Currently, the funding rates of mainstream cryptocurrencies are negative, indicating more short positions than long positions. The market sentiment was clearly shaken by the non-farm data correction event. However, the market experienced an oversold rebound on Sunday night, and with the current situation of exhausted negative factors, it is waiting for the impact of interest rate cuts. This week, several Federal Reserve board members will give speeches. Although they are not as important as Powell's comments, they can be seen as a barometer for September's interest rate cut expectations. If there are no additional negative events, the market is expected to continue oscillating upward at low levels.

VX: TZ7971

The Bitcoin market is staging a classic battle between bulls and bears. After reaching a historical high of around $123,250, BTC has retraced 7.50% within three weeks, briefly falling below $113,000. Looking beyond the surface, the powerful support of the 50-day Exponential Moving Average (EMA) coinciding with the neckline of an Inverse Head and Shoulders pattern forms a "perfect bottom" technical structure. Meanwhile, on-chain data shows that the $9.6 billion sell-off by "old whales" is not bearish, but rather similar to the profit-taking after the ETF approval in March 2024 and Trump's potential victory in late 2024. Historically, such massive sell-offs have been followed by more intense market rallies.

Technical Resonance: Double Support Constructing a Bull Market Launchpad

Bitcoin's daily chart is outlining a typical bull market correction path. On Sunday (August 3rd), the price briefly fell below the 50-day EMA (red wave line) but quickly recovered this key level, repeating the technical script from June - when a similar breach triggered a 25% rapid rebound. This moving average has been a bull fortress since the 2025 bull market, with three pullbacks transforming into upward momentum.

More notably, the 50-day EMA forms a technical resonance with the Inverse Head and Shoulders (IH&S) neckline. After breaking through this neckline in late July, the current pullback is seen as a retest of the breakthrough's validity. If successfully defended, it will open an upward space with a measured target of $148,250. This target echoes the weekly-level rounded bottom pattern (target $140,000) and the bull market flag breakout (target $150,000).

The market structure has quietly transformed: CME's $115,000 gap replenishment, high-leverage position cleansing, and financing rates returning to a healthy range have cleared obstacles for a "net long rise".

Liquidity Tailwind in the Interest Rate Cut Cycle

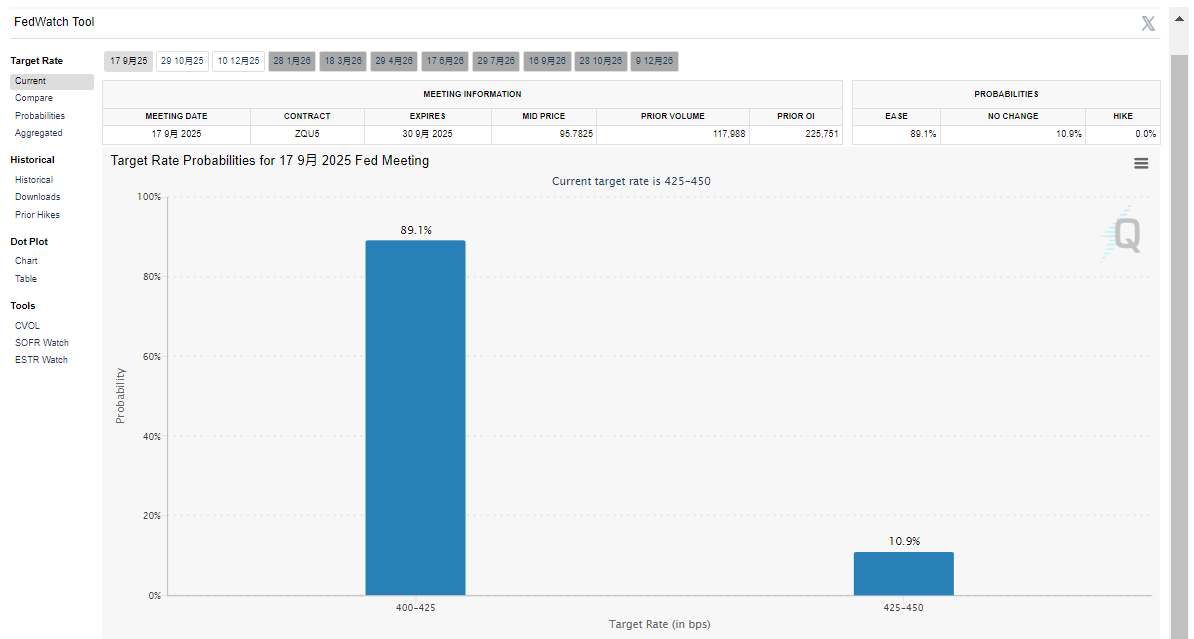

Bitcoin's rise logic is deeply tied to global monetary policy. The U.S. July non-farm data "unexpectedly" (only 73,000 new jobs, unemployment rate rising to 4.2%) completely reversed market expectations, with the Federal Reserve's September rate cut probability soaring to 80%. This confirms the previous Snowball column's prediction: under the overlay of $31 trillion in Treasury issuance and the interest rate cut cycle, Bitcoin will become a beneficiary of the "fiscally-led" paradigm.

(Translation continues in the same manner for the rest of the text)