summary

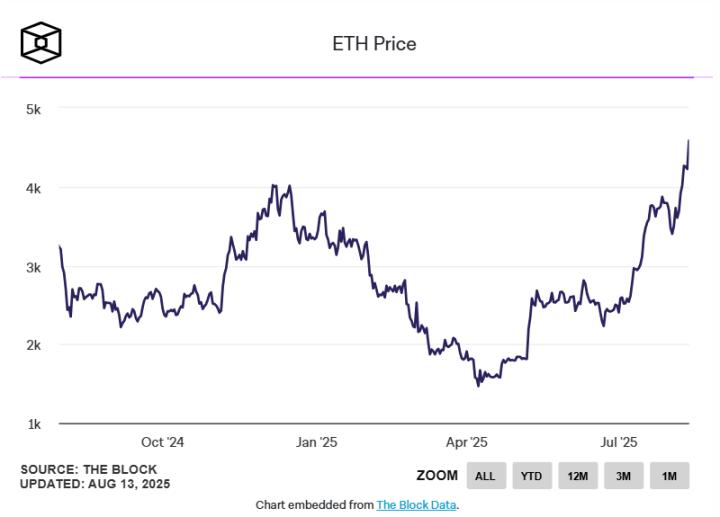

On August 7, 2025, the United States officially signed an executive order allowing 401(k) retirement plans to invest in diverse asset classes, including cryptocurrencies. This represents the most structurally significant institutional upgrade since the Employee Retirement Income Security Act (ERISA) of 1974. This policy liberalization, coupled with the influx of long-term funds such as university endowments, Wall Street narratives, accelerated inflows into ETFs and futures markets, and the macro tailwinds brought by expectations of a Federal Reserve rate cut, have collectively driven Ethereum to surpass Bitcoin in capital momentum and pricing power in this market cycle.

This article will systematically analyze the deep logic behind ETH's transformation into a financial asset from the dimensions of institutional breakthroughs, institutional layout, and market narrative evolution, and look forward to the structural opportunities and investment strategies in the coming months.

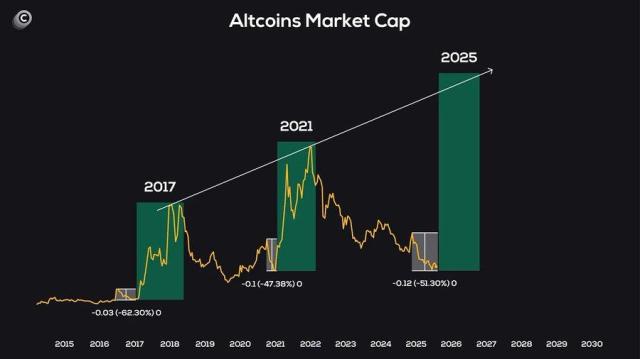

As of now, the total market capitalization of the global cryptocurrency market has exceeded $4 trillion, a record high. Compared with approximately $1.08 trillion at the beginning of 2023, this has nearly quadrupled in less than three years, demonstrating the explosive power of the market driven by institutionalization and institutionalization.

According to CMC data, the market capitalization rose by approximately 8.5% over the past week, with the cumulative increase over the past two weeks estimated to be between 10% and 12%. This trend is not driven by a single market trend, but rather by the combined efforts of institutional policy support, shifts in institutional allocations, market structure optimization, and narrative catalysts.

This research report will focus on three main themes: policy catalysis, institutional confidence endorsement, narrative and market structure, and deeply analyze the logic of the ETH bull market and future pricing path, and combine historical analogies, data modeling and risk analysis to provide investors with a comprehensive perspective.

1. Policy Catalysis: The Structural Significance of 401(k) Opening

1.1 Historical Context: The Pension Revolution from Stocks to Crypto Assets

The significance of this 401(k) opening to crypto assets becomes clearer when viewed within the context of the century-long evolution of US pension plans. The last paradigm shift occurred after the Great Depression. Back then, pension funds were primarily defined benefit (DB) systems, with funds tied to a "legal list" of government, high-quality corporate, and municipal bonds, driven by a single rationale: safety first. The 1929 stock market crash devastated corporate cash flow, leaving many employers unable to meet their obligations. The federal government was forced to provide a safety net through the Social Security Act. Bond yields continued to decline after the war, with municipal bonds falling to around 1.2% at one point, completely failing to cover the promised long-term returns. It was precisely amid this imbalance between safety and return that the "Prudent Man Rule" was reinterpreted in the 1940s and 1950s: no longer adhering to the principle of "only buying the safest assets," but rather adhering to the principle of "prudent overall portfolio management." Consequently, stocks began to be included in limited amounts. In 1950, New York State allowed up to 35% of pension funds to be allocated to equity assets, followed by North Carolina and other states. There was considerable opposition - "gambling with workers' hard-earned money" - but history chose growth. In 1974, the Employee Retirement Income Security Act (ERISA) wrote the modern framework of "prudent investment" into national regulations. Pensions are deeply tied to the capital market. The subsequent long-term bull market in the US stock market and the modernization of treasury markets all have this institutional footnote.

