This market trend looks like a bull market, but it's more like a "meat grinder". BTC and ETH are about to close their monthly lines with obvious volatility, but few can actually get on board, and even fewer can hold - especially in the Altcoin battlefield, which is simply "blood flowing like a river".

BTC oscillates and upgrades, ETH changes hands at high levels, "critical point" is imminent

Yesterday, #BTC once rushed to 119300, but was immediately knocked down, falling back to around 117200 support before barely rebounding, closing a daily candlestick with an upper shadow. This trend is a standard "last crucial step" - the direction hasn't broken, but sentiment is starting to loosen.

#ETH is the same. Unable to break 3880, it pulled back to 3720 before rebounding, closing a daily candlestick with a pin. Lacking upward momentum, short-term volatility has expanded, looking like a wash-out and multi-trap before month-end.

Key references are as follows:

- BTC's short-term pressure is in the 118-119 interval, with support between 1155-1165; once 116 is lost, it may explore 113-114;

- ETH's resistance is at 3820-3880, support at 3600-3660, and breaking could directly pull it to 3500 for testing.

Summary: The market is still oscillating, but funds are already looking for successors, with local handover in progress.

The performance of Altcoins can only be described as "cold".

Whether it's AI tracks, RWA, staking concepts, or the previously hot #ONDO, #MERL, almost all are "pull and smash" - rapidly rising and falling short-term, with no sustainability. This trend is typical of "multi-trap wash-out". Structurally, most Altcoins are still running below the downtrend line, with trading volume not effectively expanding, indicating that main players' willingness to build positions remains insufficient.

More critically, large funds are now generally "sitting on the fence", focusing on short-term arbitrage with extremely fast hot spot rotation. So now, Altcoins are more like "quick in and out trading tools", not value assets you hold indefinitely. In terms of operation, it's better to participate less and not linger.

On-chain data shows: The bull market's "third wave" is still on the way

Don't rush to say the market is over. On-chain data signals that Bitcoin's active supply has increased by nearly 1 million since the ETF launch, with many "sleeping whales" beginning to awaken - a typical mid-bull market characteristic. Remember the previous rounds of rushing to 70,000 and 100,000? They also started after sudden on-chain activity recovery.

This round's rhythm is indeed slower, but the structure is more solid, especially on the ETH side: in the next 11 days, an estimated 668,000 ETH will be unstaked, with a market value exceeding $2.5 billion. It can be expected that the area around $4,000 will be a critical handover window, and once completed, ETH may directly rush to new highs.

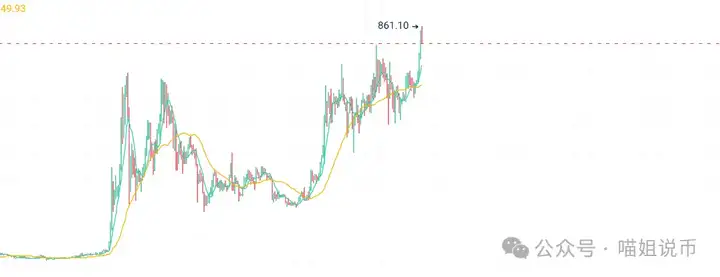

BNB's recent rhythm has been quiet, but on-chain, a subtle transformation is happening.

BNB Chain just completed a $1.25 billion PIPE financing, backed by a NASDAQ-listed BNB asset management tool - #VAPE. Notably, CEA Industries, originally in the e-cigarette business, directly cut its main business and transformed into a native BNB ecosystem financing platform, with VAPE stock surging over 550% that day.

This is not just concept speculation, but a complete asset positioning upgrade. Meanwhile, BNB chain's block time has shortened from 1.5 seconds to 0.75 seconds, with on-chain transaction volume soaring 142.8% in three months, far outpacing ETH's 24.3% in the same period.

It looks like paving the way for "breaking $1,000".