Ethereum (ETH) concluded July with an impressive performance, increasing by over 60%. However, August 2025 may pose a challenge for ETH, as the market reveals potential signs of a significant price correction.

Based on recent data and expert analysis, here are four critical warning indicators to closely monitor.

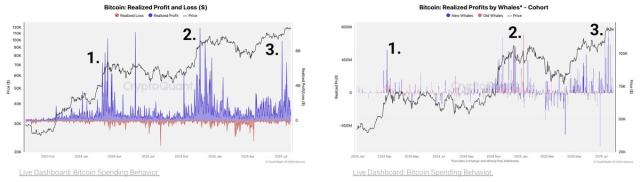

1. Over 700,000 ETH in Staking Withdrawal Queue

The first warning sign is over 700,000 ETH currently in the unstaking queue, the highest level in four years, according to data from ValidatorQueue.

This indicates that many users and organizations are preparing to withdraw staked ETH, potentially to take profits or reallocate assets.

A week ago, BeInCrypto reported around 350,000 ETH in the queue, valued at approximately 1.3 billion USD. Now, that number has doubled.

Ethereum Validator Queue. Source: ValidatorQueue

Ethereum Validator Queue. Source: ValidatorQueueNotably, the withdrawal queue is significantly larger than the staking queue. While over 700,000 ETH is waiting to be withdrawn, only around 250,000 ETH is waiting to be staked.

Data from ValidatorQueue also shows that the unstaking waiting time will extend for approximately nine more days. This means Ethereum will enter August with a large supply returning to circulation — just as ETH approaches a strong resistance zone near 4,000 USD.

"Validators are likely withdrawing to restake, optimize, or rotate operators, not leaving Ethereum. On the other hand, they might want to take profits. So, it can be assumed that some stakers are preparing to sell, which could create short-term selling pressure and potentially lead to a price correction," everstake.eth, Head of Department at Everstake, commented.

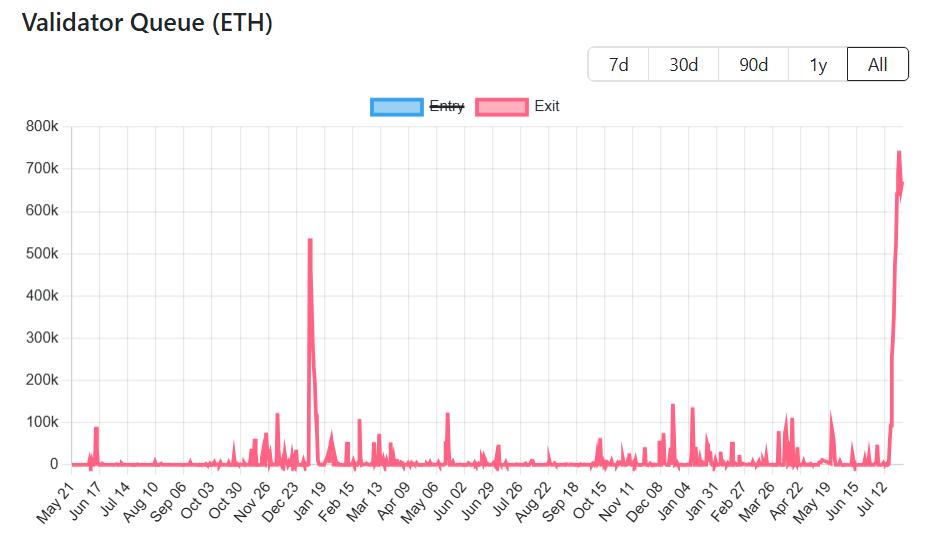

2. ETH Coinbase Premium Gap Turns Negative

According to data from CryptoQuant, the second warning sign is that the ETH Coinbase Premium Gap turned negative at the end of July.

This indicator reflects the price difference between Coinbase and Binance and is typically used to measure demand from US investors compared to the rest of the world.

Ethereum Coinbase Premium Gap. Source: CryptoQuant

Ethereum Coinbase Premium Gap. Source: CryptoQuantThe Premium Gap remained positive throughout July when ETH increased from 2,400 USD to near 4,000 USD. But by the end of the month, it sharply dropped into negative territory — indicating reduced buying pressure from US investors.

At the current price above 3,800 USD, most retail and institutional investors who bought ETH in Q2 are profitable. This raises the question: Are they satisfied with their profits?

