Author: kkk, BlockBeats

On August 12, Ethereum broke through $4,700, reaching a four-year high, and @CryptoHayes, who had previously taken profits early last week, repurchased Ethereum on August 9; Bitcoin also reached a new high, with the total cryptocurrency market value surging to $4.2 trillion, completely igniting market sentiment.

The traditional market was equally vibrant. The S&P 500 and Nasdaq 100 both set new historical records, with global liquidity accelerating towards risk assets; the US Dollar Index (DXY) fell below 98, further opening the floodgates for capital inflow into stocks and crypto markets. Such a macroeconomic environment not only consolidated the upward trend but also continuously boosted investor confidence in high-risk assets.

Meanwhile, the market is almost certain that the Federal Reserve will cut interest rates at its September 17 meeting, with a probability close to 100%, reducing the benchmark rate to the 4.00%-4.25% range. This expectation provides additional fuel for markets dependent on high liquidity—especially cryptocurrencies. Now, the wealth effect of the Altcoin season has become a hot topic of market discussion, with the key question being when it will fully launch.

Next, BlockBeats has compiled traders' views on the upcoming market situation to provide some directional references for this week's trading.

@b66ny

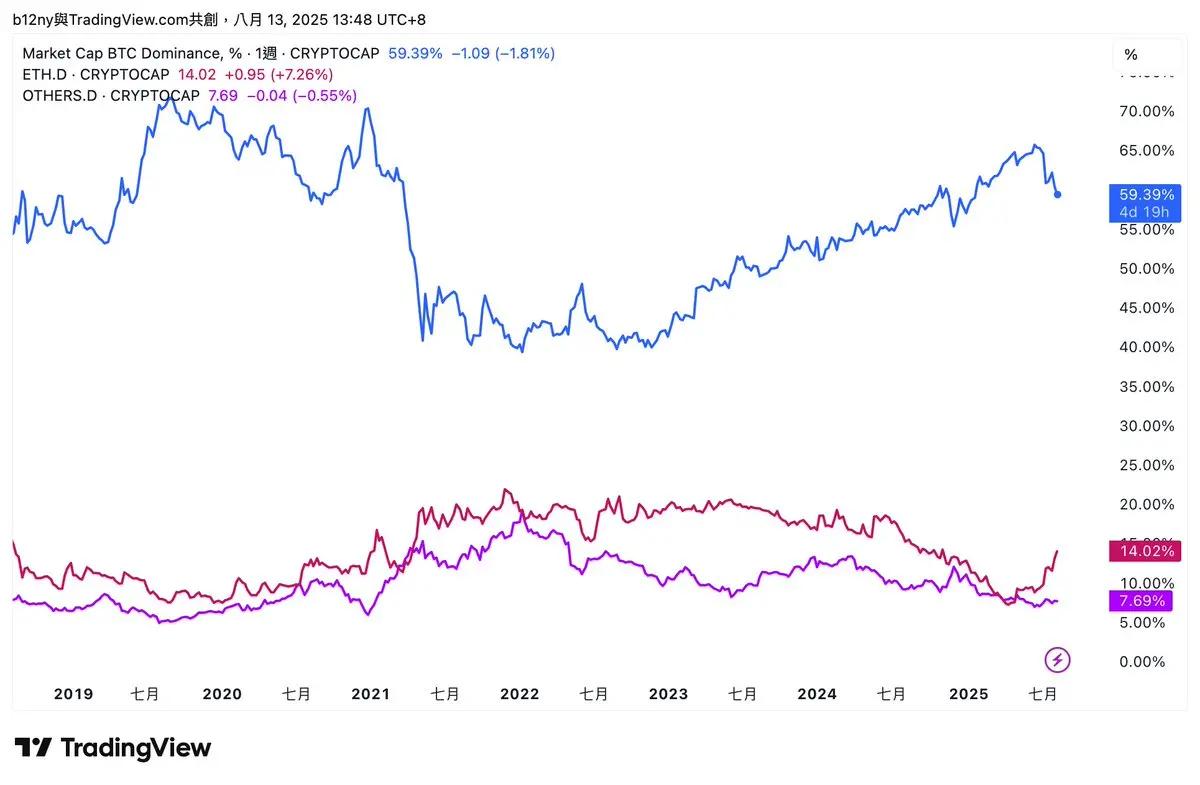

BTC.D has shown a clear downward trend, falling from its previous high point to around 57.7%. Combined with ETH.D's trend, I believe this is a typical capital rotation signal: market funds are beginning to withdraw from relatively stable assets and pursue higher-risk, higher-potential targets. Historically, the continuous decline of BTC.D has often been one of the necessary conditions for the Altcoin season's launch.

ETH.D not only represents Ethereum's strength but is also often viewed as the leader of the entire Altcoin market. Currently, ETH.D is performing strongly, with its dominance rebounding to 14.0%, and accompanied by ETH's rapid price increase, ETH/BTC rose over 4% in 24 hours, indicating a clear trend of funds flowing from Bitcoin to Ethereum.

This trend follows the classic script of capital rotation: in the first stage, BTC stagnates or even falls back, and funds begin flowing into ETH; ETH's rise not only boosts market confidence but also creates conditions for more liquidity to be injected into the Altcoin market.

The focus next is on OTHERS.D (market cap percentage of mid-to-small Altcoins excluding top coins like BTC and ETH). Currently, OTHERS.D remains in a long-term bottom consolidation and has not seen an explosive growth like ETH.D, meaning fund heat is still concentrated on a few top assets. Although SOL also had a significant rise today, making the capital rotation more evident, it has not yet fully spread to the high-risk, small-cap speculative sector.

Looking at these three indicators comprehensively, the market is likely in the early stage of rotation:

Already happened: BTC.D declining, funds overflowing.

Happening now: ETH.D rising, funds concentrating on ETH.

Not yet happened: OTHERS.D rising, funds dispersing to small-cap Altcoins.