Original Author: Zack Pokorny

Reprint: Oliver, Mars Finance

Original Title: The Most Profitable L2, Why Can Base Earn $180,000 per Day?

Base, built by cryptocurrency exchange Coinbase, is the most revenue-generating platform in the Ethereum Layer2 (L2) network, with daily revenue often exceeding the total of all other top Rollup projects. In the past 180 days, Base's average daily revenue reached $185,291, far surpassing Arbitrum's second-place $55,025.

Clearly, Base has become a platform with sustained high income, but what drives its economic activity? What advantages does Base possess that other leading L2s do not have, enabling it to create such high value?

This report will explore Base's fee structure and highlight the activities driving its revenue growth. We found that Base's sequencing mechanism and decentralized exchange (DEX) activity are key driving factors.

Base's Transaction Sequencing Mechanism

Transaction sequencing on Base is determined by two variables:

Transaction submission time (delay);

Fees paid by the sender relative to transaction complexity (economic incentive).

This mechanism is similar to the operating model of logistics companies like UPS: packages are sent in the order of user delivery, while allowing senders to pay additional fees to choose "expedited" delivery for faster service. The priority fee mechanism creates a dynamic auction market, consistent with Ethereum's EIP-1559 fee model, balancing delivery time with economic incentives.

Specifically, transactions on Base include a "base fee" (lowercase "b", not to be confused with the chain's name) and priority fees: all users must pay a base fee when sending transactions, while priority fees are optional and used only to accelerate transaction execution.

But how do sequencers decide which "expedited" transactions to prioritize? They do not directly consider total fees, but focus on the price per unit of Gas (required computational resources), that is, the cost-effectiveness of the transaction's required resources versus its revenue.

Let's illustrate this again with a logistics company example: Suppose the delivery truck's space is limited (similar to the Block's Gas limit), and the driver (sequencer) wants to maximize tip income within limited space.

A large package with a base freight of $50, but only a $10 priority tip, occupying half the truck space;

A small package with a base freight of only $20, with the same $10 priority tip, occupying very little space.

Although the large package's total fee is $30 higher than the small package, the driver will prioritize loading the small package because its cost-effectiveness in space usage is higher.

Base's sequencer follows the same logic, prioritizing transactions with the highest priority fee per unit of Gas, thereby ensuring that the most "costly" computational resource Block is also the highest-revenue Block. Therefore, when two users submit transactions simultaneously, regardless of transaction complexity or total fees, the user paying a higher priority fee per unit of Gas is more likely to have their transaction prioritized for inclusion in the Block.

[Rest of the translation continues in the same professional manner]

