Recently, Bitcoin price has been continuously hovering at a high level, oscillating repeatedly around the key technical support level of $115,000, seemingly caught in a "dilemma".

Beneath the calm surface, undercurrents are surging: market trading volume continues to shrink, investor sentiment is becoming cautious, and three core on-chain indicators—futures short-side leverage intensity, on-chain realized profit release degree, and whale fund movements—are simultaneously approaching historical extreme values. This rare synchronous critical state of three indicators overlaps, rendering the current market structure exceptionally fragile, with significant high-pressure conditions. Any anomaly in a key indicator could become the fuse triggering violent market fluctuations.

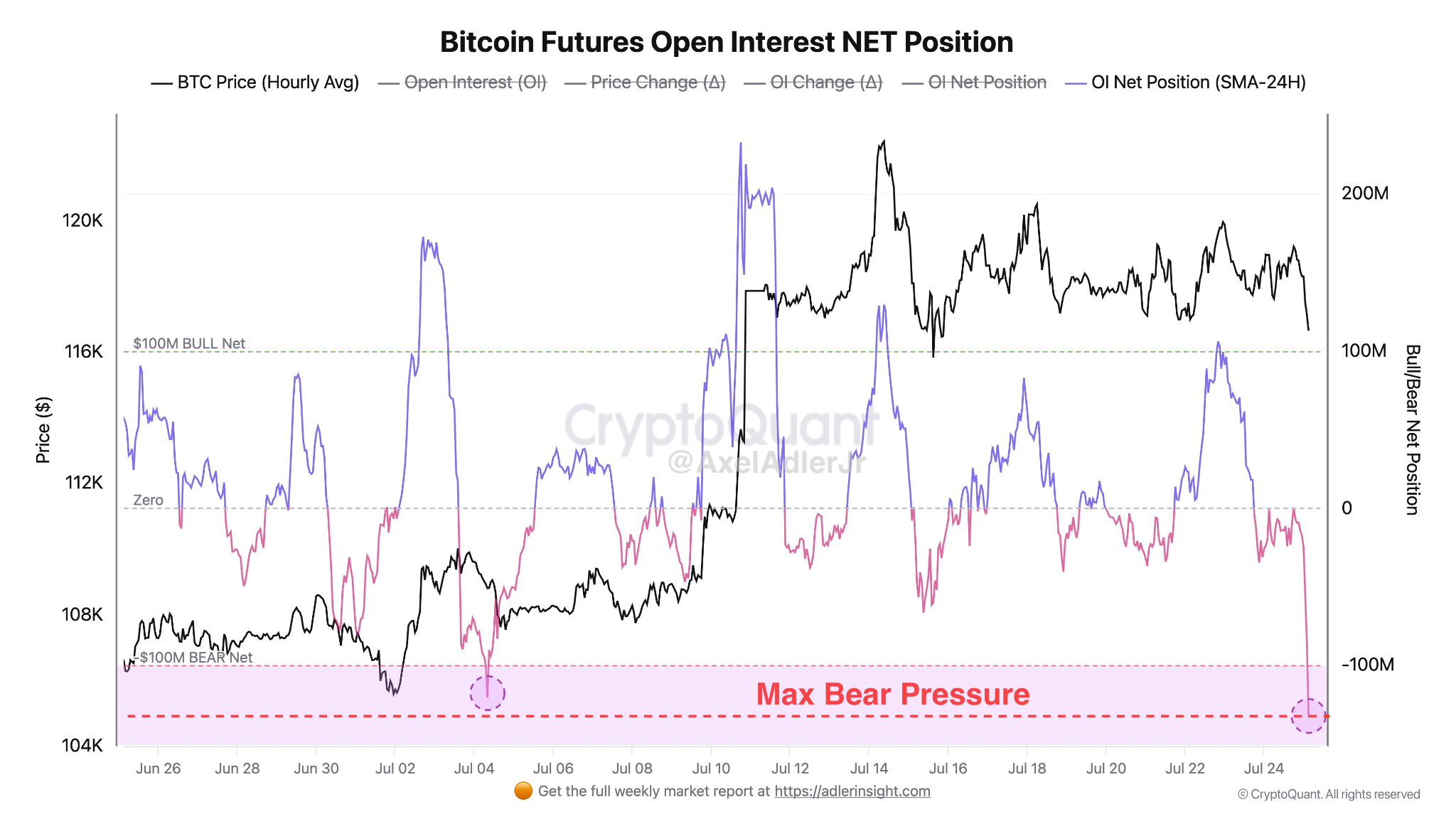

Signal One: Shorts Continuously Applying Pressure, OI Net Position Breaks Below $100 Million Warning Line

According to CryptoQuant data, on July 25, BTC futures market net open interest (OI) again fell below $100 million, creating a new low since early July, entering the "maximum short pressure" zone. This means short contracts dominate the funding structure, severely compressing long-side leverage space.

