Compiled by: Block unicorn

Three months ago, George Calram had never considered that his semiconductor company would start buying Bitcoin.

With his New York-listed company's stock price long depressed, Calram became interested in Bitcoin after reading news of a healthcare company's stock soaring after purchasing digital currency. He said, "I was looking for ways to unlock the company's value" after a failed transaction scared off investors.

After consulting with the board and some investors, Calram decided to launch a Bitcoin strategy. Sequans Communications raised $384 million from debt and equity markets to purchase the world's most popular cryptocurrency. Its stock price surged 160% after the announcement.

Calram said, "I wouldn't have said this last year, but today I completely believe... I am 100% certain that Bitcoin will continue to exist."

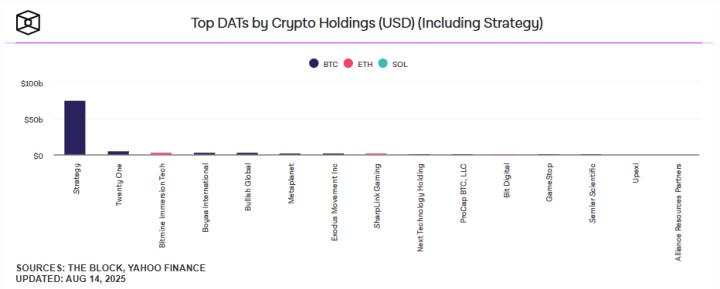

This cryptocurrency novice largely owes his transformation to Bitcoin evangelist Michael Saylor. Since 2020, this American crypto tycoon has been spending billions of dollars buying Bitcoin almost weekly and hosting conferences to encourage others to follow suit. Saylor's software company, which has turned into a Bitcoin accumulator, Strategy, is now valued at around $115 billion, almost twice the value of its Bitcoin holdings, as investors flock in. Last week, Strategy purchased $2.5 billion in Bitcoin, its third-largest purchase record. Its stock price has soared over 3000% in five years.

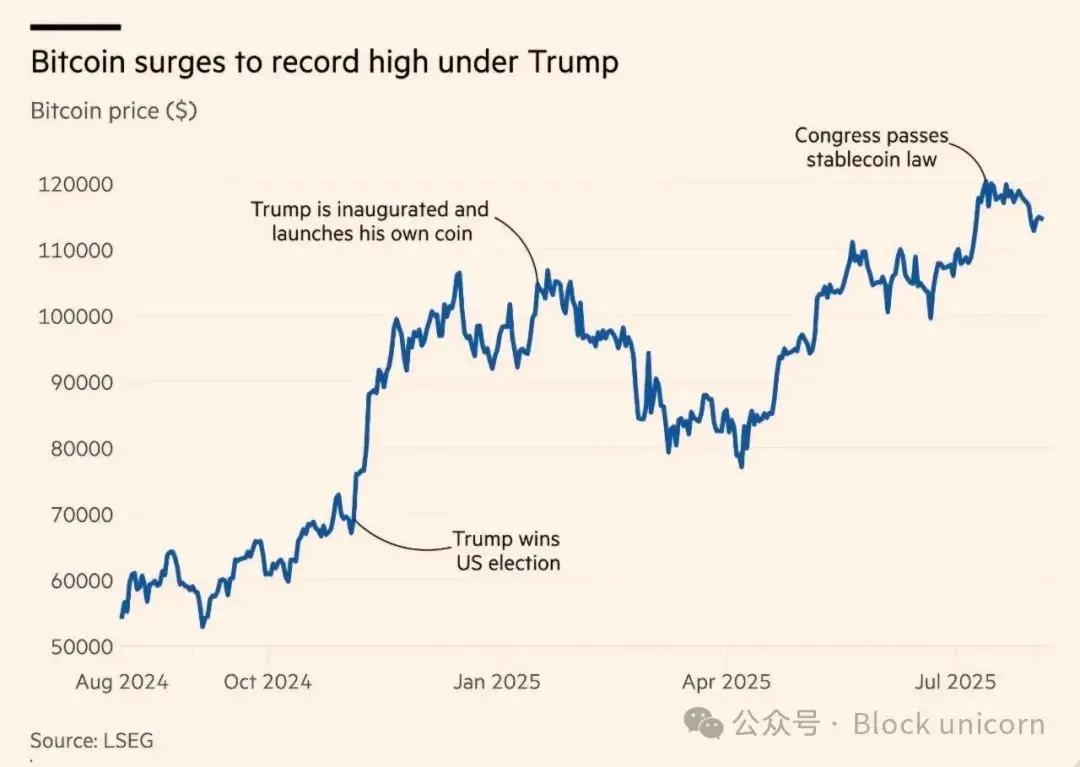

This success, coupled with former US President Donald Trump's full support for the digital asset industry, has inspired a surge in the number of so-called "crypto treasury companies" globally.

