Written by: BitpushNews

Do you remember the frenzy of DeFi in 2020? Four years have passed, and the once-hot "Farming" tide has gradually receded, while a deeper revolution is quietly unfolding. It doesn't rely on high annual yields or dazzling innovative gameplay—instead, it moves real-world gold, bonds, and funds onto the chain, opening the door to "blockchain transforming Wall Street".

Its name is: RWA (Real-World Assets) Tokenization.

In 2025, this sector once questioned as "overly idealistic" is disrupting the global financial landscape at an unprecedented speed. This article will break down how the most traditional Wall Street players are gradually going All In on blockchain.

Goldman Sachs Partners with BNY Mellon: Traditional Finance Moves from "Testing Waters" to "Diving In"

Recently, Goldman Sachs and BNY Mellon jointly launched a plan for a "Mirror Tokenized Money Market Fund (MMF)", officially announcing the blockchain "mirroring" of some traditional fund shares.

What is Mirror MMF?

Simply put, it involves generating a 1:1 mapped digital token (Mirror Token) through Goldman's private chain (GS DAP) for money market fund shares held by investors in the real world. These tokens cannot be freely transferred but can be used for collateral, trading, and settlement.

BNY's LiquidityDirect platform will serve as the entry point for investors to subscribe and redeem. Behind this, fund giants including BlackRock, Fidelity, Federated Hermes, and BNY Dreyfus will also participate in the pilot.

This is not a "trial", but the first time in US history that fund managers have actively issued tokenized shares on the blockchain. It's a landmark institutional breakthrough.

Goldman Sachs Global Head of Digital Assets Mathew McDermott stated: "In the future, MMF shares can be directly traded on-chain, used as collateral, enabling real-time settlement in global markets."

Real-World Assets on Chain Have Reached $25 Billion!

We might not have realized: RWA is no longer just a "new concept", but the fastest-growing track in DeFi with the most capital inflow.

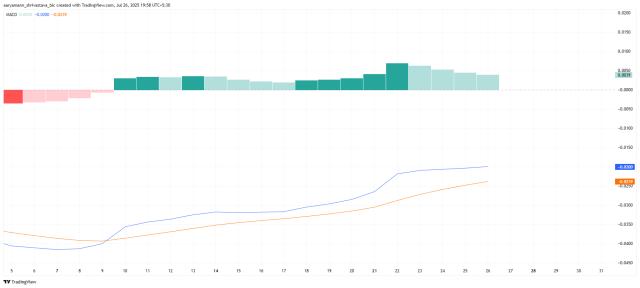

- In January 2024, RWA's total market value was only $8.5 billion

- By July 2025, it has exceeded $25 billion

- Year-on-year growth over 194%, with a nearly 5-fold increase in three years!

This is not just a trend in a small sector, but a "infrastructure migration" of the entire financial industry.

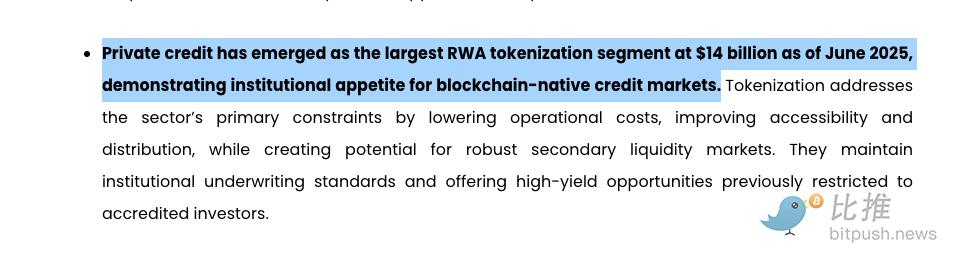

The largest sector is—Private Credit.

According to RedStone data, as of mid-2025, private credit accounts for 60% of the entire RWA market, approximately $15 billion, becoming the most core structure of on-chain real-world assets.

The Big Players Are Unreasonable, Directly "Throwing Money" In!

Goldman Sachs and BNY are not isolated cases.

BlackRock

Launched the world's largest RWA product—BUIDL (BlackRock USD Digital Liquidity Fund), with current assets of $2.24 billion, using on-chain issuance and settlement, primarily allocating funds to US Treasury bonds.

Apollo Private Equity

Brought bond fund assets on-chain, collaborating with Securitize and Gauntlet, focusing on stable returns and risk modeling.

Citigroup & Fidelity

At the end of 2024, jointly released a proof-of-concept product for tokenized MMF, supporting multi-currency and cross-chain asset settlement in seconds.

UBS

Even earlier in 2024, launched the first tokenized investment fund product, being one of the first traditional European banks to enter.

These are not "PoC (Proof of Concept)" stages, but are truly operational.

Why is RWA Becoming So Hot?

