Written by: David, TechFlow

The crypto market has its own "wolf is coming" story.

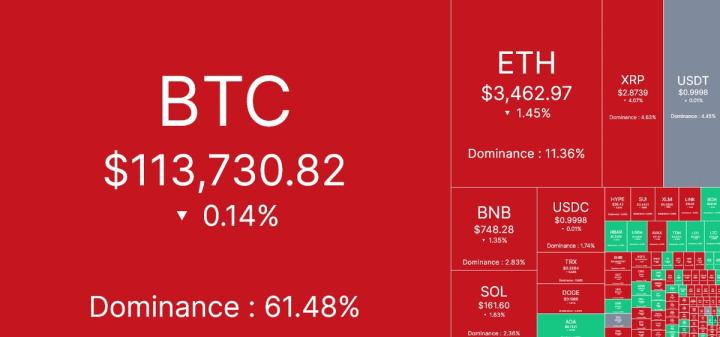

On August 3rd, the well-known foreign financial news platform First Squawk posted on social media: "China has officially banned cryptocurrency trading, mining, and related services due to financial risks, capital outflow issues, and environmental impacts".

Overseas financial accounts with millions of followers, such as Investing.com and Rawsalerts, subsequently reposted this unverified "breaking news". Clearly, using China's ban on cryptocurrencies has become a "traditional skill" of spreading fake news in the crypto market.

In the comments section of this news, there was a comment that made people laugh - Grok, tell me, how many times has China banned cryptocurrencies?

Old investors have long been aesthetically fatigued by such fake news, and Bitcoin's price has long been immune to such rumors.

However, the crypto market does have an absurd cycle - every now and then, an extremely influential fake news story emerges.

You can be immune to the cycle of Chinese bans, but you may not be immune to the emergence of all fake news. When enough people believe a fake news will affect the price, it will indeed affect the price.

The Chinese "ban" is just the tip of the iceberg of fake news influencing the crypto market. Looking back at the history of the crypto market, those heavyweight fake news stories have indeed influenced the direction of crypto assets;

And behind a piece of fake news, you can even see a hidden information propagation chain.

Crypto Fake News Chronicle: From Amateur to Professional, Key Events Recap

2017: Vitalik's Death, the First Lie in the Blockchain World

If writing an evolution history of cryptocurrency fake news, June 26, 2017, would definitely be a milestone.

That afternoon, a message appeared on the famous 4chan forum: "Vitalik Buterin died in a car accident." No source, no evidence, not even a decent detail.

But this rough rumor caused the first market crash in cryptocurrency history due to fake news in the next few hours. At the time, ETH dropped from $317 to $216 within 6 hours, a decline of nearly 32%.

The Reddit r/ethtrader section was filled with posts asking "Is it true?" "Can someone confirm?" In Telegram groups, token holders were debating whether to sell immediately.

About 10 hours after the rumor spread, Vitalik himself debunked it on Twitter by posting a photo holding the day's Ethereum block number and hash, proving he was alive using the blockchain itself.

Vitalik is still here, but your position might be gone.

The market's reaction revealed a cruel truth: in the early wild west of the crypto world, an anonymous post could be as destructive as an official announcement.

Early fake news creators were mostly amateur players. They would either establish so-called insider groups on Telegram or post on forums like 4chan. It was a market with extremely asymmetric information, where investors were like groping in the dark, and any slight movement could cause a stampede.

During this period, fake news was more like a few people's pranks, directly linked to the project's founders; the market directly connected the founders' personal safety with the project's survival.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms.]At 1:17 PM, a screenshot from a Telegram group began circulating in the crypto community. The screenshot allegedly showed a message on the Bloomberg Terminal: SEC had approved BlackRock's iShares Bitcoin Spot ETF.

For crypto investors who had been waiting for years, this was undoubtedly a historic moment.

Cointelegraph's social media team saw the message. As one of the world's largest crypto media outlets, they certainly understood the weight of this news.

But before publishing, they faced a dilemma: should they spend time thoroughly verifying the information, risking being scooped by other media? Or publish immediately to capture traffic?

