The cryptocurrency market has entered a correction, falling from a peak of $4.08 trillion on August 15 to around $3.89 trillion today. That’s a 4.6% drop in less than a week, putting most categories under pressure. Smart contract platforms and DeFi Token led the retreat. Despite the volatile landscape, a few projects stood out as notable altcoins this weekend.

We have selected three coins/ Token that are showing signs of strong price growth. One coin is even attracting significant interest from “whales”.

Zcash (ZEC)

Zcash, known for its privacy-focused protocol, is showing signs of strength again after weeks of sideways trading. The price is up 9% over the past day.

On the 12-hour chart, ZEC price is approaching the resistance at $43.48.

Zcash Price Analysis : TradingView

Zcash Price Analysis : TradingViewWhat makes this move noteworthy is the growing consensus among momentum indicators: the 20-day EMA (red line) is on the verge of crossing above the 50-day EMA (orange line). This bullish shift usually precedes strong rallies.

A bullish EMA crossover occurs when the short-term EMA (like the 20-day EMA) moves above the long-term EMA (like the 50-day EMA). This shows that buyers are gaining strength and the trend may be turning bullish.

Meanwhile, the Bull Bear Power indicator has turned sharply towards the bulls, supporting the bullish momentum focused on the weekend.

The Bull Bear Power indicator shows the battle between buyers (bulls) and sellers (bears). When it is positive, the bulls are stronger; when it is negative, the sellers are exerting more pressure.

If this setup holds, ZEC could extend its rally to $45.99 and $47.12. However, a candle close above $43.48 would be needed for that to happen. The risk lies in losing the $39.60 mark, which would neutralize the bullish crossover narrative and send the Token back into consolidation.

To stay updated on TA and the Token market: Want more Token insights like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Chainlink (LINK)

Chainlink continues to cement its reputation as a leading oracle project, and recent on- chain activity has added momentum to this narrative.

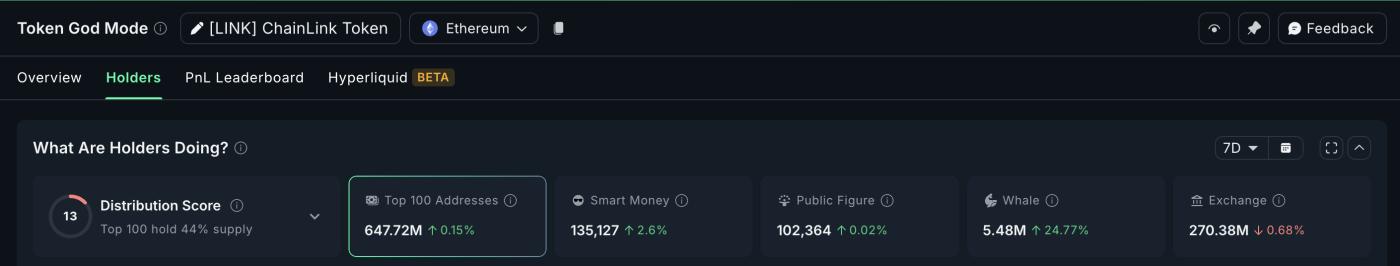

LINK Whales Make It One of the Top Altcoins to Watch: Nansen

LINK Whales Make It One of the Top Altcoins to Watch: NansenIn the past week alone, whales have accumulated 1.09 million LINK, a 24.77% increase in holdings, now worth nearly $27 million at current prices. Concentrated buying from large investors is rarely overlooked, and often creates a market underpinning, while also suggesting confidence in the project’s prospects.

LINK Price Analysis: TradingView

LINK Price Analysis: TradingViewTechnically, LINK is consolidating around $24.95, which is between the $24.69 (0.382) and $25.72 (0.5) Fibonacci retracement zones.

A successful breakout above $26.76 (0.618) could push the Token towards $28.23 and eventually the psychological $30.00 level.

Importantly, the current dip has created new entry zones just as demand from whales has increased, underscoring why Chainlink remains a top pick in any list of notable altcoins . However, a sustained break below $21.34 would invalidate the bullish setup.

Toncoin (TON)

Toncoin is slowly gaining market attention, both technically and fundamentally. On the chart, TON is trading near $3.28, within a week-long bullish channel. The price is consolidating just below the resistance at $3.35, and a breakout there could push the price to $3.51 and $3.70.

Adding weight to the bullish case is a hidden divergence: while the RSI (Relative Strength Index) has made a lower Dip , price has made a higher Dip ; a classic signal of underlying buyer strength and an upcoming reversal.

RSI tracks buying and selling momentum on a scale of 0 to 100. Divergence occurs when price and RSI move in opposite directions. For example, in a hidden bullish divergence, price makes a higher Dip while RSI makes a lower Dip . This often signals that buying pressure is secretly increasing despite the chart looking weak.

TON Price Analysis: TradingView

TON Price Analysis: TradingViewFundamentals provided further support. Verb Technology’s $780 million treasury strategy backing TON boosted investor confidence, while Ledger Live’s integration of native TON Staking opened up access to secure, non-custodial Staking to millions of users.

Together, these factors position TON as one of the strongest altcoins to watch this weekend. However, invalidation lies below $3.18, and a deeper slide below $3.09 would turn the trend neutral.