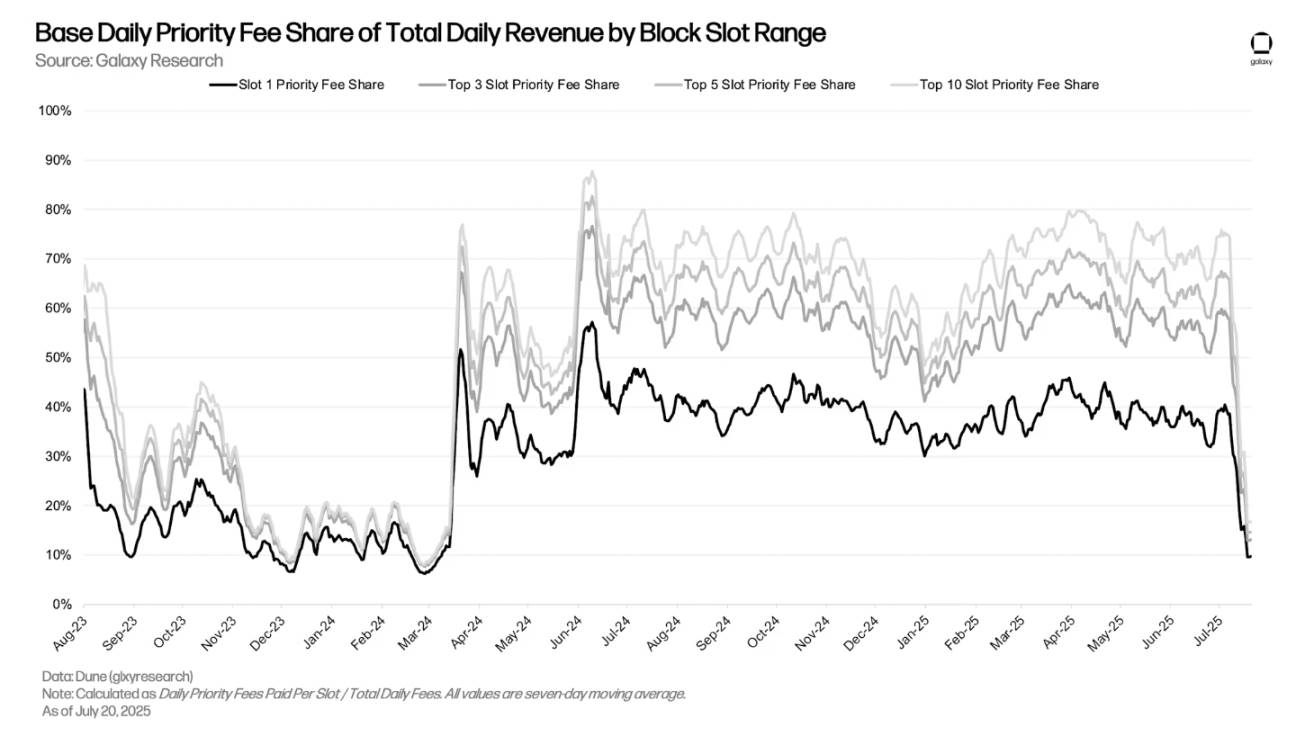

Specifically, the priority fees for the top slot of the Base Block are a significant contributor to the sequencer's revenue, with users competing for positions near the top of the block. Since 2025, priority fees paid by transactions in the first slot of each block have contributed 30% to 45% of daily revenue. Additionally, during the same period, priority fees paid by transactions in the top 10 slots of each block have contributed 50% to 80% of daily revenue. However, in the weeks following July 5th, the share of top slot priority fees in daily total revenue significantly decreased. This is due to two factors: 1) increased traffic driving up the base fee, thereby diluting the proportion of priority fee revenue; 2) the implementation of "Flashblocks" on July 16th (to be detailed below) causing high-priority transactions to fall into lower slots within the block (but, as we will see, this is not necessarily a bad thing).

