Ki Young Ju, CEO of CryptoQuant and a prominent figure in cryptocurrency analysis, has publicly declared that the traditional Bitcoin cycle theory is no longer valid.

This bold statement is also an acknowledgment that his previous predictions are now outdated. This reflects a profound change in the market's nature compared to before.

Why has the traditional cycle theory collapsed?

Ki Young Ju's previous Bitcoin cycle theory was built on two pillars: buying when whales accumulate and selling when retail investors participate.

He had used these two factors as the foundation for his previous predictions — including his earlier prediction in March that the price cycle had ended.

However, as market momentum changed, he acknowledged that this theory is no longer applicable. He even apologized, expressing concern that his prediction might have influenced someone's investment decision.

The key difference that led him to abandon the theory lies in how whales behave. Previously, whales distributed Bitcoin to retail investors. But now, he realizes that old whales are selling to emerging long-term whales.

This change has caused the number of holders to increase — surpassing the number of traders.

Bitcoin's institutional acceptance has exceeded not only his expectations but also those of many other analysts. This has created a market environment completely different from Bitcoin's history, making comparisons difficult.

Recent analysis on CryptoQuant supports his argument. Analyst Burakkesmeci noted that on-chain data clearly shows this is not a classic "retail investor frenzy", unlike previous cycles.

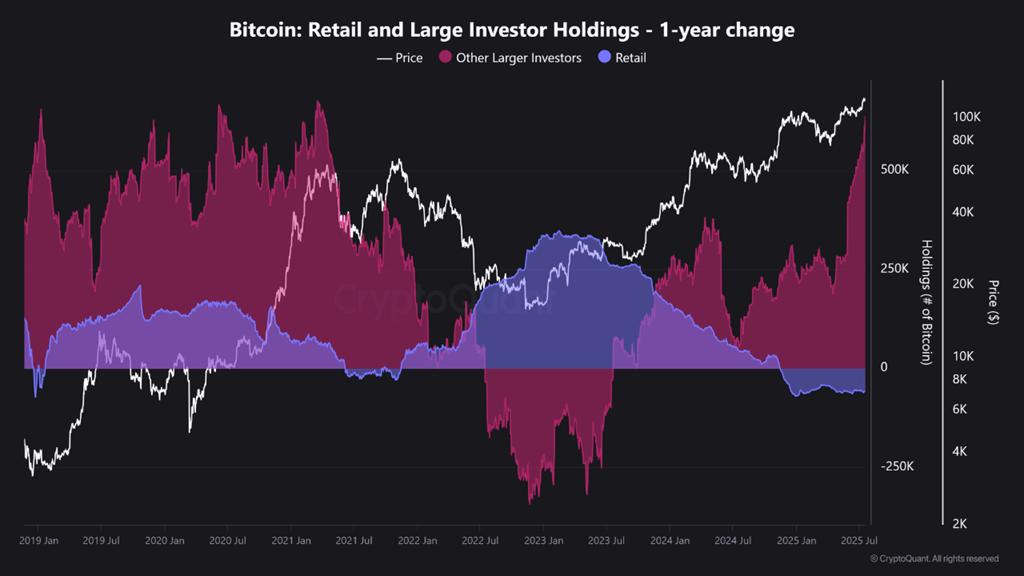

Bitcoin: Retail and large investor holdings. Source: CryptoQuant.

Bitcoin: Retail and large investor holdings. Source: CryptoQuant.The chart shows that since early 2023, retail investors have been selling BTC and their holdings have gradually decreased. In contrast, institutions, funds, and large wallets — including ETFs — have actively accumulated Bitcoin.

"This cycle is not like the madness of 2021. There's no public excitement, nor is there an overflow on social media. Smart and quiet money is now on stage — and most people are still standing outside observing," Burakkesmeci said.

However, this new market environment also makes forecasting much more challenging.

In previous cycles, investors recognized the bear market through the panic of small holders. But now, an urgent question arises: What would the bear market look like if institutional investors start to panic instead?

This could be the greatest challenge for risk managers today.