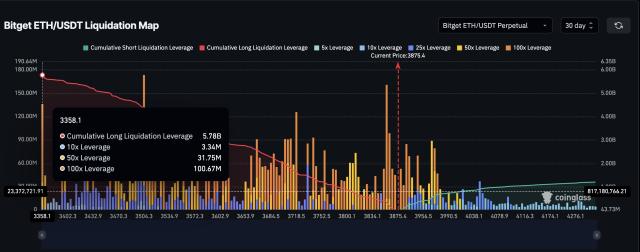

External buyers are driving a paradigm shift in the $ETH asset, challenging our inherent perception that it "will only decline". Shorts will eventually be forced to close. Then, native crypto capital will start chasing the trend until a comprehensive speculative frenzy about $ETH appears in the market, ending with a spectacular top.

If all this really happens, then the All-Time High (ATH) won't be too far away.

Click to learn about BlockBeats job openings

Welcome to join the BlockBeats official community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Communication Group: https://t.me/BlockBeats_App

Twitter Official Account: https://twitter.com/BlockBeatsAsia