Original | Odaily Odaily( @OdailyChina )

Author | Asher ( @Asher_0210 )

While it's not altcoin season, projects with significant momentum have still seen significant gains. Bio Protocol (BIO), a popular project in the Desci sector, has surged over 230% this month, breaking through $0.30 at one point and repeatedly appearing on Binance's gainer charts. This momentum stems from the launch of its first AI agent project on its own Launchpad platform.

Bio Protocol : Desci sector leader

BIO Protocol is an innovative platform within the DeSci sector dedicated to funding and commercializing scientific research in the biotechnology sector. Through the protocol, patients, scientists, and biotech investors worldwide can jointly fund, create, and own tokenized biotech projects and intellectual property (IP), accelerating the advancement of biotechnology.

The BIO Protocol platform has four core functions:

- BIO Launchpad: The new listing section is divided into three phases: the governance phase: BIO holders vote to decide which BioDAO projects can be launched through the BIO Protocol; the acceleration phase: projects raise the first round of funds through auctions and other mechanisms; the separation phase: projects enter the open market through the on-chain liquidity pool, and the BIO Protocol provides liquidity support.

- BioDAO Launchpad: BIO Protocol supports the creation and development of BioDAO, helping it complete its legal governance framework, brand building, and Web 3 tool deployment.

- Liquidity Protocol: BIO Protocol provides an on-chain liquidity pool, supports liquidity trading of BioDAO tokens and ETH, and promotes the healthy development of the DeSci ecosystem.

- Tokenized Intellectual Property: BIO Protocol tokenizes scientific intellectual property, giving it liquidity and enabling investors to participate in the value creation of biotechnology assets earlier.

BIO Protocol launches its first BioAgent project, Aubrai

The short-term surge in BIO token prices is due to the launch of Aubrai , the first IPO project on BIO Protocol's Launchpad V2 platform. Aubrai is a decentralized scientific intelligence jointly developed by VitaDAO and BIO Protocol to combat human aging.

20% of the total token supply is used for new issuance

According to the Aubrai token economic model, the total supply of tokens is 2 million, and the specific distribution details are as follows:

- New issuance (called Ignition Sale on the platform): 20% of the total token supply;

- Liquidity pool: 6% of the total token supply;

- Treasury: 15% of the total token supply;

- Initial funders: 20.1% of the total token supply;

- Allocation to LEVE: 10% of the total token supply;

- Allocation to VitaDAO: 22% of the total token supply;

- Allocation to Bio Protocol: 6.9% of the total token supply.

Among them, the FDV of the new shares during the sales period is set at approximately US$269,000. After the sales are completed, AUBRAI is expected to be listed on the secondary trading platform with a FDV of approximately US$896,000.

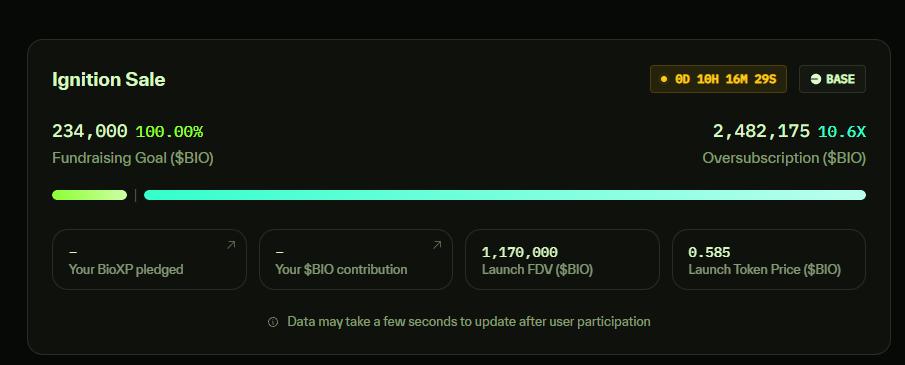

The new issue is still in progress and is currently oversubscribed by 10.6 times

Aubrai's new offering on the BIO Protocol platform opened last night. The process will last for 24 hours, after which the tokens can be traded on the secondary market. It is currently oversubscribed by 10.6 times, with nearly 2.5 million BIO tokens subscribed, worth approximately US$500,000.

AUBRAI new data on BIO Protocol

You need BioXP points to participate in new stock issuance

In addition to holding BIO tokens, BioXP points are crucial for determining the number of tokens awarded when participating in the BIO Protocol platform's new token offering. BioXP is a points-based rewards system that tracks and rewards users for their contributions to the BIO Protocol ecosystem. Typically, BioXP points expire 14 days after being earned (special retroactive points allocated to early supporters will expire one month after the first V2 Ignition Sale). Furthermore, a single user cannot purchase more than 0.5% of the total token supply.

