Translated | TechFlow

Recently, interest in Ethereum has surged again, especially after the emergence of ETH reserve assets. Our fundamental analysis team explored the valuation framework of ETH and constructed a compelling long-term bullish forecast. As always, we are happy to connect and exchange ideas - remember to do your own research (DYOR).

Let's dive deep into ETH with our fundamental analysis expert Kevin Li.

Key Highlights

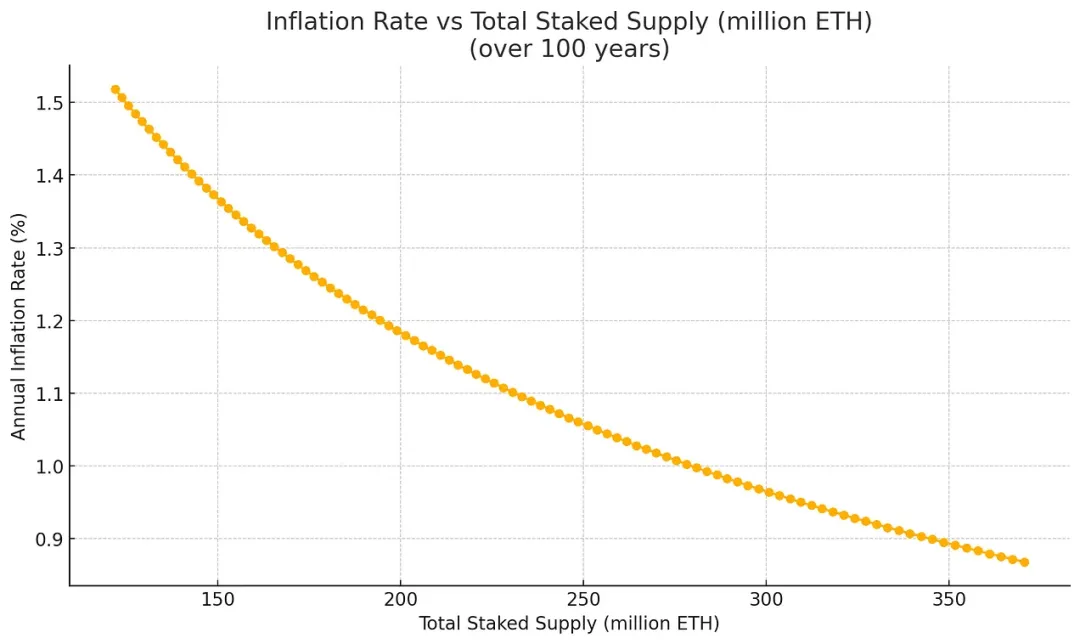

· Ethereum (ETH) is transforming from a misunderstood asset to a scarce, programmable reserve asset that provides security and momentum for a rapidly compliant on-chain ecosystem. ETH's adaptive monetary policy is expected to reduce inflation rates - even with 100% of ETH staked, the inflation rate will be at most around 1.52%, dropping to approximately 0.89% by the 100th year (2125). This is far lower than the average annual growth of 6.36% in the US M2 money supply (1998-2024) and can even be compared to gold's supply growth rate.

· Institutional adoption is accelerating, with companies like JPMorgan and BlackRock building on Ethereum, driving continued demand for ETH to secure and settle on-chain value.

