Title: '24 Industry Experts Predict ETH Will Reach $4,300 by Year-End'

Author: Richard Laycock

Translated by: TechFlow

Key Points

2025 Price Prediction: Experts predict an average Ethereum price of $4,308 by the end of 2025.

Peak and Trough Predictions: Significant volatility expected in the remainder of 2025, with an average peak prediction of $4,746 and a low point prediction of only $1,940.

Long-term Outlook: Experts believe Ethereum will continue to rise, expecting a price of $10,882 by 2030 and reaching $22,374 by 2035.

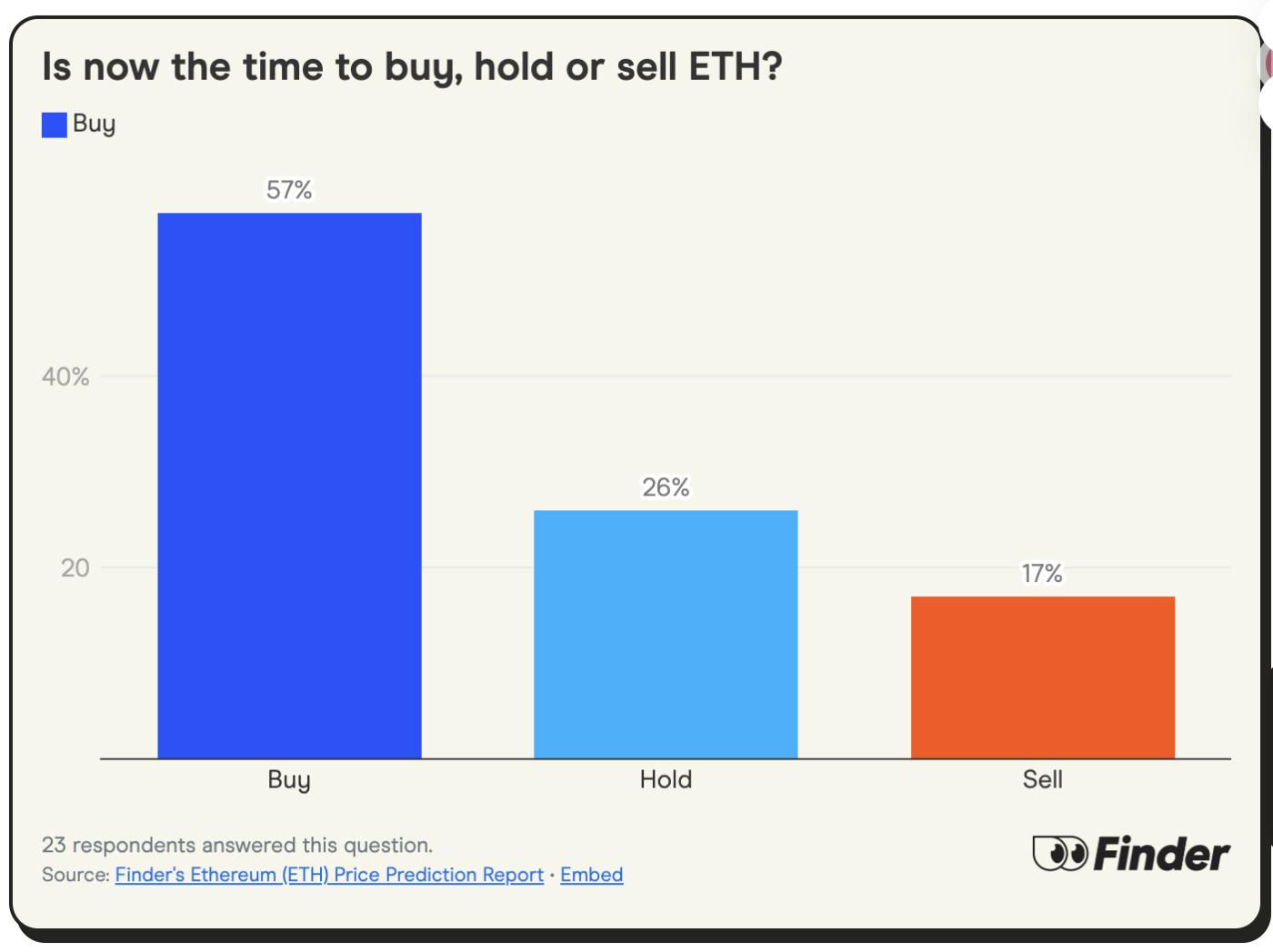

Should You Buy ETH: Most experts (57%) believe now is a good time to purchase Ethereum.