At 1:24 PM, just 7 minutes later, Cointelegraph published the "breaking news" on their official X account. The tweet was striking: "Breaking: SEC Approves BlackRock Spot Bitcoin ETF".

The market's reaction was immediate and intense. Bitcoin price surged from $27,900 to $30,000 within 30 minutes, a rise of over 7%; trading volume instantly expanded, putting pressure on exchanges' servers. The derivatives market went crazy, with $81 million in short positions being forcibly liquidated during this sudden surge.

However, excitement quickly turned to confusion. Careful observers began to raise questions:

Why was Cointelegraph the only outlet reporting this? Why was there no announcement on the SEC website, and why was BlackRock silent?

At 2:03 PM, 39 minutes after the tweet, Cointelegraph deleted the original post. But the damage was done. In less than an hour, the market had gone through a complete cycle of rise and fall.

According to the media's subsequent investigation report, the error stemmed from an internal process breakdown - the social media editor violated regulations requiring editorial confirmation before publishing.

This incident sparked intense discussion in the industry. One sharp perspective argued that when media prioritizes speed over accuracy, they are no longer media, but tools for market manipulation.

Crypto media face enormous pressure. This is a 24/7 market where news can break at any time. If you're 5 minutes late, your traffic is stolen. In this environment, publishing first and verifying later is a risky but potentially high-reward strategy, but it could come at the cost of credibility.

In traditional financial markets, major news is usually released through official channels with strict disclosure rules. But in the crypto market, information channels are scattered and truth is hard to distinguish. A screenshot or a tweet can trigger billions of dollars in capital flow.

Ironically, when the SEC actually approved the Bitcoin ETF in January 2024, the market's first reaction was not cheering, but doubt.

2024: SEC Twitter Incident, Regulators Also Victims

In January 2024, the SEC's official X account published a false Bitcoin ETF approval message. According to a subsequent FBI investigation, attackers gained account control through a SIM card swap attack. Bitcoin price rose from $46,600 to $47,680 after the fake news, then dropped to $45,627 after the clarification.

In October 2024, the FBI arrested suspect Eric Council Jr. Court documents revealed this was a premeditated financial crime, with attackers establishing large Bitcoin long positions before releasing the false news.

Over a decade, crypto fake news has transformed from "unintentional mistake" to "deliberate crime". Technical barriers, fund scale, and organizational levels have all upgraded. You might dodge one fake news, but can't guarantee avoiding the next.

Three Make a Tiger: When Truth Gets Diluted

In the crypto market, tracing the source of a fake news story is often futile.

When news like "China Bans Cryptocurrency Again" creates market waves, massive resharing, algorithmic recommendations, and increased self-media discourse make it impossible to trace the original source.