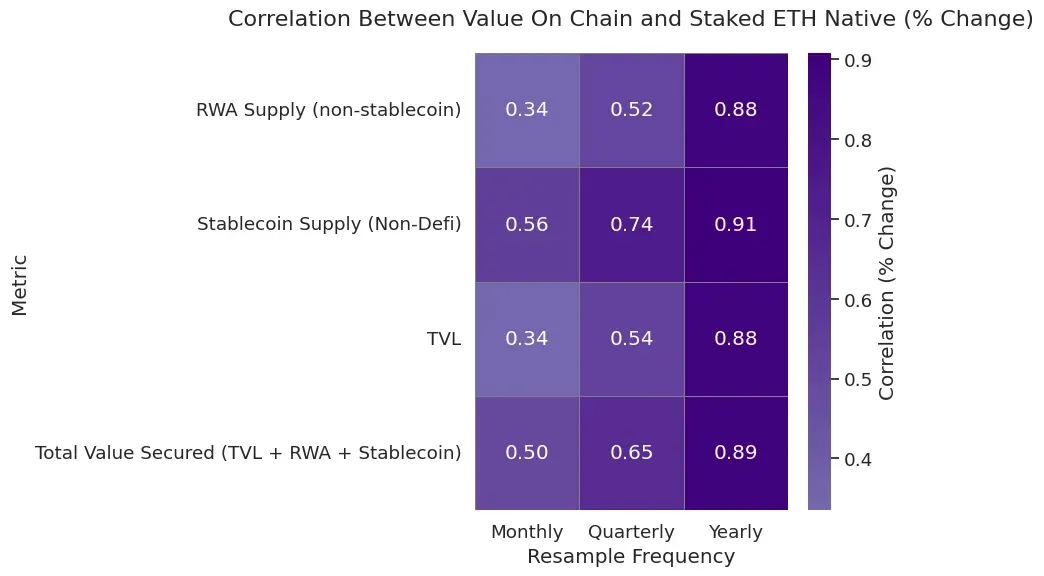

· The annual correlation between on-chain asset growth and native ETH staking is over 88%, highlighting strong economic consistency.

· The SEC issued a policy note on staking on May 29, 2025, reducing regulatory uncertainty. ETH ETF filing documents now include staking terms, thereby enhancing returns and strengthening institutional alignment.

· ETH's deep composability makes it a productive asset - usable for staking/restaking, as DeFi collateral (e.g., Aave, Maker), AMM liquidity (e.g., Uniswap), and as the native gas token on Layer 2.

· While Solana gained attention in Memecoin activities, Ethereum's stronger decentralization and security enable it to dominate high-value asset issuance - a larger and more enduring market.

· The rise of Ethereum reserve asset trading, starting with Sharplink Gaming ($SBET) in May 2025, has led to listed companies holding over 730,000 ETH. This new demand trend mirrors the Bitcoin reserve asset trading wave of 2020 and has contributed to ETH's recent outperformance of BTC.

Not long ago, Bitcoin was widely seen as a compliant store of value - its narrative as "digital gold" seemed far-fetched to many. Today, Ethereum (ETH) faces a similar identity crisis. ETH is often misunderstood, with poor annual return performance, missing key meme cycles, and experiencing retail adoption slowdown in most crypto ecosystems.

A common critique is that ETH lacks a clear value accumulation mechanism. Critics argue that the rise of Layer 2 solutions erodes base layer fees, weakening ETH's position as a monetary asset. When viewed primarily through transaction fees, protocol revenue, or "real economic value", it begins to resemble a cloud computing security - more like Amazon stock than a sovereign digital currency.

In my view, this framework creates a misclassification. Evaluating ETH solely through cash flow or protocol fees confuses fundamentally different asset classes. Instead, it's best understood through a commodity framework similar to Bitcoin. More accurately, ETH constitutes a unique asset class: a scarce yet productive, programmable reserve asset whose value accumulates through its role in securing, settling, and driving an increasingly institutionalized, composable on-chain economy.

[The translation continues in the same manner for the rest of the text...]Importantly, even in this worst-case scenario of issuance rate, it will decrease with the increase of total ETH supply, following an exponential decay curve. Assuming 100% staking and no ETH burning, the expected inflation trend is as follows:

Year 1 (2025): ~1.52%

Year 20 (2045): ~1.33%

Year 50 (2075): ~1.13%

Year 100 (2125): ~0.89%

Figure 4: Illustrative Inference of ETH Maximum Issuance, Assuming 100% ETH Staked, Starting Stake of 120 Million ETH, as Total Supply Increases

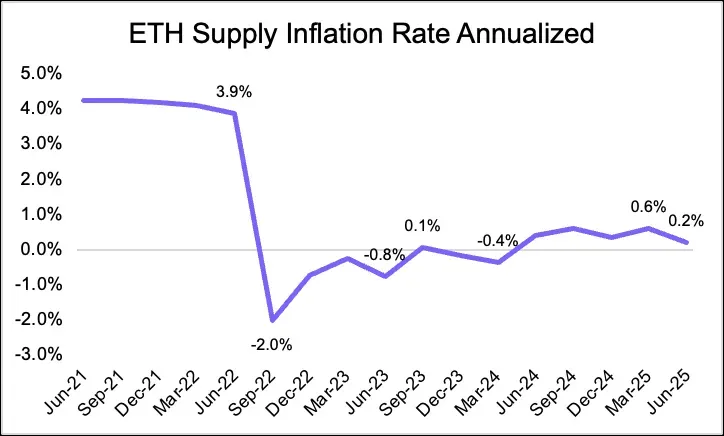

Even under these conservative assumptions, Ethereum's continuously declining inflation curve reflects its intrinsic monetary law — enhancing its credibility as a long-term value storage mechanism. If the burning mechanism introduced by EIP-1559 is considered, the situation would improve further. A portion of transaction fees will permanently exit circulation, meaning the net inflation rate could be far lower than the total issuance, and sometimes even become deflationary. In fact, since Ethereum's transition from Proof of Work to Proof of Stake, the net inflation rate has remained below the issuance and periodically dropped to negative values.