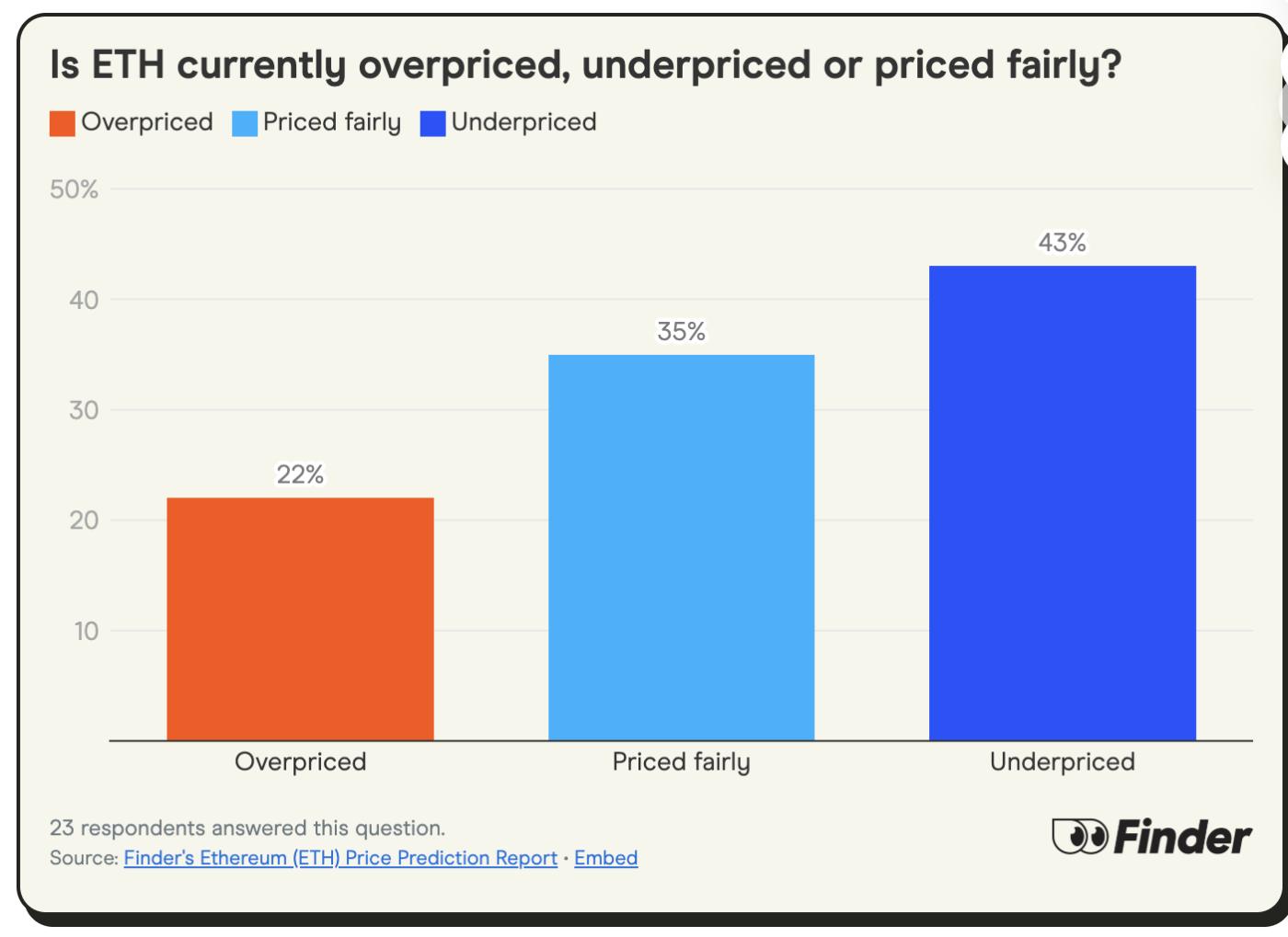

Is Ethereum Undervalued: Nearly half of the experts (43%) believe Ethereum is currently undervalued.

Disclaimer: This article does not constitute financial advice or a recommendation for digital assets or services. Digital assets are highly volatile and risky, and past performance does not indicate future results. Potential regulatory policies may affect their availability and related services. Consult a professional financial advisor before investing. Finder and the authors may hold the cryptocurrencies mentioned in the article.

Finder conducts quarterly expert price predictions. In late June 2025, we surveyed 24 crypto industry experts to understand their views on Ethereum (ETH) performance through 2035.

All prices mentioned in this report are calculated in US dollars.

The expert panel averages predict Ethereum's price will reach $4,308 by the end of 2025, rising to $10,882 by the end of 2030, and further climbing to $22,374 by 2035.

Ethereum (ETH) Price Prediction: 2025, 2030, and 2035 Outlook

[The rest of the translation follows the same professional and accurate approach, maintaining the specific cryptocurrency terminology as instructed.]

Is Now the Best Time to Buy, Hold, or Sell Ethereum (ETH)?

Ethereum is currently trading below its January 2025 peak, which may prompt 57% of experts to believe now is a good time to buy Ethereum; 26% of experts recommend holding, while 17% advocate selling.

Ruslan Lienkha, Market Director at YouHodler, believes Ethereum is an asset worth buying because it is the leading blockchain for stablecoin issuance.

Ethereum remains the leading blockchain for stablecoin issuance and non-financial applications in the broader economy. At the same time, it is still the second-largest cryptocurrency by market cap and is generally considered more decentralized compared to its closest competitors.

Miles Paschini, CEO of FV Bank, suggests holding ETH because it "remains the dominant decentralized network and has strong usage across multiple domains and Layer 2 support."

Joseph Raczynski, a futurist at JT Consulting & Media, also supports holding, stating:

70% of stablecoin transactions occur in the Ethereum ecosystem, including the top two stablecoins: Circle's USDC and Tether's USDT. With the passage of the GENIUS Act, most US companies will have new channels to attract more users. This is an underestimated critical moment that will have significant positive implications for Ethereum (ETH) in the future.

Desmond Marshall, Managing Director of Rouge International and Rouge Ventures, suggests that ETH should be sold, with no positive comments about the token.

"ETH has been consistently disappointing. Regardless of market conditions, its price has always hovered around a maximum of $2,600. I have been outspoken that ETH is heavily manipulated; it does have functionality as a token... but as a financial asset, it has no value."

Is Ethereum (ETH) Currently Overvalued, Undervalued, or Fairly Valued?

About 43% of the expert panel believes Ethereum is currently undervalued, 35% think the price is reasonable, and 22% believe it is overpriced.