- Technical Key Points: BTC faces a resistance of $118,000 in the short term, MACD momentum converges, and the Bollinger Band range is between $112,122-$122,552

- Market Sentiment: Institutional accumulation and whale selling create a contradiction, with head and shoulders pattern warning of pullback risk

- Long-term Catalysts: Spot ETF approval, geopolitical hedging demand, and halving cycle will support bullish trend before 2040

BTC Price Prediction

BTC Technical Analysis: Short-term Trend and Key Levels

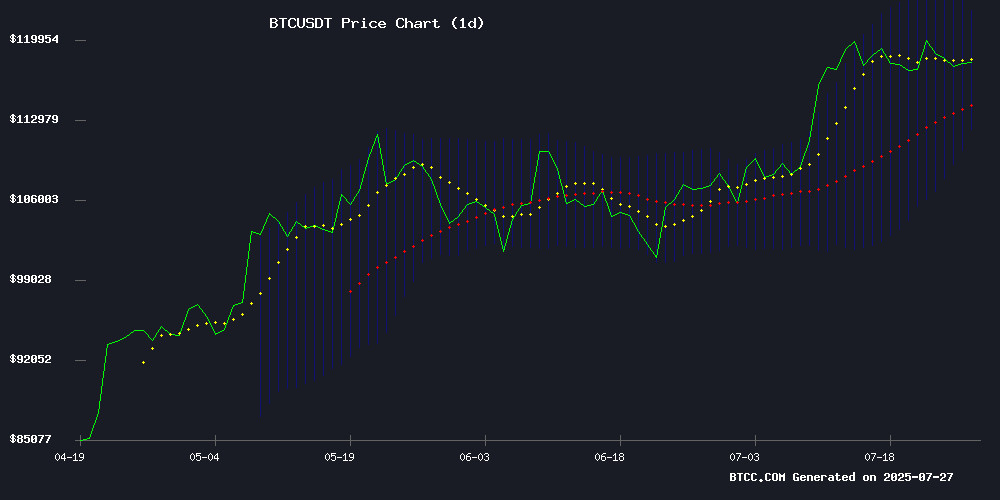

According to BTCC financial analyst James's technical analysis, BTC's current price is $118,149.20 USDT, slightly above the 20-day moving average of $117,337.69, indicating short-term support. The MACD indicator shows -2,506.05, still in the negative zone, but the histogram shows convergence, suggesting weakening downward momentum. The Bollinger Band upper rail is at $122,552.50, middle rail at $117,337.69, and lower rail at $112,122.88. The price is currently near the middle rail, and breaking through the upper rail could initiate a new upward trend, while falling below the lower rail might test the $109,000 support.

Market Sentiment and News Impact: BTC Faces Key Resistance

BTCC financial analyst James points out that recent news shows mixed market sentiment. On one hand, institutional interest continues to grow, with El Salvador and Refine Group AB increasing BTC holdings, reflecting long-term bullish confidence. On the other hand, Galaxy Digital's large-scale selling and the technical head and shoulders pattern warn of a potential short-term pullback to $109,000. $118,000 is a key resistance level, and breaking through could challenge the historical high, but social signals suggest a bearish short-term outlook.

Factors Affecting BTC Price

80K Bitcoin Whale Identity Exposed? MyBitcoin Wallet Linked to Recent Large Transfer

Bitcoin market volatility intensified as Galaxy Digital executed a historic sell order of over 80,000 BTC (worth over $9 billion). This transaction is one of the largest in cryptocurrency history, causing price volatility and speculation about the seller's identity.

CryptoQuant CEO Ki Young Ju revealed that these transferred tokens have been dormant for 14 years, originating from wallets related to the defunct MyBitcoin platform. The reactivation of these early tokens has sparked discussion about the original holders (possibly early miners or hackers).

Market participants are closely watching Bitcoin price trends and institutional behavior to find signals of their next move. The timing and scale of this transaction could have a crucial impact on BTC's short-term trend.

Bitcoin Surges 250% After BlackRock Spot ETF Application, Marking a New Era of Stability

Since BlackRock submitted the spot ETF application, Bitcoin has shown unprecedented price behavior, surging 250% with significantly reduced volatility. Bloomberg's Eric Balchunas emphasized this structural change, noting that the previously common violent corrections in the cryptocurrency market are no longer present. This moderate price trend seems to be attracting institutional investors while reshaping Bitcoin's market image.

Blockware analyst Mitchell Askew believes that ETF approval will effectively divide Bitcoin's history, ending the cycle of extreme bull and catastrophic bear markets. This digital asset now appears ready to enter a stable growth phase spanning a decade - a maturity trajectory identical to traditional asset classes.

Geopolitical Tension and Bitcoin Surge: A Contrasting Week

US President Trump's threat of 36% tariffs quickly halted border conflicts between Thailand and Cambodia, demonstrating the overwhelming influence of economic leverage on traditional diplomacy. This dispute over temple sovereignty suddenly cooled after artillery exchanges and large-scale evacuations.

Meanwhile, Bitcoin strongly rebounded to $118,000 amid geopolitical turmoil. Thailand simultaneously launched a cryptocurrency regulatory sandbox for digital baht payments, highlighting the increasingly intertwined relationship between finance and technology in emerging markets.

Bitcoin Faces $118,000 Resistance, Social Signals Show Bearish Sentiment

Bitcoin's rally shows signs of fatigue, struggling to maintain the $118,000 level, with on-chain indicators sending warning signals. Falling 4.24% from the $123,091 high, such pullbacks are still common in a bull market. Historical patterns suggest that deeper corrections - like the 50% retracement in 2021 - often create new highs.