Historical patterns reveal warning significance: Whenever OI net position enters this area (such as October 2023, March 2024, early July 2025), the market often experiences violent short-term fluctuations. Extreme short pressure typically generates local bottoms or triggers short-term explosive rebounds.

Potential trigger point analysis: Shorts continue to add positions, expecting price to ultimately break down. However, from market behavioral perspectives, the extremely crowded short structure itself is a typical reverse signal—once price initiates a rebound, massive short-side stop-loss liquidations will form a "short squeeze" effect, driving price to explosive upward movement. The current market's key observation point is whether Bitcoin can effectively break through the $116,000-$118,000 resistance zone, igniting this "short-side powder keg".

Signal Two: Whale Selling Pressure Looms, Galaxy Digital Transfers 3,700 BTC Again

While futures structure remains highly tense, the "spot" variable on-chain—namely whale asset behavior—also provides no breathing space for longs.

On-chain data shows that since July 15, an old wallet address holding over 80,000 BTC has begun continuously transferring assets to exchanges and new addresses. The address was subsequently identified as managed by Galaxy Digital, which is assisting in selling these early mining-obtained assets in batches.

Latest developments and position insights:

- As of July 24, confirmed transfers have exceeded 68,000 BTC, flowing into exchanges like Binance, Bitstamp, OKX, Bybit, and potential OTC buyer new addresses.

- Within 24 hours, the address distributed 3,715 BTC (approximately $428 million) to 12 new addresses.

- The wallet currently holds 18,504 BTC, valued at over $2.1 billion.

Market interpretation and strategic impact: For the market, Galaxy's remaining uncleared position remains a hanging "Sword of Damocles". Although current prices haven't significantly dropped, real on-chain selling pressure is far from over, providing shorts with confidence. Notably, its transfer rhythm (small batches, multiple times) indicates a "gentle but persistent" distribution strategy, aiming to avoid concentrated selling market impact. While this strategy mitigates short-term stampede risks, it might extend the suppression period and delay the market's complete strengthening time window.