Biotechnology companies, mining companies, hoteliers, electric vehicle companies, and e-cigarette manufacturers are all rushing to buy cryptocurrencies, supported by investors who want to share in the crypto market dividends without directly touching digital assets.

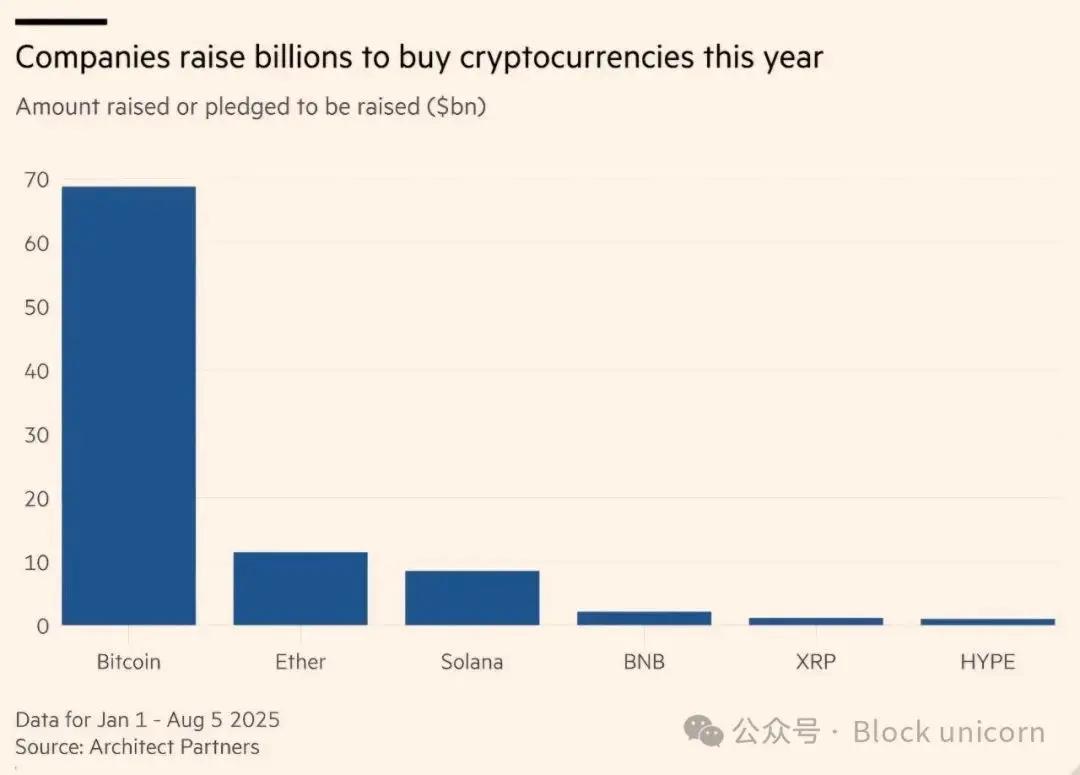

According to data from crypto advisory firm Architect Partners, in the year up to August 5, about 154 listed companies have raised or committed to raising a total of $98.4 billion to buy cryptocurrencies. Previously, only 10 companies had raised $33.6 billion.

Some companies are mimicking Strategy, changing their website colors to Bitcoin's orange tone and providing data showing how many cryptocurrencies they hold, their value, and other metrics important to investors.

Even Trump himself joined the action - his family media company raised $2 billion in July to buy Bitcoin and related assets.

In a year when Bitcoin and benchmark stock indices have repeatedly hit new highs, traditional investment institutions are struggling to find the best way to participate in the new world of digital assets, thus sparking a crypto hoarding trend.

But many doubt whether this trend can be sustained. Rapid growth has made some investors worry about market overheating. Brian Estes, CEO of Off The Chain Capital, who has invested in several Bitcoin treasury companies, says: "This is similar to the internet bubble of 1998," when companies raced to reposition themselves as web-first enterprises to attract attention.