Figure 5: ETH Supply Inflation Rate Annualized

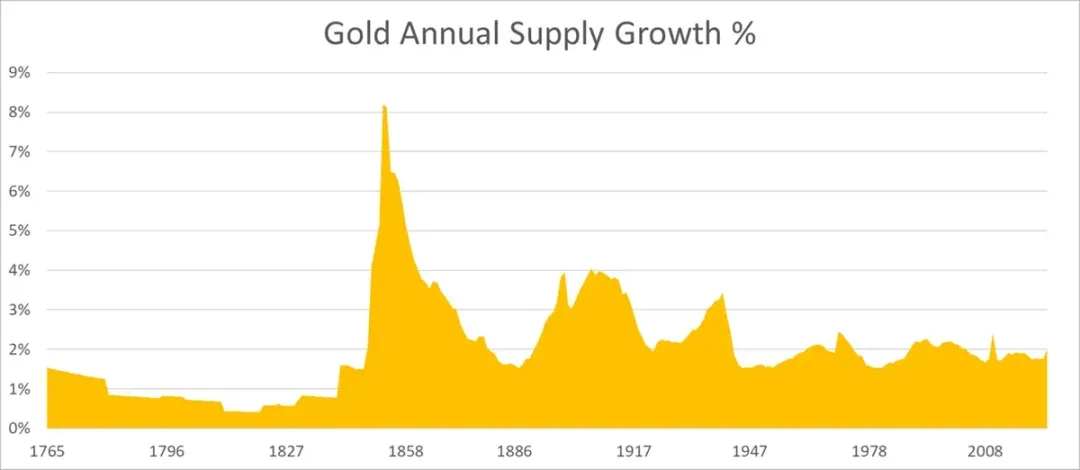

Compared to fiat currencies like the US dollar (with an average M2 money supply growth rate exceeding 6%), Ethereum's structural constraints (and potential deflation) enhance its attractiveness as a value reserve asset. Notably, Ethereum's maximum supply growth rate is currently on par with gold, and even slightly lower, further consolidating its position as a robust monetary asset.

Figure 6: Gold Annual Supply Growth Rate

Institutional Adoption and Trust

While Ethereum's monetary design effectively addresses supply dynamics, its actual utility as a settlement layer has now become the primary driver of adoption and institutional trust. Major financial institutions are building directly on Ethereum: Robinhood is developing a tokenized stock platform, JPMorgan is launching its deposit token (JPMD) on Ethereum Layer 2 (Base), and BlackRock is using BUIDL to tokenize a money market fund on the Ethereum network.

This on-chain process is driven by a powerful value proposition that can address legacy inefficiencies and unlock new opportunities:

1. Efficiency and Cost Reduction: Traditional finance relies on intermediaries, manual steps, and slow settlement processes. Blockchain simplifies these processes through automation and smart contracts, reducing costs, minimizing errors, and shortening processing time from days to seconds.

2. Liquidity and Partial Ownership: Tokenization enables partial ownership of illiquid assets like real estate or art, expanding investor access and releasing locked capital.

3. Transparency and Compliance: Blockchain's immutable ledger ensures verifiable audit trails, simplifying compliance and reducing fraud by providing real-time visibility of transactions and asset ownership.

4. Innovation and Market Access: Composable on-chain assets allow new products (like automated lending or synthetic assets) to create new revenue streams and expand financial scope beyond traditional systems.

ETH Staking as Security Guarantee and Economic Coordination

The on-chain migration of traditional financial assets highlights two primary drivers of ETH demand. First, the continuous growth of real-world assets (RWA) and stablecoins increases on-chain activity, driving up demand for ETH as a gas token. More importantly, as Tom Lee observed, institutions might need to purchase and stake ETH to secure the infrastructure they depend on, aligning their interests with Ethereum's long-term security. In this context, stablecoins represent Ethereum's "ChatGPT moment" - a breakthrough use case demonstrating the platform's transformative potential and broad utility.

As more value settles on-chain, the alignment between Ethereum's security and its economic value becomes increasingly crucial. Ethereum's finality mechanism, Casper FFG, ensures blocks are only finalized when an overwhelming majority (two-thirds or more) of staked ETH reaches consensus. While an attacker controlling at least one-third of staked ETH cannot finalize malicious blocks, they can fundamentally disrupt finality by breaking consensus. In such a scenario, Ethereum can still propose and process blocks, but without finality, these transactions might be revoked or reordered, introducing severe settlement risks for institutional use cases.

