Within 72 hours from August 3rd to 5th, 2025, the cryptocurrency market witnessed the most violent asset movement of the year. The token $MYX of the decentralized derivatives protocol MYX Finance surged from a low of $0.1 to $2, with a single-day maximum increase of 336%, achieving nearly 20-fold growth in 48 hours.

This sudden storm not only thrilled early holders but also broke through contract short positions worth $10 million within 24 hours, pushing the technical narrative of "chain abstraction" into the spotlight.

I. Storm Center: Market Madness Behind the Data

- Price Trajectory Steepening: On August 3rd, $MYX was oscillating in the $0.1-0.11 range. On August 4th, following Bitget's announcement of spot trading, the price launched a rocket-like ascent from $0.23, reaching a high of $2. This rise, detached from conventional fundamentals, exposed the fragility of low-liquidity tokens under concentrated buying.

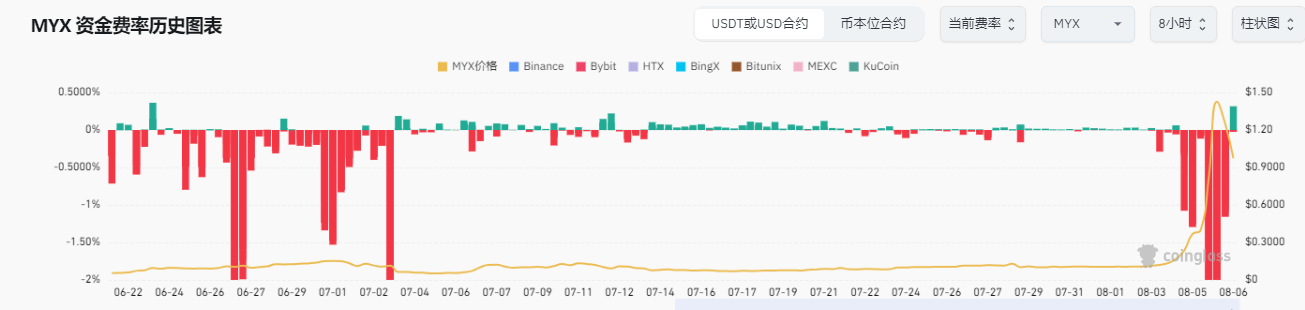

- Bloody Harvest in the Contract Market: During the surge, the funding rate once dropped to a historical extreme of -2%, revealing the tragic situation of massive forced short liquidations. Market makers achieved risk-free arbitrage through high-frequency long and short operations, with retail investors serving as the primary fuel for this "meat grinder game".

- Contradictory On-chain Signals: Despite the price surge, on-chain monitoring showed no significant movement in core whale and project party addresses. True selling pressure was hidden in dispersed operations of associated small addresses, effectively evading regulatory and community monitoring.

II. MYX Finance: Chain Abstraction Experiment Reconstructing Trading Equality

MYX Finance's rise is no coincidence. As the first protocol proposing the "chain abstraction derivatives trading" concept, it aims to solve DeFi's most stubborn pain point—breaking institutional monopoly on Alpha opportunities. Its technical architecture directly addresses core user needs:

MYX Finance's rise is no coincidence. As the first protocol proposing the "chain abstraction derivatives trading" concept, it aims to solve DeFi's most stubborn pain point—breaking institutional monopoly on Alpha opportunities. Its technical architecture directly addresses core user needs:

- Frictionless Trading Experience: Through its unique MPM (Matching Pool Mechanism) and unified account system, users can perform cross-chain (supporting BNB Chain, Arbitrum, Linea, etc.) derivatives trading without managing wallets, paying gas fees, or repeatedly signing, offering an experience comparable to centralized exchanges.

- Permissionless Listing Mechanism: The 2025 roadmap shows MYX will launch the world's first "chain abstraction Perp DEX" on Solana. Any community-approved token (including early MEME coins) can be instantly listed with deep liquidity, with liquidity providers (LPs) sharing 80% of platform transaction fees.

- Institutional-backed Value Cycle: With capital support of $10.5 million from institutions like Sequoia China and Hashkey Capital, MYX's node system establishes a powerful deflationary model—nodes must stake at least 300,000 MYX, with all income used for token buyback and burning, creating a virtuous cycle of supply contraction.

- Technical Implementation Timeliness: Whether V2 can be launched as scheduled before September and achieve "permissionless listing" will be a touchstone for verifying the team's execution. If the Solana ecosystem's meme craze can be captured by MYX, it will open up a new value space.

- Market-Making Strategy Sustainability: The current long and short double explosion model faces liquidity exhaustion risks. After Bitget's launch, if it fails to successfully list on top exchanges like Binance, the incremental capital bottleneck will lead to price collapse.

- Node Economic Reflexivity Test: After node staking volume breaks through 50 million MYX, whether staking returns can maintain above 15% becomes critical. Once the yield slides, it may trigger a "staking redemption → increased selling pressure → yield decline" death spiral.

Epilogue: The Eternal Parable of the Crypto Market

As of press time, MYX is priced at $0.98, having dropped 50% from its peak.

MYX's roller coaster market is essentially the ultimate interpretation of the crypto market's "narrative valuation" mechanism. When technical vision (chain abstraction), token model (node destruction), and market cycle (Altcoin season) form a triple resonance, prices may escape realistic gravity.

But as demonstrated by the 2021 DeFi Summer and 2023 L2 battle, only projects that iterate products while traversing bull and bear markets can distill speculative bubbles into real value.