Written by: Tanay Ved

Translated by: Saoirse, Foresight News

Key Points:

Bitcoin has achieved a market capitalization breakthrough of $1 trillion, reflecting that as the total cryptocurrency market cap approaches $4 trillion, long-term holders are investing more funds with greater conviction.

Continuous capital inflows from spot ETFs, coupled with ongoing corporate fund reserves, have created a demand for BTC and ETH that exceeds new issuance.

The market dominance landscape is gradually expanding, with ETH relatively strengthening, and Altcoins like SOL and XRP continuously improving participation through growth in spot trading volume.

The 'GENIUS Act' established the first federal regulatory framework for fiat-backed stablecoins in the United States, bringing regulatory clarity to the stablecoin market exceeding $250 billion and laying the foundation for enhanced industry participation and competitiveness.

Introduction

The digital asset market is approaching the $4 trillion mark for the first time, marking a significant milestone in the industry's development. The latest price surge stems from a combination of structural and cyclical factors, including continuous capital inflows into Bitcoin and Ethereum spot ETFs, accelerated asset accumulation by digital asset management firms, and major regulatory breakthroughs like the passage of the 'GENIUS Act'. The driving force behind cryptocurrencies seems to be continuously strengthening.

In this article, we will analyze the key market forces and on-chain fund flows driving this expansion phase.

