- XRP's current price is slightly above the 20-day moving average, which may provide short-term support.

- The MACD indicator shows that downward momentum is weakening, but remains negative overall.

- Market sentiment is mixed, and investors should be cautious about volatility.

XRP Price Prediction

XRP Technical Analysis: Current Trend and Future Outlook

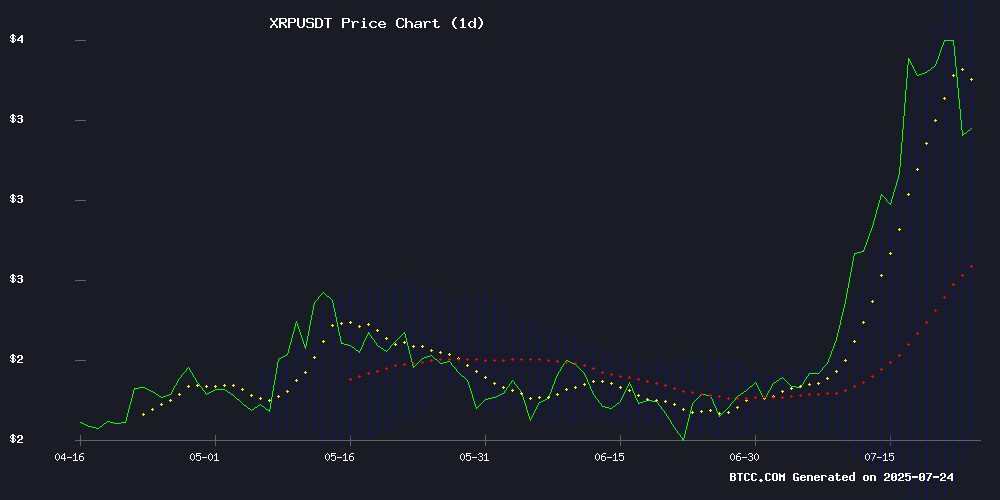

According to BTCC financial analyst John's technical analysis, XRP's current price is 3.1099 USDT, slightly above the 20-day moving average of 2.9206, indicating potential short-term support. The MACD indicator shows a negative value (-0.5918), but the difference (-0.0915) suggests that downward momentum is weakening. The Bollinger Bands show an upper band of 3.8371, a middle band of 2.9206, and a lower band of 2.0040, with the current price near the middle band, indicating a relatively balanced market state.

John noted that if XRP breaks through the upper band of 3.8371, it could potentially initiate a new upward trend; conversely, if it falls below the lower band of 2.0040, it may further decline. In the short term, investors should pay attention to the price performance around the Bollinger Bands' middle band.

Market Sentiment and News Impact: XRP's Short-Term Volatility

BTCC financial analyst John states that recent news about XRP presents a mixed sentiment. Ripple's CEO warned YouTube users about AI-enhanced XRP scams, and the US Banking Association opposed stablecoin companies' trust bank applications, which may negatively impact market sentiment.

However, there are also optimistic voices in the market, such as investors expecting XRP to potentially break $10 in 2025, and increasing momentum for XRP ETF. John believes these news may provide short-term support for XRP prices, but investors should still be cautious about market volatility.

Factors Affecting XRP Price

Ripple CEO Warns: YouTube Users Need to Be Wary of AI-Enhanced XRP Scams

Scammers are using artificial intelligence technology to create realistic voice imitations of Ripple executives on YouTube, targeting unsuspecting cryptocurrency investors. Ripple CEO Brad Garlinghouse issued a stern warning, urging users to report scam content. These scams typically lure victims with free XRP tokens, requiring upfront payments, and have already defrauded millions of dollars.

Despite Ripple's lawsuit against YouTube in 2020, the platform has made no progress in governing crypto-related scams. The current wave of AI-driven scams highlights ongoing content review vulnerabilities. Garlinghouse emphasized: "As always, if it sounds too good to be true, it probably is."

This warning comes at a time of increased XRP market volatility, which typically attracts scam activities. Scammers are now hijacking legitimate YouTube channels to increase the credibility of their schemes, marking a new evolution in crypto scam tactics.

US Banking Association Opposes Stablecoin Companies' Trust Bank Applications

The US Banking Association has formally objected to national trust bank license applications from four stablecoin issuers—Circle, Fidelity Digital Assets, Protego Trust, and Ripple. In a letter to the Currency Supervisory Office, the association cited insufficient public review information as the reason for opposition.

