Bitcoin (BTC) is showing weakness, dropping to around 115,000 USD and moving further away from its recent high.

This occurs in the context of strong selling pressure related to Galaxy Digital, driven by a prolonged selloff from one of the largest known BTC whale wallets.

Bitcoin Giants Awaken as Galaxy Digital Pressure Peaks

Blockchain analysis tool Lookonchain revealed that Galaxy Digital sent 2,850 BTC, worth 330 million USD, to exchanges on Friday morning. This transaction adds to over 12,800 BTC (1.5 billion USD) transferred to exchanges within 24 hours.

"It seems Galaxy Digital has sold 10,000 BTC (1.18 billion USD)! In the past 3 hours, they withdrew 370 million USDT," Lookonchain previously reported.

The Bitcoin being sold originates from a legendary whale address holding 80,009 BTC, valued at approximately 9.6 billion USD before selling.

This address began transferring coins to Galaxy Digital on 07/15. According to multiple Lookonchain posts, the entire transfer was completed on 07/18. Over 40,000 BTC were transferred in one day, causing market concern.

"Bitcoin OG with 80,009 BTC seems to be selling BTC... In the past hour, they transferred 9,000 BTC (1.06 billion USD) to Galaxy Digital—possibly preparing to sell through their service," Lookonchain noted on 07/15.

Although the selling pressure has significantly impacted Bitcoin's price in the short term, some traders believe the worst may have passed.

Adding to market anxiety, some Bitcoin wallets that had been inactive for a long time suddenly became active in July, sparking speculation of potential further sales. According to blockchain analysis platform SpotOnChain, three wallets, likely related to a single entity, transferred 10,606 BTC worth 1.26 billion USD this week.

All wallets received their BTC on 12/13/2020, when Bitcoin was priced at 18,803 USD. At the current price, these Bitcoin tokens have seen a 6.3x increase.

Inactive Bitcoin Wallets Simultaneously Awaken in July

Lookonchain also identified a whale wallet that had been inactive for 14.5 years. This week, it transferred 3,962 BTC (468 million USD) to a new address.

The same wallet had received its Bitcoin at 0.37 USD per coin in January 2011, making it one of the oldest addresses recently reactivated.

Earlier in July, another wallet transferred 6,000 BTC (649 million USD) after being silent for six years. All three cases involve long-term holders moving to new wallets or exchanges.

Community members on X (Twitter) have taken notice. Some speculate that Bitcoin holders from the Satoshi era might be preparing to exit during the next price surge.

"There have been many recent old bitcoin transfers," one user posted. "Could they be preparing to sell during the next price increase?" a user wrote.

Combined with Galaxy Digital's recent liquidation activity, the reactivation of these long-dormant wallets indicates a shift in cryptocurrency market dynamics. Old supply is increasingly being repositioned ahead of expected volatility.

Although Bitcoin's fundamentals remain strong, July's whale coin transfers have created new uncertainty in the short-term outlook. Currently, traders are monitoring the volatility to confirm that selling has ended, and investors hope new capital flows might push BTC back to new highs.

Meanwhile, as Bitcoin whales worry the market, altcoin traders signal that capital rotation might trigger an altcoin season.

This expectation coincides with a significant BTCD crash. This index dropped from 64% to 60% between 07/17 and 07/21.

BTCD. Source: TradingView

BTCD. Source: TradingViewThe index attempted a slight recovery on Friday, with a reading of 61.55% at the time of writing.

A declining dominance index suggests investors are moving from Bitcoin to altcoins. This trend is one of the earliest signs of an emerging altcoin season.

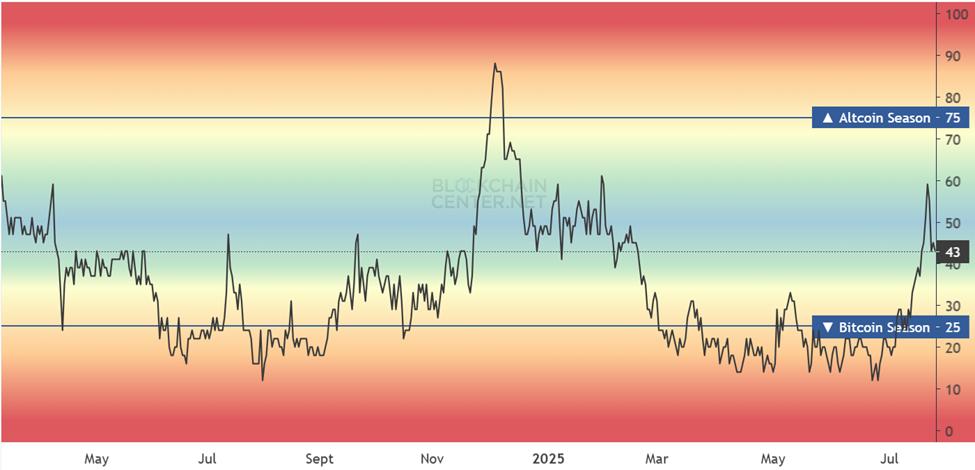

Altcoin Season Index. Source: Blockchain Center

Altcoin Season Index. Source: Blockchain Center The current Altcoin Season Index is 43, indicating the cryptocurrency industry has not yet entered altcoin season. However, the upward trend suggests a shift in market momentum.