The surge of new companies has also raised concerns about cryptocurrency price drops and their chain reaction. Companies that have borrowed billions to buy cryptocurrencies may soon find themselves unable to repay creditors.

Eric Benoist, investment banking technology and data expert at Natixis CIB, says: "The risk is a Bitcoin crash. In such a case, stock prices would also fall, and if companies cannot pay bondholders, investors would suffer losses," he added, "This could cause a systemic impact on the Bitcoin ecosystem. Every time there's a small market panic, the entire market drops."

Kevin de Patoul, CEO of crypto market maker Keyrock, says investors should maintain a realistic attitude. "You're injecting a large amount of risk into a system that ultimately has almost no support, except for the continued appreciation of assets."

For struggling companies, buying cryptocurrencies seems to be a surefire way to attract investor attention and boost stock prices - at least temporarily.

Aidan Bishop, founder of London-listed Bluebird Mining Ventures, says: "If we hadn't gone down this path, we would have found it difficult to raise future funds; we were like a dying company." The company raised £2 million in June to buy Bitcoin. Before that, "to raise funds, I had to go knocking on doors," he added.

Source: Travis P Ball / Sipa / Reuters

Crypto evangelist Michael Saylor has spent billions of dollars buying Bitcoin since 2020 and hosting conferences to encourage others. His company Strategy's stock price has soared over 3000% in five years.

Most newcomers are ordinary enterprises with no previous crypto experience, but their digital asset holdings far exceed the company's actual revenue.

For example, US thermal technology company KULR Technology has a market value of about $211 million, despite operating at a loss of $9.4 million in the first three months of the year. However, it holds Bitcoin worth about $118 million.

In the UK, website design company The Smarter Web Company only achieved a net profit of £93,000 in the six months ending in April, but its market value is about £560 million due to its Bitcoin holdings worth £238 million.

The premium investors are willing to pay highlights their recognition of the value of these cryptocurrency-holding companies.

Companies that prove their commitment to continuing to raise funds to buy cryptocurrencies are rewarded by investors, whose stock valuations are higher than the value of the Bitcoin they hold. To actually purchase these tokens, companies typically raise funds by issuing debt or equity, and then use exchanges like Coinbase to invest in buying cryptocurrencies.

Speed is crucial. Estes says: "Ultimately, it's a speed issue. The goal is to increase the number of Bitcoins per share, and companies that can do this fastest will get a high premium."

For investors, "Bitcoin per share" - the number of Bitcoins a company holds per share - is a measure of success. If a company quickly buys more tokens, equity investors indirectly hold more cryptocurrencies per share - which is why investors are willing to pay a premium early on, hoping to hold more Bitcoin per share in the future.

Most companies buying Bitcoin are also operating other businesses, but the new wave of transactions involves shell companies that are buying or promising to buy large amounts of cryptocurrencies. These companies operate as Special Purpose Acquisition Companies (SPACs), raising funds to buy or merge with existing enterprises.

Rob Hardwick, general partner at venture capital firm Dragonfly Capital, says that when a company with an actual business buys Bitcoin, operational risks are "often actually higher": "You have an existing management team whose goals may change over time and may conflict with operational business priorities."

Executives are now starting to buy other tokens as the trend has expanded beyond Bitcoin. These tools also provide ways for those holding large amounts of cryptocurrencies to extract value without selling.

ReserveOne is a $1 billion transaction funded by investors including Kraken and Blockchain.com, and the company plans to purchase Bitcoin and other crypto tokens such as ETH and Solana. Ether Machine raised $1.5 billion, planning to use it to buy ETH. Former Barclays CEO Bob Diamond raised $888 million through a Spac transaction with a biotech company to purchase HYPE tokens. The venture capital firm led by crypto billionaire CZ completed a $500 million transaction to help a Canadian e-cigarette manufacturer purchase BNB, the token of Binance exchange co-founded by CZ.

Hardik said: "We are obviously witnessing an irrational gold rush. It feels unnecessary to establish (investment tools) for all these different tokens."

For retail and institutional investors, crypto vault companies are an alternative way to gain token exposure without directly holding tokens.

Some investors choose to do this through US exchange-traded funds (ETFs) launched by large asset management companies such as BlackRock, Fidelity, and Invesco, which have accumulated over $100 billion in investments.

