Recently, we have all witnessed the surge of ENA, with its price skyrocketing and attracting significant attention, rising at an astonishing speed.

However, what most people haven't realized is that the main catalyst has yet to appear, which is the fee switch.

The Rise of a New Stablecoin Giant

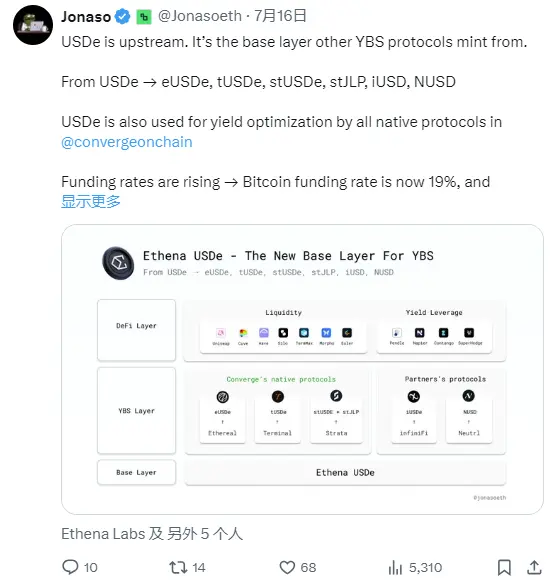

In less than a year, the USDe supply has risen from 0 to over $6 billion, surpassing Dai to become the third-largest decentralized stablecoin, second only to USDT and USDC.

The annual yield of sUSDe has reached 10%, becoming the highest sustainable yield in the current crypto space. The surge in yield is driving aggressive arbitrage strategies on Aave and other decentralized platforms.

Financing rates continue to rise, with the current Bitcoin financing rate at 19% and Ethereum at 12%, marking the first time both have broken the 11% benchmark in six months.

Ethena's weekly income reached $7.8 million, with an expected annual income of over $400 million. Even with a conservative estimate, there is room for growth. Currently, Ethena has transferred 41% of its stablecoin reserves into higher-yield perpetual contract strategies, with the market average funding rate reaching 14%.

The higher annual yield simultaneously meets the key conditions for enabling the ENA fee switch: sUSDe's yield must be at least 5% higher than the current Sky savings rate (currently 4.5%), a milestone that has now been confirmed.

Market Macro Perspective: Federal Reserve Rate Cut and Ethena Stablecoin Strategy

Ethena's business model stems from market volatility and high funding rates of perpetual contracts.

Unlike traditional stablecoins (such as USDC or USDT) that rely on Treasury interest, Ethena's income comes from its neutral hedging strategy: long spot and short perpetual contracts.

When funding rates are high, Ethena can generate more income. Because of this, many anticipate that if the Federal Reserve begins to cut rates as predicted by the end of 2025, Ethena will gain even more revenue.

In fact, after the most recent rate cut in December 2024, Ethena set a new monthly revenue record of $12 million.

Ecosystem Growth and Strong Indicators

Ethena has rapidly risen to become a top-ranked DeFi protocol in TVL, currently breaking through $6 billion, while achieving nearly $400 million in revenue, ranking among the most profitable DeFi projects.

Three flagship products are helping expand the Ethena ecosystem

- Ethereal: A decentralized perpetual contract exchange, with a TVL of about $712 million.

- Terminal: A liquidity center focused on tokenized assets, currently with a TVL of nearly $129 million.

- Strata: Structured yield products, with a TVL of $13 million.

Meanwhile, Ethena is expanding across multiple chains.

The trading volume of USDe on Bybit has exceeded USDC (5.4 billion vs 4.44 billion)

On the TON network, the TVL of stablecoin USDe has reached $87 million in just six weeks.

Institutional Capital and Token Buyback

Recently, Ethena announced a partnership with the fund management company StablecoinX. StablecoinX plans to list under the stock ticker USDE on the Nasdaq.

This round of financing attracted well-known crypto VCs such as Pantera, Dragonfly, and Wintermute, raising $360 million.

Of this, $260 million will be used for ENA buybacks through the open market in the next six weeks, absorbing nearly 8% of the token's circulating supply.

StablecoinX will permanently incorporate ENA into its balance sheet for long-term holding, aiming to reduce the token's market circulation to support the protocol's long-term development.

Fee Switch: The True Catalyst

Although the above factors have driven ENA's rise, the true catalyst has yet to appear, which is the fee switch.

Despite strong market performance, the ENA and sENA tokens currently lack a direct mechanism to capture this value.

To address this issue, the Wintermute governance team has submitted a proposal to launch the fee switch mechanism, aimed at allowing token holders to share the revenue.

This mechanism will enable sENA holders to receive a share of the protocol's income. In other words, it will create actual value for token holders, making ENA more than just a governance token.

To activate the fee switch, Ethena needs to meet 5 conditions. As of July 2025, 4 of the 5 conditions have been met:

- USDe supply exceeds $6 billion

- Cumulative income over $250 million

- 1% reserve fund of total supply

- Spread ≥ 5%

The only remaining condition is to list USDe on Binance or OKX (the token is already listed on Bybit, MEXC, and Bitget).

Once this final step is completed, the fee switch can be enabled, at which point sENA holders will begin to receive a portion of Ethena's project revenue.

Based on Ethena's current revenue levels, token holders can obtain very competitive yields.

Conclusion

With the fee switch activated, ENA will take off immediately.