The market rhythm these days has been quite intense.

BTC's 4-hour chart has been pressed to the lower end of oscillation, with 115,000 becoming a critical support. If it fails to hold, it might retest 112,000. However, to be honest, I'm not worried. Such short-term adjustments are just technical washouts in the larger cycle and won't significantly impact the overall trend in the second half of the year. Instead, each deep squat is a good opportunity to layout leading assets in the medium term.

I'm now very clear: #BTC, #ETH, buy the dips until you're no longer panicked. As for Altcoins, choose projects with clear logic, funding attention, and established position foundations, and don't blindly buy the dips.

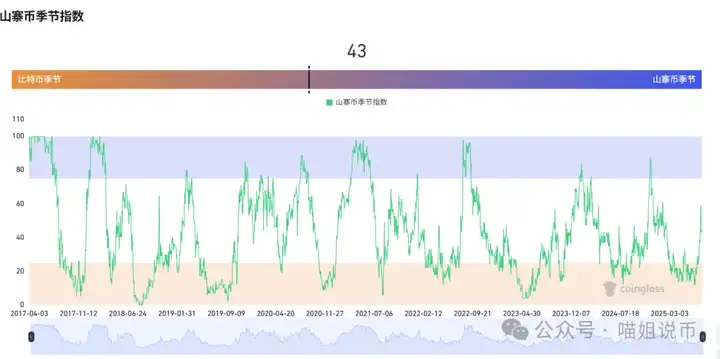

Altcoin Season Preheating: Is it time to All In?

Altcoins have indeed been a bit restless recently, with several old faces pulling up. But is the "Altcoin Season" truly here? I think it's not quite there yet. A real Altcoin Season depends on three conditions: Bitcoin's dominance decreasing, funds clearly flowing to Altcoins, and market sentiment comprehensively heating up. Currently, these are only slightly fluctuating, at most a "preview". On-chain activity, mainstream exchanges' listing pace, and some Altcoin ETFs and MEME coin explosion points are worth continuous attention.

In my own operations, I'm still cautiously testing the waters, waiting for BTC to confirm stability before boldly attacking. ETF data doesn't lie: Funds are speaking, don't just look at prices. Although BTC, ETH, and SOL have been retracing these days, ETF fund flows haven't stopped:

- ETH Spot ETF had a single-day net inflow of $231 million;

- SOL ETF also recorded a $13.4 million net inflow.

This indicates that even with price drops, main funds haven't left the market but are adding positions during market panic, showing that everyone hasn't lost confidence in the bull market. Often, this "decline + inflow" combination is a prelude for smart money to enter.

Considering the current market, it's most likely that a true "takeoff window" will come after the market is mostly cleared in August and September. Spot players can slowly layout during this oscillation period.

TRON Rings the Bell, Injective Launches Tokens, Blockchain Isn't Lacking Excitement

#TRON rang the bell at NASDAQ, which is not just a honor for their team but a step towards a compliant financial system for the entire industry. For users, stricter regulation means safer assets; for the entire crypto space, this is a positive statement of "mainstreaming".

Meanwhile, #Injective has been busy, tokenizing SharpLink's stock and creating a "Ethereum Reserve Tracking + RWA Token Vault" combination. The biggest highlight of such projects is building a bridge between traditional assets and on-chain finance, with immense future potential.

XRP: Dead Cat Bounce or Resilient Counterattack?

#XRP experienced a rollercoaster yesterday, dropping to $2.96 before quickly rebounding to $3.11. Honestly, this trend looks like both a rebound and a bull trap.

Technically, XRP's RSI is neutral to strong, MACD is contracting but hasn't formed a death cross, price is above the 20-day line, but volume is insufficient, overall showing an oscillating rebound pattern. First support at 2.90, resistance at 3.27 and 3.66, with breakthrough potentially exploring new highs.

Fundamentally, XRP wallet count has exceeded 7.2 million, with increasing ecosystem participation. However, recent frequent fraud incidents have dampened market sentiment. In the short term, I recommend treating it as a high-volatility coin, primarily high selling and low buying. Long-term, if it stabilizes around 3.27, it might continue exploring upwards.

Let's look at on-chain MEME:

Forget about Old Horse's AI Three Musketeers, further pulling will be limited. #ANI peaked without breaking previous highs, and its heat is quickly fading. Although he's still the on-chain meme king, current liquidity is shrinking too fast, marketing effectiveness is declining, and there are too many coins with quality not keeping up. I started reducing positions after yesterday's daily line change and recommend those holding $ANI, #RUDI, #VAL to sell during the rebound. The next hot spot will definitely be more exciting than these old plates, don't blindly hold faith waiting for billions.

That's it for the article! If you're feeling lost in the crypto space, consider joining me in layout and harvesting from market makers! You can join the community via WeChat+QQ group for market analysis, Altcoin operations... WeChat: c13298103401 or QQ: 3806326575