Written by: San

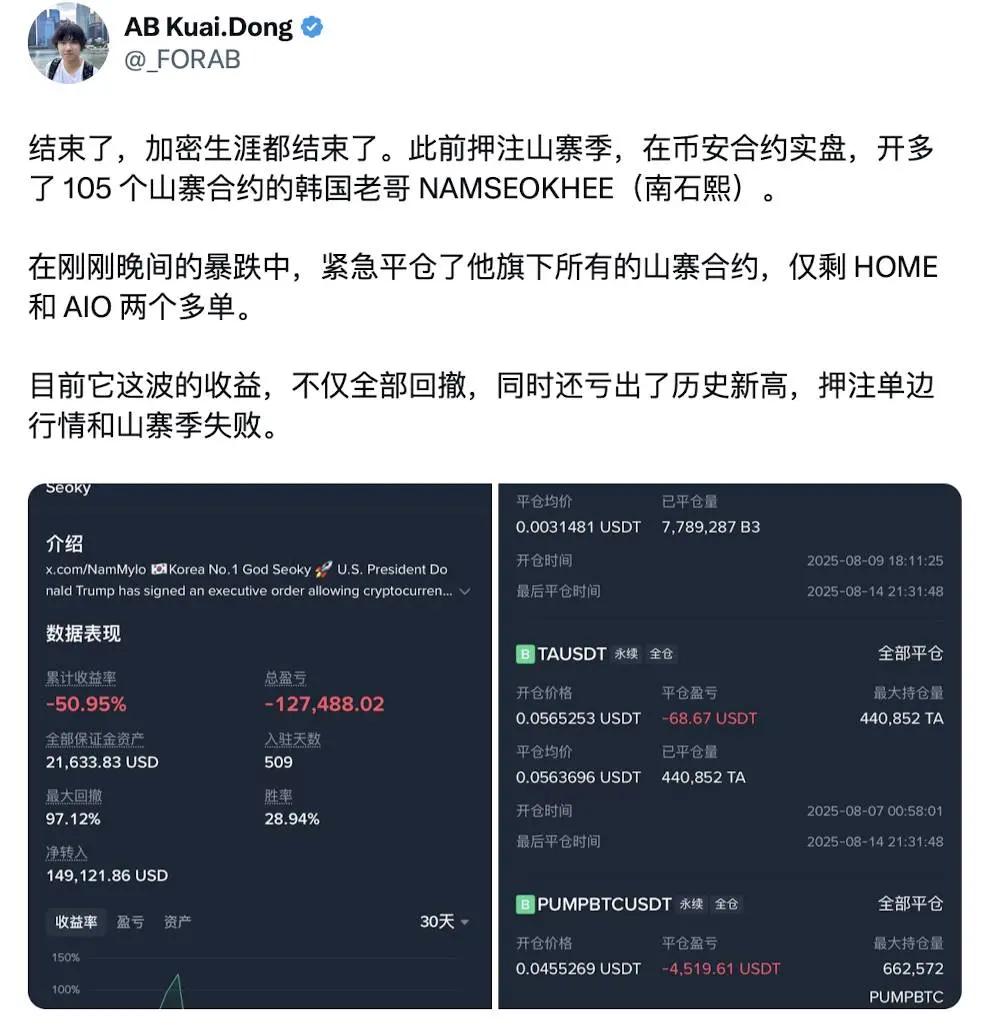

Recently, two traders from the Korean crypto market have become the focus of discussion in the crypto circle due to their remarkable performance.