On August 7, 2025, Trump signed an executive order, pushing this risk-return rebalancing pendulum to the forefront again: 401(k) plans can invest in private equity, real estate, and, for the first time, crypto assets. The order also directs the Department of Labor to collaborate with the Treasury, the SEC, and other agencies to assess whether rule changes are necessary and how to provide plan participants with a comprehensive menu of alternative assets and compliance facilitation. This isn't just an isolated "policy benefit," but rather the most structural upgrade to the pension system since ERISA: it allows digital assets, still in their early stages of high volatility, to be included in the 401(k)—the most core retirement account for the American middle class. It directly addresses two questions: First, are crypto assets "eligible" for long-term institutional investment? Second, who guarantees this eligibility? The answer is straightforward: a "national" framework and the US pension system.

1.2 401(k) System Analysis and Funding Potential Assessment

To understand its magnitude, we need to shift our perspective from "news" to "asset pools." The US retirement system operates on three parallel tiers: Social Security, Individual Retirement Accounts (IRAs), and employer-led defined contribution (DC) plans, with 401(k)s being the dominant DC. By March 2025, total assets across all employer-led DC plans will be approximately $12.2 trillion, of which 401(k)s will comprise approximately $8.7 trillion, covering nearly 60% of American households. Mutual funds are the primary investment channel for 401(k)s, with approximately $5.3 trillion held in mutual fund accounts, including $3.2 trillion in stock funds and $1.4 trillion in mixed funds. This demonstrates that even within the "pension" framework, the US's risk tolerance and return ambitions have long since shifted away from the old "bond-only" world. The executive order now adds "crypto assets" to the already diverse investment landscape, extending beyond stocks, bonds, REITs, and private equity.

Translating "possibility" into "scale" reveals the vastness of this door. Assuming only 1% of 401(k) assets are allocated to crypto assets, theoretically, this translates to approximately $87 billion in medium- to long-term net buying; 2% would translate to $174 billion; and 5% would translate to approximately $435 billion. Compare this to the reality we can see: Ethereum spot ETFs have seen cumulative net inflows of approximately $6.7 billion so far this year, and just two days after the executive order took effect, ETH ETFs saw an additional $680 million in net inflows.

Why did ETH's price reaction this time appear significantly stronger than BTC's? If we only look at the same-day comparison of "news-price," we might misjudge the market's bias towards narrative. A combined analysis of both on-chain and off-chain factors offers a more comprehensive view. First, the "carryability" of funds: ETH has a lower price base and a wider range of ecological applications (DeFi, stablecoin liquidation, L2 settlement, RWA tokenization), which is more friendly to the "long-term funds-productization" story; second, the "readiness" of the product: At a time when Bitcoin ETF has been running for more than a year, Ethereum spot ETF naturally inherits the funding and compliance framework. The "shortest path" for the implementation of the executive order is "copying from IBIT to ETHA"; third, the trading structure: After the announcement of the executive order, the annualized premium of CME ETH futures once stood at 10%, significantly higher than BTC. The "sloping" term structure provides funds with a clearer hedging and leverage path; finally, the "dominance" of the narrative: In the past two months, BitMine used the rhythm of "disclosure-financing-increasing positions-re-disclosure" to establish the brand of "the largest ETH treasury company" within 35 days, and moved the over-the-counter structured tools (OTC design + on-chain delivery + custody settlement provided by Galaxy) into a reusable template; Tom Lee's "1.5 The "$100,000" target price spread this template from institutional circles to media and retail investors. Combined with the verifiable data of $680 million in net ETF inflows over two days, the narrative became self-evident. This isn't about "storytelling to drive price," but rather a closed loop of "structural design to channel funds—prices spontaneously validate—and narrative passively reinforced."

