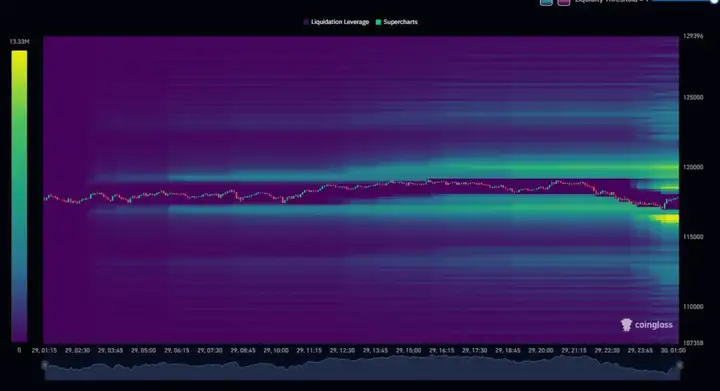

Over the past two days, the cryptocurrency market has felt stagnant, and in the absence of special negative news, this trend is likely driven by liquidity liquidation. Entering July, the market was driven by ETH's upward momentum, with optimistic sentiment high, so recent pullbacks have seen large amounts of funds buying the dip, mostly from leveraged investors, resulting in significant market liquidation.

VX: TZ7971

After experiencing a small rally on Sunday, the market began consecutive long position liquidations on Monday, as investor sentiment was generally bullish, accumulating many long positions. This trend continued on Tuesday, with nearly $500 million liquidated in the cryptocurrency market within 24 hours since Bitcoin broke below $118,000, of which ETH alone was liquidated for nearly $120 million.

According to the latest options market data: Bitcoin's December implied volatility is only 30%, indicating investors' stable expectations for its upward path; Ethereum's December implied volatility is as high as 60%, almost double that of Bitcoin.

This seems to show: Bitcoin appears to be following a steady upward main wave; while Ethereum may experience a more intense, non-linear burst.

ETH's trend confirms this: the main focus over the past two weeks has been ETH's significant rise, surging from $2,600 to nearly $3,800. ETHBTC remained low even after BTC repeatedly broke its all-time high, until $123,000, after which ETH's turn came. It rose from $3,000 to $3,800 in 5 days, a 27% increase with very limited pullback.

Ethereum ETF has had daily inflows exceeding Bitcoin ETF for 6 consecutive days, creating a new historical record of 16 consecutive days of net inflows.

Macroeconomic policies and tech sector earnings remain the core variables of current market sentiment. The White House's first crypto policy report will be released on July 30th, potentially bringing new regulatory guidance to the digital asset industry. On July 31st, the Federal Reserve will announce its latest interest rate decision, with Chair Powell attending the press conference. Currently, the market's expectation of a September rate cut is 62.4%. If the meeting's language or economic outlook changes, it may trigger a reassessment of monetary policy. The market doesn't expect an actual rate cut but is waiting for a "rate cut signal".

In the tech stock sector, Nasdaq-listed BTC financial company Strategy will disclose its second-quarter results after US stock market close on July 31st and hold an online seminar. As a significant BTC asset holder, its financial report will be a market focus. Coupled with major global economies about to release core data like GDP, employment, and inflation, market volatility may further amplify under the interweaving of macro and industry fundamentals. Close attention to policy trends and key financial report performances is needed, with caution against market disruptions from sentiment changes.

Currently, the futures market is still predominantly long, with significant long liquidity around $116,500 for Bitcoin, so market downward liquidation remains a risk. Starting today, the US will publish important economic data, including tonight's mini non-farm payrolls and GDP, and the day after tomorrow's monetary policy meeting. Market ups and downs using these news are possible, so position management is crucial, avoid chasing highs, and stay calm. CFX surged to 0.27 yesterday, a timely reminder to exit with a 50-point gain, now back to 0.2. Looking forward to the potential breakout of APT and LDO.