Author: Martin, W3C DAO

By the end of June 2025, a listed company called BitMine Immersion Technologies launched an Ethereum treasury plan, acquiring over 135,000 ETH in the past 10 hours, with total holdings breaking through 1.3 million ETH, and the company's chairman Thomas Lee publicly declared: "Our goal is to hold 5% of the global Ethereum."

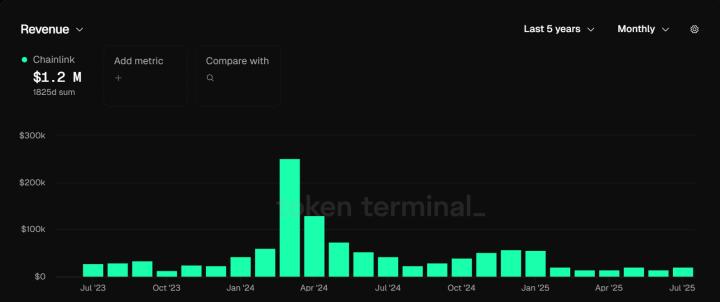

This is not an isolated case. From traditional gaming company SharpLink to investment institution BTCS, listed companies are hoarding Ethereum at an unprecedented speed. Strategic ETH reserve data shows that as of August this year, institutional holdings of ETH have reached 8.3% of the total supply, doubling from 3% in early April.

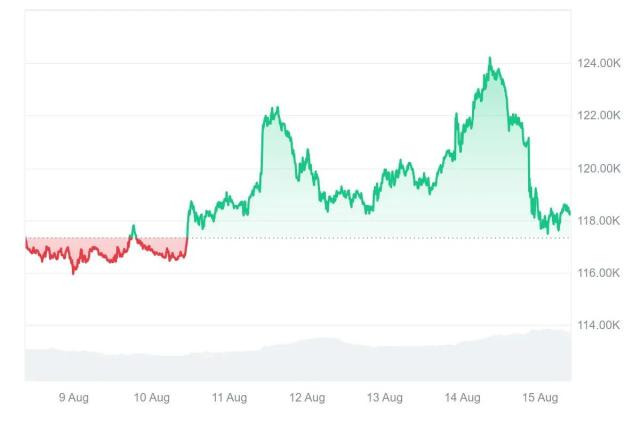

During the same period, Ethereum price soared from $1,385 to $4,788, with daily trading volume climbing to the $4.5-4.9 billion range. Wall Street analysts have begun to call ETH "digital oil" - both the energy driving the blockchain economy and an indispensable strategic reserve in institutional asset allocation.

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and meaning while translating to English.]It is not only a better "digital gold" - but also a productive asset connecting traditional finance and the crypto world, serving as the settlement layer for the RWA trillion-dollar market, and the infrastructure for the AI agent economy. Every additional ETH in corporate treasuries is voting for this value reconstruction.

As Bitmine said during its transformation: "We are betting not on token prices, but on the operating system of the entire digital economy". When Ethereum sheds its old labels, the golden age of the smart contract ecosystem is just dawning.

BlackRock is hosting $2.4 billion in government bonds on Ethereum, Sony is building a metaverse on Layer 2 - the entry of the traditional world signals that the "institutional narrative" of Ethereum has just turned its first page.

The more profound impact is the reconstruction of financial infrastructure. As the on-chain trend of RWA (Real World Assets) accelerates, a $16 trillion market opportunity is opening up, and Ethereum, as the underlying platform, is poised to become the core infrastructure of the next-generation financial system.

When Ethereum occupies 81% market share in the RWA market and 54% in the stablecoin market, a question is worth pondering for investors: Are we witnessing a replay of another Bitcoin story, or the beginning of a more profound "digital oil" revolution?