"Demand in the US market is weakening. Caution is advised," the IT Tech analyst said.

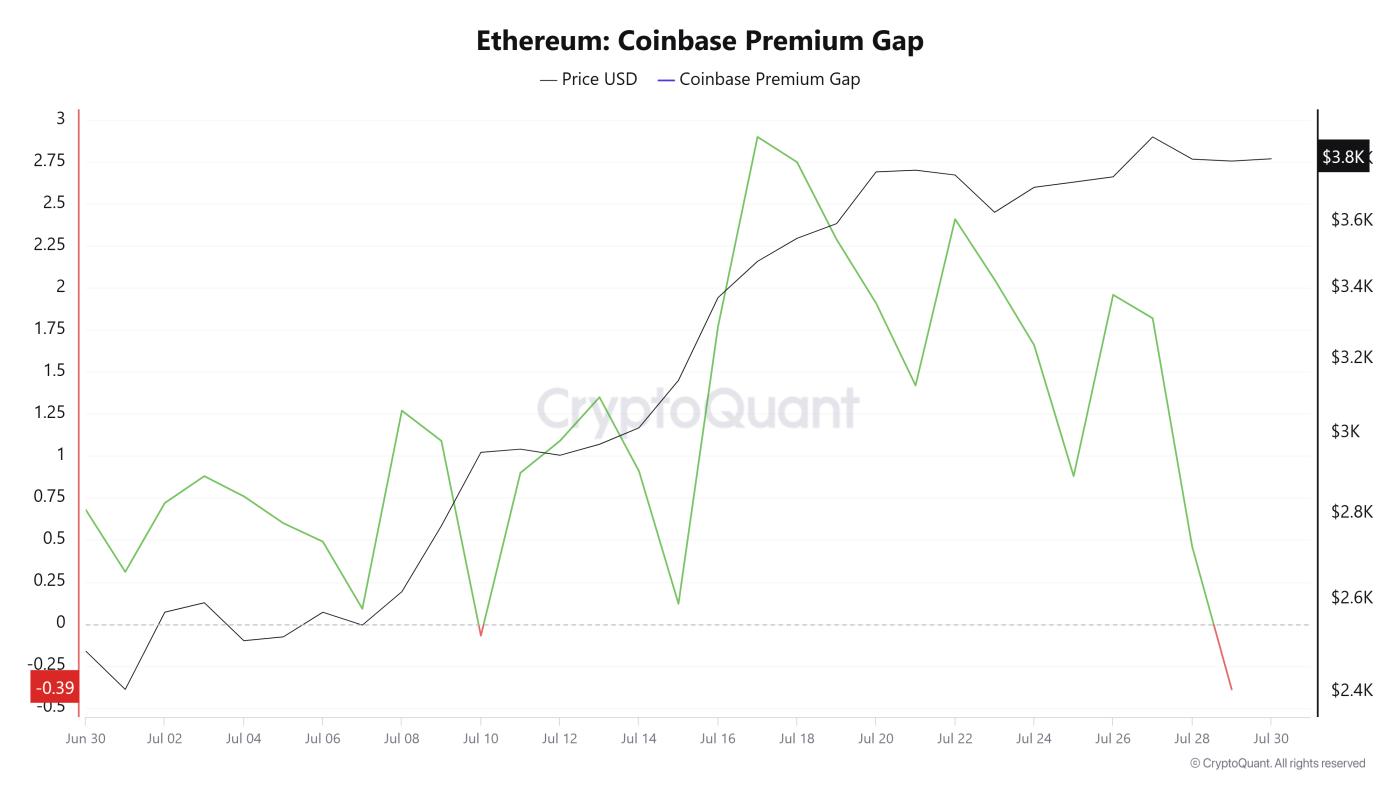

3. Net Taker Volume Turns Negative 231 Million USD

Ethereum's Net Taker Volume shows a negative 231 million USD at the end of July. This means sell orders significantly outweigh buy orders, according to analyst Maartunn.

Net Taker Volume reflects trader sentiment, tracking active order placers. It reveals which side — buying or selling — is dominating the market.

A negative indicator suggests net selling on exchanges, typically signaling bearish sentiment or capital outflow.

