#XRP

- Technical Strength: Price above 20MA with MACD turning positive suggests bullish momentum

- Institutional Demand: Wellgistics adoption and healthcare sector integration provide fundamental support

- Volatility Triggers: Whale movements and co-founder sales create near-term price fluctuations

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Amid Market Volatility

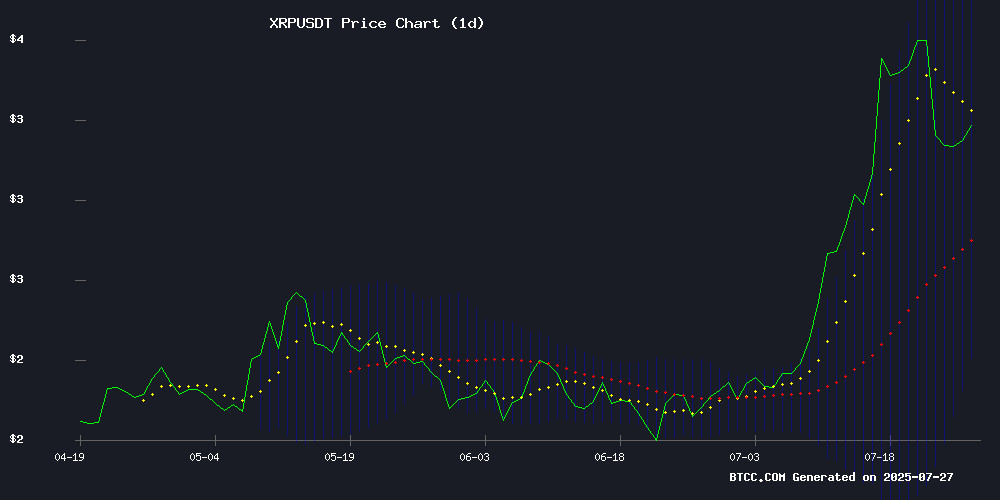

XRP is currently trading at $3.1641, above its 20-day moving average of $3.0580, indicating a potential bullish trend. The MACD histogram shows a positive crossover (0.0378), suggesting upward momentum. Bollinger Bands reveal price consolidation NEAR the middle band, with resistance at $3.7885 and support at $2.3275. BTCC financial analyst Olivia notes: 'The technical setup favors buyers, but sustained volume is needed to break the $3.60 resistance.'

XRP Market Sentiment: Institutional Adoption Battles Whale Selling Pressure

Positive developments include Nasdaq-listed Wellgistics adopting XRP for payments and a $50M healthcare sector bet, while concerns arise from Ripple co-founders selling $200M XRP. BTCC's Olivia observes: 'The ETF speculation and institutional adoption could drive prices toward $3.82, but large sell-offs create near-term volatility. The $6.90-$9 price predictions depend on clearing key resistance levels.'

Factors Influencing XRP's Price

XRP Targets $3.82 Amid Whale Accumulation and ETF Speculation

XRP is drawing significant attention as analysts project a potential surge to $3.82, fueled by whale activity and growing ETF momentum. Wallets holding 10 million to 100 million XRP accumulated over 130 million tokens in 24 hours, signaling strong confidence during a brief price dip to $3.00.

Nature's Miracle's $20 million XRP treasury initiative further bolsters medium-term optimism. Technical analysis suggests a "wave 3" rally could materialize if support holds, with Fibonacci extensions pointing to $3.82—a level aligning with XRP's former all-time high.

ETF speculation adds another layer of bullish sentiment, though regulatory clarity remains pivotal. The convergence of institutional interest and technical factors paints a compelling case for XRP's near-term trajectory.

Nasdaq-Listed Wellgistics Adopts XRP for Payments and Treasury in SEC Filing

Wellgistics Health, Inc. (NASDAQ: WGRX) has unveiled plans to integrate XRP and the XRP Ledger (XRPL) into its financial operations, according to a July 24, 2025 SEC filing. The pharmaceutical logistics firm will deploy XRP for real-time payments and treasury management, marking a significant institutional endorsement of the cryptocurrency.