The exchange whale ratio is currently 0.52, a level historically associated with short-term declines. Recent long position liquidations have increased selling pressure, temporarily pushing BTC to $115,000 before partial recovery. "When whales transfer tokens to exchanges, it usually signals the start of a distribution phase," a Crypto Quant analyst noted.

Bitcoin Price May Drop to $109,000? Analysts Warn of Head and Shoulders Reversal Pattern

Bitcoin price showed a clear hesitant trend over the past week, oscillating between $117,000 and $120,000 before suddenly dropping to $115,000. This decline, accompanied by large token transfers to centralized exchanges, has raised market concerns about further drops.

Certified market technical analyst Aksel Kibar pointed out a reversal head and shoulders pattern on the weekly chart, suggesting a potential drop to $109,000. This technical pattern typically signals a bullish breakout when crossing the neckline, but currently indicates a potential bearish reversal for Bitcoin. Traders are assessing the risk of continued decline, with market sentiment appearing fragile.

El Salvador Continues to Accumulate Bitcoin Amid Market Volatility

El Salvador added 8 more Bits to its national reserves in the past week, bringing the total to 625.018 BTC, valued at approximately $737 million. Despite the volatile cryptocurrency prices, this Central American country continues to accumulate Bits, consolidating its position as the world's only country with Bit as legal tender.

President Nayib Bukele's aggressive accumulation strategy has captured over 0.03% of the total Bit supply. This occurs at a time when institutional interest in digital assets is reigniting, with spot ETF continuing to see capital inflows, and corporate treasury departments beginning to explore crypto asset allocation.

Bit falls below $115,000, testing July lows

The downward trend of Bit continues, dropping below $115,000 and reaching its weakest performance since July 10th. This selloff reflects widespread market unease amid liquidity volatility and changing investor sentiment.

Market observers note the lack of strong institutional buying to halt the decline. Despite the price drop, trading volumes remain low on major exchanges, indicating cautious participant attitudes.

Bit drops due to Galaxy Digital's $1.5 billion selloff

Bit faces significant downward pressure as GALAxy Digital sold over 12,800 BTC (worth $1.5 billion) within 24 hours. This selloff originated from one of the largest known whale wallets, which held 80,009 BTC (valued at $9.6 billion) before liquidation began.

Blockchain analysis company Lookonchain tracked this fund movement, noting a single transfer of 9,000 BTC (worth $1.06 billion) to Galaxy Digital on July 15th. By July 18th, all transfers were completed, with 40,000 BTC moved in one day.

Market sentiment remains divided. While short-term price trends reflect heavy selling pressure, some traders expect the market might catch a breather now that Galaxy's selloff appears complete. One observer noted: "The good news is that Galaxy's selling pressure is now eliminated, and BTC can finally climb to a new historical high."

Bit's intraday decline narrows, briefly breaks $116,000 mark

Bit recovered some losses after early morning trading declines on Thursday, briefly breaking the $116,000 level. According to HTX market data, this flagship cryptocurrency was reported at $116,000.18, narrowing intraday losses to 2.58%.

This partial rebound occurred amid continued digital asset market volatility, with traders closely watching key psychological price levels. Bit's ability to recover after testing lows suggests that underlying demand remains solid despite short-term fluctuations.

Swedish company Refine Group AB receives $520,000 for Bit accumulation

Swedish company Refine Group AB has further increased its Bit reserves with an additional $520,000 in funding. This investment follows a previous $5 million financing specifically for BTC purchases, indicating continued institutional investor interest in crypto allocation.

As enterprises diversify their treasury strategies, enterprise-level Bit adoption continues to accelerate. While Refine Group's latest move is relatively small, it aligns with MicroStrategy's ongoing Bit accumulation strategy, demonstrating confidence in Bit's long-term value storage characteristics amid market volatility.

Listed companies' Bit holdings surge, reflecting continued institutional interest

Corporate Bit adoption continues to accelerate, with the number of publicly listed companies holding over 1,000 BTC increasing from 24 to 35 in two quarters. Fidelity Digital Assets Research Vice President Chris KuiPEr noted that this trend indicates warming institutional attitudes toward the flagship cryptocurrency.

Analyst Zack Wainwright's tracking data shows these companies collectively custody nearly 900,000 BTC—demonstrating significant digital asset exposure. The growth trajectory shows steady expansion: 30 companies held significant positions in Q2 2025, rising to the current 35.

Purchase patterns have democratized in the corporate world, rather than being concentrated among whale entities. Quarterly acquisition volumes jumped 35% from 99,857 BTC in Q1 to 134,456 BTC in Q2, reflecting the expanding scope of crypto treasury strategies.

BTC Price Prediction: Outlook for 2025, 2030, 2035, 2040

BTCC analyst James provides the following long-term BTC prediction based on technical and fundamental analysis:

| Year | Price Range (USDT) | Key Driving Factors |

|---|---|---|

| 2025 | 95,000-150,000 | Spot ETF capital inflows, supply tightening post-halving |

| 2030 | 250,000-400,000 | Institutionalization of allocation, mature global regulatory framework |

| 2035 | 600,000-1,200,000 | Established Bit reserve asset status |

| 2040 | 1,500,000+ | Total supply approaching limit, strengthened deflationary properties |

Note: Predictions are based on current data models and may be influenced by black swan events or technological breakthroughs.