Of course, equating "state endorsement" with "risk-free growth" is dangerous. The integration of crypto assets' technology and institutions remains in a transitional phase: on-chain event risks (contract security, cross-chain bridges, oracle manipulation), macroeconomic policy uncertainty (anti-money laundering, stablecoin regulatory frameworks, and taxation), and legal risks (the boundaries of trustee lawsuits and the burden of proof) can all trigger unexpected repricings in a single event. While pension funds' low turnover helps reduce volatility, if product design fails to address redemption gates, premium and discount management, and liquidity preservation in extreme market conditions, it may amplify shocks during stress testing. Therefore, true institutionalization involves more than just "buying in"; it also involves "managing it": insurance pools and payout clauses, trigger conditions for catastrophic events, audit and evidence collection processes, and on-chain transparency and traceability must all be aligned with the pension fund's manageable operational risks.

At the asset level, the "structural benefits" of this policy for ETH also manifest themselves in both supply and demand. On the demand side, we've already seen: the "reacceleration" of ETFs, CME term premiums, and the proliferation of treasury companies and endowment funds. On the supply side, staking has locked up previously "active and tradable" ETH into "income-generating collateralized assets," and the destruction of EIP-1559 has further suppressed "net issuance" during the active period. A market characterized by "drip-feed long-term demand + reduced/locked supply" will naturally produce the characteristics of a "slow-moving bull market"—not a sharp daily rally, but rather a quarterly rally followed by a convergence of pullbacks. This also explains why BTC rose only approximately 2% on the day of the executive order, while ETH rose rapidly and recorded a two-day net inflow of $680 million into ETFs: the market prioritizes "institutionalizable growth" in assets with multi-purpose settlement layers and the ability to be embedded in financial products.

Finally, we need to translate "scale" into "path." In the short term, the first responses to policy changes will still be secondary market ETFs and over-the-counter structured products (easily auditable ledgers, implementable risk controls, and custodial underwriting). In the medium term, some targeted risk funds and balanced funds may experiment with embedding a "crypto factor" in a small proportion. In the longer term, only if the Department of Labor and the SEC provide clearer guidance on the scope of QDIAs, will truly passive crypto allocations appear in 401(k) default investments. This path doesn't require widespread enthusiasm; it requires "pension-level engineering" with compliant products, verifiable risk controls, custodial compensation, and verifiable disclosures. Once these links are established, 401(k)s will realize their potential as net buying. When net buying continues to steadily trickle into an internet asset with a gradually shrinking supply elasticity at a low frequency of 0.5 times per month for several years, a new equilibrium in price and volatility will emerge. This will not just be a "market rally," but an asset class upgrade.

2. Institutional Confidence Endorsement: The Cryptocurrency Layout of University Endowment Funds

University endowments, which, like pension funds, possess the "perpetual capital" attribute, are pushing crypto assets from fringe experimentation to the forefront of institutional allocation. Their balance sheet objective is multigenerational: to achieve a long-term real return of "inflation plus alpha" through a multi-asset portfolio, while adhering to an annual spending rate of approximately 4%–5% and safeguarding purchasing power from long-term inflation. Common characteristics of these funds are long duration, low turnover, and a keen awareness of compliance and fiduciary responsibilities. Any new asset must pass three hurdles to enter the investment committee's "core menu": legality and custody feasibility, valuation and audit verifiability, and synergy and diversification value with existing assets over the life cycle. It is for this reason that the inclusion of Bitcoin (and, by extension, Ethereum) in disclosure documents and public communications by a number of leading US universities between 2024 and 2025 is particularly significant: this is not a pursuit of short-term market trends, but a vote by long-term funds on whether it is worthy of inclusion in the strategic asset pool.