- Stable returns, volatility-resistant: During bear markets or unstable markets, on-chain US bonds, credits, and fund products offer stable returns of 4-6% annually, far higher than stablecoin staking.

- Regulatory-friendly: Compared to anonymous, highly volatile native DeFi assets, RWA is more closely integrated with compliance, attracting many institutions.

- Rich on-chain uses: RWA can be used as collateral, participate in lending, do liquidity farming, etc., introducing new "blue-chip assets" to DeFi protocols.

- Solid underlying assets: On-chain RWA is backed by real assets like Treasury bonds, real estate, funds, and credits, not "air coins".

In the Next Five Years, RWA Might Become a $10 Trillion Market?

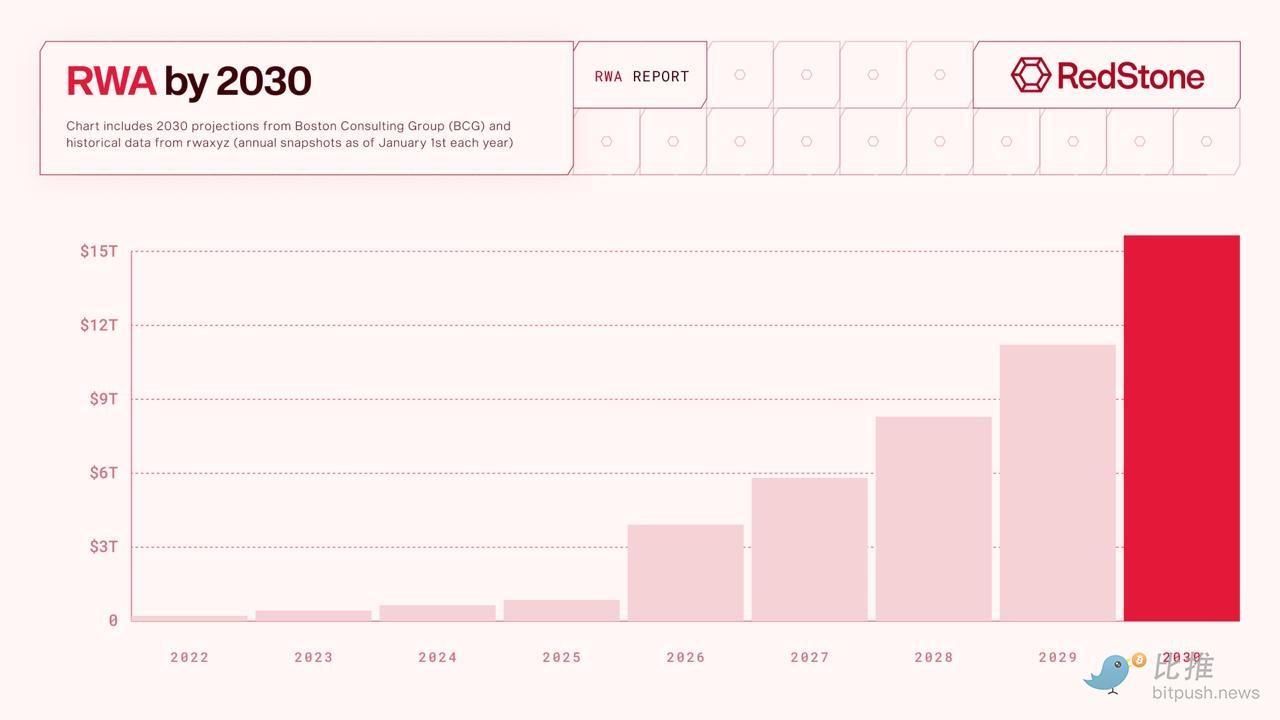

According to a joint prediction by Boston Consulting Group (BCG) and 21Shares:

By 2030, the real-world asset tokenization market will exceed $16 trillion, with $10 trillion potentially circulating on-chain.

This includes various assets such as bonds, funds, real estate, commodities, carbon credits, insurance, invoices, and private equity. Currently, the total market value of global traditional financial assets is about $900 trillion.

In other words, RWA is one of the most "certain futures" recognized by both the blockchain world and traditional finance.

Finally: The Next Step in On-Chain Finance is Not "DeFi Farming", But "Blockchain Transforming Wall Street"

Past blockchain booms were more driven by retail investor sentiment, while today's RWA revolution is backed by the collective entry of institutions like Goldman Sachs, BlackRock, Apollo, Fidelity, Citigroup, and UBS.

They tell us in the most realistic way: Whether in bull or bear markets, capital only looks in one direction—whether assets are real, markets are efficient, and rules are safe.

And RWA tokenization happens to hit the intersection of these three points.

This storm is still in its early stages. Today's $25 billion is likely just the prologue.

Whoever goes on-chain first will control the future of finance.