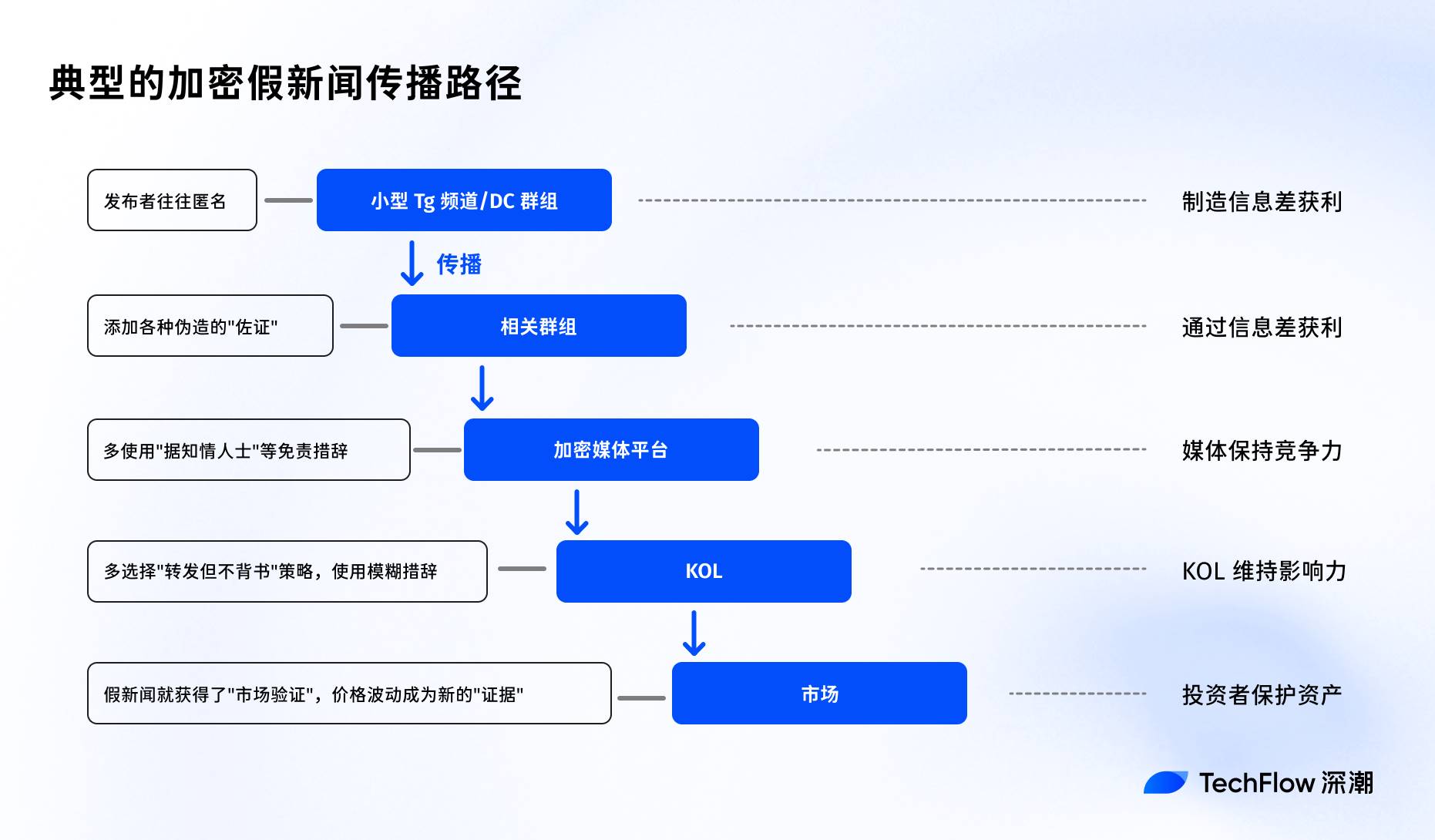

A typical crypto fake news propagation path might look like this:

First Layer Source is usually small Telegram channels or Discord groups, with source tracking almost impossible. Publishers often use anonymous accounts, facing no consequences even if exposed;

Second Layer Small Circle Fermentation spreads through related groups, beginning to add "evidence" - photoshopped images, fabricated details, seemingly logical explanations;

Third Layer Crypto Media Platforms give the message a "quasi-official" tone. Even using disclaimers like "according to informed sources", readers tend to selectively ignore.

Fourth Layer KOL Involvement, when the message reaches a certain spread, KOLs face a choice: share or not? Most choose a "share but not endorse" strategy - using phrases like "reportedly" or "sources claim".

Fifth Layer Market Reaction, once price starts fluctuating, the fake news gains "market verification". The decline itself becomes "evidence" of the message's authenticity.

After multiple layers of propagation, tracing the origin becomes almost impossible. Each layer adds new "details", introduces new explanations, until the original information is completely diluted.

In the crypto market, rumors can irresponsibly spread quickly, while debunking requires rigorous evidence and logic. Spreading panic/exclusive news might create trading opportunities, but spreading debunks offers no direct benefit.

Each participant acts rationally according to their interests, but all these "rational" choices, when stacked together, create a collectively irrational result.

The market is repeatedly fooled by fake news, but seemingly no one can or wants to break this cycle.

Perhaps this is the new meaning of "three make a tiger" in the crypto era: not that three people saying something makes it true, but that when enough people believe it will affect the market, it actually affects the market.

In this process, the truth itself becomes less important.