Judging by the timeline, these institutions have generally followed a similar path: establishing indirect exposure through "research and small-scale pilots" through crypto-themed venture capital funds around 2018, experimenting with small-scale direct holdings on exchanges or over-the-counter channels around 2020 to gain operational experience, and starting in 2024, as spot ETFs and custodial audit systems matured, they began to include products with fair valuations, intraday subscriptions and redemptions, and scalable liquidity in their disclosure forms. Harvard University is the most symbolic example to date: Harvard Management Company (HMC), with approximately $50 billion under management, disclosed in its latest 13-F filing that it holds approximately 1.9 million shares of BlackRock iShares Bitcoin Trust (IBIT). At the current quarterly market price of approximately $116 million, this ranks among the top five publicly disclosed holdings, alongside Microsoft, Amazon, Booking Holdings, Meta, and even exceeding its holdings in Alphabet. Placing a Bitcoin ETF alongside competing products is itself a shift in pricing power. In Harvard's view of assets, it is viewed as a valueable, rebalanceable asset, serving as a dual anchor alongside gold and growth stocks to protect against inflation and growth. A more subtle signal is that Harvard also increased its allocation to gold ETFs during the same period (reportedly, approximately 333,000 shares of the SPDR Gold Trust, valued at approximately $101 million). This suggests that Harvard's portfolio strategy isn't simply a matter of "discarding the old and investing in the new," but rather a combination of "commodity anchors" and "digital anchors" to balance geopolitical friction and cyclical fluctuations in US dollar liquidity. When gold strengthens its "crisis hedge" and Bitcoin strengthens its "liquidity easing and institutionalization process" beta, the correlation between the two will alternately reduce the portfolio's tail risk at different macroeconomic stages. Emory University was the first American university to speak out. On October 25, 2024, Emery publicly disclosed for the first time in a document that he held nearly 2.7 million shares of Grayscale Bitcoin Mini Trust (GBTC), with a market value of approximately US$15.1 million at the time; as the price of Bitcoin rose in the following year, the nominal value of this position was once close to US$30 million.

The institutionalization of crypto assets isn't solely driven by established giants; it's also driven by new institutions redefining the narrative. In February 2025, the University of Texas at Austin (UTX) announced the establishment of a dedicated Bitcoin fund of over $5 million, incorporated into its endowment, with a specified holding period of at least five years. Stanford's case demonstrates the cutting-edge momentum of a "campus investment culture." While the university's endowment hasn't disclosed its crypto holdings, the student-run Blyth Fund decided to invest approximately 7% of its portfolio in IBIT in March 2024, when Bitcoin was trading around $45,000. Blyth isn't a formal endowment, merely a portion of the university's available capital pool, and its assets are only in the hundreds of thousands of dollars. However, it demonstrates the risk awareness and tool-based capabilities of future managers. These students are embracing new assets within a real investment framework through "pension-grade" instruments like ETFs, and this methodology will naturally transfer to larger institutions when they join. Traditional leaders like Yale, MIT, and Michigan have a more conservative and invisible approach.

If we put these scattered actions on a single chart, we'll find several clear logical threads. First, path dependency: Almost all universities prefer to use ETFs/trusts to avoid direct private key custody and operational risks. Second, scale and pace: A small investment is made first to verify the process and risk control, and then, based on volatility, correlation, and drawdown performance, a discussion is made about whether to upgrade to the level of "strategic allocation." Third, portfolio role: Bitcoin increasingly plays the role of "digital gold," serving as a macro hedge and liquidity beta carrier. Ethereum, on the other hand, is gaining increasing attention through narratives like "financial market on-chain," "on-chain settlement layer," and "RWA tokenized infrastructure." Especially with the opening of spot ETF channels and 401(k) options, its affordability is gradually approaching Bitcoin's from an institutional perspective. It is also under this combined logic that we see the structural differences that ETH had a net inflow of US$680 million in two days after the issuance of the executive order, and the CME ETH futures premium was higher than BTC: when "long money" evaluates who is more like "an asset that can be embedded in the financial product system", ETH's multi-purpose attributes and output (staking income, MEV distribution, etc.) give it stronger marginal elasticity.

More notably, university endowments and pension funds share the same "long-term money culture." The former represents the intergenerational mission of the academic community, while the latter represents retirement security for the middle class. Therefore, simply interpreting the entry of university endowments as a "rising tide" is a misinterpretation. Rather, they serve as a testing ground for integrating crypto assets into long-term balance sheets: using the most accountable ETF entry point and applying the most rigorous trustee processes for stress testing, crypto assets are positioned within the "gold-growth-stock-high-quality bond" portfolio. If drawdowns are manageable, correlations can be dispersed during crises, and cash flows (for ETH, staking returns) are measurable, then the weighting could potentially be increased from basis points to percentage points. Once this shift is repeated across more universities and quarterly disclosures, it will cease to be "news" and become "common sense." When this common sense meets the institutionalized "drip-feed" of 401(k)s, the "strategic coin hoarding pool" at the bottom of the market takes shape—quiet but powerful.

