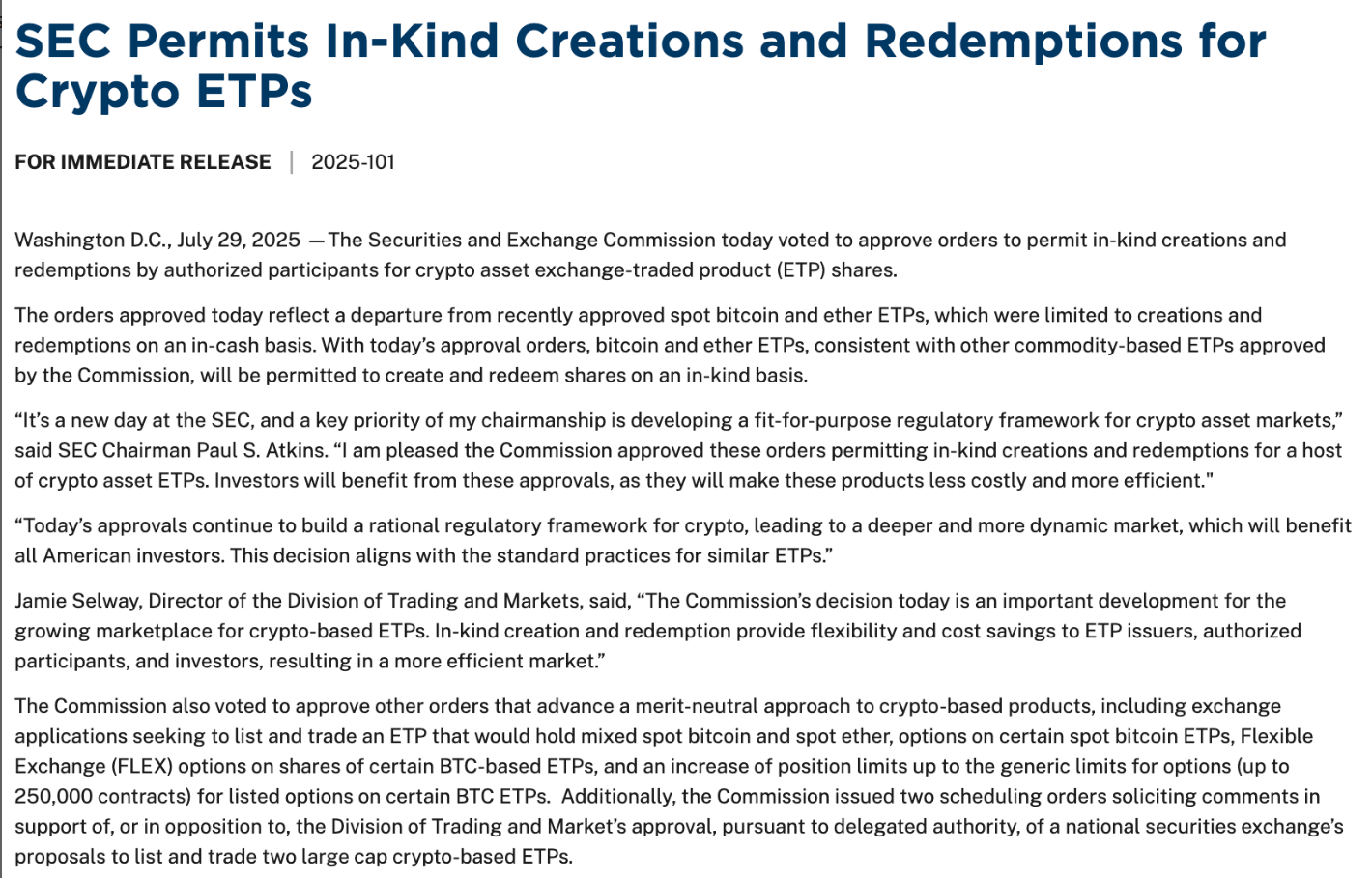

Today, I must discuss this news: SEC has officially approved the "physical creation and redemption mechanism" for Bitcoin and Ethereum ETFs. Though it sounds technical, its significance can be described as "epoch-making".

Previously, both Bitcoin and Ethereum ETFs could only be created and redeemed with cash, meaning institutions had to convert fiat currency and go through a complex process of buying and redeeming coins, which was time-consuming and error-prone. Now, they can directly use BTC/ETH for ETF share subscription and redemption, making the process clean and efficient, improving cost, efficiency, and safety.

Behind this transformation is the first "combination punch" by the SEC after changing leadership: the new chairman Paul Atkins, within a month of taking office, directly implemented this reform, sending a clear signal - "We are no longer indifferent to crypto assets."

What Does Physical ETF Mean?

First, the physical creation and redemption mechanism will make ETFs closer to the spot market, with more precise price tracking and smoother arbitrage. Previously, with cash, fund companies had to convert BTC to cash; now, they can directly provide BTC. This reduces friction costs, which is a blessing for market makers and institutions.

Jamie Selway (SEC's Trading and Markets Division head) also mentioned that this mechanism aligns Bitcoin and Ethereum ETF operations with traditional commodity ETFs like gold, effectively bringing crypto assets into the "circle" with equal treatment.

Lowering Barriers + Relaxing Restrictions, Will Derivatives Market Take Off?

Moreover, the SEC has significantly relaxed ETF options trading restrictions, increasing the Bitcoin ETF options position limit from 25,000 to 250,000 contracts, a tenfold increase! FLEX options and composite ETF applications are also approved, providing a big breath of oxygen to the entire derivatives market.