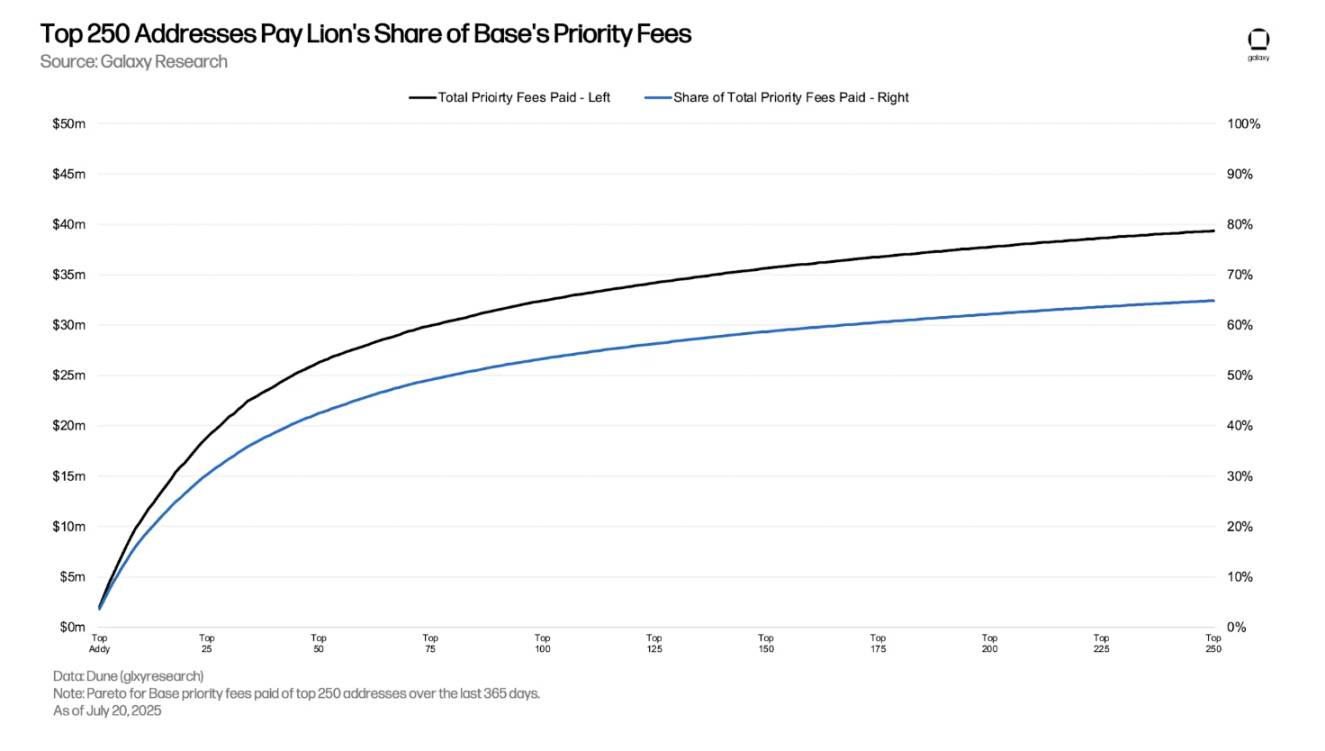

Priority fees primarily come from a small number of addresses, with 64.9% of priority fees originating from just 250 addresses in the past year. The top-ranked address paid 3.6% of all priority fees during this period, equivalent to $1.99 million when calculated at the ETH price at the time of fee payment.

What are Flashblocks?

Developed by Flashbots, Flashblocks aims to improve transaction processing speed on Base. To achieve this, it introduces "sub-blocks," which are high-confidence pre-confirmations of block sub-sections created approximately every 200 milliseconds. For example, a block can contain three different sub-parts, and users can obtain pre-confirmations of these sub-parts before the block is confirmed on-chain at the set 2-second interval. This makes transactions feel almost instantaneous for end-users, even while maintaining the same block intervals on Base, thus providing a smoother and more responsive experience.

Why is this crucial for analyzing Base network fees by slot? From a transaction sorting perspective, each "sub-block" is actually considered a new block. Therefore, high-priority fee transactions might fall into lower slots of the overall "confirmed block" but remain at the top of a "pre-confirmation sub-block".