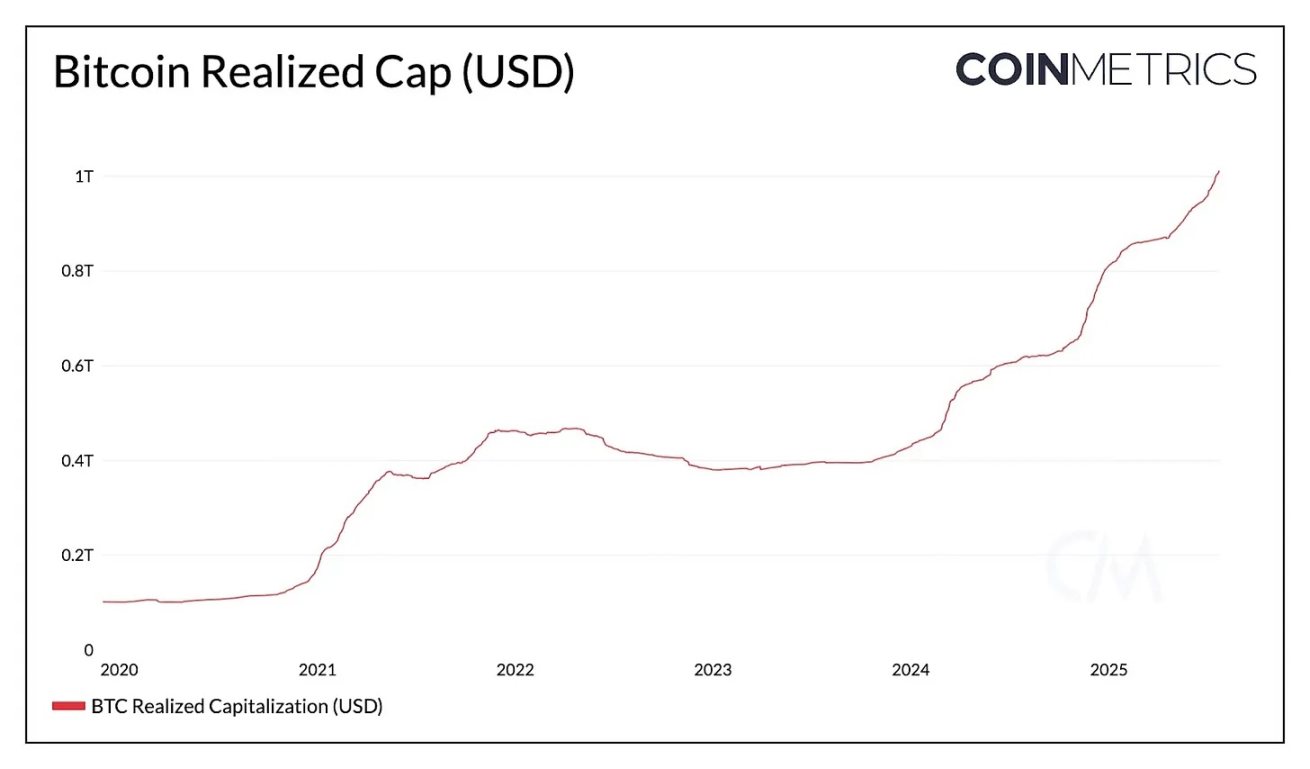

Bitcoin's Realized Market Cap Reaches $1 Trillion, Market Activity Broadens

Bitcoin hit a historical high of $123,000, with its market cap rising to $2.38 trillion, and its "realized market cap" breaking through $1 trillion. This data reflects deeper fund investments when prices are high and highlights Bitcoin's increasingly recognized status as a global asset against the backdrop of sustained ETF demand and increased institutional attention.

(Note: Realized market cap is calculated based on the price of each token at its last on-chain movement, providing a more accurate representation of actual fund investment and asset sedimentation compared to traditional market cap.)

Source:Coin Metrics Network Data Pro

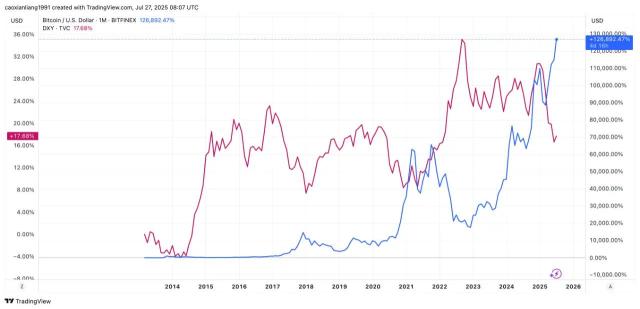

Recent market dynamics suggest we might be in the early stages of market dominance expansion. Ethereum has begun showing relative strength, with the ETH/BTC rate rebounding 73% since May, and ETH price breaking through $3,900. This momentum is driven by record ETF capital inflows, increased enterprise fund reserve adoption, and Ethereum's continued dominance in the stablecoin sector, making it a beneficiary of the 'GENIUS Act'.

