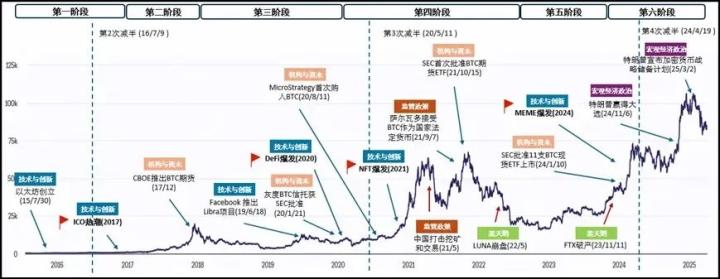

In July 2025, the crypto world was in a frenzy. Bitcoin surged forward, breaking through the $120,000 mark; Ethereum led the market with an astonishing 49% increase, with its spot ETF attracting over $5 billion in just one month, with cumulative inflows approaching $10 billion. Market confidence was soaring, bullish sentiment was unprecedented, seemingly heralding an unstoppable bull market on the horizon.

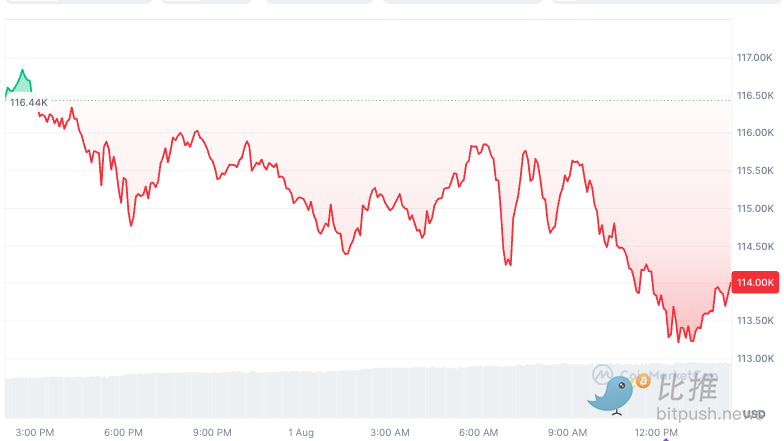

However, this upward trend encountered headwinds in early August, with a "black swan triple strike" quickly switching the market from "risk-on" mode to a risk-averse state, with CME Bitcoin futures premium turning negative and funds rapidly withdrawing from high-risk assets.

I. Triple Bearish Factors: The Trigger for Market Panic

This market crash was not coincidental but caused by a series of high-level macro events erupting in an extremely short time. These events collectively triggered investors' "risk avoidance" sentiment.

1. New Tariff Policy: Reigniting Global Trade War

US President Trump signed an executive order on July 31, announcing new reciprocal tariffs on imported goods from multiple countries, ranging from 10% to 41%. This policy quickly raised market concerns about global inflation acceleration. Investors generally believed that tariff barriers would drive up commodity prices, potentially forcing the Federal Reserve to maintain a tough stance on interest rate cuts, which was undoubtedly a clear bearish signal for risk assets dependent on loose liquidity.

2. Poor Employment Data and Political Storm

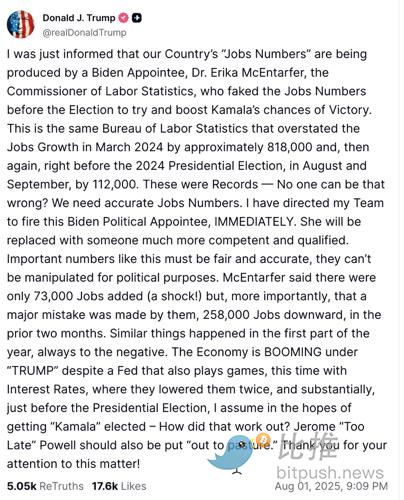

Shortly after the tariff policy was announced, the US Department of Labor released employment data far below market expectations. This weak economic signal was already enough to make investors uneasy. More dramatically, President Trump expressed extreme dissatisfaction with this data performance and fired the US Bureau of Labor Statistics Director Erika McEntarfer within hours of the report's release.

This politically charged action further amplified market panic, casting a heavy layer of uncertainty over economic prospects.

