For institutional clients (large investors or funds): KOL analyst Phyrex explained that the physical redemption of spot ETF is "more for APs to use". However, this does not mean it is irrelevant to institutional clients; on the contrary, it "can provide compliant BTC and ETH withdrawal services for institutional clients, which is a major positive for enhancing liquidity and earning capacity".

4. Consolidating and expanding the liquidity and efficiency of the crypto native market: Ecosystem self-optimization

The physical redemption mechanism enables the creation and redemption of ETPs directly at the crypto asset level, rather than just at the cash level.

Increasing the circulation and liquidity of crypto assets: Authorized participants directly transfer crypto assets during the creation and redemption process, which means more actual Bitcoin and Ethereum will flow between institutions. This helps increase on-chain activity (although most large institutions still transfer assets through regulated custodians) and inject deeper institutional liquidity into the crypto asset market.

More effective market balancer: When the ETP price deviates from the underlying asset price, AP's arbitrage behavior will be more efficient. This instant, low-cost arbitrage mechanism will make the ETP price more closely linked to the spot price, enhancing the market's efficiency and price discovery capabilities.

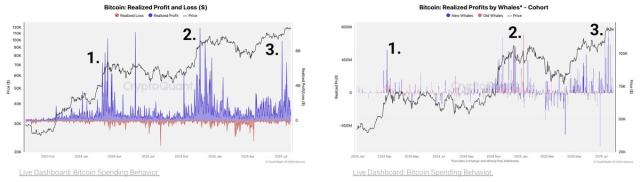

Reducing market volatility pressure: In cases of large redemptions, since APs can directly receive Bitcoin or Ethereum instead of cash, the ETF issuer does not need to sell large amounts of underlying assets in the open market to obtain cash, thereby reducing the direct impact on spot prices. The same applies in reverse. This helps smooth market volatility and improve the stability of the crypto native market.

Crypto Accelerating Towards the Ultimate Integration of "Wall Street Dance"

SEC Chairman Paul S. Atkins stated directly in the announcement: "This is a new day for the SEC, and my top priority during my chairmanship is to develop an appropriate regulatory framework for the crypto asset market." The SEC's approval of physical redemption for crypto ETPs, along with the opening of hybrid ETPs and options products, is undoubtedly a crucial watershed in the regulatory process of the US and global crypto markets.

Think about it: not long ago, crypto assets were just a "niche experiment" for a small group of tech enthusiasts, full of wildness and uncertainty. Today, it has transformed into a "strategic fortress" that Wall Street giants are competing to deploy, accelerating its integration into the vast and complex global financial network. This transformation is an irreversible tide.

Twitter: https://twitter.com/BitpushNewsCN

Bitpush Telegram Group: https://t.me/BitPushCommunity

Bitpush Telegram Subscription: https://t.me/bitpush