Bitcoin remains within a narrow range around the 120,000 USD mark, while Ethereum faces resistance pressure at 4,000 USD.

Institutional investment flows and positive regulatory developments continue to support Bitcoin towards new medium-term highs. However, short-term reversal signs appear as the market does not strongly react to recent positive news.

- Bitcoin maintains the price range of 116,000-120,000 USD with stable demand from institutional investors.

- Ethereum weakens near the psychological resistance of 4,000 USD, with momentum index becoming neutral.

- Potential risks from excessive short positions on USD and macroeconomic developments could affect risky asset markets.

Is Bitcoin Really Ready to Break Out of the Current Price Range?

Bitcoin's capital inflow from institutional investors remains stable, helping the currency maintain its price around 116,000-120,000 USD, according to QCP Capital, a cryptocurrency investment company in Singapore.

Large investors like Strategy and SharpLink Gaming continue to raise capital to buy Bitcoin, demonstrating long-term confidence in this asset. However, the market remains cautious as prices have not strongly reacted to favorable legal news and positive cryptocurrency ETF developments. According to QCP Capital's report, this is a typical sign when the market enters the final stage of a short-term growth cycle.

"Bitcoin's lack of significant price increase despite many positive news indicates weakening short-term momentum, which is a common market characteristic in the late cycle stage."

Mr. John Lee, QCP Capital Strategy Director, 30/07/2024

What Challenges is Ethereum Facing as it Approaches the 4,000 USD Threshold?

Ethereum approaches the psychological resistance of 4,000 USD with diminishing upward momentum, with the momentum index showing a neutral trend, according to QCP Capital's analysis.

Weakness in technical chart momentum warns of potential correction or interruption of the short-term upward trend. This factor suggests investors should be cautious when making Ethereum trading decisions, especially in the context of cryptocurrency markets experiencing volatility from macro signals.

What Macro Risks Could Affect the Cryptocurrency Market in Q3/2024?

Excessive short positions on USD are creating risk pressure for risky asset markets, including cryptocurrencies, stocks, and emerging markets, according to data from the U.S. Commodity Futures Trading Commission (CFTC).

The USD has dropped approximately 10% this year compared to the Yen, increasing the risk of "short-covering" in the foreign exchange market. Simultaneously, the trade war continues to impact corporate profits and consumer prices. Important economic data on inflation and employment in the U.S. will directly influence market trends in Q3.

"USD selling pressure and expectations for upcoming economic data will be the decisive push for risky assets, including cryptocurrencies, this quarter."

Dr. Nguyen Hoang, Macroeconomic Expert, 28/07/2024

The Federal Open Market Committee (FOMC) is expected to maintain interest rates at the July meeting while emphasizing dependence on economic data before the important September meeting. The possibility of interest rate cuts remains highly unpredictable.

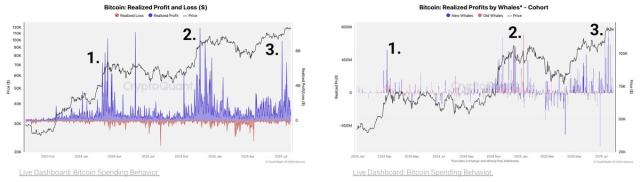

How are Institutional Investors Acting in the Bitcoin Market?

According to QCP Capital, institutional investors continue to actively accumulate Bitcoin through multiple capital raising rounds, demonstrating long-term confidence in price prospects.

Investment strategies of organizations like Strategy and SharpLink Gaming show that the cryptocurrency market is being solidly consolidated in terms of capital flow and large resource mobilization. This contributes to enhancing Bitcoin's reliability as a risk prevention and portfolio diversification asset.

Frequently Asked Questions

1. Can Bitcoin Exceed the 120,000 USD Threshold in the Short Term?

Experts at QCP Capital believe Bitcoin has many supporting factors but lacks immediate momentum to break through, and recommend observing additional signals from institutional capital flows and macro fluctuations.

2. Will Ethereum Experience Strong Correction When Reaching 4,000 USD?

The current momentum index is neutral, warning of potential short-term fluctuations or decline. Investors should be cautious and closely monitor technical indicators.

3. How Do Excessive USD Short Positions Affect the Cryptocurrency Market?

Extremely high short positions can lead to short-covering phenomena, causing significant market volatility and correction risks in cryptocurrencies and other risky assets.

4. How Will the Fed's Interest Rate Decision Impact Cryptocurrencies?

Stable interest rates from the Fed may maintain a positive sentiment, but policies could change based on economic data affecting capital flows and market volatility.

5. What Role Do Investment Institutions Play in Bitcoin Trends?

Institutional investors help consolidate liquidation and long-term confidence in Bitcoin, while contributing to shaping more sustainable price trends.