XRP has, in the last seven days, struggled to breach the $3.50 resistance level as it pushes for a new all-time high (ATH). However, the asset has faced rejection on every attempt, causing disappointment among some traders.

$3 support keeps XRP’s ATH alive

CoinMarketCap data suggests that XRP’s quest for a new ATH is not completely dead as technical indicators signal bullish momentum ahead.

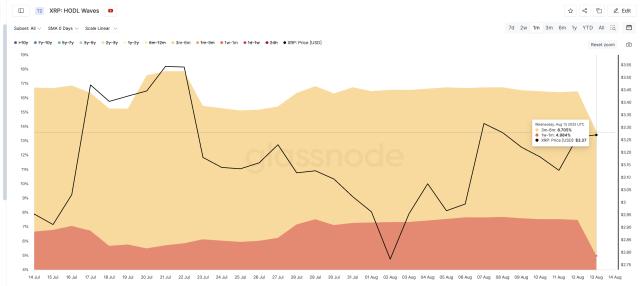

Amid market volatility, the XRP price dipped from a high of $3.34 to $3.04 as it threatened the $3 support level. Ecosystem bulls were able to step in as the asset has broken out of its falling wedge. XRP has begun an upward move with the potential to form a bull flag.

The XRP price has climbed from its low of $3.04 to an intraday high of $3.26. As of press time, XRP is changing hands at $3.12, which reflects a 3.6% decline in the last 24 hours. Trading volume also suggests that the current sell-off is easing, although it remains in the red zone by 1.31% at $10.17 billion.

With XRP maintaining stability above its $3 support and gradually forming a potential bull flag above $3.10, the asset’s trajectory to a new ATH might still be on track. Market watchers are considering the recent sell-off as a mild retracement in price.

Can regulatory clarity trigger price surge?

In the broader cryptocurrency space, an update is no longer expected in the Securities and Exchange Commission v. Ripple lawsuit today, Aug. 15. Since both entities have amicably resolved their legal battle, it has boosted the XRP price outlook.

Popular on-chain analyst Ali Martinez predicts that XRP’s $12.6 target is a realistic expectation to focus on if market conditions are right. The asset’s chart shows growth potential, and a status update on the lawsuit could act as a catalyst for it.

In the short term, investors might have to keep an eye on XRP reclaiming the $3.40 level. Michaël van de Poppe, a top crypto analyst, believes XRP could find stability at this level.