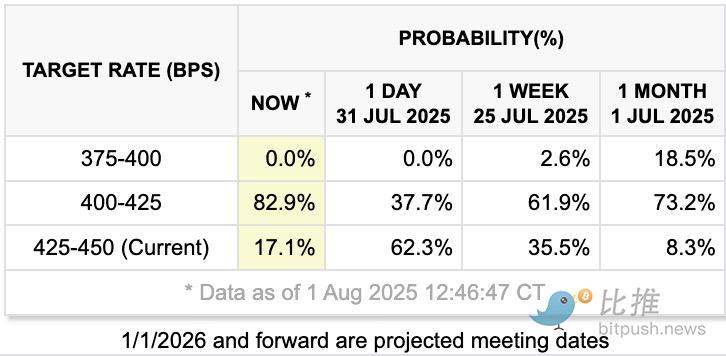

Traders' response to the employment report was a significant increase in September rate cut bets: CME FedWatch data at the time of writing showed nearly 83% probability of the Federal Reserve lowering target rates to 4.00-4.25%, up from the previous day's 37.7%.

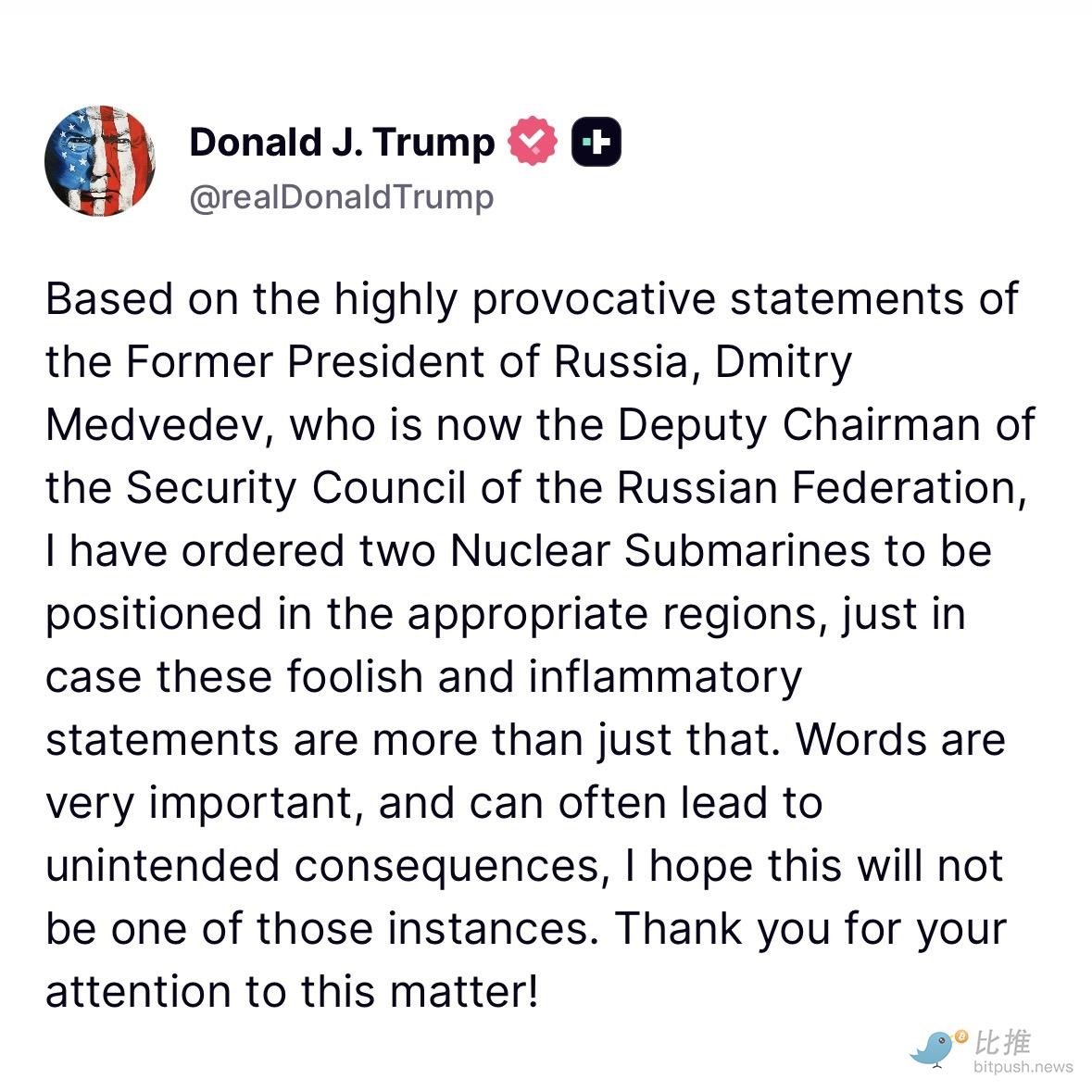

3. Nuclear Submarine Deployment: Geopolitical Tension

In terms of geopolitical risk, Trump ordered the deployment of two nuclear submarines to the area near Russia. This tough military action was a direct response to a "provocative statement" by a senior Russian official.

