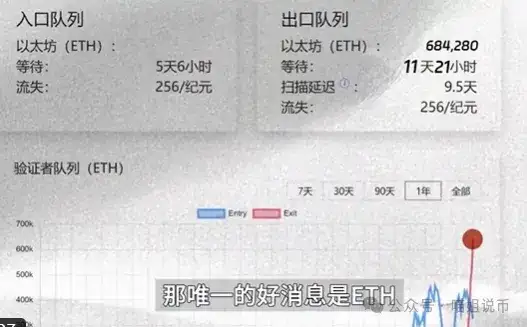

Recently, a very strange data appeared on the Ethereum chain: 680,000 ETH are queuing to be unstaked, with an average waiting time of up to 11 days, which is the largest single unlocking scale in history, without a doubt.

This means that after 11 days, the market will face potential selling pressure of over $2.3 billion. If you convert this volume to Bitcoin market value, it's equivalent to a selling pressure of around $10 billion.

Although there are still 11 days left, we must admit - this is ETH's last window period. Whether it will surge to $4,000 and then drop, or directly enter the release period, we will soon find out.

Some say: "Isn't there still 300,000 ETH waiting to be staked?" Right, but you must understand - these ETH have been bought and will not create new buying pressure. The 680,000 ETH about to be unstaked are existing chips that can be sold at any time. The impact is completely different.

More interestingly, Justin Sun has also been making frequent moves. Whether it's his ATH staking on Lido, ETH in his own exchange, or lending collateral on Aave, he has been massively withdrawing recently, with a total outflow exceeding $2 billion.

This retreat is not simple. To be honest, I was originally full of expectations for this altcoin season. According to the index, it may have only gone 2/3 of the way, theoretically, it could still go crazy for a while. But the on-chain data gave me a wake-up call - fund flows are clearly taking profits, some large holders are shorting to hedge, and I'm currently only doing short-term trades, no longer holding long positions. The selling pressure on Ethereum is already fierce, and Bitcoin hasn't been stable either.

Bitcoin: Continuous ETF Net Outflows, MACD Death Cross Emerging

In recent days, Bitcoin ETF has experienced consecutive days of net fund outflows. Although the price remains relatively strong, Wall Street funds are withdrawing, which is absolutely invisible from the K-line.

Meanwhile, the daily MACD for #Bitcoin has formed a death cross structure: the yellow line is pressing down the blue line, indicating a possible weak period. Based on past experience, this structure typically continues to weaken until the blue line rises again.

So I suggest: wait until the "surprise line" forms again before entering. I personally believe that Bitcoin's next big opportunity might follow a typical "AMD pattern". Especially the CME futures gap of $114,000-$115,000, which is a "technical bait" for market makers. If Bitcoin retraces to fill this gap and then shows a bullish reversal, it could potentially form a new high.

The best entry point is: a false breakout below the box that quickly recovers, that's the signal.

#SOL: Potentially the Next ETH-like Scenario

With the current market pressure, I'm increasingly optimistic about a low-key player - SOL (Solana). In October, its spot ETF will be approved, meaning institutions will buy SOL through official channels for the first time. Compared to ETH facing Grayscale unlocking and staking releases, SOL's token structure is much healthier.

Moreover, it has a technical upgrade in progress. The latest #286 proposal is expected to pass within a month, at which point Solana's computing capacity will increase from 60 million to 100 million units, improving network efficiency by 66% - a potential "performance leap". In other words: with positive news, upgrades, and no selling pressure, SOL is the only undervalued spot ETF concept stock.

Don't forget, when ETH was abandoned at $2,000, who bought quietly? Smart money never chases highs but lurks when no one is paying attention. So I'll keep a close eye on SOL, and if it hits a low point in August, I'll call everyone to build positions. Finally, a reminder: the biggest macro event this month - the Federal Reserve's interest rate meeting - will be held next Thursday at 2 AM.

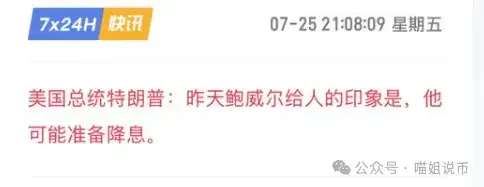

The market's most pressing question is: will they cut rates? I'll tell you clearly: 100% no rate cut in July, September is still 50/50.

Although Powell is stubborn, Trump has already started "winning people over", even promising certain officials positions as the next chairman, like Waller and Bowman. And the interest rate isn't solely Powell's decision - he only has 1 vote, the other 11 FOMC members also have decision-making power.

So we can't rule out the possibility of an unexpected rate cut in September.

A final reminder: this is significant! In early July, US stocks and the crypto market rose largely due to tariff postponement. But if tariffs are officially implemented on August 1st, the market will face "post-good news" pullback pressure, which must be guarded against.

In the next two weeks, Ethereum's selling pressure, Bitcoin's technical signals, the Fed's attitude, Trump's policies, SOL's undercurrents... will all intertwine. Control your positions, be cautious, and prepare to buy the dip.

If the market truly experiences a deep decline, it will be the starting point for our next "undervalued dividend".

Don't forget, the real bull market profits have never come from topping out, but from picking up chips in fear.

That's it for the article! If you're feeling lost in the crypto world, consider joining me in layout and harvesting from market makers! You can (follow backup public account: Sister Meow Talks Crypto) join the community WeChat+QQ group without threshold to get market analysis, altcoin operation... WeChat: c13298103401 or QQ: 3806326575