Source: Coin Metrics Market Data Pro

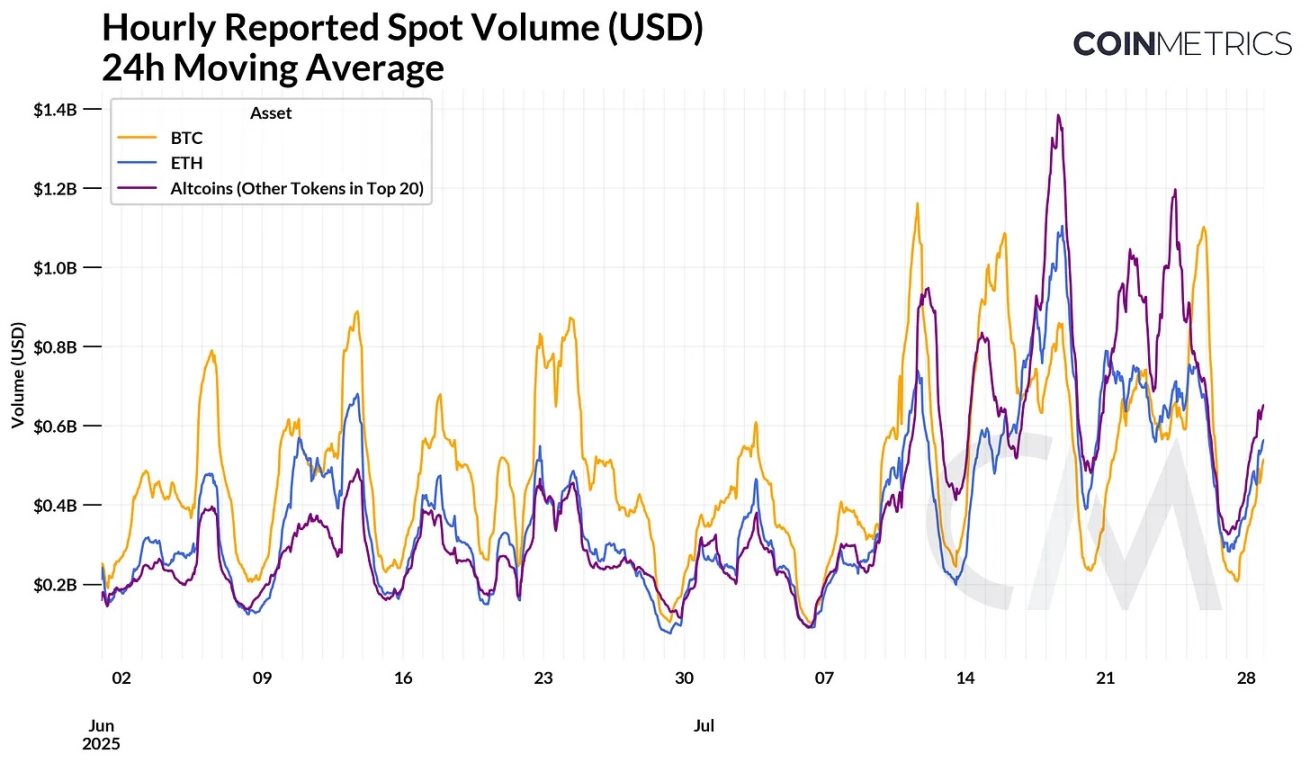

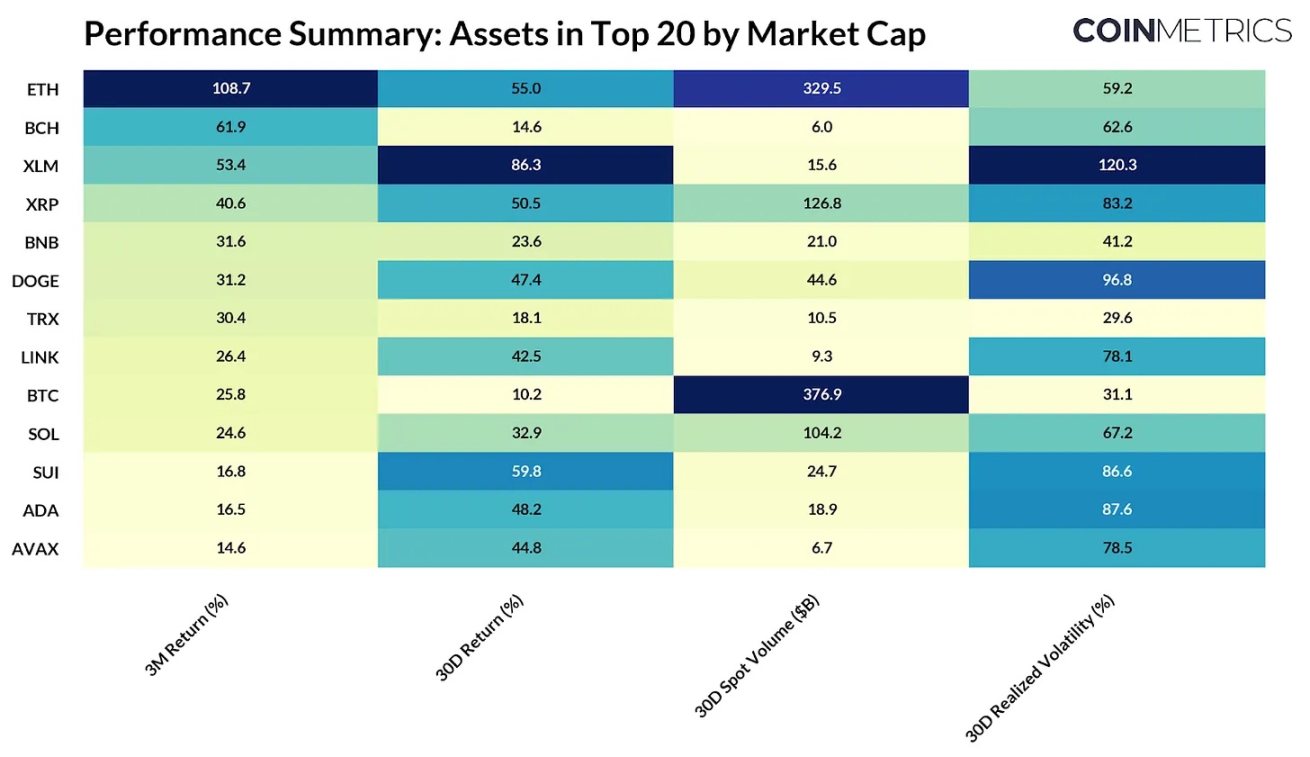

This landscape expansion is also reflected in spot trading volumes, with ETH and major Altcoins like SOL and XRP experiencing renewed trading activity. While Bitcoin's trading volume remains strong, ETH and Altcoins have shown significant volume growth in recent weeks. As Altcoins' total market cap approaches $1.6 trillion, Bitcoin's market dominance has dropped to 59%. Although early signs of landscape expansion are evident, whether this represents a sustained market transformation remains to be seen.

The following table summarizes market data for the top 20 tokens by market cap (excluding stablecoins and other on-chain derivatives):

Source: Coin Metrics Reference Rates& Market Data Pro

ETFs and Corporate Fund Reserves Accelerate Demand Growth

A key source of demand for Bitcoin and Ethereum is spot ETFs. After slowing in March and April, Bitcoin ETF fund flows regained momentum in May, bringing the total holdings of US spot ETFs to over 1.27 million BTC (6.4% of total supply). BlackRock's iShares Bitcoin Trust (IBIT) remains the largest issuer, holding 735,000 BTC (valued at $87 billion).

Source:Coin Metrics Network Data Pro, Note: Excluding Fidelity Wise Origin Bitcoin Fund (FBTC)

Ethereum is experiencing similar demand surge. In the past few weeks, Ethereum spot ETF has seen continuous net capital inflows, sometimes even exceeding Bitcoin ETF. Although Ethereum ETF has been available for over a year, growth has been significant in recent months, with ETF holdings now reaching 5.8 million ETH, representing 4.8% of total supply.

Increasing enterprise fund reserves focused on Ethereum also support demand growth, with ETH accumulation exceeding new issuance. Unlike Bitcoin reserves that primarily hold BTC as a passive asset, ETH reserves actively generate native yields through staking and DeFi, a model now extended to other major token ecosystems like Solana (SOL), TRON (TRX), and Ethena (ENA).