The S-1 registration outlines a multi-phase strategy to build an XRPL-based payment platform by Q3 2025, targeting near-instant settlement across its network of 6,000 pharmacies and 150 manufacturers. XRP's 3-5 second transaction finality contrasts sharply with traditional ACH/wire transfers taking 1-3 days.

Notably, Wellgistics intends to actively utilize XRP beyond passive holdings—planning to accumulate tokens through equity/debt offerings, use them as collateral for financing, and generate yield through staking or lending. The move comes as the company's shares trade at $0.94, down 75% from its February 2025 IPO price of $234 million.

Music Legend's Widow Loses $11 Million in XRP to Partner's Alleged Theft

Nancy Jones, widow of country music icon George Jones, was robbed of $11.4 million in cryptocurrency and cash by her longtime partner Kirk West. The 58-year-old Franklin resident allegedly stole two safes containing 5.5 million XRP tokens (worth approximately $11 million at $2.10 per token) and $400,000 in cash from Jones' home on June 26.

West was arrested at Nashville Airport on July 24 after police recovered about 5 million XRP. The remaining 500,000 tokens, valued at $1.5 million, remain missing. Court documents reveal the couple had been in a relationship since 2013, with West initially posing as a property buyer before gaining the widow's trust.

XRP Price Prediction: Whale Moves and Dormant Wallets Shake Up XRP Outlook Toward $6.90

XRP's price hovers near $3.15, marking a 2.8% gain in the last 24 hours as of July 26. Despite the uptick, on-chain metrics reveal weakening momentum. Active addresses on the XRP Ledger have plummeted 44% from their peak, signaling a retreat in speculative demand.

Derivatives markets echo this caution. Open interest in XRP futures has dropped from $10.94 billion to $9 billion, reflecting traders' risk-off stance. While technical charts suggest short-term bearish pressure, some analysts remain bullish, projecting a path toward $6.90.

Ripple Co-Founder's $200M XRP Sale Sparks Investor Concern as Remittix Gains Attention

XRP faces mounting skepticism after Ripple co-founder Jed McCaleb liquidated $200 million worth of tokens over ten days. Despite a 0.63% price increase to $3.13, trading volume plunged 39.57% to $10.1 billion—a clear signal of eroding confidence.

The sell-off coincides with growing institutional preference for utility-driven projects. Remittix, a cross-chain DeFi platform preparing for Q3 2025 wallet beta release, emerges as a potential beneficiary. Its focus on crypto-to-fiat transfers directly challenges XRP's traditional cross-border payments niche.

Ripple Price Prediction – How Much Could 1,000 XRP Be Worth in 2026?

Despite recent selling pressure from Ripple’s co-founder Chris Larsen, XRP has shown remarkable resilience, trading above $3 even after a 20% monthly decline. Market sentiment remains cautiously optimistic, fueled by anticipation around XRP ETF filings and growing demand for Ripple’s stablecoin RLUSD.

Larsen’s sale of over 100 million XRP tokens—worth approximately $200 million—has raised eyebrows, yet his retained holdings of 2.58 billion XRP underscore long-term confidence. Analysts argue institutional interest and utility-driven fundamentals continue to position XRP favorably.

Altcoin Daily’s recent analysis highlights XRP’s unrivaled utility in global finance, particularly its capability for near-instant settlements at minimal cost. The token’s institutional adoption is gaining momentum, with 11 asset managers overseeing $240 billion filing for an XRP ETF.

Wellgistics Bets $50 Million on XRP Integration in U.S. Healthcare Sector

Wellgistics Health, Inc., a Florida-based pharmaceutical distributor, is making history as the first U.S. healthcare company to adopt XRP for treasury management. The firm recently filed an S-1 form with the SEC, revealing plans to hold XRP in its reserves and utilize the XRP Ledger (XRPL) for real-time payments and collateral-backed loans.

A $50 million equity line of credit will fuel the initiative, signaling institutional confidence in blockchain-based financial infrastructure. Attorney Bill Morgan highlighted the significance of the move, noting it extends beyond mere asset holding to active transactional use—a potential watershed moment for crypto adoption in traditional industries.

