Enterprise crypto financial companies are holding digital assets worth hundreds of billions of USD, dominated by Bitcoin and Ethereum.

Various organizations from companies, exchanges to non-profit organizations are accumulating large amounts of cryptocurrencies, demonstrating the influence of digital assets in the modern financial ecosystem.

- Enterprise crypto financial companies own total assets of over 100 billion USD.

- Bitcoin dominates with 791,662 BTC, equivalent to nearly 93 billion USD, representing 3.98% of circulating supply.

- Ethereum also has significant value with 1.3 million ETH, over 4 billion USD, while the total value of ETH held by organizations exceeds 10 billion USD.

How are enterprise financial companies holding large amounts of cryptocurrencies?

The July 2023 Galaxy Research report shows that organizations like Strategy, Metaplanet, and SharpLink own total digital asset values around 100 billion USD, with Bitcoin and Ethereum being prominent.

Data from Galaxy Research indicates that Bitcoin Finance holds over 791,662 BTC, equivalent to about 93 billion USD, representing nearly 4% of the current Bitcoin supply. This figure demonstrates a strong concentration of Bitcoin in corporate asset portfolios.

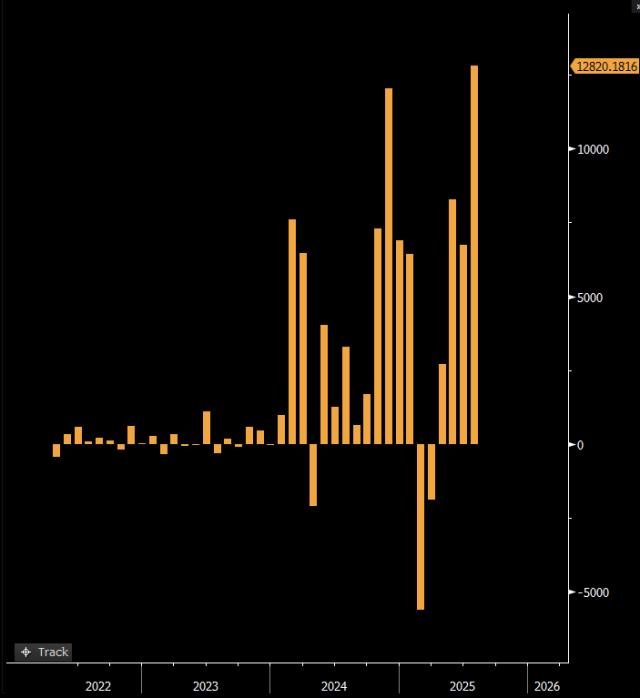

These organizations' large BTC accumulation not only reflects long-term value confidence but also significantly impacts global cryptocurrency market liquidity and volatility.

How are enterprises holding Ethereum in their treasury?

Ethereum Finance holds approximately 1.3 million ETH, equivalent to over 4 billion USD, representing 1.09% of Ethereum in the market, according to the Galaxy Research report.

However, figures from The Block confirm that the ETH treasury values of 64 global organizations have exceeded 10 billion USD, including publicly listed companies, exchanges, DeFi protocols, non-profit organizations, and even federal governments.

This affirms Ethereum's increasingly important role in the cryptocurrency financial ecosystem, especially in staking, DeFi, and smart contract activities.

"Ethereum treasury surpasses 10 billion USD, proving the trust and strong development of applications on the Ethereum network."

James Chen, Galaxy Research Director, July 2023

How does large-scale cryptocurrency accumulation affect the market?

Corporate whales holding large amounts of Bitcoin and Ethereum directly influence supply and demand, as well as price volatility in the cryptocurrency market.

These organizations can create liquidity pressure or hold to confirm HODL sentiment, simultaneously affecting investment strategies of individual and other institutional investors.

According to many digital finance experts, corporate cryptocurrency accumulation creates relative market stability through long-term valuation and minimizing speculative psychology-driven volatility.

"Corporate participation makes the cryptocurrency market more mature, enhancing trust levels and promoting sustainable development."

Linda Davis, Cryptoasset Financial Analyst, 2023

Who are the largest organizations holding Bitcoin and Ethereum currently?

According to Galaxy Research, Bitcoin Finance leads in Bitcoin holdings with over 791,662 coins, equivalent to around 93 billion USD.

Simultaneously, Ethereum Finance and dozens of other diverse organizations are also accumulating large amounts of ETH, exceeding 10 billion USD in total according to The Block.

These names are not just investment funds but also include exchanges, non-profit organizations, and even governments, demonstrating the diversity and widespread penetration of cryptocurrencies in the financial ecosystem.

Comparing cryptoassets between enterprise financial organizations

| Organization | BTC Held | BTC Value (Billion USD) | ETH Held | ETH Value (Billion USD) | Total Value |

|---|---|---|---|---|---|

| Bitcoin Finance | 791,662 BTC | 93 | None | 0 | 93 Billion USD |

| Ethereum Finance | None | 0 | 1.3 Million ETH | 4+ | 4+ Billion USD |

| 64 Diverse Organizations | Not clearly specified | – | Over 10 Million USD (Total ETH Treasury) | 10+ | 10+ Billion USD |

Frequently Asked Questions

Which cryptocurrencies are enterprise financial organizations currently focusing on?

According to the latest data, Bitcoin is the cryptocurrency with the largest proportion in corporate asset portfolios, followed by Ethereum with its important role in DeFi and smart contracts.

How do corporate cryptoasset holdings affect the market?

Holding large amounts of cryptocurrencies helps stabilize the market while impacting supply and demand volatility and the confidence of individual and institutional investors.

What are reliable data sources about corporate cryptocurrency treasuries?

Reports from Galaxy Research and The Block are widely recognized for their accuracy and in-depth analysis from top industry experts.

What types of organizations are accumulating the largest cryptocurrencies?

Not just financial companies, but also including exchanges, non-profit organizations, and even federal governments participating in cryptoasset holdings.

Why is Ethereum treasury so valuable?

Ethereum treasury is large due to its crucial role in DeFi applications, staking, and smart contracts, attracting diverse investments from many organizations.