Ethereum Net Taker Volume. Source: CryptoQuant

Ethereum Net Taker Volume. Source: CryptoQuant"Continuous attack from the selling side. Taker sell volume exceeds taker buy volume by 231 million USD daily," Maartunn said.

History shows that deep negative Net Taker Volume often coincides with major ETH price peaks. Although the current figure is not as extreme as the 500 million USD drop earlier this year, it remains a warning sign worth monitoring.

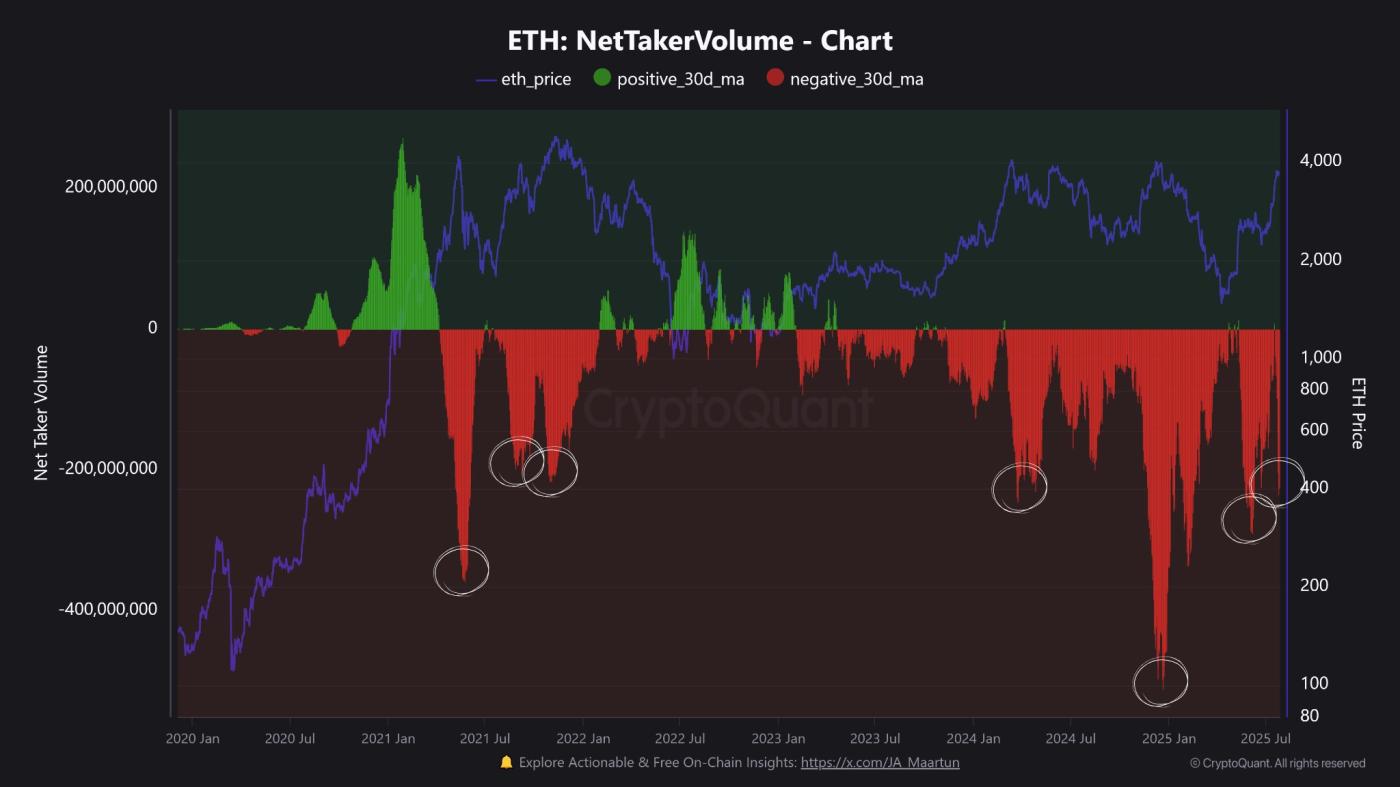

4. Ethereum Foundation Sells 25,833 ETH

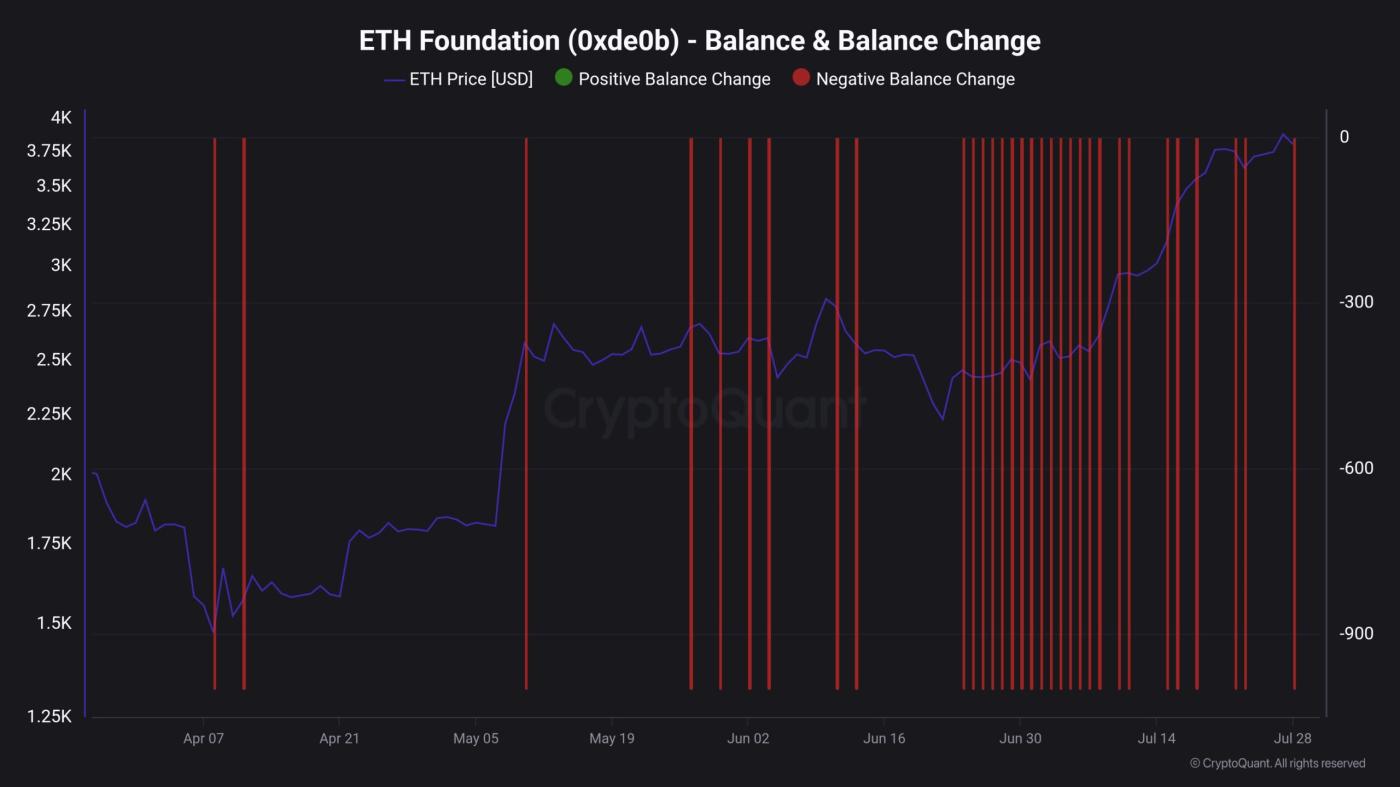

The final warning sign is that the Ethereum Foundation has sold 25,833 ETH — valued at nearly 100 million USD — over the past few months, according to Maartunn.

This is significant because the Ethereum Foundation is one of the most influential organizations in the ecosystem, having held a large amount of ETH since the early days.

These sales could fund development initiatives or manage treasury. However, they create psychological selling pressure for the market — especially when combined with other price decline signals.

"Is this confidence? Over the past few months, the Ethereum Foundation has sold 25,833 ETH — nearly 100 million USD. Watch actions, not words," Maartunn added.

ETH Foundation Balance Change. Source: CryptoQuant.

ETH Foundation Balance Change. Source: CryptoQuant.Data shows the Foundation increased selling activity in July when ETH surged.

Despite these warning signs, Ethereum continues to trade above 3,800 USD. Accumulation by institutions and Ethereum fund managers keep ETH in high demand — positioning it as the most sought-after cryptoasset after Bitcoin.