New allegations have emerged, claiming that Binance is deliberately holding back Solana ’s growth to protect its BNB Token, causing controversy in the cryptocurrency market.

This adds to the list of times the largest exchange by volume has been accused of using market maker Wintermute to influence prices.

Is Binance secretly suppressing Solana in favor of BNB?

Analyst Marty Party sparked the debate on X (Twitter), alleging that Binance collaborated with market maker Wintermute to prevent Solana 's market Capital from surpassing BNB.

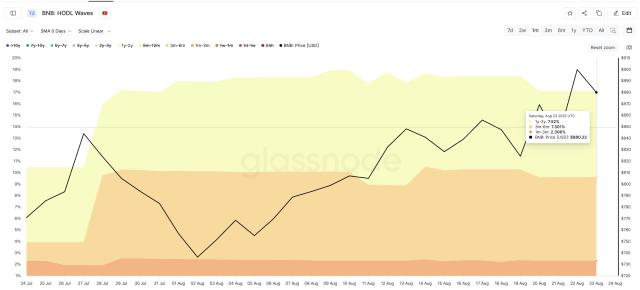

He Chia what he called “proof,” questioning how the Binance exchange could provide SOL for trading when its Proof of Reserves (PoR) showed no Solana beyond customer deposits.

At the time of writing, Solana is trading at $203 with a market Capital of $109.7 billion, second only to BNB ’s $865.97 price and $120.6 billion market Capital .

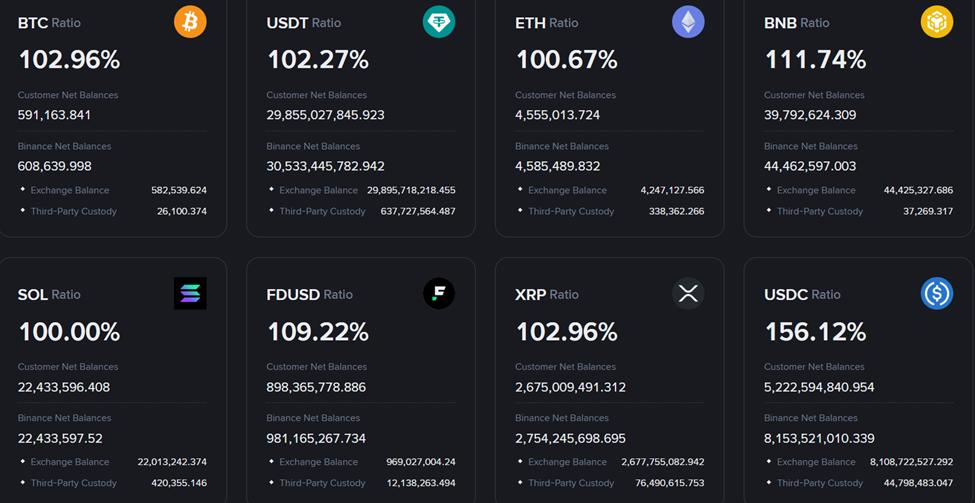

Indeed, Binance’s Proof of Reserves show no Solana beyond customer deposits of 22.433 million SOL Token. This includes 22.013 million in exchange balances and 420.35 in third-party custody.

Binance Proof of Reserves . Source: Binance

Binance Proof of Reserves . Source: BinanceMeanwhile, this is not the first time Binance and Wintermute have been linked to each other in market controversies.

Five months ago, it was reported that Wintermute was involved in coordinated sell-offs that drove down the price of smaller Token like ACT . Binance was also allegedly involved in the activity.

Similarly, seven months ago, Binance also faced scrutiny over $20 million worth of cryptocurrency transactions linked to Wintermute.

BeInCrypto reported that this has sparked heated debates about the murky relationship between exchanges and market makers . BeInCrypto has also explored the Vai of market makers beyond providing necessary liquidation and preventing price volatility.

Critics argue that if Binance used Wintermute to influence liquidation flows and stifle Solana, it would represent a direct conflict of interest.

More closely, this would undermine the credibility of both the PoRs framework and the fairness of open markets.

Industry experts call for action as market reaches crossroads

The allegations have raised questions about Binance's dominance and the vulnerabilities of markets controlled by centralized exchanges.

“So the ‘new’ system is worse than the old one? Why did we accept a system that is so fragile… corrupt… and manipulable? When will Binance be forced to shut down? Arrest them. Prosecute them,” wrote Alan Knitowski, founder and former CEO of NASDAQ-listed companies Cisco Systems and Phunware Inc.

These comments underscore the growing frustration among traditional finance (TradFi) veterans entering the cryptocurrency space, many of whom believe that blockchain markets will provide a more transparent alternative to legacy systems.

Instead, repeated allegations of manipulation and conflicts of interest may increase skepticism.

The allegations come at a crucial time for Solana, as it has seen explosive adoption in DeFi, Non-Fungible Token , and meme coins .

Its growth has positioned it as a potential challenger to Ethereum's scalability dominance , and now, apparently, to Binance's BNB Token .

Whether the allegations are accurate or not, the controversy reflects the fragile trust that underpins cryptocurrency markets.

On one hand, the Solana community sees a network that is moving toward mainstream adoption. On the other hand, critics argue that large players may be actively creating limits to protect their dominance.

This tension leaves regulators, investors, and developers with an unresolved question: How much power should centralized exchanges have over market outcomes?