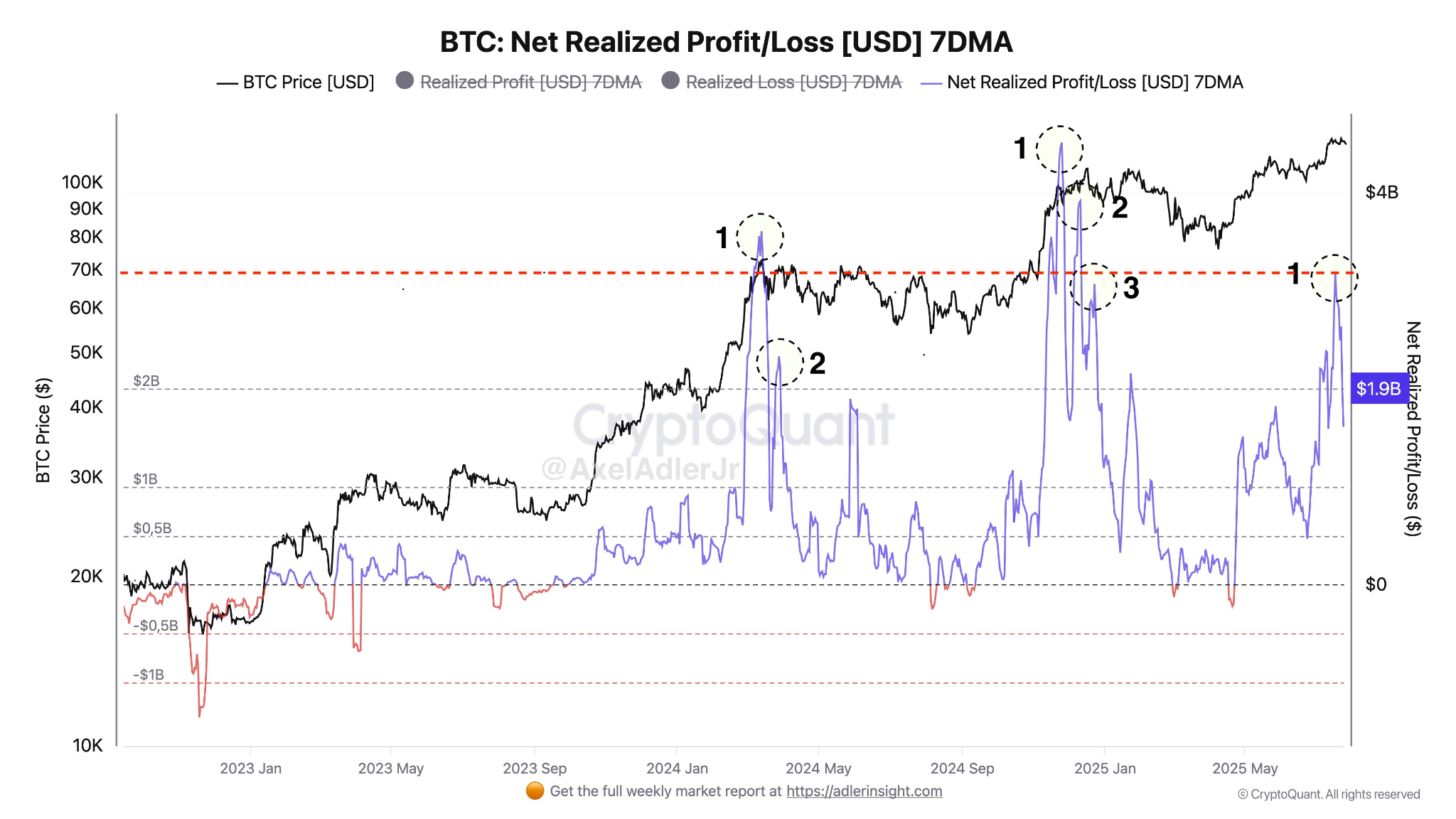

Signal Three: Profit-Taking Clusters, 7-Day PNL Touches Year's Second Highest

The third major on-chain warning signal emerges: Bitcoin's 7-day average net realized profit (PNL) surged to $1.9 billion on July 24, creating the second-highest point since 2025, just below the March peak.

Historical backtest associated risks: The past three similar profit-taking peaks (November 2023, March 2024, January 2025) variously foreshadowed stage tops. The internal logic is—high prices prompt asset holders to concentrate profit-taking; if subsequent buying fails to follow, selling pressure will self-reinforce, forming a "profit-taking top formation".

Current assessment and warning:

- Despite BTC price not creating new highs, PNL indicator rapidly climbing shows substantial funds have chosen to secure profits in advance.

- Some selling might originate from long-term holders (LTH) with assets over 1 year, whose outflows often hint at medium-term trader confidence wavering.

- Key divergence point: While $1.9 billion realization scale hasn't reached historical peaks and belongs to "healthy adjustment" range, if this indicator continues rising in subsequent days while price remains stagnant, it might confirm multi-directional power reversal risks.

High-Pressure Market: Multi-Directional Contest at Critical Point

The current market presents a typical "triple critical" high-pressure structure: futures short-side leverage reaching peaks, on-chain profit-taking accelerating, whale spot selling pressure hanging unresolved. Any single variable's mutation can break the current fragile balance, triggering a new market phase.

Multi-directional contest core logic:

- Short-side perspective: BTC price constrained by $118,000 resistance, Galaxy's remaining quantity uncleared, PNL high—three factors suggest downside risks persist.

- Long-side reliance: Betting on excessive short-side leverage (short squeeze potential), marginal selling pressure reduction, and structural rebound potential accumulation.

Historical experience and path inference: Such high-pressure states are difficult to sustain. The critical watershed lies in:

- If effectively breaking below $112,000 support, confirming short-term downward trend.

- If strongly breaking through $118,000 resistance zone, potentially triggering massive short-side stop-loss liquidations, driving rapid price uplift.

Investor strategy recommendations:

Facing high uncertainty, medium-short-term investors should currently avoid heavy one-directional bets. Rather than "chasing rises and killing drops", reducing leverage, closely tracking fund movements and technical structure changes, and waiting for clear directional signals before deciding, represents a more prudent strategy choice.

Conclusion: Avoid Unilateral Bets, Maintain Strategic Flexibility

The Bitcoin market is at a critical moment of extreme multi-directional structural confrontation. This is neither a unilateral bull market acceleration period nor a confirmed bear market, but a typical "oscillating convergence" window.

On one side, on-chain basic indicators (like active addresses, transaction frequency) haven't significantly diminished, showing market vitality remains; on the other side, position structures, price momentum, and sentiment indicators are simultaneously approaching limits. Any leading force's (long/short) initial breakthrough could trigger chain-reaction technical breakdowns and fund stampedes.

The market lacks no directional choice energy, only the final triggering opportunity. This opportunity might originate from a sudden macro positive news, a whale's completed liquidation, or a concentrated liquidation wave.

Before trend dust settles, maintaining strategic flexibility far surpasses blind directional betting.