With increased regulatory scrutiny, the Currency Supervisory Office has suspended processing related applications, requesting Hong Kong regulatory authorities to clarify specific details of business plans and information disclosure frameworks. This highlights the ongoing institutional friction between traditional financial systems and digital asset innovators seeking banking infrastructure.

XRP Bulls Claim: Holding 500 XRP Could Be Life-Changing at $100 Target Price

ALPHA Lions Academy founder and XRP supporter Edoardo Farina claims that holding just 500 XRP tokens could potentially change an investor's financial trajectory. Despite the current token price of $3.20 requiring a 3,324% increase to reach his $100 target price, he remains steadfast in this view.

Market analyst EGRAG's more conservative $27 prediction would value 500 XRP at $13,500—a significant return, but unlikely to be transformative. Farina's confident stance contrasts with his previous advice of holding 10,000 XRP for financial freedom, indicating increased confidence in the asset's asymmetric upside potential.

These claims emerge amid ongoing market speculation about XRP's potential to return to 2018 highs. Skeptics question the feasibility of these goals under regulatory pressure, while supporters believe Ripple's institutional adoption could be a catalyst for exponential growth.

XRP Whales Transfer $759 Million in Tokens: What Are Their Intentions?

Significant whale activity was detected on the XRP blockchain, with two large transactions totaling $759 million in the past 24 hours. The cryptocurrency transaction tracking platform Whale Alert reported these movements, emphasizing the potential impact on market sentiment.

The larger transaction involved approximately 200 million XRP, valued at around $700.6 million. Both transactions occurred between unknown wallets, indicating self-custody activities rather than exchange-related operations. Such opaque transfers typically spark speculation about institutional players' strategic accumulation or reallocation.

XRP Price Drops 12%, Trading Volume Surges

Ripple (XRP) price dramatically dropped to $3.05, with a 12.43% decline in 24 hours, while trading volume surged 124% to $16.36 billion. This divergence indicates traders are actively adjusting positions in preparation for the next market trend.

Although XRP is still up 3% this week with a market cap of $180 billion, altcoins showed mixed performance during this trading period. Story, LEO, and Kucoin tokens led the gains, while meme coins like dogwifhat and utility tokens including JasmyCoin performed poorly.

Market dynamics reflect fund allocation shifts rather than rising overall hedging sentiment. Massive trades at key support levels suggest institutional investors are buying XRP at lower prices.

Angel Investor Predicts: XRP May Exceed $10 by 2025 with Regulatory Clarity

Renowned crypto angel investor Dennis Liu (alias VIRTUAL Bacon) predicts XRP could reach $10 by 2025 under continued regulatory progress and practical application. The Ripple-SEC lawsuit settlement for $50 million and the Genius Act's market clarity have altered XRP's development trajectory. Unlike previous cycles, this rally has substantial institutional momentum.

Google and YouTube search data show retail interest in XRP significantly surpassing BTC and ETH. Liu notes this will trigger price surges and has deployed algorithmic trading robots targeting the $1.45 to $6 range, aligning with XRP's current $2.70 price stage.

As XRP ETF Momentum Strengthens, Pepe Meme Coin Presale Attracts Market Attention

After ETF speculation caused recent volatility, XRP price has stabilized. ProShares Ultra XRP ETF opened institutional investment channels, with trading volume doubling daily average when price dropped to $3.42, indicating strong demand. The token currently fluctuates between $3.40 and $3.56.

With US legislators passing three crypto-focused bills, regulatory tailwinds may ease long-standing uncertainties. The $3.56 resistance remains crucial, though institutional buying appears to establish solid support at $3.40. Market participants expect increased spot market activity as ETF adoption progresses.

Meanwhile, Pepeto (Pepe) meme token project has generated significant discussion during its presale across multiple platforms. This community-driven project emphasizes safety features and viral appeal, priced at $0.00000142 with a total supply of 420 trillion tokens.

Is XRP a Good Investment?

According to BTCC financial analyst John, XRP's current technical indicators show a relatively balanced market, but mixed news may cause short-term volatility. Investors should closely monitor price performance near the Bollinger Band midline and market sentiment changes.

| Indicator | Value |

|---|---|

| Current Price | 3.1099 USDT |

| 20-day Moving Average | 2.9206 |

| MACD | -0.5918 |

| Bollinger Band Upper | 3.8371 |

| Bollinger Band Lower | 2.0040 |

Overall, XRP may be suitable for investors with higher risk tolerance, but position management should be cautious.