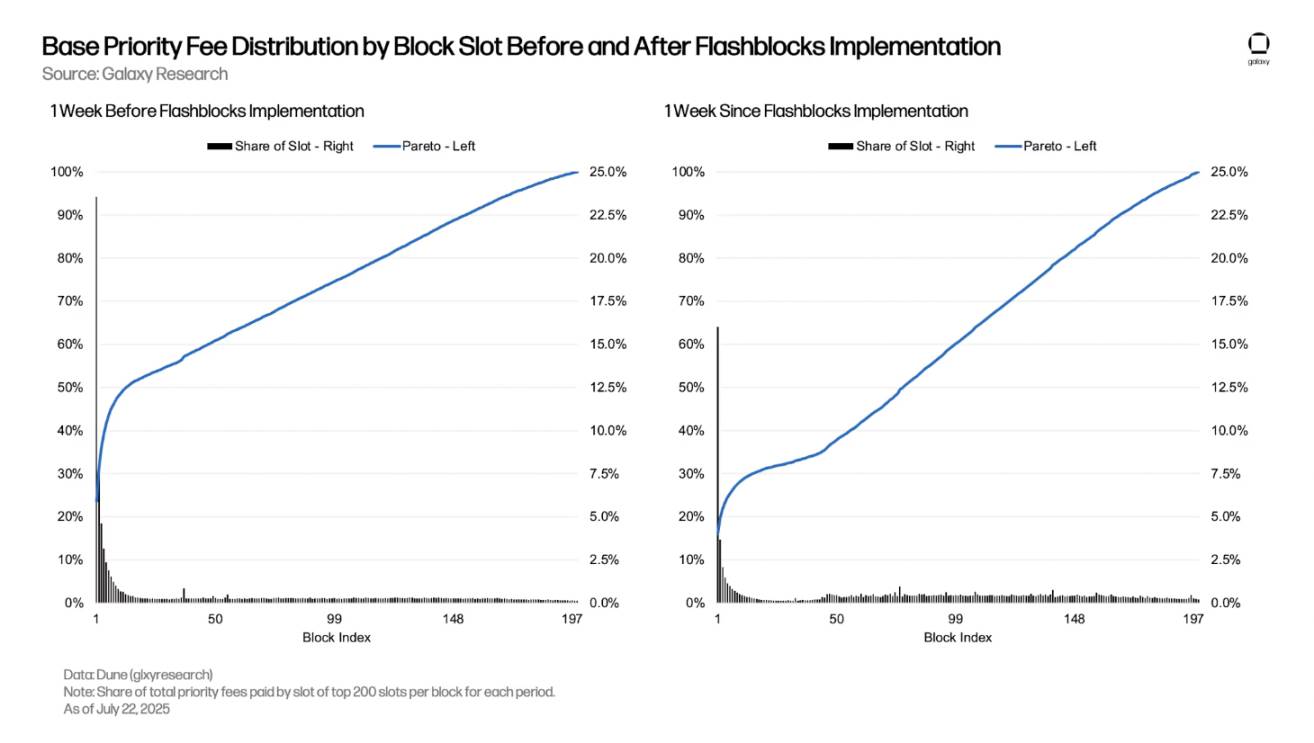

The following image shows the difference in priority fee distribution across the first 200 block slots before and after Flashblocks implementation. The black histogram represents the proportion of priority fees for each slot, while the blue line represents the cumulative proportion of all slots up to that point (Pareto distribution).

In the week before Flashblocks implementation, the Pareto curve rose sharply in the first 10 slots and then grew linearly towards the 200th slot. In contrast, during the week after Flashblocks implementation, the Pareto curve was more gradual at the lowest slots, with a steep rise beginning around the 50th slot of each block - indicating that high-priority fee transactions are falling into later slots within the confirmed block.

Impact of DEX Transactions

DEX activity on Base is highly active. Among all Ethereum L2 networks, Base has the highest daily DEX trading volume, accounting for 50% to 65% of L2 network DEX trading volume, and its DEX Total Value Locked (TVL) is the highest among all L2 networks (excluding perpetual futures DEX).

