Ethereum's treasury should essentially enjoy a higher mNAV premium, thanks to Ethereum's native yield mechanism. These activities can generate recurring "yields" or increase the per-share Ethereum value without incremental capital. In contrast, Bitcoin treasury companies must rely on synthetic yield strategies (such as issuing convertible bonds or preferred shares). Without these institutional products, it would be difficult to justify yields when the Bitcoin treasury's market premium approaches net asset value.

Most importantly, mNAV has reflexivity: a higher mNAV enables treasury companies to more effectively raise funds through market pricing. They issue stocks at a premium and use the proceeds to purchase more underlying assets, thereby increasing the per-share asset value and reinforcing this cycle. The higher the mNAV, the more value can be captured, making market issuance particularly effective for Ethereum treasury companies.

The ability to obtain capital is another key factor. Companies with deeper liquidity and stronger financing capabilities naturally enjoy a higher mNAV, while companies with limited market access tend to trade at a discount. Therefore, mNAV typically reflects a liquidity premium - the market's confidence in the company's ability to effectively obtain more liquidity.

How to Screen Treasury Companies from First Principles

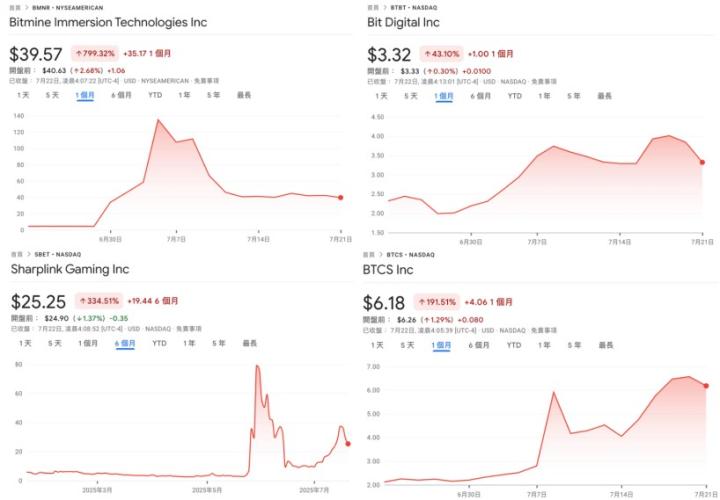

A useful mental model is: viewing market issuance as a way to raise capital from retail investors, while convertible bonds and preferred shares are typically designed for institutional investors. Therefore, the key to a successful market issuance strategy is building a strong retail base, which often depends on having a credible and charismatic leader and ongoing transparency around the strategy to make retail investors believe in the long-term vision. In contrast, successfully issuing convertible bonds and preferred shares requires strong institutional sales channels and relationships with capital market departments. Based on this logic, I believe SBET is a stronger retail-driven company, mainly due to Joe Lubin's leadership and the team's consistent transparency in ETH accumulation. Meanwhile, BMNR, under Tom Lee's leadership and closely connected to traditional finance, seems more capable of leveraging institutional liquidity.

