Japan’s Financial Services Agency (FSA) is preparing sweeping changes to its digital asset framework. The changes, which combine tax reforms and regulatory upgrades, could introduce exchange-traded funds (ETFs) tied to cryptocurrencies.

The initiative signals Japan’s intent to integrate crypto into mainstream finance and attract broader investment.

Tax Burden Under Review

The reform package, reported domestically, includes two key parts. First, it consists of revising the tax code that would move crypto from comprehensive taxation to the same category as equities. Second, it includes a legal amendment reclassifying crypto as a financial product, enabling the FSA to apply insider-trading rules, disclosure standards, and investor protections under the Financial Instruments and Exchange Act.

Currently, Japan taxes crypto gains as “miscellaneous income,” with progressive rates that can exceed 50 percent once local levies are included. Alternatively, equities and bonds are subject to a 20 percent flat tax.

According to Nikkei, the FSA has proposed moving crypto into that 20 percent system in fiscal 2026. Investors would also be able to carry forward losses for three years. Officials believe parity with stocks will reduce investor burden and increase market activity.

Regulatory Shift to Enable ETFs

The FSA’s second pillar involves amending securities law to classify crypto as a financial product. This would clear the path for crypto ETFs, including spot Bitcoin funds, which remain unavailable in Japan. Observers argue ETFs could provide accessible, regulated options for investors while boosting market transparency.

According to BeInCrypto, the agency also plans an internal restructuring, creating a bureau dedicated to digital finance and insurance. That reflects how crypto has become intertwined with broader financial systems, requiring consistent oversight.

Japan’s history with crypto illustrates both risk and resilience. In 2014, Tokyo-based Mt. Gox once processed over 70 percent of global Bitcoin trades before collapsing. Regulators embedded lessons from that crisis into today’s stricter frameworks.

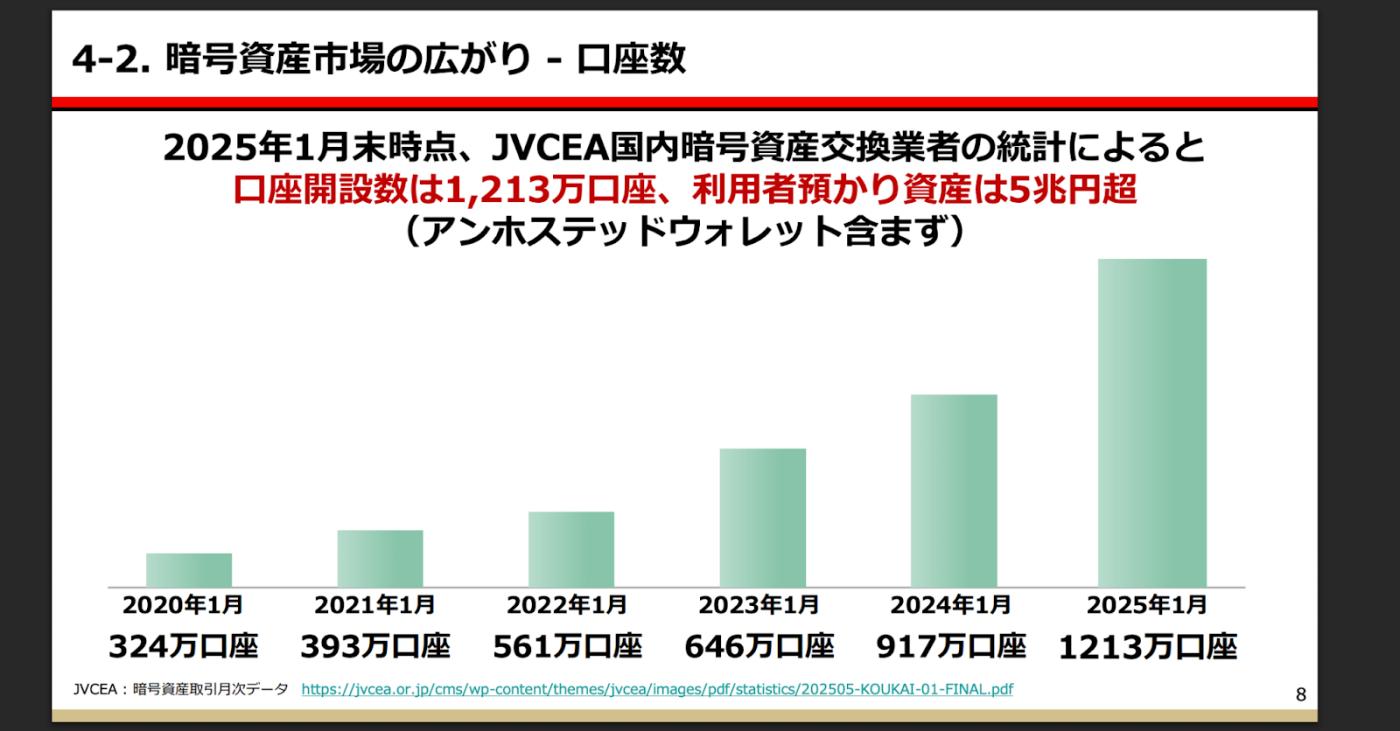

The number of custody wallets in Japan. Source: JVCEA

The number of custody wallets in Japan. Source: JVCEAMomentum has since shifted toward measured but steady growth. Japan Crypto Business Association Vice Chairman Shiraishi has documented the global market’s expansion from $872 billion to $2.66 trillion. In contrast, Japan’s domestic trading volume advanced from $66.6 billion in 2022 and is forecast to double to $133 billion. This underscores that while corporate adoption is accelerating, retail participation remains subdued.

88% Nationals Never Owned Bitcoin

A survey by the Cornell Bitcoin Club, cited by DocumentingBTC, found that 88 percent of Japanese residents have never owned Bitcoin. Analysts suggest that tax burdens and regulatory uncertainty have discouraged wider household adoption. The FSA’s reforms aim to address these barriers by simplifying tax treatment and providing trusted ETF structures.

Institutional interest, however, is rising. A joint survey by Nomura Holdings and Laser Digital revealed that 54 percent of Japanese institutional investors plan to invest in crypto assets within three years, with 62 percent citing diversification benefits. The FSA also published the findings, noting preferred allocations of 2–5 percent of assets under management. The results highlight readiness among major financial players to embrace ETFs once regulatory conditions allow.

The reforms align with Japan’s “New Capitalism” agenda, emphasizing investment-led growth. By clarifying the legal framework and reducing tax burdens, officials hope to encourage households to treat digital assets as part of long-term portfolios rather than purely speculative bets.