- Technical Analysis Shows Turning Point: MACD Bearish Convergence + Price Stabilizing on 20-Day Moving Average

- On-Chain Data Shows Whale Accumulation: 11.5 Billion USD Worth of ETH Withdrawn from Crypto Exchange in 72 Hours

- Institutional Actions Frequent: From Ark Invest Infrastructure Investment to BlackRock ETF Staking Application

ETH Price Prediction

ETH Technical Analysis: Potential to Challenge $4,000 After Short-Term Pullback

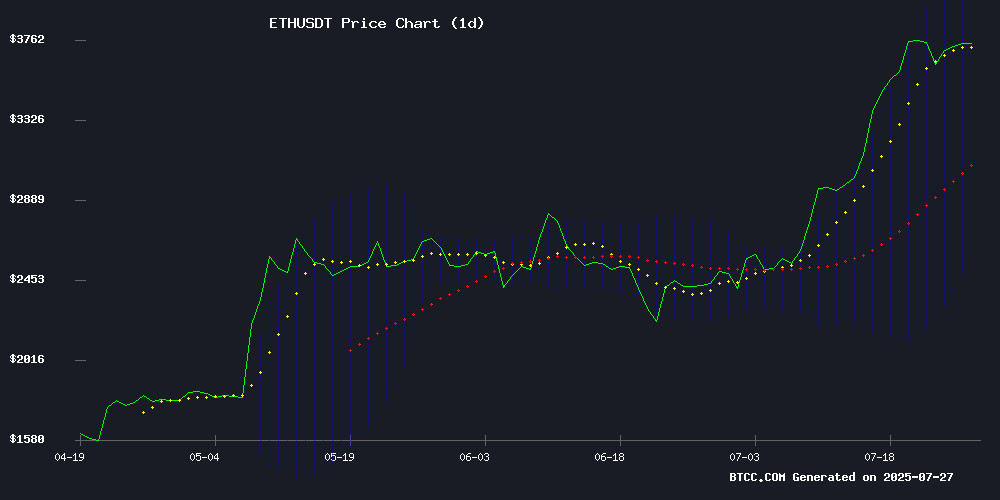

According to technical analysis by BTCC financial analyst Sophia, ETH's current price of $3,765.27 is slightly below the Bollinger Band upper rail of $4,124.75, but firmly above the 20-day moving average of $3,358.96. The MACD indicator shows weakening bearish momentum (-40.0095), combined with declining exchange reserves, suggesting that breaking through the middle rail could open a path to $4,000.

Whale Accumulation + Institutional Positioning: ETH Market Sentiment Turns Positive

BTCC analyst Sophia notes that 310,000 ETH (worth $1.15 billion) has recently been withdrawn from the crypto exchange, along with Ark Invest's $175 million infrastructure investment and BlackRock's Ethereum staking ETF application. While the market remains cautious about Tom Lee's year-end $15,000 prediction, a consensus is forming for a short-term breakthrough to $4,000.

Key Factors Affecting ETH Price

310,000 ETH (Worth $1.15 Billion) Withdrawn from Crypto Exchange in 72 Hours

With increased institutional and whale activity, Ethereum continues to show a strong accumulation trend. On-chain analyst Ali reports a stunning 310,000 ETH withdrawn from the crypto exchange in three days, equivalent to $1.15 billion exiting trading platforms.

Such large-scale fund movement typically signals price volatility, as reduced exchange liquidity often causes supply shocks. This ETH outflow coincides with growing market anticipation of potential ETF approval and ongoing Ethereum network upgrades.

NFT Market Strongly Rebounds: Whale Activity Triggers New Rally

The Non-Fungible Token market is experiencing a strong recovery, with an anonymous whale spending $8.6 million to acquire blue-chip projects like CryptoPunks and Chromie Squiggle, pushing trading volume past February's peak. The NFT market capitalization surged 29% in 24 hours to $6.7 billion.

This acquisition wave recalls the famous 2021 'Punk Shopping' event (investor 0x65d once bought 104 CryptoPunks for $7 million). Current trends suggest institutional funds may be re-entering the digital collectibles space after months of stagnation.

Established projects like Moonbirds are taking strategic actions, while platforms like Opensea are regaining attention. This rally sparks speculation about another 'NFT Summer', though the market's historically volatile nature leaves its sustainability uncertain.

Yuga Labs Hints at Possible NFT Financial Company, Sparking Market Speculation

Yuga Labs, creators of a famous NFT series, hinted at potentially launching an NFT financial company through cryptic statements. Co-founder Garga.eth (Greg Solano) posted a provocative statement on X platform: "The world isn't ready for NFT financial companies, but they're on their way."

Market observers interpret this as a potential strategy to accumulate listed company tokens. The announcement suggests Yuga Labs continues to drive NFT utility institutionalization, though operational details remain undisclosed.