Simply put: the options market is expected to explode. Once these supporting policies are implemented, you can not only trade spot ETFs but also create more complex and flexible strategies through options and composite products, making it easier for institutions to deploy.

Bloomberg analysts directly state: this is a "major breakthrough".

Why Now? Policy Winds Are Changing

More critically, the background of this policy change - the overall U.S. regulatory direction is clearly becoming "crypto-friendly".

Supported by the Trump administration, the U.S. Congress has recently passed three regulations on crypto market structure, stablecoins, and CBDC. Combined with this ETF policy upgrade, it's not just a "single positive point" but a clear institutional relaxation.

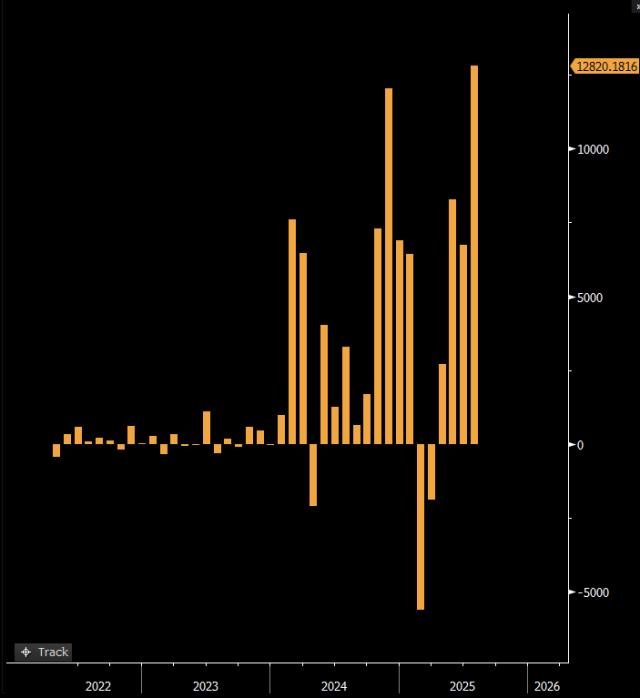

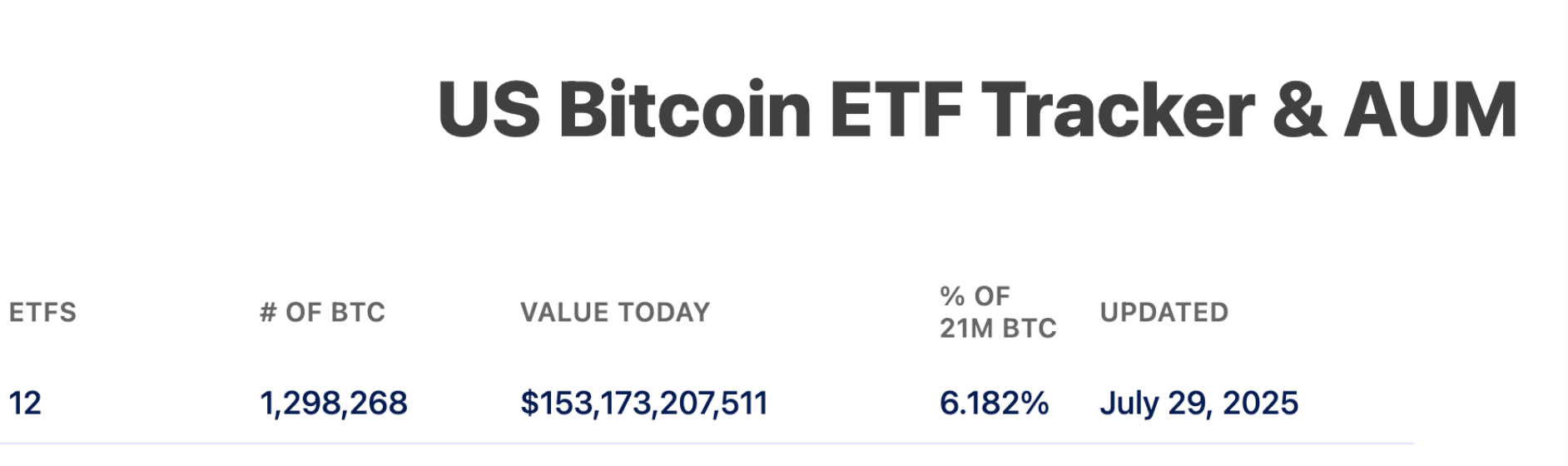

Market feedback is quick: spot BTC ETF has seen net inflows for 12 consecutive days, adding $6.6 billion; Ethereum ETF is also strong, with BlackRock's iShares ETH ETF breaking $10 billion in less than 9 months, becoming the third-fastest ETF to reach this asset size.

Written at the End: A New Era Has Truly Arrived

New chairman Paul Atkins said it plainly: "We want to establish a regulatory framework suitable for the crypto asset market." Translated, this means: the crypto world is no longer passively responding but actively embracing.

For us, this means not only more active Bitcoin and Ethereum ETF trading but also suggests that future ETFs, including Altcoins, might start directly from the "physical mechanism", with a higher starting point and lower participation threshold.

In one sentence: This is not just a technical upgrade of ETFs, but possibly an accelerator for the crypto market entering the mainstream financial system.

Next, let's see who runs faster and who captures the dividends.

The article ends here! If you're lost in the crypto world, consider joining me in layout and harvesting! You can join the community VX+Q group for market analysis, Altcoin operations... V: c13298103401 or Q: 3806326575