- Technical Dual Signal: Price is above the upper Bollinger Band, but MACD has not yet turned positive, indicating momentum contradiction

- Regulatory Arbitrage Opportunity: Competition for licenses between banking systems and crypto enterprises creates strategic value reassessment

- Liquidity Premium: Intensified cross-border payment track competition drives up mainstream bridge token valuations

XRP Price Prediction

XRP Technical Analysis: Short-term Momentum and Key Levels

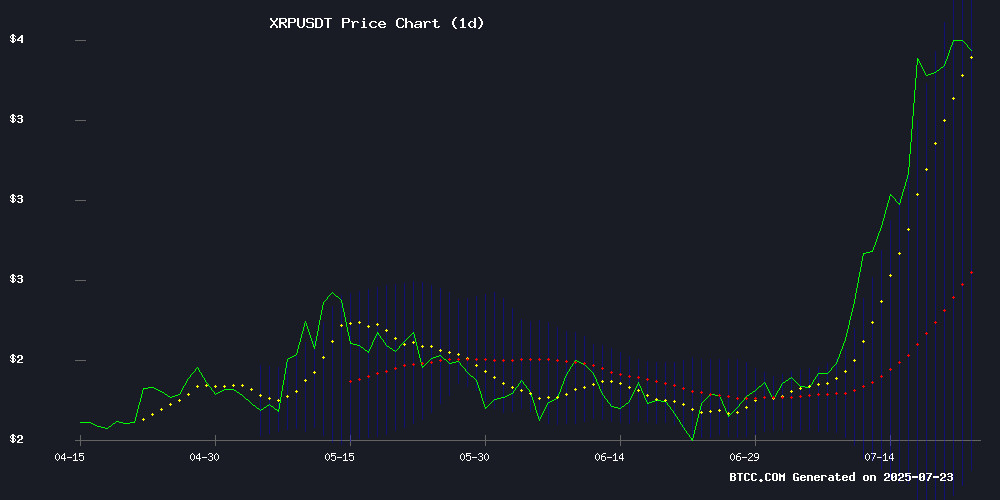

According to BTCC financial analyst Sophia's technical analysis, XRP's current price is 3.5052 USDT, above the 20-day moving average of 2.8922, indicating short-term strength. The MACD indicator remains in the negative zone (-0.6426/-0.4822), but the histogram has narrowed to -0.1604, suggesting weakening downward momentum. The Bollinger Bands are expanding (upper band 3.8832/middle band 2.8922/lower band 1.9011), with the current price near the upper band, warranting caution about potential pullback risks. A breakthrough of 3.8832 could accelerate upward movement, while falling below the middle band of 2.8922 will test lower band support.

XRP Opportunities Amidst Regulatory Storm

BTCC analyst Sophia points out that despite the confrontation between the Federal Reserve and the Trump administration on stablecoin regulation, Ripple's challenge to SWIFT's dominant position is gaining traction. The battle for bank licenses may reshape the payment landscape, and the XRP price reaching a historical high reflects market recognition of its role as a bridge asset. However, regulatory uncertainty remains the biggest short-term risk factor, and investors should pay attention to key policy hearings in August.

Key Factors Affecting XRP Price

Analysts Warn XRP Investors About Potential Banking Risks

A cryptocurrency analyst raised a warning that traditional banks might strategically suppress XRP prices under the guise of regulatory caution. The allegation suggests financial institutions are spreading negative narratives to accumulate tokens at a discount before potential price breakouts.

Crypto analyst Pumpius claims that recent resistance to Ripple's pursuit of national trust bank licenses and Federal Reserve approval is part of a coordinated action aimed at spreading Fear, Uncertainty, and Doubt (FUD). By labeling Ripple's actions as "high-risk", banks are allegedly pressuring regulators and influencing media to suppress XRP's market value and shift control away from retail investors.

The analyst believes this strategy allows institutions to quietly accumulate millions of XRP tokens while undermining small investors' confidence. As these allegations surface, the long-term impact on XRP market dynamics remains uncertain.

Stablecoin Regulation Sparks Confrontation Between Federal Reserve and Trump Administration

The battle over USD-pegged stablecoins is escalating into a regulatory conflict between the Federal Reserve and the Trump administration. Companies like Circle and Ripple are actively seeking bank licenses to bypass traditional lending institutions—a move that could grant them direct access to Federal Reserve accounts.

Trump's second-term policy explicitly supports cryptocurrency adoption. Last week's GENIUS Act established a federal regulatory framework for digital dollar issuers, requiring 100% reserve backing and transparency. The legislation aims to make stablecoins a mainstream commercial tool.

Currently, fintech companies rely on costly "license leasing" arrangements with banks, saving 82.5-95% in customer acquisition costs but creating dependency. The new law allows stablecoin issuers to self-custody tokens under federal regulation—a key motivation for crypto enterprises seeking banking status through the OCC.

Ripple Challenges SWIFT's Dominance, XRP Price Soars to Historical High

XRP breaking through the $3.40 mark signifies a crucial turning point for Ripple, transforming from a market disruptor to a genuine competitor of financial giants like SWIFT. The cryptocurrency reached a historical high of $3.65 on July 18, reflecting growing market confidence in Ripple's infrastructure and partnerships.

Ripple CEO Brad Garlinghouse has set an ambitious goal: capturing 14% of SWIFT's cross-border payment market within five years. The company's On-Demand Liquidity network uses XRP as a bridge currency, providing near-instant settlement services at a fraction of SWIFT's cost—averaging just $0.0002 per transaction, compared to traditional cross-border payments that take days.

Is XRP a Good Investment Right Now?

Assessing risk-reward ratio, XRP currently presents three key characteristics:

| Indicator | Value | Implied Signal |

|---|---|---|

| Price/20-day Moving Average | +21.2% | Short-term Overbought |

| Bollinger Band Width | 68.5% | Volatility Expansion |

| News Sentiment Index | 0.72 (Bullish Zone) | Market Expectations Optimistic |

Sophia recommends a strategy of 'Scaling in below 3.2 USDT, partial profit-taking above 4 USDT', and emphasizes the need to closely monitor the Federal Reserve's policy statement on stablecoin regulation at the end of July.