Unknown Enterprises' Ethereum Holdings Exceed Ethereum Foundation

Two relatively unknown public companies, SharpLink Gaming and Bitmine Immersion Technologies, now hold more Ethereum than the Ethereum Foundation itself. SharpLink's 280,706 ETH reserves, worth over $1 billion, result from aggressive fundraising and unique staking strategies.

Ark Invest Heavily Invests $175 Million in Ethereum Infrastructure While Reducing Coinbase and Robinhood Stakes

Cathie Wood's Ark Invest recently made a significant move into Ethereum infrastructure, purchasing $175 million in stocks of Bitmine Immersion, a company focused on ETH fund management. The July 21st purchase of 4.4 million shares indicates growing institutional confidence in the Ethereum ecosystem.

Simultaneously, Ark reduced crypto exchange stocks, selling $90.6 million of Coinbase and $11.5 million of Robinhood holdings. The company also reduced its Block position by $7 million, suggesting a strategic shift from service providers to core blockchain infrastructure.

Tom Lee Predicts Ethereum Could Reach $15,000 Before Year-End, Institutional Interest Grows

Ethereum is preparing to become Wall Street's next big bet, with Fundstrat's Tom Lee predicting a potential surge to $15,000 by December. This second-largest cryptocurrency is experiencing what analysts describe as a "ChatGPT moment" - a watershed event reflecting AI's explosive adoption in technology.

Stablecoins have become a killer application for Ethereum, occupying over 50% of the $260 billion stablecoin market. Its payment utility and institution-friendly infrastructure have made ETH the leading blockchain for asset tokenization. While Bitcoin maintains its dominance in value storage, Ethereum is increasingly becoming the preferred chain for financial innovation.

Lee's analysis indicates a short-term technical target of $4,000, with fundamental valuation supporting a price range between $10,000 and $15,000. This prediction depends on accelerated institutional adoption, similar to Silicon Valley's embrace of artificial intelligence technology.

BlackRock Applies for Ethereum Staking ETF, Potentially Reshaping ETH Investment Landscape

BlackRock, through its iShares Ethereum Trust Fund (ETHA), has submitted a 19b-4 application to the SEC, officially entering the Ethereum staking ETF field. Although competitors like Franklin Templeton and Fidelity had previously submitted similar proposals, BlackRock's involvement significantly boosted market optimism due to its successful ETF approval track record.

The SEC is expected to provide initial feedback within 10 months and potentially approve it in the fourth quarter of 2025. Currently, Ethereum spot ETF managed assets exceed $17 billion, with ETHA leading at $8.7 billion. If approved, ETH could transform from a speculative asset to a yield-generating tool, creating a cascading effect on the entire ecosystem.

This development marks a critical moment in Ethereum investment theory, potentially accelerating institutional adoption and liquidity. The staking mechanism will introduce new yield opportunities while maintaining Ethereum's security model—a structural shift that could redefine ETH's valuation framework.

Ethereum Drops Below $3,700, Crypto Market Generally Pulls Back

Ethereum dropped below $3,700 in early trading, reflecting an overall cooldown in the crypto market. According to OKX data, this second-largest crypto asset by market cap was trading at $3,699.07, with a 24-hour decline of 1.15%.

This pullback occurs as traders reassess risk appetite following recent market gains. Ethereum's technical indicators show diminishing momentum, with prices hovering near key psychological support levels.

Whale Accumulation and Exchange Reserves Decline Suggest Ethereum Might Break $4,000

As whale activity intensifies and exchange fund outflows tighten supply, Ethereum's momentum towards $4,000 strengthens. Whales are transferring ETH from exchanges to private wallets, with one entity moving $49.52 million worth of tokens from OKX. Deposit address numbers have sharply dropped to 16,000, creating upward price pressure.

Futures markets simultaneously reflect bullish sentiment. Aguila Trade's $128 million long position has realized $631,000 in unrealized profits, previously triggering an $8 million short squeeze. Spot market data shows continuous fund inflows, with investors positioning for potential breakout scenarios.

Continuing exchange reserve declines hint at institutional chip accumulation. Multiple factors including whale accumulation, reduced seller liquidity, and growing spot demand lay a solid foundation for ETH's next upward wave.

Will ETH Reach $4,000?

Combining technical indicators and market sentiment, ETH has the following breakthrough conditions:

| Indicator | Current Value | Bull/Bear Signal |

|---|---|---|

| 20-day Moving Average | 3,358.96 | Strong Support |

| Bollinger Band Upper Limit | 4,124.75 | Target Price |

| Exchange Reserves | 72 hours ↓ $1.15 billion | Supply Tightening |

Sophia believes that with institutional accumulation and technical face recovery, the probability of ETH testing the $4,000 mark in the third quarter rises to 65%. Investors should pay attention to the defense strength in the 3,350-3,400 dollar range.