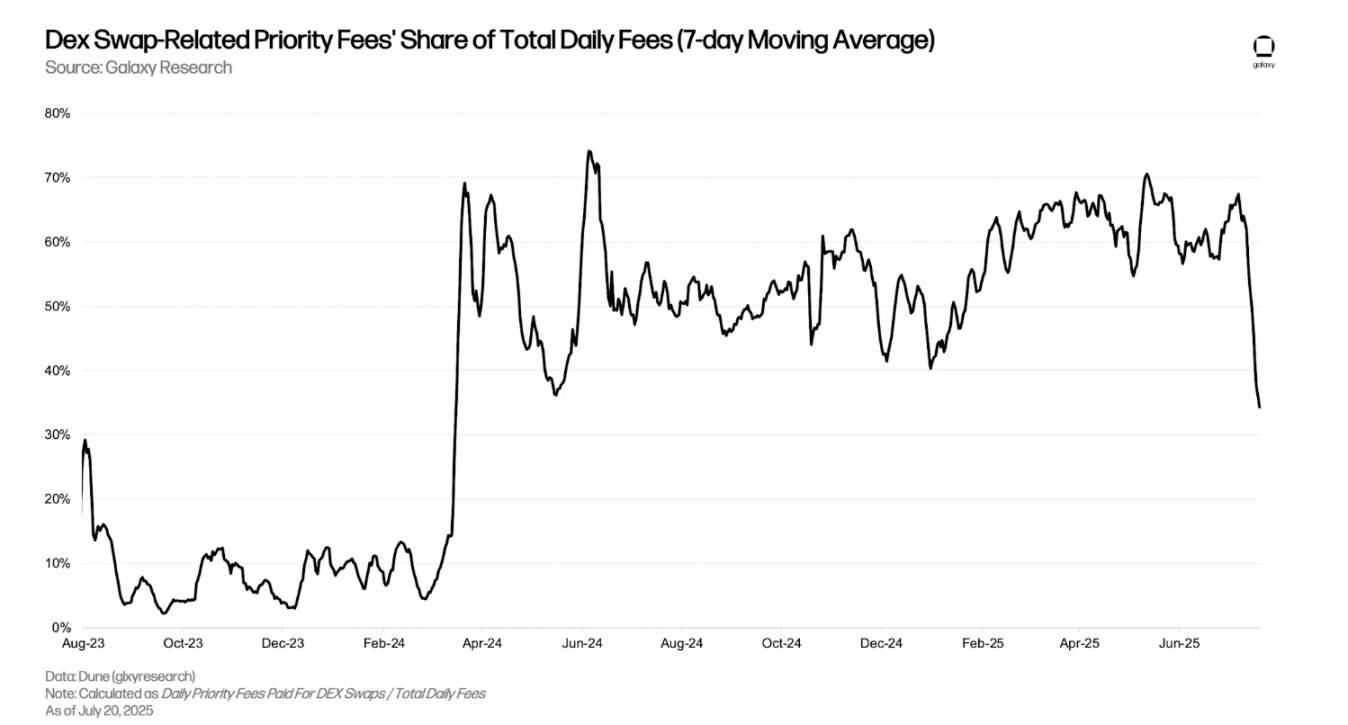

Active DEX activity is a key reason for Base's consistently high priority fees. 50% to 70% of the total daily fees received by Base sequencers come from DEX transaction priority fees. However, since July 7th, the proportion of DEX transaction fees in daily total fees has dropped from 67% to just 34%. This is due to two factors: 1) rising base fees diluting the proportion of priority fees; 2) increased on-chain block space competition forcing users to pay priority fees for non-DEX transactions.

Since 2025, DEX transactions in the first slot have contributed 30% to 35% of the total daily priority fees, while DEX transaction priority fees in the top three slots have contributed 50% to 62% of the total daily priority fees. The recent decline in the proportion of top slot DEX priority fees is due to increased overall on-chain competition leading to higher non-DEX transaction priority fees and the implementation of Flashblocks, which causes high-priority DEX transactions to fall into lower slots within the block.

Conclusion

Through an analysis of Base's DeFi and revenue structure, we discovered:

Priority fees constitute the vast majority of revenue;

Over 60% of priority fees in the past year came from just 250 addresses;

High DEX trading volume and TVL;

Priority fees from DEX transactions contributed nearly three-quarters of the total priority fees.

These points indicate that Maximum Extractable Value (MEV) transactions, especially competitive activities like DEX arbitrage, are a crucial source of Base sequencer revenue. The EIP-1559 style fee model adopted by sequencers is the direct mechanism for achieving this: it transforms block space competition from an inefficient latency-based race to an efficient economic auction.

By collecting priority fees from users willing to pay for urgent inclusion, this model enables sequencers to capture and commercialize the competitive value of block space more effectively than traditional "first-come, first-served" or purely latency-driven systems.