Last week witnessed Bitcoin reaching a new peak, with the cryptocurrency market experiencing strong growth, along with important policy and legal developments.

Developments from stablecoin battles to the conclusion of the Ripple lawsuit, coupled with the Ethereum ETF explosion, create a multifaceted picture in the current cryptocurrency world.

- Bitcoin sets a new record, cryptocurrency market exceeds $4.13 trillion.

- US banks warn of risks from stablecoin yields that could withdraw trillions of dollars from the credit system.

- Ripple lawsuit ends, SEC shifts to building clear cryptocurrency regulations.

How did the cryptocurrency market reach a total value of over $4.13 trillion with Bitcoin's surge?

Bitcoin just set a new record by surpassing $124,000, becoming the fifth-largest global asset. This price increase comes from strong institutional investor demand, ETF capital inflow, and expectations of interest rate cuts in the US.

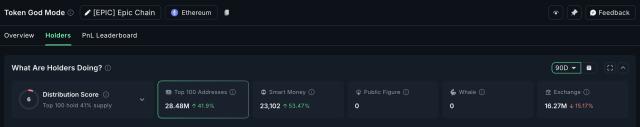

The cryptocurrency market volume was pulled up to $4.2 trillion, with Ethereum and many other Altcoins simultaneously increasing in price. This trend shows that cryptocurrencies are developing rapidly and receiving significant attention from the traditional financial market.

Why are US banks warning about risks from stablecoin yields?

Top US banking associations like the Bank Policy Institute and the US Banking Association are concerned about loopholes in the GENIUS Act that could allow stablecoin issuers to pay yields through affiliated companies.

Payment Stablecoin should not pay interest,

Quoted from the letter dated 12/08/2025 by Bank Policy Institute

They warn that this could withdraw up to $6.6 trillion in bank deposits, putting enormous pressure on the US credit system. If stablecoins offer attractive yields, they could directly compete with savings accounts and negatively impact traditional lending.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms and preserving the structure of the original text.]What are the other highlights you cannot miss this week?

- UAE airlines accept payment in Bitcoin, Ethereum and stablecoin, positioning UAE as a cryptocurrency-friendly tourism center.

- Google adjusts policy, excluding non-custodial wallets from new regulations to reduce confusion.

- Stripe and Circle accelerate Blockchain development, focusing on capturing future payment infrastructure.

- Proposed law to tightly control cryptocurrency ATMs in Wisconsin with licensing regulations, identity verification, and daily transaction limits.

- Paxos applies for National Asset Management Bank license to upgrade supervision and accelerate transaction processing.

Frequently Asked Questions

How much USD did Bitcoin just reach a new record?

Bitcoin just crossed the threshold of 124,000 USD, creating a record high price in trading history.

How did the Ripple lawsuit with SEC end?

Both parties agreed to stop appealing and share costs, paving the way for SEC to build clearer cryptocurrency regulations.

What are US banks worried about with yield-bearing stablecoins?

They warn of risks of withdrawing 6.6 trillion USD in deposits and negative impacts on the traditional credit system.

What is the current impact of Ethereum ETF?

Ethereum ETF leads in trading with a weekly volume of 40 billion USD, attracting 3.37 billion USD in capital and increasing by 126% since June.

What is the source of the US government's Bitcoin reserve strategy?

Bitcoin reserves will be based on Bitcoin seized from cases, not using taxpayer budgets.