Why Ethereum Treasury is Important for the Ecosystem and Competitive Landscape

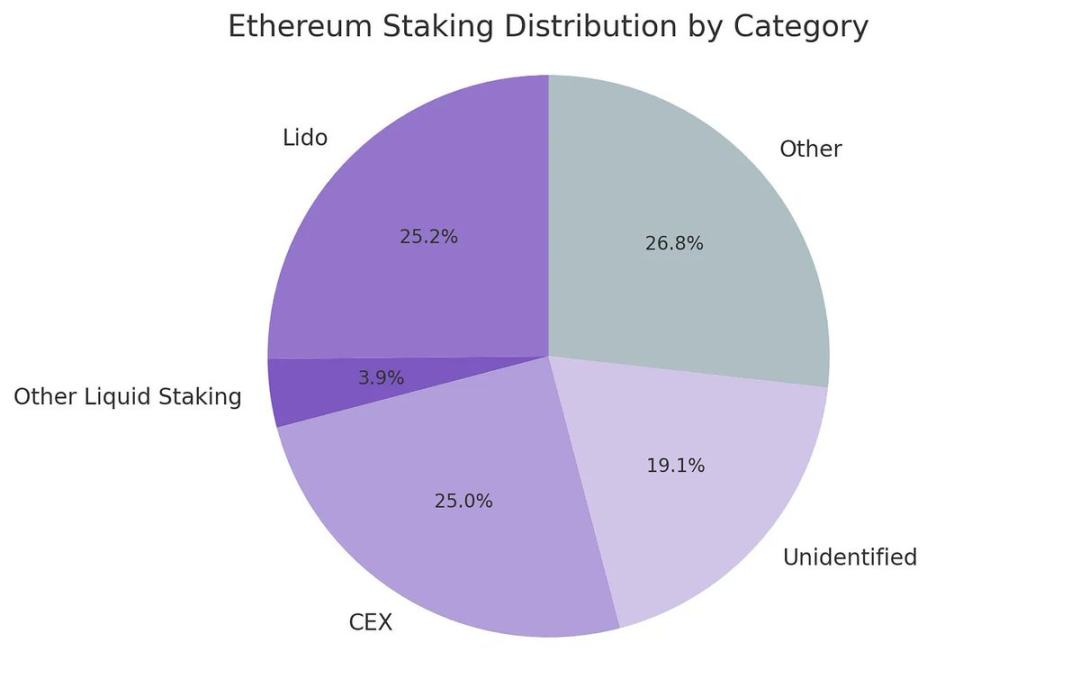

One of the biggest challenges Ethereum faces is the increasing centralization of validators and ETH staking, primarily manifested in liquid staking protocols like Lido and centralized exchanges like Coinbase. Ethereum treasury companies help balance this trend and promote validator decentralization. To support long-term resilience, these companies should distribute their Ethereum across multiple staking providers and become validators themselves when possible.

Figure 5: Staking Distribution by Category Source: Artemis

In this context, I believe the competitive landscape of Ethereum treasuries will differ significantly from Bitcoin treasury companies. In the Bitcoin ecosystem, the market has evolved into a winner-takes-all scenario, with Strategy holding ten times more Bitcoin than the second-largest holder. Benefiting from first-mover advantage and strong narrative control, it also dominates the convertible bond and preferred share markets.

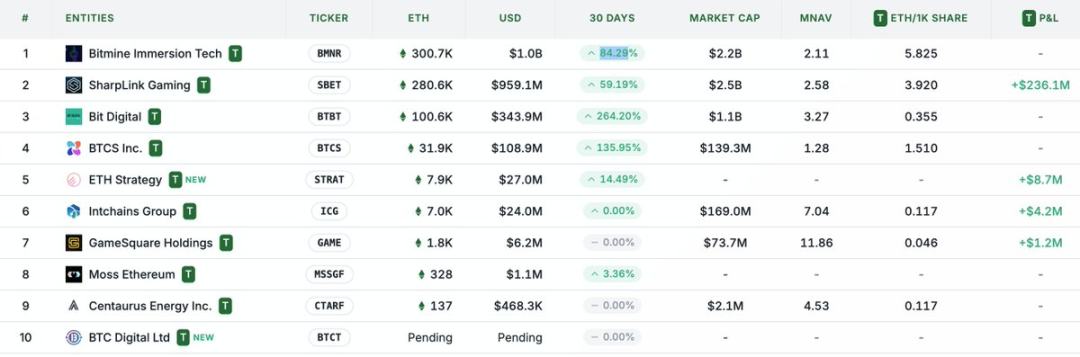

In contrast, Ethereum treasury strategies are just beginning. No single entity has established a dominant position; instead, multiple Ethereum treasuries are being launched in parallel. This state without first-mover advantage is not only healthier for the network but also cultivates a more competitive and accelerated market environment. Given that the main participants' Ethereum holdings are relatively close, I believe a duopoly with SBET and BMNR advancing together is possible.

Figure 6: Ethereum Treasury Company Holdings Source: strategicethreserve.xyz

Valuation: A Combination of Strategy and Lido

Broadly speaking, the Ethereum treasury model can be viewed as a fusion of Strategy and Lido, designed for traditional finance. Unlike Lido, Ethereum treasury companies have the potential to capture a larger share of asset appreciation because they hold the underlying assets, making this model far superior in value accumulation.

From a rough valuation perspective: Lido currently manages about 30% of total staked Ethereum, with an implied valuation exceeding $30 billion. We believe that within a market cycle (4 years), the total scale of SBET and BMNR could potentially exceed Lido, thanks to the speed, depth, and reflexivity of traditional financial capital flow - as demonstrated by Strategy's growth strategy.

As a reference: Bitcoin's market cap is $2.47 trillion, while Ethereum's is $428 billion (about 17%-20% of Bitcoin). If SBET and BMNR reach around 20% of Strategy's $120 billion valuation, this means their long-term value is approximately $24 billion. Today, their total valuation is slightly below $8 billion, indicating significant growth potential as Ethereum treasuries mature.

Conclusion

The fusion of cryptocurrency and traditional finance through digital asset treasuries represents a major transformation, with Ethereum treasuries now becoming a powerful force. Ethereum's unique advantages give Ethereum treasury companies distinctive growth potential. Their potential to promote validator decentralization and foster competition further distinguishes them from Bitcoin treasuries. Combining Strategy's capital efficiency with Ethereum's built-in yields will unlock tremendous value and drive the on-chain economy to integrate more deeply with traditional finance. Rapid expansion and growing institutional interest suggest that this will have a transformative impact on cryptocurrency and capital markets in the coming years.