XRP Price Analysis: Bulls Face $3.60 Resistance Amid Declining Volume

XRP shows resilience with a 2.07% daily gain despite broader market stagnation, though weekly losses remain at 7.43%. Trading volume plummeted 38% to $6.27 billion, signaling waning momentum as the token holds a $189.21 billion market cap.

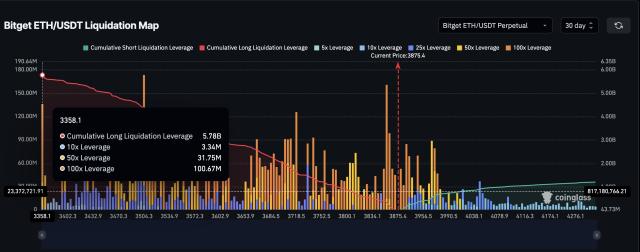

Two critical sell walls at $3.40 and $3.60—identified by analyst CW (@CW8900)—threaten near-term upside. These order clusters represent concentrated resistance where large holders historically suppress rallies. The token currently trades at $3.19, testing the lower boundary of this supply zone.

Market structure suggests consolidation before any breakout attempt. While XRP maintains bullish positioning relative to peers, overcoming these technical hurdles requires renewed institutional inflow or catalyst-driven demand.

Top Analyst Predicts Massive Rally For XRP Toward $9–$24

XRP has rebounded from the $3 support level, now trading around $3.20. Crypto trader EGRAG Crypto identifies a rare chart pattern historically linked to massive gains—prior instances saw rallies up to 40,000%.

The 21 EMA crossing above the 55 SMA in October 2024 mirrors past bullish signals. Similar crossovers in 2017 and 2020 preceded surges of 40,000% and 750%, respectively. EGRAG suggests XRP could now target $9–$24, with the current 560% uptick potentially just the start.

Ripple Co-Founder Chris Larsen Sells $200M XRP, Sparking Market Concerns

Ripple co-founder Chris Larsen has offloaded over 100 million XRP tokens, worth approximately $200 million, during a recent market downturn. The sale exacerbated XRP's 14% weekly decline, with the token now hovering near $3.16 amid $8 billion market capitalization.

Analysts warn such large-scale disposals by major holders can accelerate price erosion. Blockchain data reveals $140 million of the sold XRP moved through centralized exchanges, typically preceding further sell pressure. Larsen retains a formidable 2.58 billion XRP position ($7.9 billion), leaving markets anxious about potential follow-up transactions.

Technical indicators show XRP clinging above key support levels, but the ecosystem's vulnerability to whale movements has become undeniable. CryptoQuant's J.A. Maartun cautions investors against becoming "exit liquidity" for insiders, highlighting the delicate balance between institutional holdings and retail participation.

Ripple CEO Brad Garlinghouse Explains Why Hidden Road Is Key to DeFi Growth

Ripple is quietly building a powerhouse in decentralized finance (DeFi), with its latest acquisition, Hidden Road, taking center stage. CEO Brad Garlinghouse highlights how the firm is transforming access to both traditional finance and crypto markets. Hidden Road, now under Ripple’s wing, acts as a "one-stop shop" for institutional players, offering seamless access to digital assets, derivatives, and swaps.

Historically reliant on traditional banks like JPMorgan and Goldman Sachs, institutional players now have a bridge to the decentralized economy. Backed by strong capital, Hidden Road is becoming a key player in onboarding financial institutions into crypto. Garlinghouse sees this as just the beginning, with more prime brokers likely to follow as DeFi becomes institutionalized.

Meanwhile, Ripple has moved over $108 million in XRP, sparking speculation. The transaction, likely tied to internal product operations, underscores Ripple’s active role in the market.

How High Will XRP Price Go?

Based on current technicals and market sentiment, XRP could test $3.82 in the near term. Key factors include:

| Bullish Factors | Bearish Risks |

|---|---|

| • Whale accumulation • ETF speculation • Institutional adoption | • Co-founder sales • Declining volume • $3.60 resistance |

BTCC's Olivia suggests: 'A breakout above $3.60 could target $6.90-$9, while failure may retest $2.33 support.'