Written by: pony

Recently, the discussion on virtual asset regulation in Hong Kong has entered deep waters. Given that many customers and friends are very concerned about the second round of consultation on virtual asset custody and OTC (VA Dealing) at the end of August, Aiying, based on communication with relevant departments and informed sources, can share some of the latest information in advance: Currently, all practitioners must prioritize two key pieces of information that will determine the future of their business:

- Clear Timeline:

The official launch and implementation of the virtual asset custody bill is expected to take approximatelyone and a half years. This is a clear preparation window period for enterprises to plan in advance. - No Unified Transition Period:

Unlike some previous regulations, this legislation is expected to not establish a unified statutory transition period. This means that on the day the bill takes effect, unlicensed institutions must cease related business. The only "safe channel" is to proactively communicate with the SFC before the bill's release, seeking case-by-case transition period support to ensure smooth business continuity.

During this critical window period, Aiying, as one of the bridges connecting the industry and regulators, is committed to helping enterprises develop forward-looking strategies. Based on this context, this article will provide you with a strategic map that combines depth and practicality, guiding you on how to plan your path in the new regulatory landscape and prepare before the bill's implementation.

Part One: Regulatory Framework In-Depth Analysis: The "New Rules" of Hong Kong Virtual Asset Custody

To participate in Hong Kong's virtual asset custody business, one must first thoroughly understand its regulatory framework. This core regulatory blueprint clearly defines market boundaries and entry thresholds.

[The translation continues in this manner, maintaining the specified translations for specific terms and preserving the original formatting.]- Traditional Financial Institutions (such as Standard Chartered Bank):

Their core advantage lies in strong brand reputation, substantial capital, and mature compliance and risk control systems. They primarily target institutional investors who are highly sensitive to risks, establishing trust barriers by providing "bank-level" custody services. Their subsidiary Zodia Custody's layout in Hong Kong is a typical example. - Digital Native Enterprises (such as Fireblocks, bitgo):

Their core advantage is leading technological capabilities and deep industry understanding. They are usually positioned as technical infrastructure providers, offering underlying custody technology solutions for exchanges, funds, and even banks. Their strategy focuses on transforming technological advantages into compliance advantages to meet Hong Kong's strict regulatory requirements. - Virtual Banks (such as ZA Bank):

Their advantage lies in combining the compliance of a bank license with the flexibility of a tech company, particularly excelling in retail user experience and convenient fiat channels. By collaborating with licensed exchanges, such as ZA Bank's partnership with HashKey, they aim to provide one-stop virtual asset services for retail customers and achieve a breakthrough in the retail market.

In the future, the market's ultimate outcome will not be dominated by a single player, but rather a diverse ecosystem of cooperation and competition. In the short term, "grabbing licenses" will be the main theme; in the medium to long term, the market will differentiate, with institutions, technology, and retail markets being led by different types of advantageous players, and cross-industry collaboration will become the norm.

Part Three: Enterprise Compliance Strategy Guide: From Responding to Leading

Facing a clear timeline and strict regulatory requirements, enterprises must develop a comprehensive compliance strategy. Aiying recommends starting from the following aspects to transform compliance challenges into development opportunities.

1. Strategic Planning: From Passive Compliance to Active Communication

Enterprises should first conduct a comprehensive gap analysis, assessing the gaps between existing business models, technological architectures, and internal controls with the new regulations. More critically, they should change from passive waiting to active communication.

Aiying's Core Recommendation: Given that there is no unified transition period after the law takes effect, passively waiting is equivalent to placing the business on the edge of a cliff. Enterprises must transform from passive to active within the next year and a half, establishing effective communication with the SFC to seek individual transition period support.

This is where Aiying will assist enterprises:

- Precisely Interpreting Regulatory Intent:

Transforming complex regulatory provisions into clear business language and executable action items. - Constructing Compliance Narrative:

Helping enterprises sort out and clearly explain their business models, technological architectures, and risk control measures to the regulatory authorities, demonstrating their compliance capabilities and long-term commitment. - Facilitating Effective Dialogue:

Leveraging our long-term communication experience with regulatory authorities to build efficient and professional communication channels for enterprises, ensuring the quality and effectiveness of communication and laying a solid foundation for seeking transition period support.

