Author: White55, Mars Finance

Original Title: Rate Cut or Rainfall Tomorrow? Key Week Setting the August Market Script

Most people haven't realized that what's happening this week is setting the tone for August and may determine the market direction for the entire summer.

Three key variables—the Federal Reserve's interest rate decision, tech giants' earnings reports, and the White House digital asset report—will simultaneously land, just before the season historically weakest for the crypto market.

Traders stand at an awkward crossroads: whether to pre-position for a rebound or prepare for a liquidity withdrawal.

As 10xResearch's latest report wrote: "We are about to enter a critical moment: the most important events on the calendar—corporate earnings, the White House digital asset report, and the FOMC meeting—are about to be settled before summer arrives. Given the crypto market's traditionally weak performance in August and September, traders face a dilemma." Their real-time indicators also suggest that today's trend will likely set the pace for the entire summer.

More complexly, the market is not just waiting for the rate cut answer, but for a directional signal. Will it turn towards easing, continuing to push Bitcoin and Ethereum higher? Or will it remain stationary, giving the market a metaphorical rainfall?

Next, BlockBeats has compiled macro information about rate cuts and tariffs, as well as traders' perspectives on market conditions and mainstream cryptocurrency trends, to provide some directional references for this week's trading.

Macro Data Triple Threat This Week

From Wednesday to Friday, the US will consecutively release three core economic data points—GDP, core PCE, and non-farm payrolls—which collectively form the three rulers for this period's potential rate cut, and their impact on market sentiment is almost as significant as this week's Federal Reserve meeting.

July 30 (Wednesday): Q2 GDP preliminary value will be announced, expected at +1.9%, a significant recovery from Q1's –0.5%. If the actual value further rises, it might be interpreted by the market as "soft landing still in progress", potentially suppressing early rate cut expectations.

July 31 (Thursday): June core PCE inflation will be released, estimated at 2.7% year-on-year, the inflation indicator most closely watched by the Federal Reserve. A slightly lower-than-expected figure might strengthen market bets on year-end rate cuts; an unexpected increase could trigger short-term risk asset adjustments.

August 1 (Friday): July non-farm employment data will be published, expected to add 115,000 jobs, with unemployment rate slightly rising to 4.2%. This will directly impact the Federal Reserve's judgment on whether the labor market has significantly cooled, and could be a key piece in determining policy tone.

Low Probability of Rate Cut Tomorrow

The Federal Reserve will hold the FOMC monetary policy meeting from July 30 (Tuesday) to 31 (Wednesday), with the market widely expecting to maintain the benchmark interest rate in the 4.25%–4.50% range. Polymarket's prediction market shows that as of July 29, the probability of the Federal Reserve maintaining interest rates is as high as 97%, while the probability of a 25 basis point rate cut is only 3%.

In other words, the market doesn't expect an actual rate cut, but is waiting for a "rate cut signal".

[The rest of the translation follows the same professional and accurate approach]

Nick Forster, the founder of on-chain options platform Derive, also agreed with this change, stating: "Mike Novogratz's prediction of $150,000 is no longer a far-fetched idea." "The options market currently gives a 52% probability that Bitcoin will reach $150,000 before the end of the year."

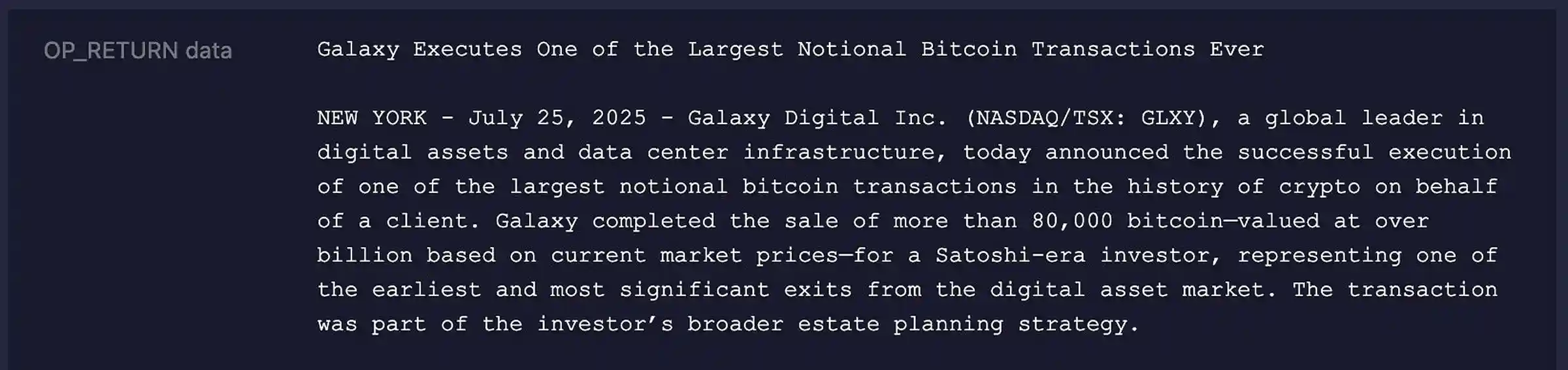

This week, Bitcoin completed a stunning "massive transfer" event - 80,000 BTC, approximately $9 billion, were awakened from a Satoshi-era cold wallet, sold, and completed circulation. This transaction was led by Galaxy Digital and became the largest known legacy transfer sale in cryptocurrency history.

According to analysis account @TheInvestorsSide, this transaction was originally highly anticipated by the market, but the actual volatility was far lower than expected: "Despite such a large scale, BTC only briefly dropped below $115,000 and recovered to $119,000 within days."