However, other investors cannot do this. In countries like the UK and Japan, crypto ETFs have been banned as regulators try to protect investors from the volatility risks of digital assets. Therefore, vault companies serve as a proxy tool, providing investors with an indirect way to access cryptocurrencies through tradable instruments.

Tyler Evans, co-founder of UTXO Management, said: "Many institutions (investors) simply cannot invest in ETFs or directly hold (cryptocurrencies)." He stated: "We believe Bitcoin vault companies fill this gap, issuing securities that comply with investment permissions." His company, with $430 million in size, invests 95% in Bitcoin fund management companies.

Investors are also taking advantage of tax arbitrage opportunities between holding crypto assets and stocks in some countries. In Japan, crypto gains are taxed up to 55%, while stock tax is 20%. In Brazil, crypto gains are taxed at 17.5%, while stock exchange-traded stocks are taxed at 15%.

Source: May James / SOPA / Getty Images

US President Donald Trump's full support for the digital asset industry has stimulated the proliferation of "crypto vault companies" globally.

Therefore, investing in companies holding large amounts of cryptocurrencies may be more tax-efficient than directly holding cryptocurrencies.

Eager investors are searching globally for countries with similar tax structures to make profits. Estes said: "The US market is now saturated... we are looking for opportunities outside the US."

The new alliance between cryptocurrencies and capital markets is ironically contrary to their original mission of disrupting traditional financial markets and staying away from the prying eyes of large institutions.

Raising debt and equity from investors is the core strategy and a necessary condition for maintaining operations. The stock prices of companies that do not purchase cryptocurrencies quickly enough have begun to decline.

Although Sequans Communications' stock price soared 160% after starting to buy Bitcoin, it has now fallen to pre-purchase levels, reflecting investors' dissatisfaction with its purchase speed.

Estes said: "When you combine Wall Street and cryptocurrencies, you need a market that can support this harvest."

To expand their scale, many such companies are planning to go beyond being merely cryptocurrency pools listed on global securities exchanges.

Diamond said his investment tool focused on HYPE tokens might acquire other crypto vault companies. "If they are in trouble, we can acquire and rebuild them," he said. "This will create opportunities for the strongest, frankly, by buying those companies that are poorly managed or underfunded."

Meanwhile, Japan's Metaplanet, the fifth-largest corporate Bitcoin buyer globally, plans to borrow against its massive token reserves and transform into a crypto financial services company.

US thermal company KULR is also exploring "Bitcoin-backed financial services" such as lending, and Panther Metals' CEO Darren Hazlewood says he plans to use its Bitcoin holdings to fund future exploration projects.

Benoist of Natixis CIB said: "The natural evolution is financial services, because you can use a pile of Bitcoin to support your financial commitments."

Source: Ethan Miller / Getty Images

Participants pose for a photo after US Vice President JD Vance delivered a keynote speech at the Bitcoin conference in Las Vegas. The stock prices of companies with insufficient crypto purchase speeds have begun to decline.

However, cryptocurrency lending is a high-risk business. In 2022, the lending market collapsed due to a series of defaults triggered by price drops, leading to the collapse of exchange FTX.

Benoist added: "My main concern with this strategy is that I don't quite understand how it will end. Companies get caught in a cycle where they must continuously purchase more to maintain the cycle, then return to the market to buy more - this cycle must continue to justify the premium."

The biggest risk is how deep the damage will be when - or if - cryptocurrency prices crash. Inevitably, a crypto market downturn means stock prices of companies tied to tokens will also decline.

Companies that have taken on debt face greater risks, as they need to pay interest to investors and may be forced to raise more funds or sell their crypto holdings to meet debt obligations.

A crypto hedge fund manager said: "If you're using debt to repay existing debt, this structure is very unhealthy and makes me very uneasy." He added: "You might face systemic risks because there are too many such fragile structures that need to be completely or partially unwound, which will put pressure on the market."

He also said: "I hope regulators will regulate this, rather than everyone assuming the market will always rise and building vaults."

Investors say they are aware of the risks but are eager to make money during the boom. Evans of UTXO Management, who serves on the board of several crypto vault companies, says he is pushing CEOs to "have cash-generating methods during market downturns through operational businesses and generate returns from Bitcoin through means other than raising capital".

However, even industry stakeholders are becoming increasingly skeptical. Estes said: "This will end with a bubble burst. They can rise as quickly as they can fall."

Click to learn about ChainCatcher's job openings

Recommended reading: