Article source: Talk Li Talk Outside

In the past few days, BTC has continued to break new highs, reaching up to $123,000, and according to the previous plan, 10% of the position was sold yesterday (7.14). Regarding our investment plan in this cycle, previous articles have shared specific details:

In 2022, we developed a 20-month BTC investment plan, consistently buying BTC monthly, ultimately completing the plan in January 2024, with the average purchase cost of newly added BTC positions around $25,000. Based on our expectations and goals for this bull market (expecting BTC to reach $100,000-$120,000, with a target of 3-5x overall position returns), we also created two selling plans, namely PlanA and PlanB previously shared (PlanA was ultimately executed).

So far, I have executed 3 selling operations as planned, on December 5, 2024, May 22, 2025, and yesterday (July 14, 2025), and have basically completed the original plan. However, if BTC continues to rise in the next six months, I might consider selling an additional 20% of the position, with at least 50% of the position remaining in the cold wallet as a long-term asset.

Of course, the above is just my personal position review. Although it's a simple summary, looking back, it seems to represent my persistence over the past few years.

1. Bull Market is a Great Retreat

Some say that the bull market is a great retreat, which is quite reasonable.

As BTC continues to break new highs in this bull market, reaching over $120,000, if historical cycle patterns remain valid, it's not unlikely that Bitcoin might enter a "consolidation or phased bear market" period. Of course, I mainly mean phased, as I have always been a long-term BTC bull.

Since US President Trump officially signed the One Big Beautiful Bill on July 3rd, BTC has risen by over $15,000, especially in recent days, creating new historical highs almost daily. A similar feeling was experienced last year (2024), if I'm not mistaken, around March and November.

Some might say: This time feels different. Others might say: The historical cycle of the crypto market has been broken.

However, rationality tells us that BTC's recent performance is worth remaining vigilant about, at least being cautious of potential risks in the next few weeks (perhaps 5-6 weeks).

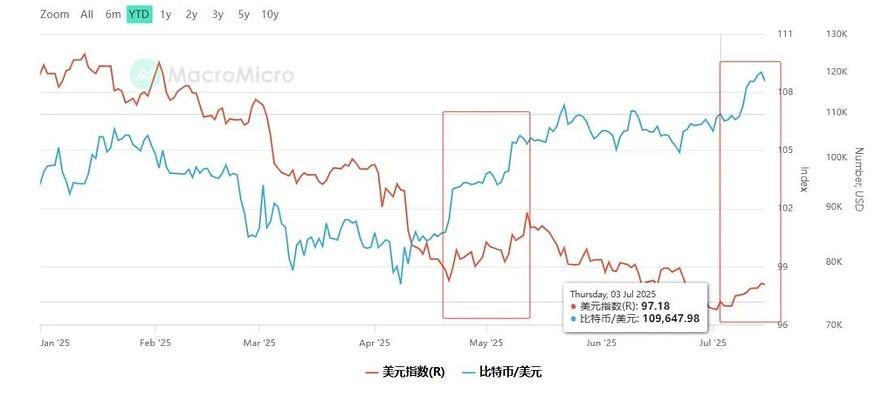

Let's explore this further through the DXY (US Dollar Index) indicator:

Typically, risk assets' trends are inversely correlated with DXY. In most cases, if the dollar is weak, high-risk assets (like gold and BTC) perform strongly, and vice versa. While we remain bullish on BTC, we must acknowledge that gold is still the preferred safe-haven asset, not BTC.

Let's first look at the comparison between gold and DXY, as shown in the following image.

Looking at the major trend, from the chart, we can see that as DXY overall declined from the beginning of the year, gold prices continuously rose, climbing until around April, then entering a major consolidation phase.

As gold consolidates at high levels, if DXY continues to decline or hover at low levels, some funds might choose to enter BTC for risk hedging, aided by macro policy changes.

Continuing to examine the Bitcoin & DXY indicator comparison reveals some insights, as shown in the following image.

From the chart, we can observe two notable divergence points in BTC and DXY comparison this year. The first occurred in April, following Trump's 90-day tariff suspension, and the second during the period since the Big Beautiful Bill was passed this month (July).

In other words, due to macro factors, BTC's trend seems to decouple from the US dollar index at certain stages, and after each decoupling, BTC continues to create new historical highs. For instance, after decoupling in early April, BTC subsequently created an $110,000 historical high; after decoupling in early July, BTC has now created a $120,000 historical high (and might continue attempting to break new highs in the next two weeks).

Could there be a possibility that, assuming current macro conditions remain relatively unchanged, after BTC continues creating new highs, it might re-enter a correction phase, potentially dropping back to around $100,000 in August (the 5-6 weeks we mentioned earlier)?

August also seems like an interesting time point. Here's a new hypothesis: If BTC indeed experiences a correction and a new policy impact event occurs (such as the Federal Reserve's rate changes in September), causing BTC and DXY to decouple for the third time this year, theoretically, BTC might continue rising and break a new historical high around October.

However, if this new hypothesis occurs, it might theoretically also mean that, without seeing more significant macro impact events this year, the new high in the fourth quarter could be the bull market's final peak, after which we might truly enter a relatively long phased "bear market".

Of course, these are just our theoretical speculations based on data perspectives. Whether BTC will enter a new stage of "consolidation or phased bear market" or completely break historical cycle patterns and enter a super "long bull cycle" remains to be seen with time.

2. Institutional Capital and the Crazy BTC

In previous articles, we discussed that BTC's price in this bull market seems primarily driven by institutions, with more and more institutional capital directly or indirectly chasing this BTC rally.

For instance, after the BTC ETF was approved, BlackRock's IBIT (iShares Bitcoin Trust) reached a record $83.5 billion in assets under management within a year, accumulating over 200,000 BTC. As shown in the following image.

In contrast, the world's largest gold ETF, GLD (SPDR Gold Shares), took 20 years to reach the same milestone.

In the earlier period, the crypto market was mainly dominated by retail investors. Since the last cycle, retail investors have been aware that more and more traditional institutions (such as Tesla) have entered the market. In this current cycle, more institutional capital, hedge funds, and family offices are beginning to research or participate in the cryptocurrency field, and even those previously "conservative" funds seem to be considering allocating 1% of their assets to BTC. According to the KobeissiLetter report, the current US institutional asset management scale is approximately $31 trillion. If 1% of US institutional capital flows into BTC, it could potentially drive an additional inflow of over $300 billion. Considering global institutional AUM, we might see over $1 trillion flowing into BTC in the future, as shown in the image below. I asked ChatGPT to calculate that if $1 trillion continues to flow into BTC, the future price of BTC might be pushed from the current $120,000 to $250,000-$340,000 (not including the acceleration of speculative funds). This figure seems to be similar to our previous article's expectation (guess), which is that BTC might reach $300,000 by 2029. In summary, we'll repeat the old saying from our previous article: If your goal is long-term and you firmly believe in BTC's future, you can buy (reserve) BTC at any time now. However, if your goal is short to medium-term, you need to be constantly alert to market fluctuations and make choices suitable for your risk appetite. Additionally, the BTC potentially entering a new "consolidation or phase of bear market" we mentioned above might not be bad for Altcoins. As we mentioned in our previous article (July 12th) about the Altcoin season: With BTC's continuous new highs and entering a consolidation phase, this might bring a new opportunity for a "mini Altcoin season". That's all for today. The sources of images/data involved in the main text have been supplemented in the Notion. The above content is just a personal perspective and analysis, solely for learning and communication purposes, and does not constitute any investment advice.