- Technical Breakthrough: Price stabilizes above 20-day moving average with MACD divergence, bullish in the short term

- On-chain Data: Whale accumulation + exchange net withdrawals intensify supply shortage

- Market Psychology: $4,000 mark becomes primary target for bulls

ETH Price Prediction

ETH Technical Analysis: Short-term Bullish Signals Emerge

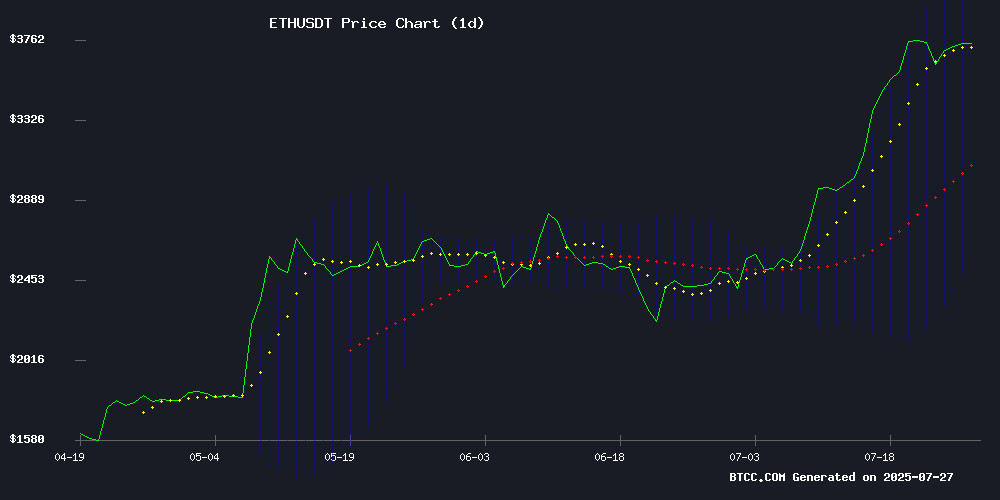

According to BTCC financial analyst Robert's technical analysis, ETH's current price is 3,826.45 USDT, above the 20-day moving average of 3,362.02, indicating short-term strength. Although the MACD indicator remains in negative territory, the histogram is converging (-43.635), suggesting weakening downward momentum. Bollinger Bands show the price is near the upper band at 4,134.73, which could accelerate upward movement if breached.

Whale Accumulation + Exchange Withdrawals: ETH Supply Tightening Imminent

BTCC analyst Robert points out that Mutuum Finance completed a $13.5 million presale, and with 310,000 ETH flowing out of exchanges within 72 hours, whales have recently accumulated 25,000 ETH (total holdings exceeding 72,000 ETH), causing liquidity to tighten. The market generally expects the $4,000 target price to be tested soon.

Key Factors Affecting ETH Price

Ethereum-based DeFi Token Mutuum Finance (MUTM) Presale Surpasses $13.5 Million

The emerging Ethereum-based DeFi token Mutuum Finance (MUTM) has surpassed the $13.5 million milestone in its presale, demonstrating strong investor interest. The project aims to improve capital efficiency through a trustless mechanism, positioning itself at the forefront of decentralized financial innovation.

This milestone highlights the market's growing confidence in the Ethereum DeFi ecosystem, with Mutuum Finance attracting funds by leveraging the network's robust infrastructure. The presale performance indicates a promising market outlook for niche DeFi tokens offering novel solutions.

310,000 ETH Withdrawn from Exchanges in 72 Hours

Ethereum (ETH) is experiencing significant outflows from trading platforms, with 310,000 tokens worth approximately $1.15 billion moved out in the past 72 hours. This may signal a shift in holder sentiment or suggest market accumulation and reduced selling pressure.

Crypto analyst @ali_charts shared a chart analysis via Jinse Finance. Although no specific exchange was mentioned, such large-scale withdrawals typically presage bullish momentum before supply tightening.

Whale Purchases 25,000 ETH, Total Holdings Exceed 72,000

According to Ember Monitoring, a significant Ethereum whale recently acquired 25,213 ETH, valued at approximately $94.66 million. The transaction was completed through FalconX, a platform designed for institutional-grade cryptocurrency trading.

The address currently holds 72,333 ETH, with a total value of around $272 million, at an average purchase price of $3,618 per ETH. Such large-scale accumulation typically indicates strong confidence in the asset's long-term potential.

Whale ETH Accumulation Tightens Supply, $4,000 Target Price Approaches

With whale activity showing supply tightening, Ethereum's path to $4,000 is accelerating. Only 16,000 deposit addresses remain active—a five-year low—while exchange reserves have dropped to pre-2021 bull market levels.

Aguila Trade's $128 million long position has realized $631,000 in unrealized profits, reflecting widespread institutional confidence. A whale previously short on ETH and suffering $8 million in losses has now turned long, suggesting professional traders expect the uptrend to continue.

OKX saw a withdrawal of 13,244 ETH (valued at $49.52 million) this week, the latest in a series of custodial outflows. When whales transfer assets to cold wallets, the market typically interprets this as a cross-quarter holding strategy rather than short-term profit-taking.

How Will ETH Develop in the Next 10 Years?

Combining technical analysis and on-chain data, ETH may develop in three stages over the next decade:

| Stage | Time Frame | Key Characteristics |

|---|---|---|

| Short-term (1-2 years) | 2025-2027 | Driven by ETF approval and Layer 2 adoption, testing $6,000-8,000 |

| Medium-term (3-5 years) | 2028-2030 | Mature POS mechanism + institutional adoption, potentially breaking $15,000 |

| Long-term (5-10 years) | 2030-2035 | Established Web3 infrastructure position, reduced volatility trending towards stable asset |

Robert emphasizes three key variables to watch: (1) Ethereum network upgrade progress (2) Stablecoin issuance changes (3) DeFi TVL growth curve. If ETH maintains over 25% annual on-chain transaction volume growth, its market cap could exceed Apple's current level by 2035.