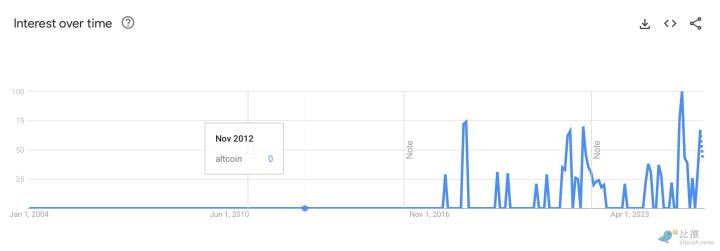

The trader with the username Namseokhee placed high-leverage contract long positions on Altcoins on Binance, increasing his long positions from 75 to 105 within two weeks, with returns skyrocketing from 134x to 1400x, while his initial margin was less than $3,000.

Image source: @_FORAB

Another trader, Ohtanishohei, is a staunch ETH supporter who continuously added to his ETH contract long positions over the past two weeks, with profits increasing from $1.57 million to a peak of $3.37 million.

Their brilliant achievements not only ignited the passion of Korean investors but also drew global attention to this vibrant market.

In the past half year, the Korean market has been increasingly mentioned in the Crypto field, and its rise is no coincidence. In 2024, the asset management scale of Korea's top five crypto exchanges exceeded $74.8 billion, with managed assets reaching $73 billion and daily trading volume surpassing Korea's two major securities exchanges.

Upbit, as Korea's largest crypto exchange, saw its daily trading volume once exceed $10.2 billion, a year-on-year growth of 94.5%. More notably, the Korean won accounts for 37% of global legal currency to crypto trading, second only to the US dollar.

These figures demonstrate that Korea is not only a hub for Asian crypto trading but also occupying an increasingly important position in the global market.

Betting on Altcoins, Nationwide Crypto Trading

Mentioning Korea, many crypto investors might have a negative first impression. In 2022, the Terra project founded by Korean trader DoKwon once had a market value of $40 billion but instantly went to zero due to an algorithmic stablecoin out of control, with Korean investors losing over $6 billion. BTC was affected, continuously dropping from $40,000 in early May to $17,000 within two months.

This event caused the trading volume of Korea's two major crypto exchanges, Upbit and Bithumb, to drop by 30%, and the Korean won's share in global crypto trading fell from 40% to 25%. Along with this drop was Korea's status in the crypto market.

Coming to the second half of 2024, several Altcoins saw price surges after listing on Korean exchanges, a phenomenon that continues today. Recently, CYBER listed on the Korean exchange Upbbit, with its price soaring over 130% in a single day, trading volume surging 500%, and market value momentarily exceeding $170 million.

These data reflect that Korean crypto investors' enthusiasm might far exceed our imagination, which can be confirmed by the demographic composition of Korean crypto investors.

According to the latest "20-50 Generation Virtual Asset Investment Trend Report" released by the Korea Anya Financial Research Institute, among 1,000 financial investors aged 20-50, 27% hold cryptocurrencies, accounting for 14% of their total financial assets. Moreover, 70% of respondents expressed willingness to invest in cryptocurrencies in the future.

Korean people's crypto craze goes beyond this. According to Korean Central Bank data in 2024, by November 2024, 30% of Korean residents had opened crypto exchange accounts, with two out of ten government officials holding cryptocurrencies.

Behind Korea's "nationwide crypto trading" phenomenon are the current social background and the government's changing attitude towards crypto.

Currently, young Koreans are facing unprecedented social pressure.

According to Korean Statistical Bureau data, the youth unemployment rate in July 2025 reached 5.5%. Korean youth generally view the economic outlook pessimistically, and with upward mobility channels almost completely blocked, countless young Koreans see cryptocurrencies as their only opportunity for class mobility.

This explains why Korean crypto traders generally prefer high-leverage trading, and some classic lines in Korean media and TV shows also reflect this social phenomenon.

Image source: Korean popular TV series 'Squid Game 2'

Regarding the Korean government's attitude towards the crypto market, the most significant good news for Korean traders is Lee Jae-myung becoming president.

Lee Jae-myung is not only a political winner but also one of the most steadfast advocates of Korean crypto policy. In his "Korean Crypto Industry Promise", he indicated that he will promote the legalization of spot ETFs for virtual assets, guide large-scale Korean national pension funds to allocate crypto assets, and construct Korean won stablecoins.