Three ways to earn BioXP points

The platform for checking BioXP points is: https://app.bio.xyz/bioxp . There are three ways to earn points:

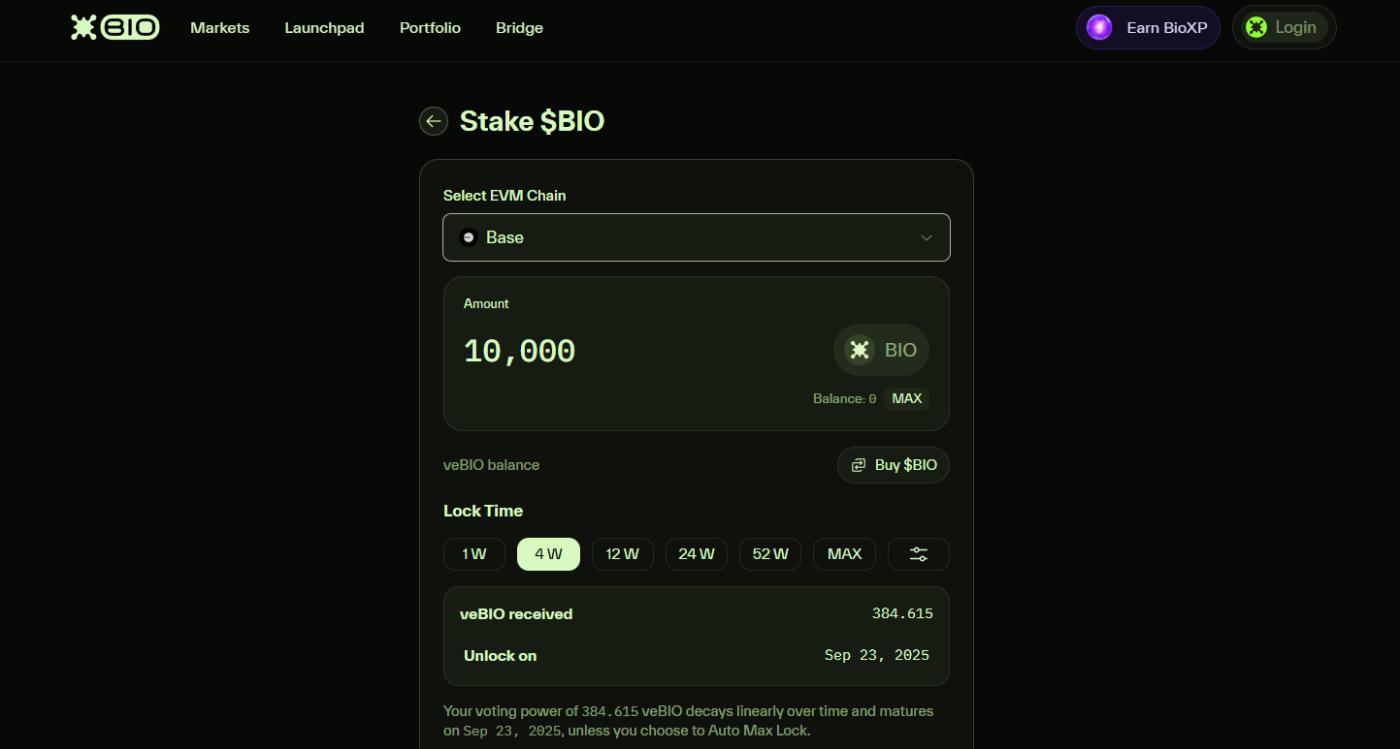

- Staking BIO tokens: Staking the same amount of BIO tokens with different lock-up periods will result in different veBIO tokens and daily points earned.

- Staking other Desci ecological projects on the platform: In addition to staking BIO tokens, you can also stake tokens of other Desci ecological projects supported by the platform to earn points;

- Post content about BIO Protocol or supported projects on the X platform to earn points (users must first bind their personal X account on the platform).

It is worth mentioning that 85% of the points allocated daily by BioXP will be distributed to BIO token stakers, and only 15% will be used to purchase ecological tokens and Yapper, so the price of BIO will skyrocket in a short period of time.

The opening market value is less than one million, and participating in the new listing may bring good returns

According to official data, Aubrai's initial market capitalization was only $200,000, and its opening market capitalization was only around $900,000. This low initial market capitalization suggests significant upside potential for investors. Considering the popularity of previously popular IPOs like Virtual, it's not impossible for the opening market capitalization to exceed $5 million or even $10 million.

It's worth noting that Aubrai isn't just any IPO. As the first BioAgent IPO, it's jointly developed by VitaDAO and BIO Protocol . Its dual narratives of Desci and AI Agents suggest strong potential for near-term hype.

Compared to Virtuals Protocol, BIO Protocol is still in its early stages of IPO. Will you participate in this event?