On-chain Holdings by Address Balance

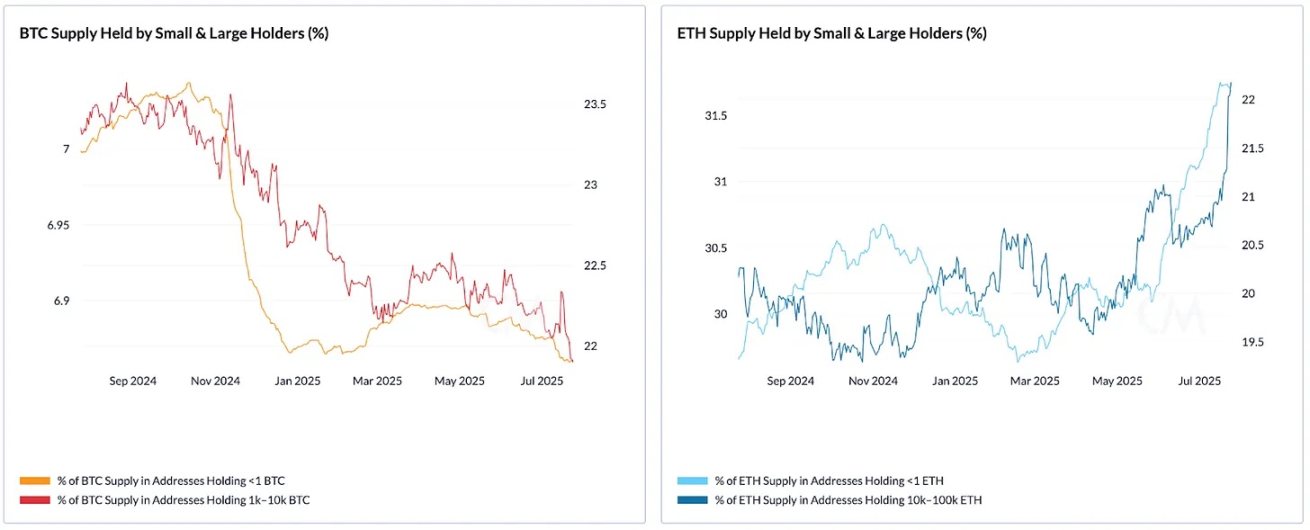

Source:Coin Metrics Network Data Pro(BTC and ETH Supply by Address Balance)

The chart shows that over the past year, small (<1 BTC) and large (1k–10k BTC) Bitcoin holders' positions have gradually decreased, indicating the market is in a chip dispersion phase during high prices. In contrast, Ethereum shows new accumulation signs, especially among large holders (10k–100k ETH), whose holdings recently rose to over 22%. Small ETH holders (<1 ETH) have also increased their holdings, continuing the steady upward trend since 2021.

The 'GENIUS Act' and a New Era for Stablecoins

On July 18, the 'GENIUS Act' was officially signed into law, establishing the first federal framework for fiat-backed stablecoins in the United States. The framework creates a fair competitive environment for stablecoin issuers, requiring full reserves of low-risk, short-term US Treasury bonds and cash, periodic audits, and issuance permits. Similar to the Bitcoin spot ETF approval, the 'GENIUS Act' is expected to bring clarity and legitimacy to the USD-pegged stablecoin sector.

