Currently, eight major Korean banks are establishing a joint venture to jointly issue a Korean won stablecoin. The participating institutions include Kookmin Bank, Shinhan Bank, Woori Bank, Agricultural Cooperative Bank, Korea Development Bank, Water Cooperative Bank, and the Korean branches of Citibank and Standard Chartered. The project is jointly promoted by the eight banks, the Open Blockchain and Decentralized Identity Association, and the Financial Supervisory Service. If approved by regulators, it is expected to go online by the end of this year or early next year.

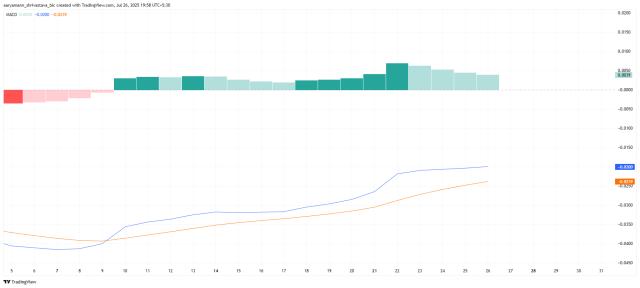

However, the current regulatory environment remains uncertain. According to Four Pillars Research Director 100y.eth's analysis, Korea is currently experiencing a stablecoin bubble, with no clear regulatory guidance. Financial news almost daily reports banks or companies applying for stablecoin-related trademarks, with related listed company stock prices typically rising 15%-30% on the same day.

Thailand: Policy Unlocked, Cautious Exploration

Policy Progress Speed: ★★★

Thailand's stablecoin policy has gradually shifted from early wariness to cautious pilot testing. As early as 2021, the Thai Central Bank initiated stablecoin regulatory exploration and issued preliminary guidelines. Stablecoins pegged to the Thai baht are viewed as "electronic money" regulated under the Payment Systems Act, with relevant institutions needing to consult the central bank for approval before issuance; stablecoins pegged to foreign currencies (such as USDT, USDC) are not prohibited but require further regulation.

A true turning point occurred in 2024. In August, Thailand established a regulatory sandbox, allowing specific service providers to experiment with cryptocurrencies

In 2025, the pilot scope accelerated expansion:

- In January, the Thai Minister of Finance stated at the Securities and Exchange Commission meeting that the government is considering issuing a stablecoin backed by 10 billion baht in government bonds.

- In March, the Thai Securities and Exchange Commission (SEC) approved USDT and USDC as tradable assets in the country's regulated exchanges.

- In July, the SEC and BOT jointly launched a "national crypto sandbox", allowing foreign tourists to exchange digital assets (such as USDT, USDC) for Thai baht through licensed platforms for tourism consumption.

In March 2025, the Japanese Financial Services Agency promoted the "Payment Services Law Amendment of 2025", optimizing the stablecoin issuance mechanism: allowing trust-type stablecoins to use up to 50% of reserve assets for specific low-risk tools, such as short-term government bonds or time deposits. The law also adds a special registration category for crypto intermediaries, lowering the threshold for over-the-counter trading.

Russia: Mainly Exploratory, Still Limiting External Use

Policy Progress Speed: ★★

Russia's attitude towards stablecoins has significantly changed in recent years, shifting from initial caution and opposition to limited support, primarily driven by strategic needs for cross-border settlement and an autonomous financial system under geopolitical pressure.

In 2022, the Russian Central Bank had pushed for a comprehensive ban on cryptocurrencies. However, a key policy shift occurred in July 2024. The Russian Federal Assembly passed two bills, officially legalizing cryptocurrency mining and allowing enterprises approved by the central bank to use crypto assets, including stablecoins, for international settlements with foreign partners. However, in the domestic domain, cryptocurrencies remain prohibited as a means of payment.

In March 2025, the Russian Central Bank issued a proposal to allow "specially qualified" high-net-worth individuals and certain enterprises to invest in crypto assets during a three-year pilot period, exploring a more transparent and controlled market environment.

Outside the policy context, Ivan Chebeskov, head of the Digital Financial Assets Department of the Ministry of Finance, publicly stated that Russia should consider launching a national sovereign stablecoin to adapt to global payment system evolution trends.

United Kingdom: Regulatory Advancement in Progress

Policy Progress Speed: ★★

The UK policy is currently at a critical junction transitioning from framework design to legislative implementation. The relevant regulatory system is based on the "Financial Services and Markets Act 2023", supplemented by secondary legislation and regulatory guidelines from the Financial Conduct Authority (FCA) and the Bank of England (BoE). The bill was granted royal assent on June 29, 2023, for the first time incorporating "digital settlement assets" (including stablecoins) into the legal scope of regulated financial activities.

In November 2023, the UK Financial Regulatory Authority announced regulatory requirements for companies issuing or custodying fiat-backed stablecoins. The proposed framework will seek to apply several existing regulatory standards currently applicable to many FCA-authorized entities to the stablecoin activity domain.

In April 2025, the UK government released a consultation document on cryptocurrency legislation, planning to add regulated activities, including operating crypto asset trading platforms and stablecoin issuance.

Despite continuous regulatory progress, the Bank of England's governor has demonstrated a more conservative stance. Governor Andrew Bailey has repeatedly stated publicly that widespread stablecoin adoption might undermine public trust in the national currency and even pose systemic risks to the financial system.

(Translation continues in the same manner for the remaining text)Welcome to join the Web3Caff official community: X(Twitter) Account丨Web3Caff Research X(Twitter) Account丨WeChat Reader Group丨WeChat Official Account