3. Narrative Drive and the Transfer of ETH Pricing Power

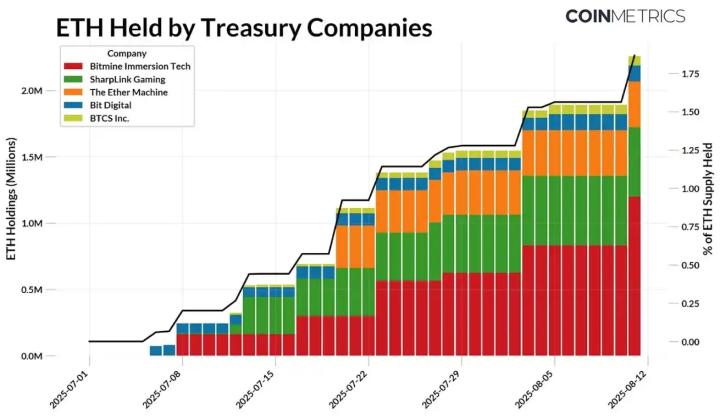

If this shift in Ethereum's pricing power is like the "invisible hand," then the back of the hand represents real money, while the palm represents a carefully orchestrated rhythm of information. The most telling difference is the parallel and diverging nature of two capital paths: on one end, SharpLink embodies the OG approach—low-cost, long-term, on-chain-focused, closed-loop information, trading time for space; on the other, BitMine embodies the Wall Street approach—structured financing, pacing disclosures, media presence, and price resonance, leveraging structure to amplify time. Both are "buying ETH," but their methodologies point to two completely different pricing systems: the former believes price will return to value, while the latter actively carves value narratives into price.

The story of SharpLink begins with holding costs. Its shareholders, including Consensys (Lubin serves as Chairman), Pantera, Arrington, Primitive, Galaxy, GSR, and Ondo, span the infrastructure and financialization chains, passively ensuring a closed-loop "buy-manage-use-custody-derivative" model. Early positions were primarily built through internal transfers within the team's wallet, rather than through the open market. Units were small and distributed over a long period, emphasizing security, liquidity, and auditing. Overall costs ranged from $1,500 to $1,800, with some falling below $1,000. This "hoarding" mentality led to two predictable consequences: First, when the price returned to around $4,000, a natural sell-off of historical holdings became almost institutionalized. Second, information disclosure tended to be "wait for financial reports," allowing for the sale of shares at any time after the effective date of the S-ASR, filed on June 12, 2025, further reinforcing the committee's "slow is steady" approach. Applying this path to the question of “who defines the price of ETH”, the answer is: the native community on the chain and time.

BitMine, on the other hand, delivered a different answer in just 35 days. The timeline was as clear as a script: From July 1st to 7th, $250 million in PIPE financing was completed, with the initial deposit of approximately 150,000 ETH disclosed. From July 8th to 14th, an additional 266,000 ETH were added, bringing total holdings to over 560,000. From July 15th to 21st, an additional 272,000 ETH were added, bringing the total to 833,000. Rather than wait for quarterly reports, BitMine maintained a weekly cadence through its official website, media, and IR letters, accurately signaling its continued massive purchases. Meanwhile, Galaxy Digital provided a toolchain combining "OTC structure design + on-chain delivery + custodial settlement" to ensure efficient acquisition without significantly increasing slippage. More crucially, the disclosed average purchase price of approximately $3,491 ETH avoided both the peak of the previous period and the sensitive threshold of a new upward trend.

This strategy is effective because it accurately grasps the mechanism of narrative generation: first, time rhythm - breaking information into high-frequency fragments, so that the market has "no window period" in terms of continuity, reducing narrative entropy; second, narrative container - packaging ETH from a "technology platform currency" into a "priceable, tradable, and cashable" financial asset, inventing a set of appropriate indicator language, such as ETH-per-share, which is analogous to "earnings per share", and synthesizing variables such as on-chain staking income, destruction rate, and net inflow of spot ETFs into a model that can be "explained to sellers, buyers, and the board of directors"; third, measurable verification points - using specific numbers to solidify expectations: average purchase price of $3,491, 833,000 coins in three weeks, 9 times the stock price, CME futures annualized premium >10%, and "ETH ETF net inflow of $680 million two days after the executive order" such "anchor points", so that media and institutional research can all refer to the same set of calipers; fourth, channel positioning - IR The integration of letters, mainstream financial media, and short social media videos allows narratives to take effect simultaneously on both institutional investors (who need models) and retail investors (who need stories). Consequently, the narrative chain is compressed into four steps: rhythmic release → media amplification → investor FOMO → price feedback feeds back into the narrative. When prices confirm, "We are indeed buying, and buying leads to price increases," a new pricing power naturally emerges.

