Author: Jiawei @IOSG

Three years ago, we wrote an article about Appchain, triggered by dYdX's announcement to migrate its decentralized derivatives protocol from StarkEx L2 to the Cosmos chain, launching its v4 version as an independent blockchain based on Cosmos SDK and Tendermint consensus.

In 2022, Appchain might have been a relatively marginal technical option. Entering 2025, with the emergence of more Appchains, especially Unichain and HyperEVM, the competitive landscape is quietly changing, and a trend around Appchains is forming. This article will start from this point to discuss our Appchain Thesis.

We are witnessing a paradigm shift from the "fat protocol" theory to the "fat application" theory. Looking back at the pricing logic for crypto projects in the past, it was mainly driven by "technical breakthroughs" and underlying infrastructure. In the future, it will gradually shift towards a pricing method anchored by brand, traffic, and value capture capabilities. If applications can easily build their own chains based on modular services, the traditional L1 "rent-collecting" model will be challenged. Just as the rise of SaaS reduced the bargaining power of traditional software giants, the maturity of modular infrastructure is also weakening the monopoly position of L1.

In the future, the market value of top applications will undoubtedly exceed most L1s. The valuation logic of L1 will transform from "capturing total ecosystem value" to that of a stable, secure decentralized "infrastructure service provider", with its valuation logic becoming closer to a public product generating stable cash flow, rather than a "monopolistic" giant capturing most of the ecosystem value. Its valuation bubble will be squeezed to some extent. L1 will also need to rethink its positioning.

Regarding Appchain, our view is: Due to its brand, user mindset, and highly customizable on-chain capabilities, Appchain can better precipitate long-term user value. In the "fat application" era, these applications can not only capture the direct value they create but also build a blockchain around themselves, further externalizing and capturing infrastructure value—they are both products and platforms, serving both end users and other developers. Beyond economic sovereignty, top applications will also seek other sovereignties: the right to decide protocol upgrades, transaction ordering and censorship resistance, and ownership of user data.

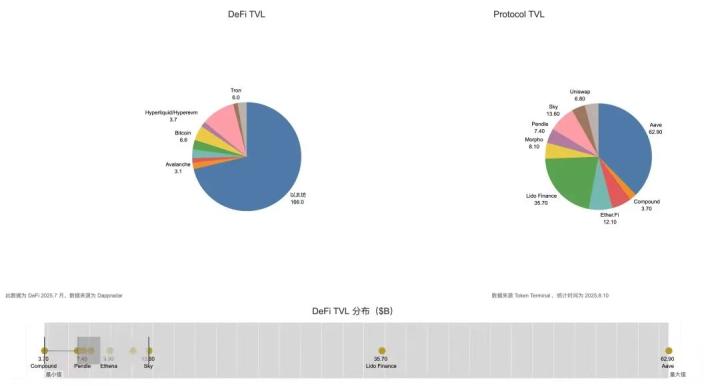

Of course, this article mainly explores the context of top applications like Uniswap and Hyperliquid that have already launched Appchains. The development of Appchains is still in its early stages (Uniswap's TVL on Ethereum still accounts for 71.4%). For protocols like Aave that involve wrapped assets and collateral, and are highly dependent on composability on a single chain, Appchain is not very suitable. Relatively speaking, perpetual protocols with only external oracle needs are more suitable for Appchain. Moreover, Appchain is not the best choice for mid-tier applications and requires case-by-case analysis. We will not elaborate further here.