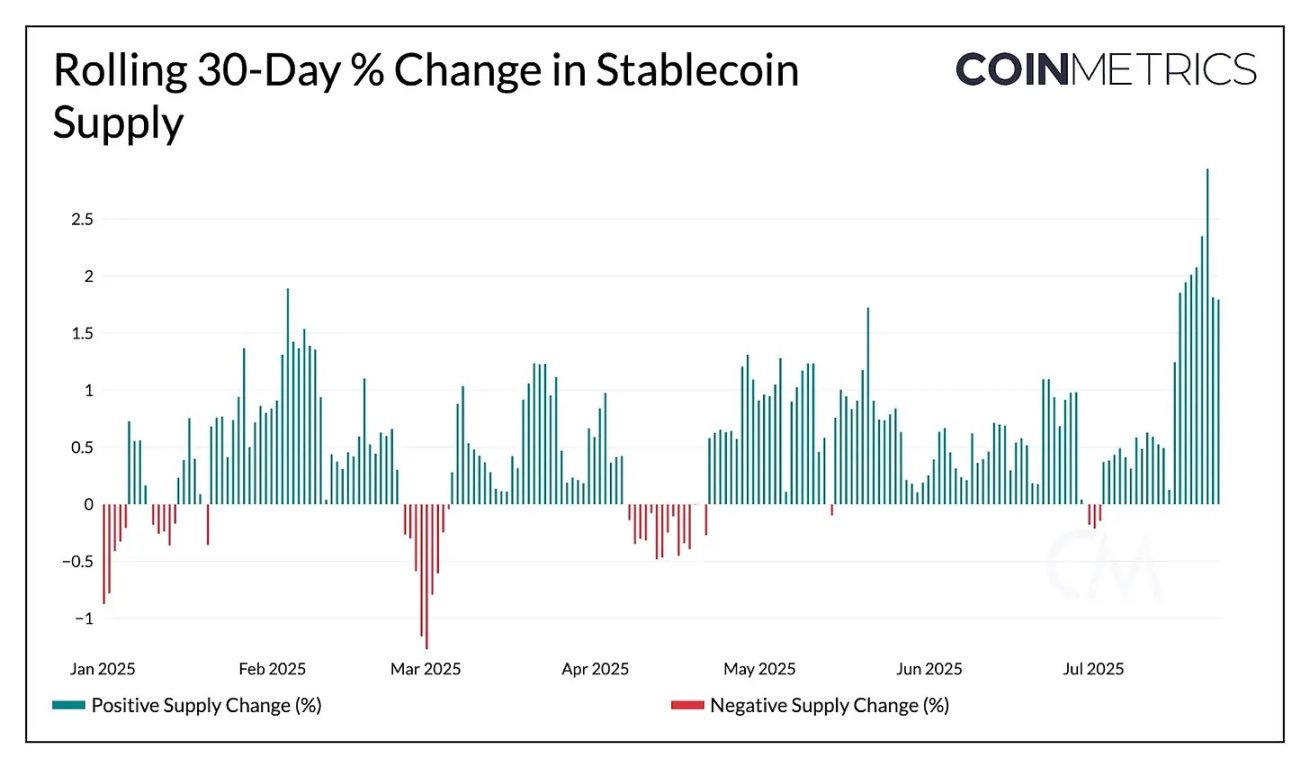

Looking at the 30-day rolling supply change, stablecoin supply growth has accelerated in recent weeks, now exceeding $255 billion in total supply.