Under the shadow of the Russia-Ukraine conflict, this level of geopolitical tension escalation made global investors uneasy. Seeking safe-haven assets became the top priority, and cryptocurrencies, as high-volatility assets, naturally became objects of sell-off.

Under the shadow of the Russia-Ukraine conflict, this level of geopolitical tension escalation made global investors uneasy. Seeking safe-haven assets became the top priority, and cryptocurrencies, as high-volatility assets, naturally became objects of sell-off.

II. Liquidation Storm

Under the bombardment of bearish news, cryptocurrency prices plummeted, triggering a chain reaction. Bitcoin dropped over 3% in a day, falling to $113,231; Ethereum and Solana suffered even more severe declines of 6% and 5% respectively. XRP was not spared, falling over 10%.

The sharp price drop quickly triggered a "domino effect" in the derivatives market. According to CoinGlass data, over $940 million in long positions were forcibly liquidated in the crypto market in the past 24 hours, with long liquidations accounting for the vast majority at $860 million.

Crypto concept stocks were hit even harder, with declines exceeding the crypto assets themselves. This revealed the market's double concerns during risk-averse periods: worrying about macroeconomic conditions and their business fundamentals.

Coinbase: Its stock plummeted 16% after publishing second-quarter financial results below expectations. Despite poor performance in its core trading business, the massive stock price drop also reflected collective market panic in the face of uncertainty.

Strategy: As a famous Bitcoin "proxy stock", its stock price dropped 8.7%, highlighting the fragility of such high-leverage assets.

Other crypto companies like Circle and Galaxy Digital also suffered severe stock price drops, indicating that any market fluctuations in the crypto market would be amplified multiple times through listed companies' stock prices in traditional financial markets. 10-year US Treasury yields plummeted 14 basis points to 4.22%, while gold prices rose 1.5% to $3,400 per ounce, returning to historical highs.

IV. Healthy Pullback or Risk Warning?

Facing the market retreat, analysts' views diverged.

Crypto research platform DYOR CEO Ben Kurland held an optimistic view, defining this decline as a "healthy and strategically meaningful cooling period". He pointed out that after July's "blazing hot" performance, the market is undergoing a "planned pause", with funds flowing from the most speculative and volatile asset classes to safer havens. In his view, this is not a "crisis" but a rational response to the "lack of new crises".

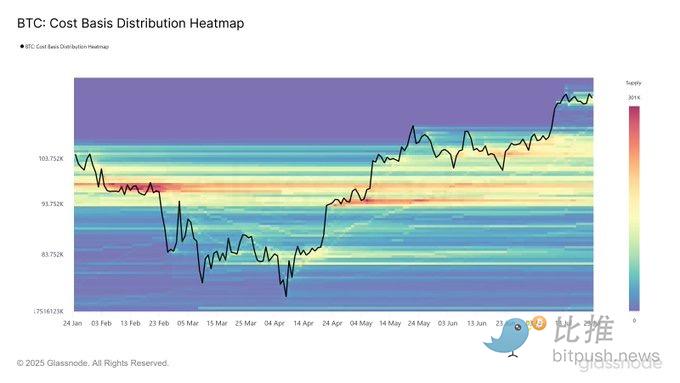

However, some analysts remained cautious. They believed the macro driving factors behind this decline were complex and unpredictable. Some analysts predicted that considering historical patterns and current macro uncertainties, Bitcoin prices might continue to be under pressure in August and September, potentially falling to $80,000, with a possible turnaround only in the fourth quarter.

glassnode analysts predicted that if Bitcoin prices fall below $110,000 after recent surge, it might trigger accelerated selling.

Except for halving years, August is typically a relatively low period in Bitcoin's history. July's revelry ultimately needs August's calmness to digest. Whether this market's violent shock is a healthy profit-taking or a warning of a larger storm remains to be seen. Perhaps only after digesting all the bearish news can the market find a new direction amidst intense volatility.

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG Group: https://t.me/BitPushCommunity

BitPush TG Subscription: https://t.me/bitpush