2. System Building: Creating a Solid Internal Compliance and Risk Control

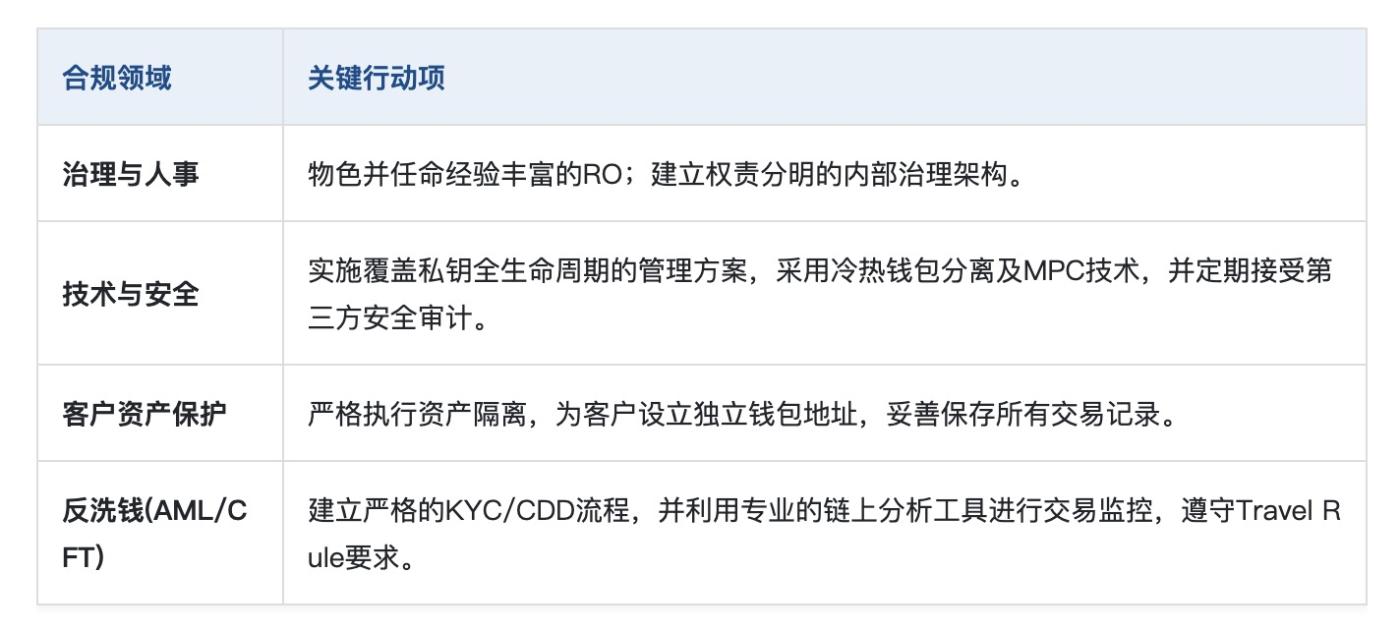

A sound internal system is the cornerstone of obtaining and maintaining a license. Enterprises should focus on building the following areas:

3. Execution and Implementation: Technology Selection and Group Management

At the specific execution level, enterprises need to focus on the selection of technology partners and internal group compliance management. When choosing technology service providers, priority should be given to their depth of understanding of Hong Kong regulations and technical support capabilities. For group companies, a unified group compliance standard must be established, and responsibilities of each legal entity must be clarified through service level agreements (SLA), ensuring that all key operational personnel meet the SFC's regulatory requirements.

Conclusion: Embrace Regulation and Welcome New Opportunities

Although the regulatory framework established by Hong Kong for virtual asset custody services brings challenges, more importantly, it creates unprecedented certainty and opportunities. By introducing the core element of "trust," it paves the way for institutional funds to enter and lays a solid foundation for the healthy development of the entire virtual asset ecosystem (including spot ETFs, RWA tokenization, etc.). Aiying will continue to stand alongside industry peers, using professional insights and rich experience to welcome a broader future for Hong Kong's virtual asset custody services. The next issue will provide an interpretation of the latest developments in Hong Kong's OTC law and "intelligence," so please stay tuned!

References

Consultation Conclusions on Legislative Proposals to Regulate Virtual Asset Custody Services: https://sc.sfc.hk/TuniS/apps.sfc.hk/edistributionWeb/gateway/TC/consultation/doc?refNo=25CP7