Source:Coin Metrics Network Data Pro

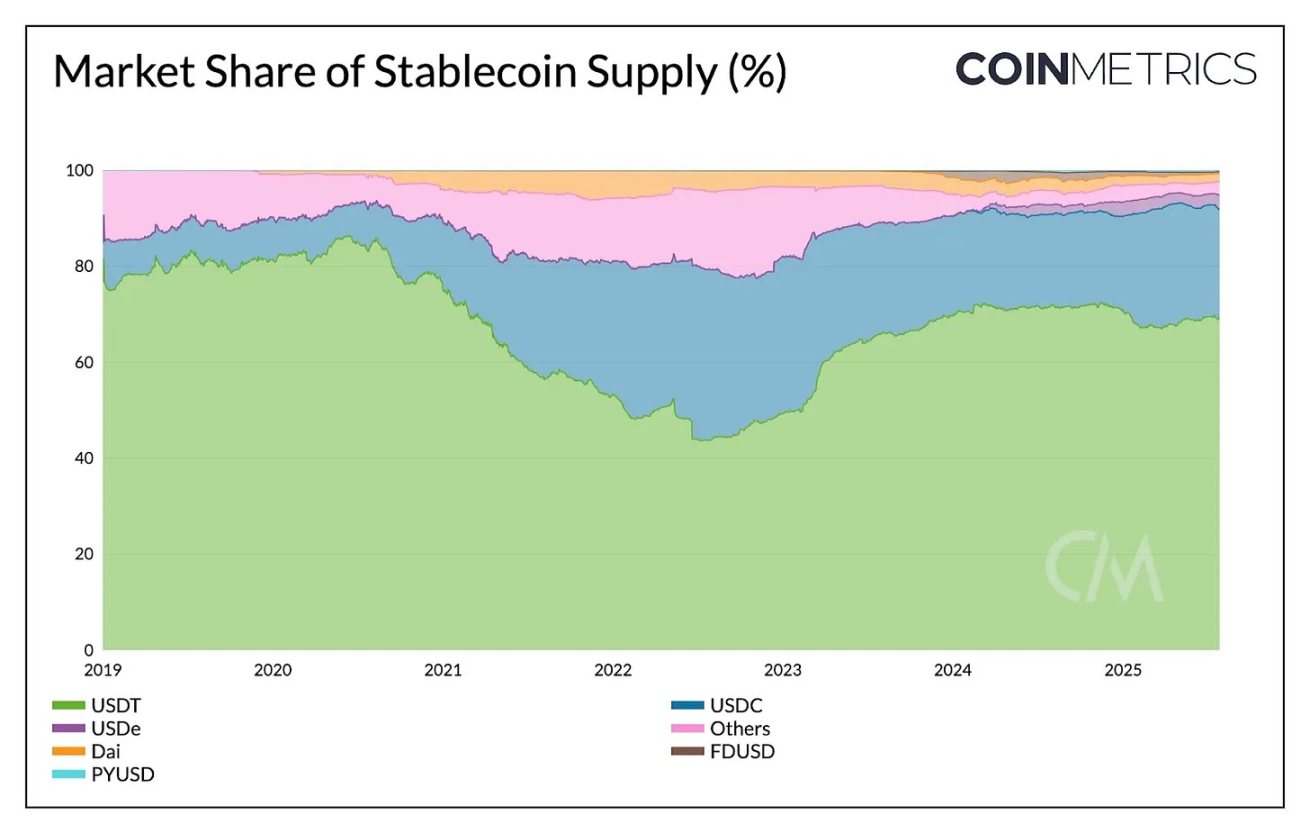

This framework is expected to enhance market trust in fiat-backed stablecoins, lower entry barriers for new participants, and create conditions for payment sector competition upgrades. From existing issuers like Tether and Circle to potential entrants such as regulated banks and fintech companies, competition could not only reduce costs for consumers and businesses but also enhance US dollar demand.

Source:Coin Metrics Network Data Pro

Among existing issuers, Circle and Paxos appear to be prepared to meet the requirements of the GENIUS Act, with their issued USDC and PayPal USD (PYUSD) backed by full reserves and undergoing regular verification. Circle is actively applying to the Office of the Comptroller of the Currency (OCC) for a federal trust bank license to fully comply with the GENIUS Act and provide custody services for institutional clients. Other major issuers are also adjusting their structures to adapt to new regulations. Federal chartered crypto bank Anchorage Digital is collaborating with Ethena Labs to launch USDtb through its stablecoin issuance platform, making Ethena's USDtb one of the first stablecoins fully compliant with the GENIUS Act, with Anchorage responsible for federal regulation and reserve management. This model provides a "one-stop" solution for other projects looking to operate in the US market.

Tether (USDT), which accounts for about 68% of stablecoin supply, faces a more complex compliance path. USDT has historically operated outside direct US regulation, with reserves including non-compliant assets such as Bitcoin and precious metals. In response, Tether plans to launch an independent, US regulation-compliant stablecoin focused on institutional payments and interbank settlements. The new product will follow GENIUS Act standards, while the existing $162 billion USDT will continue to operate in offshore markets, primarily serving emerging markets.

Stablecoin issuers have three years to comply with the GENIUS Act. After three years, only stablecoins that meet the act will be supported by exchanges and custodial institutions, providing time for issuers to adapt to the new framework.

Conclusion

The market's recent push towards a $4 trillion market cap reflects growing investor confidence in these assets. ETF and corporate fund reserve demand continues to exceed new issuance, creating favorable supply dynamics for Bitcoin and Ethereum. Bitcoin's market value to realized value (MVRV) and other valuation indicators suggest the market has not yet entered an overheated phase. Although Bitcoin maintains its core position through strong ETF fund inflows and long-term holders, the market's dominant landscape shows signs of broadening.

Moreover, the passage of the GENIUS Act marks a critical turning point in US cryptocurrency regulation, bringing clarity to the stablecoin sector and paving the way for enhancing industry competitiveness and deepening integration with traditional finance. Despite potential short-term volatility, strong structural demand, continuously improving regulatory environment, and increasingly broad participation all suggest the market is likely to remain robust in the future.