During the interest rate hike cycle, both cryptocurrencies and the stock market typically enter a bear market or experience a pullback. Currently, we are in a rate-cutting cycle with ample market funds, making high-quality assets easier to attract buying support. Moreover, this market trend is accompanied by landmark events such as the approval of Bitcoin ETF and large-scale Bitcoin purchases by U.S. stocks companies like MicroStrategy, further driving funds, especially institutional and retail investor funds, directly or indirectly into the crypto industry. The combination of these two factors is a key reason why Bitcoin has risen to $120,000 without a significant pullback.

VX: TZ7971

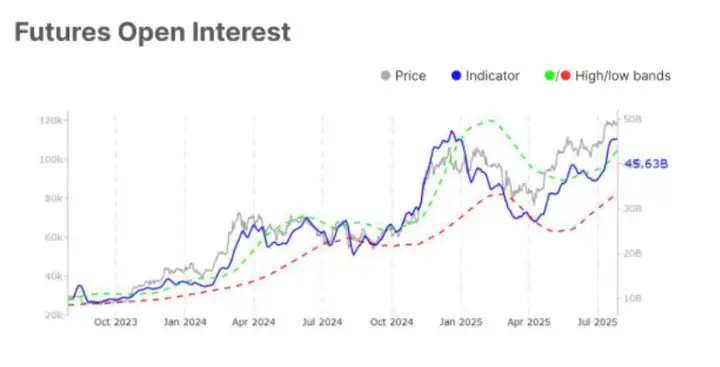

Over the past week, Bitcoin spot prices retreated after hitting a historical high, triggering market consolidation and presenting a complex situation with both bullish and bearish sentiments. Despite the price pullback, the total uncleared futures contracts slightly increased to $45.6 billion, maintaining a high level. Meanwhile, the continuous payment of funding rates for long positions reflects that leveraged investors' optimism has not faded. However, the constant increase in leverage makes the market susceptible to sudden deleveraging events, and the risk of chain liquidation increases with the growth of speculative positions.

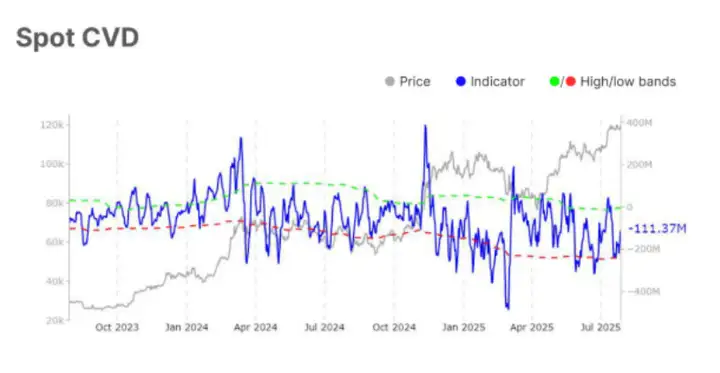

The spot market's cumulative trading volume difference (Spot CVD) has significantly improved, indicating that buyers have entered the market after the price drop, forming short-term support. However, the overall spot market momentum is gradually weakening, with the Relative Strength Index (RSI) dropping sharply from the overbought zone of 74.4 to 51.7, showing significantly exhausted buying momentum. Spot trading volume has shrunk to $8.6 billion, with overall market participation declining.

ETF funds have clearly receded, with weekly net inflows plummeting 80% to $496 million, and total trading volume sliding to $18.7 billion, indicating a temporary cooling of institutional buying interest. The ETF's Market Value to Realized Value (MVRV) ratio remains high at 2.4, suggesting that holders have accumulated significant unrealized profits and may trigger profit-taking at any time, potentially creating selling pressure and hindering further price increases.

Despite the overall market activity cooling down, on-chain transaction fees have risen, and the "Realized Market Cap" has grown significantly by 6.6%, strongly suggesting that new capital continues to flow into the Bitcoin network even during consolidation.

Trump said rates would be cut this week, which seems unrealistic, and his comments about global tariffs are slightly negative, but a small dip is insignificant. If an opportunity arises, it's time to get on board.

After Bitcoin rose to $120,000 and stabilized, mainstream funds shifting to Ethereum speculation is not surprising. Previous structures have shown that Ethereum has gained some mainstream capital recognition, and its DeFi chain's Total Value Locked (TVL) data appears relatively authentic. During the 2021 bull-to-bear market transition, Ethereum and Bitcoin declined similarly, making it a resilient asset. In this bull market, mainstream funds traditionally prioritized Bitcoin, driving its bull market trend. Now, Ethereum's catch-up is a natural logical progression.

Ethereum remains attractive in the long term. On one hand, it enjoys mainstream recognition, and on the other, its DeFi applications are active, with TVL accounting for over 50-60%. Currently, its TVL and Fully Diluted Valuation (FDV) have not reached new highs, whereas Solana's issuance will be more. Overall, we remain optimistic about Ethereum's medium to long-term performance in this cycle.

The Altcoin market trend has not truly begun and is far from over.