The attitude behind these messages consistently points to one result: Korea is making a comeback in the crypto market, and this time, the storm might be more intense than ever.

Tom Lee, Korea's New Do Kwon?

Korea's crypto market comeback is not just about policy statements but is more reflected in the actual actions of Korean forces. Korean investors' "self-selected" lists often include the following targets:

ETH

In the Korean crypto market, the crypto gold is not BTC but ETH.

According to Korea's two major crypto exchanges Upbit and Bithumb, in the past 24 hours, ETH/KRW trading pairs accounted for 18.06% and 12.1% of trading volumes respectively, with total trading amounts exceeding $1.26 billion. Moreover, Upbit alone saw ETH trading volume reach an astonishing $111.1 billion in July.

This is inseparable from Tom Lee, the BitMine board chairman with the most ETH holdings, who is also a Korean-American, continuously shilling to inject confidence in Korean crypto traders.

Overlaid with national sentiment, media promotion, and the crypto currency label, Tom Lee is currently seen by Korean crypto traders as comparable to LUNA founder DoKwon. Even legendary trader Eugene mentioned Tom Lee in the community.

Image source@_FORAB

BMNR

Besides ETH, Tom Lee's importance in Korean traders' hearts is also reflected in the stock BMNR of the ETH microstrategy company BitMine.

As of August 15th, BitMine held over 1.2 million ETH, valued at $5.3 billion, more than double the second-place SharpLink's ETH holdings. According to Korean Securities Depository data, Korean retail investors have net bought over $259 million of BMNR since July, making it the most popular foreign security during that period.

In the eyes of countless Korean traders, BitMine has become the manipulator controlling ETH's rise, and the US stock target BMNR has become a leveraged ETH. Compared to ETH, BMNR's maximum increase of 66% since July 1st is more in line with Korean crypto traders' high-risk appetite.

XRP

Besides ETH, XRP is another major target for Korean crypto investors. In the past 24 hours, XRP's total trading amount on Upbit and Bithumb reached $1.13 billion, just $100 million less than ETH.

On May 26th, the XRP/KRW trading pair surpassed BTC and ETH to top the Korean market. Even more crazy was that XRP's price on Upbit rose to $265 million, over 3% higher than the international market price.

On the other hand, Upbit, Korea's largest crypto exchange, holds over 5.9 billion XRP reserves, nearly twice that of Binance. Behind this crazy phenomenon are the SEC's withdrawal of XRP's securities lawsuit and its cross-border payment potential, attracting Korean investors. The Korean won stablecoin policy further boosts its demand, with retail investors generally optimistic about XRP's future potential.

Returning to the Crypto Stage

Driven by ETH, BMNR, XRP, and other popular targets, the Korean crypto market is returning to the Crypto stage at an astonishing speed. From retail investors to institutions, from policy to culture, Koreans seem to have viewed cryptocurrencies as a new engine for national development. However, this "nationwide crypto trading" and high-leverage trading strategy are not without concerns.

Just yesterday on August 14th, after the US released PPI data, the crypto market plummeted, and Namseokhee's position, which had previously bet heavily on a unilateral upward trend, has turned from profit to loss, even experiencing the largest historical loss. Although such an extreme trading strategy is not worth advocating, the enthusiasm of Korean crypto traders cannot be ignored.

Image source:@_FORAB

In summary, the Korean crypto market is making a strong comeback from the "Terra shadow" and becoming a force that global investors cannot ignore. In the near future, with the popularization of Korean won stablecoins and further implementation of crypto-friendly policies, we are likely to see Korea rise to the status of the "Asian Crypto Capital".

Click to learn about ChainCatcher's job openings

Recommended reading:

Challenging Pump.fun, can Bags' "creator-first" gameplay overturn meme coin issuance | CryptoSeed