Written by: Thejaswini M A

Compiled by: Block unicorn

Preface

The mediator had just announced Facebook's settlement: 65 million dollars. The room was silent. Mark Zuckerberg's lawyers were waiting for a response.

Most people would take the money and leave. Tyler Winklevoss looked at his brother Cameron Winklevoss, then across the table.

"We choose stocks."

The lawyers might have exchanged glances. Facebook was still a private company at the time, and the stocks could be worthless, and the company might fail. Cash was tangible, while stocks were a bold gamble.

But Tyler's response defined the next decade of their lives. They bet the entire settlement on a company that had technically stolen their idea.

When Facebook went public in 2012, their 45 million dollars in stocks were worth nearly 500 million dollars.

The Winklevoss brothers completed one of the boldest moves in Silicon Valley history. They lost the battle for Facebook but made more money from Facebook than most early employees.

In 2013, they seized the opportunity again and found a new chance.

Birth of a Mirror

Before becoming crypto billionaires or Facebook litigation plaintiffs, Cameron and Tyler Winklevoss were each other's mirrors, literally.

Born on August 21, 1981, in Greenwich, Connecticut, they were identical twins with only one key difference: Cameron was left-handed, Tyler was right-handed. Perfect symmetry.

They were tall, athletically gifted, and worked together seamlessly. At 13, they self-taught HTML and built websites for local businesses. During their teenage years, they founded their first web company, creating websites for any willing-to-pay clients.

At Greenwich Country Day School and later Brunswick School, they discovered competitive rowing and co-founded the school's rowing program.

In an eight-person boat, timing is crucial. A delay of a fraction of a second means losing. Perfect coordination requires understanding teammates, reading the water, and making instant decisions under pressure.

They became extremely skilled. Skilled enough to row at Harvard, skilled enough to compete in the Olympics.

But rowing taught them something far more valuable than sporting honors - the art of perfect timing and seamless collaboration.

[The translation continues in the same manner for the entire text, maintaining the specified translations for specific terms and preserving the original formatting.]Think about it, they are Olympic athletes, Harvard graduates, young people with infinite possibilities, yet they have bet millions of dollars on a digital currency that most people associate with drug dealers and anarchists.

Their friends must have thought they were crazy.

But they had witnessed a dorm room idea turn into a company worth billions of dollars. They understood how quickly the impossible could become inevitable.

Their analysis was: if Bitcoin becomes a new type of currency, early adopters will receive huge returns; if it fails, they can afford the loss.

When Bitcoin reached $20,000 in 2017, their $11 million turned into over $1 billion. They became the world's first confirmed Bitcoin billionaires.

This pattern was gradually becoming clear. Cameron and Tyler Winklevoss had unique insight.

Building Infrastructure

The twins not only bought Bitcoin and waited for appreciation, but they began to build infrastructure to drive mass adoption.

Winklevoss Capital provided seed funding for building a new digital economy: exchanges (like BitInstant), blockchain infrastructure, custody tools, analysis platforms, and later DeFi and Non-Fungible Token projects. Their investment portfolio covered everything from protocol developers (like Protocol Labs and Filecoin) to energy infrastructure for crypto mining.

In 2013, they submitted the first Bitcoin ETF application to the SEC. This was an almost doomed attempt, but someone had to take the first step. In March 2017, the SEC rejected their application due to market manipulation. They tried again, and were rejected again in July 2018. But their regulatory efforts laid the foundation for other applicants. In January 2024, the spot Bitcoin ETF was finally approved, marking the fruition of the framework this twin pair had begun building over a decade ago.

In 2014, BitInstant CEO Charlie Shrem was arrested at the airport for money laundering related to Silk Road transactions, and BitInstant was forced to close. The major Bitcoin exchange Mt. Gox was hacked, losing 800,000 Bitcoins. The infrastructure the twins invested in was collapsing, and the Bitcoin market was turbulent.

But they saw opportunity in the chaos. The Bitcoin ecosystem needed legal, regulated companies.

In 2014, they founded Gemini, one of the first regulated cryptocurrency exchanges in the United States. While other crypto platforms operated in legal gray areas, Gemini collaborated with New York state regulators to establish a clear compliance framework.

They understood that for cryptocurrency to become mainstream, it needed institutional-level infrastructure. The New York State Department of Financial Services granted Gemini a limited purpose trust license, making it one of the first Bitcoin exchanges licensed in the US.

By 2021, Gemini was valued at $7.1 billion, with the twins owning at least 75% of the shares. Today, the exchange has total assets over $10 billion, supporting more than 80 cryptocurrencies.

Through Winklevoss Capital, they invested in 23 cryptocurrency projects, including participating in Filecoin's funding round and Protocol Labs in 2017.

The Winklevoss brothers did not fight regulatory agencies, but instead worked to educate them. They did not seek regulatory arbitrage, but integrated compliance into their products from the beginning.

Gemini faced challenges including a $2.18 billion settlement agreement in 2024 for its Earn program. But the exchange survived and continued operations.

The twins understood that technology alone was insufficient for success, and regulatory acceptance would determine the fate of cryptocurrency.

In 2024, they each donated $1 million in Bitcoin to Donald Trump's presidential campaign, positioning themselves as advocates for crypto-friendly policies. Their donations exceeded federal contribution limits and partially needed to be returned, but they had made their stance clear.

The twin brothers have been outspoken in criticizing the SEC's overly aggressive enforcement under Chairman Gary Gensler. Their regulatory battles involve both personal and professional development. The SEC's lawsuit against Gemini directly challenged their business model. In June 2025, Gemini secretly filed an IPO.