In this system, the role of individuals is magnified to the point of "leverage upon leverage." Tom Lee's value lies not in "hitting the mark" but in "narrative standardization." His compilation of indicators like the Bitcoin Misery Index (BMI), on-chain activity, volatility, drawdown depth, ETF subscriptions and redemptions, and the M2 environment has been refined into three dimensions: a "sentiment dashboard" for retail investors, a "structural indicator card" for institutions, and "easy-to-understand headlines" for the media. He rarely leaves a blank window in front of the camera: at the bottom, he declares "extreme emotional pain, a window for long-term holders"; at the upside, he declares "a structural bull market unfolding"; and at a pullback, he declares "on-chain structure repairing." What matters isn't the accuracy of his conclusions, but their frequency, early presence, and impact. As BitMine's three-week progress bar was constantly pinned to the top of media outlets, Tom Lee confidently articulated ETH's $15,000 target price in a podcast. The 180,000 views gave retail investors the "psychological permission to act," and institutional research departments received external endorsement worthy of a memo. Subsequently, a shift in the term structure, with CME ETH futures trading at a premium exceeding BTC, emerged, providing a lever for capital to leverage using basis strategies. Further, a two-day net inflow of $680 million into spot ETFs digitized the "buying power." This chain of "people, events, price, and volume" made ETH's transition from a technology platform token to a financial asset no longer just a wish within the industry, but a perceptible, measurable, and repeatable fact for the outside world.

Ultimately, pricing power isn't about who has the loudest voice, but rather who can align prices more quickly and sustainably with a set of widely accepted narratives and metrics. The most profound structural change in this upward trend isn't who's bullish on ETH, but who can explain, carry, and deliver on ETH—the narrative leaders are becoming the ones writing prices.

IV. Summary and Investment Implications

In general, the reason why this round of price appreciation appears to be "more sensitive to Ethereum and cleaner in its performance" is essentially due to a realignment of funding structures: with the dual-track approach of ETFs and derivatives, incremental buying is more likely to prioritize assets with the deepest liquidity and strongest infrastructure attributes. In the two days following the executive order, ETH spot ETFs saw net inflows of approximately $680 million, adding to the previous year's cumulative net inflows of approximately $6.7 billion. This demonstrates the repeatability of the funding pipeline from "pensions - brokerage windows - ETFs - secondary market."

It's important to note that institutional allocations not only pursue beta but also manage the portfolio's maximum drawdown and redemption liquidity constraints. In terms of "carryability," ETH's spot and derivatives order book depth is second only to BTC, and its ecosystem applications allow for the fusion of "non-financial demand" and "financial demand," creating a "bridge width" that is most friendly to passive funds. This also explains why, despite the announcement of similar favorable policies, BTC only saw a roughly 2% increase in 24 hours, while ETH's price and trading volume simultaneously surged, a fact confirmed by both ETF and futures funds. In contrast, the Altcoin' "follow-up, fall-behind, and then divergence" pattern is not accidental, but an inevitable consequence of market structure.

The macroeconomic environment provides the "capital weather" for this structure. Weak US non-farm payroll data in July and a slight rise in the unemployment rate, coupled with top regulators hinting at three interest rate cuts this year, led to the CME's "Fed Watch" indicator implying an 88.4% probability of a 25 basis point rate cut in September. The expectation of falling nominal interest rates has raised the pricing ceiling for risky assets and increased the medium- to long-term return/volatility trade-off for long-term investors. Interest rate fluctuations are transmitted to the crypto market through two pathways: First, the discount rate cut directly boosts the valuation of assets with promising cash flow potential, with ETH benefiting more significantly within the "fees-burns-staking yield" framework. Second, the "USD liquidity-asset reallocation" chain has made US stocks, gold, and BTC/ETH the primary recipients. Within this contingent, Ethereum, due to its "financial infrastructure" attributes, occupies a central position in the pricing narrative. This upward trend in ETH isn't a trading signal, but rather a repricing of the asset class. This process begins with the "compliant channels" of pension system reform, with ETFs, futures, and over-the-counter structures channeling funds into the secondary market. Treasury companies, university donations, and long-term investment accounts drive down turnover and deepen the bottom line. Finally, media and research narratives standardize the dissemination of "verifiable facts." Only by understanding this logic can we seize the core dividend of ETH's long-term revaluation as it gradually transitions from a "trading-driven uptrend" to an "allocation-driven uptrend."