What does this mean? He believes: "Bitcoin barely maintained the $9 billion sell-off, which tells us everything we need to know. The natural market trajectory remains upward, and if BTC can overcome next week's macro resistance, my next short-term target is $130,000."

Famous on-chain analyst and Checkonchain co-founder James Check (@Checkmatey) provided a more detailed review: "This was a very traditional benign sale. Galaxy helped customers complete the transfer and published the news on-chain using OP_RETURN."

More interestingly, he pointed out that Galaxy also "casually" sent back a transaction output with 1 satoshi to the original address - widely interpreted as giving the middle finger to those trying to "legally take over these BTC".

But from an on-chain perspective, Check was more focused on structural capital flow: "This is not a simple wallet migration, but a real change of ownership. Whether sold over-the-counter or on exchanges, the on-chain transaction must be completed, and capital is thus repriced."

He emphasized that market cap, active addresses, and capital movements accurately reflected this event; the price only pulled back 3.5% before quickly recovering.

Check pointed out that this is a typical retracement-rebound pattern that appears in the middle of a bull market, called the "Dali Llama recovery pattern": "Even occurring on the weekend, on-chain data and market reactions were surprisingly robust, and Bitcoin will move higher."

ETH Approaching $4,000

According to the latest options market data: Bitcoin's December implied volatility is only 30%, indicating investors' stable expectations for its upward path; Ethereum's December implied volatility is as high as 60%, almost double that of Bitcoin.

This seems to show: Bitcoin is more like walking a steady upward main wave; while Ethereum might experience a more intense, non-linear burst.

ETH's trend also confirms this: the main focus in the past two weeks has been ETH's significant rise, from $2,600 to nearly $3,800. ETHBTC remained low after BTC broke through multiple historical highs until $123,000, after which it was ETH's turn. It rose from $3,000 to $3,800 in 5 days, a 27% increase with very limited pullback.

According to @TheInvestorsSide: "Ethereum ETF has had daily inflows exceeding Bitcoin ETF for 6 consecutive days and created a new historical record of 16 consecutive days of net inflows."

He directly stated that this is a typical Wall Street sentiment replenishment: "After months of neglect, Wall Street is re-embracing ETH, which makes me believe we will see ETH break $5,000 in the medium to short term."

Nick Forster, founder of on-chain options platform Derive, provided a more direct prediction: "The probability of Ethereum reaching $6,000 by the end of the year has skyrocketed from less than 7% in early July to over 30%." He views this as a "massive repricing of tail risks".

This echoes the judgment of Capriole Fund founder Charles Edwards: he believes ETH will create a new all-time high in the next "6 to 12 months".

Analyst Viktor revealed another layer of funding logic - the reflux cycle of ETH funding companies is accelerating this process:

Most notably are Sharplink Gaming and Tom Lee's Bitmine. Sharplink Gaming's stock price rose nearly 5 times in two weeks in early July. The team seized the opportunity to sell newly issued stocks and reinvest the funds in ETH, with the highest weekly purchase reaching $400 million. Currently, its mNAV is 2.3, and if the valuation remains high, this "sell stock, buy crypto" behavior is expected to continue. Bitmine completed a $250 million private placement in just 10 days and publicly announced that its total ETH holdings have exceeded $1 billion. It is continuously financing through ATM and purchasing ETH.

"These Altcoin fund companies are creating a self-activated capital path through stock price rise-financing-crypto buying," Viktor added: $ETH's strength naturally drove the rise of some "ETH test coins", especially in the DeFi field, with $CRV, $FXS, and $CVX all doubling. $ENA also soared from the bottom, rising 125%, but the final stage of the rise might be due to preemptively announcing the establishment of the $ENA fund company named StablecoinX, with the ticker $USDE. Again, caution is advised when purchasing Altcoin fund company stocks.

In Bitmine Chairman and Fundstrat co-founder Tom Lee's latest internal report "The Alchemy of 5%", he directly stated: "Wall Street generally believes that Ethereum will be one of the most important macro trades in the next decade."

His prediction for BTC is that it will reach $250,000 by the end of 2025. His ETH target price is set at $60,000, with the following reasons: ETH is the main platform for Web3, DeFi, stablecoin issuance, and staking; spot ETF has perfected the entry path; fund companies provide structural buying; inflation and macro cycles will boost crypto asset premiums.

In his view, this market cycle is not a traditional "hype bull market", but an institutional-level main upward cycle jointly shaped by ETFs, fund companies, and on-chain liquidity.

Traders Entering SUI

The token's daily trading volume is $4.7 billion, with a market cap of $9.98 billion, and is beginning to show an upward trend with further potential for growth. As SUI recovers from market pressure typically seen during long-term volatility periods, traders are starting to re-examine it.

Famous crypto analyst Ali Martinez analyzed that the SUI token broke through a symmetrical triangle pattern on the daily chart - a classic technical pattern usually accompanied by significant price volatility. A symmetrical triangle pattern breakthrough is typically interpreted as a transition from market uncertainty to a clear directional momentum, in this case, upward.

Ali Martinez mentioned that as long as investment flow continues, confirming a breakthrough above the $4.50 resistance could lead the price to further surge towards $8. He also explained that the triangle pattern marks the end of a consolidation phase and the beginning of a trend reversal.

According to Reuters, institutional investment firm Canary Capital has submitted the first spot SUI ETF application to the US SEC. The document indicates that if approved, it will make SUI one of the first mainstream Layer-1 coins to obtain a traditional ETF channel. This process is seen as an important prelude to driving institutional funds into SUI.