Ethereum Price Breaks $4,000 for First Time in Eight Months, Driven by Treasury Accumulation and ETF Inflows

The Ethereum token price has reached the $4,000 mark for the first time since December 16th. This rise comes as Ethereum treasury companies accelerate token accumulation and ETF funds continue to flow in recent weeks.

On Friday, the native asset of Ethereum broke through $4,000 for the first time in eight months, briefly touching $4,013.67 on Coinbase before slightly retreating. According to The Block's ETH price page, the second-ranked cryptocurrency by market cap rose 3.8% in the past 24 hours, with a weekly gain of 11.3% and a monthly increase of over 50%. Its last breakthrough of $4,000 was on December 16th, when it reached a high of $4,107.

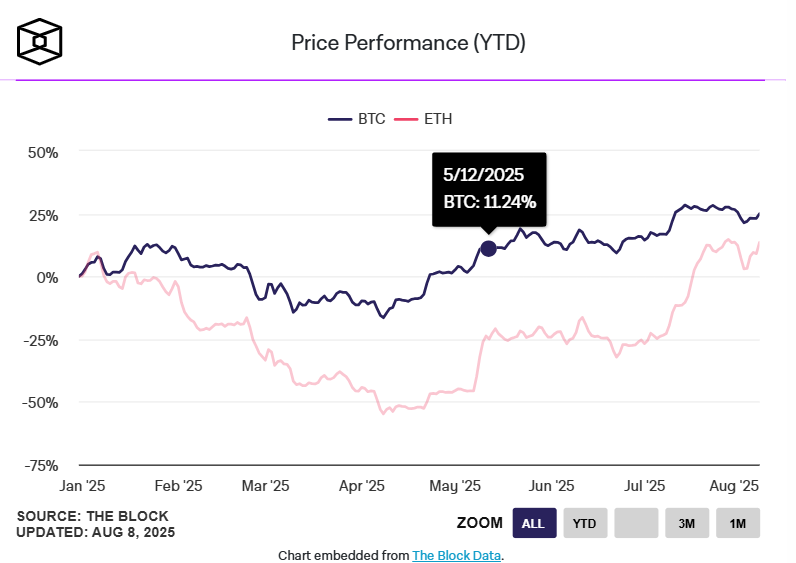

For most of 2025, ETH has performed weakly relative to BTC. Before April, the ETH/BTC trading pair dropped to a bottom of 0.018, depreciating 50% from the beginning of the year after former President Donald Trump announced the "Liberation Day" tariff policy. However, since April 21st, Ethereum has begun a strong rebound cycle, cumulatively rising about 90% against the Bitcoin exchange rate.

Nevertheless, Ethereum's year-to-date gains still slightly trail Bitcoin (19.2% vs 25%), and it remains about 18% below its all-time high of $4,867 from November 2021.

Rapid Ethereum Treasury Accumulation and Surging ETF Inflows

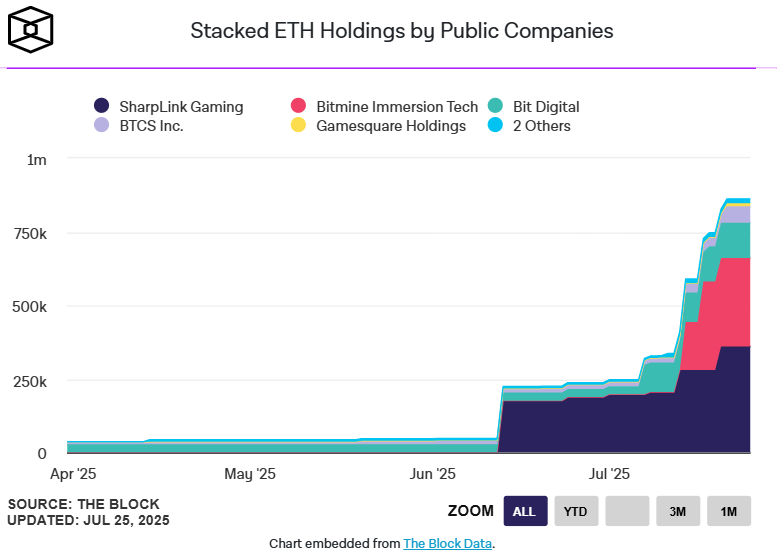

The rise in Ethereum token price stems from recent massive accumulation by emerging Ethereum treasury companies, who have raised and purchased billions of dollars worth of ETH, mimicking Michael Saylor's pioneering strategy for Bitcoin treasuries, but this time for a Proof-of-Stake (PoS) cryptocurrency.

According to The Block's Ethereum Treasury Holdings page, BitMine led by Tom Lee currently tops the list with over 833,000 ETH ($3.3 billion), followed by Joe Lubin's SharpLink with nearly 522,000 ETH ($2.1 billion), and The Ether Machine holding over 345,000 ETH ($1.4 billion).

Geoffrey Kendrick from Standard Chartered Bank noted in a recent report that Ethereum treasury companies are "just getting started" - potentially increasing their holdings to 10% of total ETH supply, which would be 10 times the current scale.

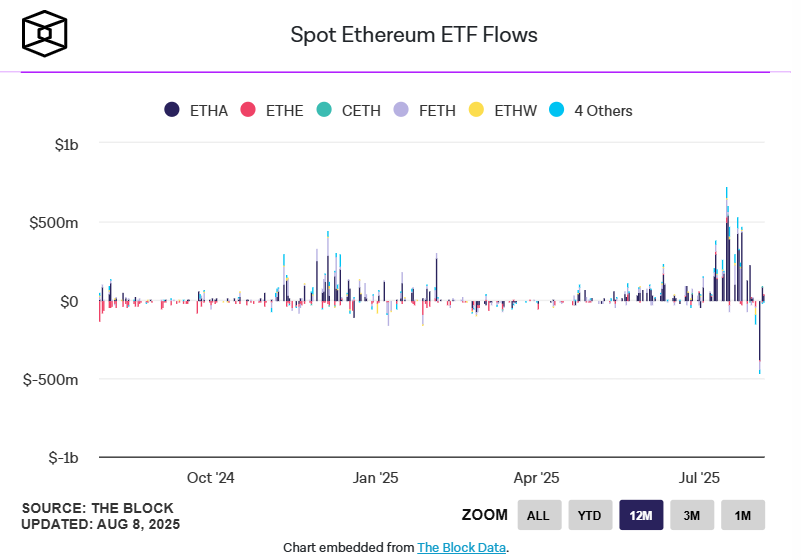

Additionally, net inflows for US spot Ethereum ETFs have significantly increased in recent weeks, even outperforming Bitcoin ETFs. In the past month alone, net inflows approached $5 billion, and since the product began trading in July 2024, total net inflows have reached $9.4 billion.

Another driving factor is Ethereum's new daily transaction volume record of 1.74 million on Wednesday, surpassing the previous peak from May 2021. Previously, the network just experienced its busiest month ever in July, with over 46 million transactions.

Vincent Liu, Chief Investment Officer at Kronos Research, told The Block on Thursday that Ethereum's surging on-chain activity has not yet fully been reflected in ETH price, and the potential SEC approval of spot Ethereum ETF staking functionality could be the next catalyst.