Current Achievements

Forbes currently values the brothers at $4.4 billion, with a total net worth of about $9 billion, with Bitcoin assets constituting the largest component of their wealth.

Their cryptocurrency assets include approximately 70,000 Bitcoins, valued at $4.48 billion, as well as significant holdings in Ethereum, Filecoin, and other digital assets.

Gemini remains one of the most trusted cryptocurrency exchanges globally, with institutional-level security features and regulatory compliance. The exchange's IPO application marks an important step towards integration with mainstream financial markets.

In February 2025, the twins became partial owners of Real Bedford, an eighth-tier English football club, investing $4.5 million.

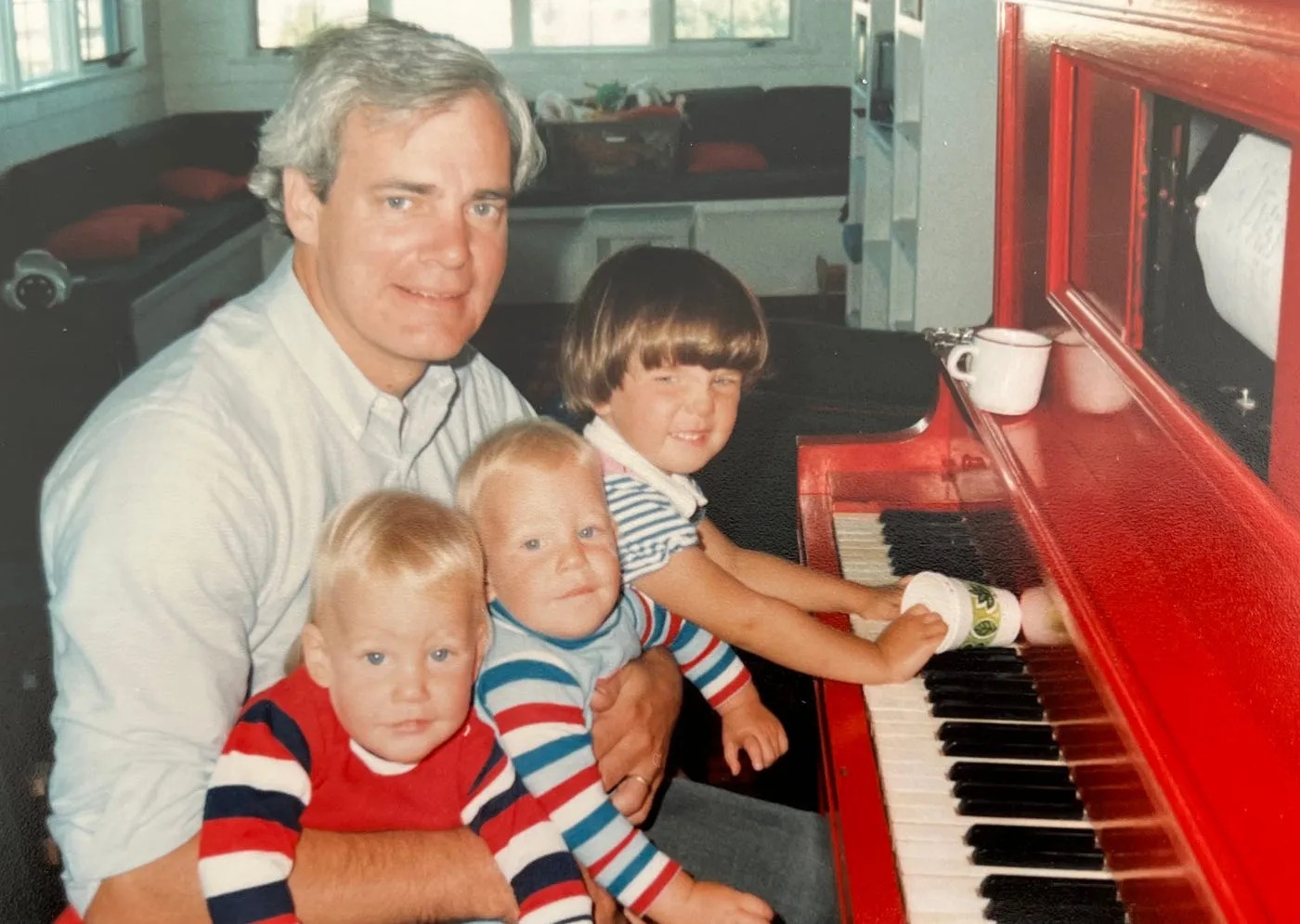

Collaborating with crypto podcast host Peter McCormack, they are attempting to push this semi-professional team towards the Premier League. Their father Howard also donated $4 million in Bitcoin to Grove City College in 2024, the first Bitcoin donation to the school, to fund the new Winklevoss Business School.

The twin brothers personally donated $10 million to Greenwich Country Day School, the largest alumni donation in the school's history.

They publicly stated that they would not sell Bitcoin even if its market value reaches the level of gold, demonstrating their belief that Bitcoin is not just a store of value, but a fundamental reimagining of currency.

The Harvard Crimson exposed Mark Zuckerberg's betrayal, and a one-dollar bill on an Ibiza beach ignited a revolution - these two moments occurred before and after they learned to see what others could not. Cameron and Tyler Winklevoss have long been considered as having missed the party. It turns out they just arrived early at the next feast.