Even when operating on Layer 2 that relies on Ethereum for final settlement, institutional participants depend on the base layer's security. Layer 2 not only does not harm ETH but actually enhances ETH's value by driving demand for base layer security and gas. They submit proofs to Ethereum, pay base fees, and typically use ETH as their native gas token. As Rollup execution scales, Ethereum continuously accumulates value through its foundational role in providing secure settlement.

In the long term, many institutions might move beyond passive staking through custodial services to operate their own validators. While third-party staking solutions offer convenience, operating validators provides institutions with greater control, higher security, and direct consensus participation. This is particularly valuable for stablecoin and RWA issuers, enabling them to capture MEV, ensure reliable transaction inclusion, and execute privacy — features critical for maintaining operational reliability and transaction integrity.

Importantly, broader institutional participation in validator node operations helps address one of Ethereum's current challenges: stake concentration among a few large operators, such as liquid staking protocols and centralized exchanges. By diversifying the validator node collection, institutional participation helps enhance Ethereum's decentralization, increase its resilience, and strengthen the network's credibility as a global settlement layer.

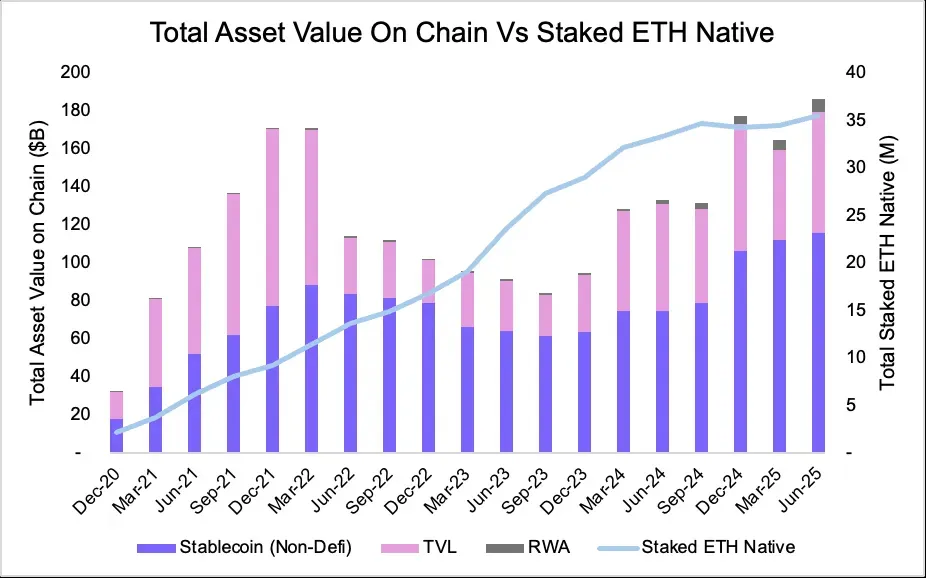

A notable trend between 2020 and 2025 reinforced this incentive alignment: the growth of on-chain assets closely correlates with staked ETH. As of June 2025, the total stablecoin supply on Ethereum reached a record $116.06 billion, while tokenized RWA climbed to $6.89 billion. Simultaneously, the amount of staked ETH grew to 35.53 million ETH, highlighting how network participants balance security and on-chain value.

Figure 7: Total On-Chain ETH Value vs Native Staked ETH Value

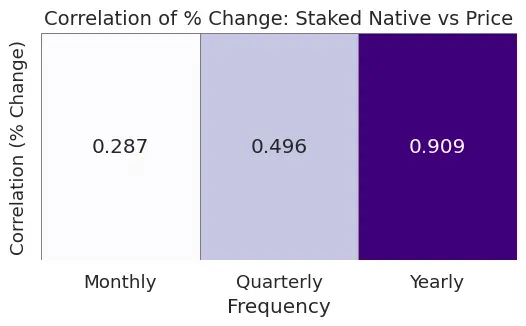

From a quantitative perspective, the annual correlation between on-chain asset growth and native ETH staking has consistently remained above 88% across major asset classes. Notably, stablecoin supply growth closely correlates with staked ETH. While quarterly correlations exhibit significant volatility due to short-term fluctuations, the overall trend remains consistent — as assets flow on-chain, the motivation for staking ETH strengthens.

Figure 8: Monthly, Quarterly, and Annual Native Correlation of Staked ETH with On-Chain Value

Additionally, increased staking impacts ETH's price dynamics. As more ETH gets staked and removed from circulation, ETH supply tightens, especially during periods of robust on-chain demand. Our analysis shows an annual correlation of 90.9% between staked ETH quantity and ETH price, with a quarterly correlation of 49.6%, supporting the view that staking not only secures the network but also creates favorable supply-demand pressure for ETH in the long term.