Source: Purpose Investments

Original title: It's Beginning to Look a Lot Like Market Recap Time 2025: Tech and Crypto Edition

Compiled and edited by: BitpushNews

It's that time of year again when we gather product managers and fund managers to review the market performance in 2025 and look ahead to the next 12 months.

This year, two main themes have been present throughout: despite persistent volatility, the institutional viability of digital assets continues to grow; meanwhile, big tech stocks have remained at the heart of market discussions. With these thoughts in mind, we interviewed Paul Pincente, Vice President of Digital Assets at Purpose Investments, and fund manager Nick Mersch to discuss the dramatic changes of the past year and potential future trends.

Will the AI boom continue to create miracles in 2026, or will investors face disappointment after being overhyped?

Nick Mersch's (fund manager) opinion:

In my view, the AI hype is the most dazzling decoration on the "Christmas tree" of the market in 2025. More importantly, it's no longer just a spark. Now, real revenue, real workloads, and tangible budget projects are flowing steadily into AI. While hyperscale cloud providers are aggressively investing in capacity, this is increasingly matching the needs of enterprises moving from pilot phases to full production. Customer support, code assistance, advertising, data analytics, and internal productivity tools are all beginning to show measurable benefits. This is key to transforming capital expenditures (CapEx) from a gamble into long-term annuity income.

Yes, the scale of investment is staggering, ranging from hundreds of billions of dollars in capital expenditure plans to massive electricity purchases. But this may also be building a foundational layer of computing and energy that the entire economy could rely on for the next decade or even longer. Every new model, agent, and application launched by 2026 will require an operating environment, and those platforms that have built capacity early on will be the first to capture these expenditures. AI is behaving more like a multi-year wave of infrastructure and productivity gains than a fleeting frenzy.

Are there bubble risks in individual stocks? Absolutely. Some stocks are priced not only to reflect perfect expectations, but even to an absurd degree. However, this is not the same as saying the entire AI cycle is a mirage. In 2026, investors will have the opportunity to participate in this long-term trend while maintaining cautious exposure. We advocate focusing on companies with the following characteristics:

It has a clear path to monetization;

It can convert AI capital expenditures into recurring revenue and cash flow;

It occupies key links such as computing power, network, energy or distribution.

In my view, the magic hasn't disappeared; it's just shifting from "storytelling" to "execution," which will ultimately benefit disciplined stock pickers.

For the cryptocurrency world, the volatility at the end of 2025 was like a sled gliding across a half-frozen gravel road. Will the journey in 2026 be smoother?

Paul Pincente (Vice President of Digital Assets) offers the following perspectives:

First of all, this feeling of turbulence isn't your imagination, and you're not alone in feeling nervous. Cryptocurrency has always been like that kind of passenger: one side insists the road conditions are good, while your teeth chatter like an overactive simulated bird.

However, a rough road surface does not necessarily mean that the carriage is damaged.

In my view, this year-end turmoil is less a solemn funeral bell and more a routine, albeit somewhat dramatic, "housekeeping" exercise in the high-beta asset class. After a strong rally, excess leverage must be deflated, bubbles must be deflated, and the boldest narratives must be tested under the cold light of real positions. This is the season when the market forces confidence to "prove its innocence."

So, will 2026 be a stable year? We should use that word with caution. Cryptocurrency is not a calm lake, but a turbulent and bifurcated river. However, I do think its volatility may become more mature. Not more docile, but more understandable. This could mean fewer “system crash” headlines and more recognizable risk asset BlockBeats.

Furthermore, there's a practical reason to remain optimistic. If macroeconomic conditions allow for a more supportive policy stance and inflation performs well enough to avoid triggering new policy panic, risk appetite typically tends to revert to its previous state. When it does, cryptocurrencies rarely tiptoe back in; instead, they burst in like a band asked for an encore.

So yes, we believe you can anticipate drama, tension, and the market turning over-leveraged people into cowards and patient people into philosophers. But we believe you shouldn't mistake a bumpy December for a doomed decade. Sometimes, the bumps are simply the price of a better road.

Tech stocks have consistently enjoyed valuations that gleam like shop windows in a high-end department store. Are these valuations sustainable, or will the harsh realities of the market freeze the industry?

Nick Mersch's opinion:

Tech stocks are indeed in a full-blown "holiday window" mode in 2025, but beneath the glitter, we believe there is more substance than pessimists admit.

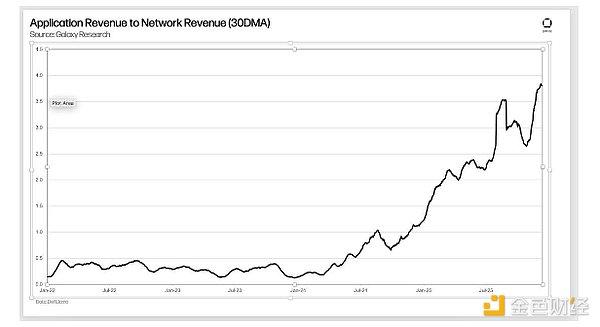

Earnings revisions for key AI beneficiaries are generally trending upward, with improved margins as cloud and software scale up, and many balance sheets remaining net cash or low leverage. I believe we are witnessing the largest capital expenditure cycle in tech history, with hyperscale service providers guiding annual AI spending of tens of billions of dollars. However, their starting point is their dominant market position and strong cash flow engine, which may provide a greater buffer than in past cycles.

The key difference in 2026 lies in whether this brilliance is supported by fundamentals or merely a glimmer of hope. I believe some software and smaller AI stocks are significantly overvalued relative to current earnings. However, valuations in core infrastructure, cloud services, and specific platform companies appear to me more like "high but deserved" than pure speculation.

Rather than framing it as a binary "bubble or non-bubble" debate, we believe investors can view 2026 as a filtering mechanism. Companies demonstrating significant operating leverage in their AI investments and rising marginal returns on capital will be able to maintain or even expand their valuation premiums. Conversely, companies that merely talk about gigawatts (GW) and GPUs without a roadmap for unit economics may be most vulnerable when the downturn arrives. We believe the shine can continue, provided there are earnings to support it.

With ETF , regulatory, and institutional inflows finally on track, is cryptocurrency ready to hit the "adult table" this holiday season?

Paul Pincente's opinion:

There's an interesting tidbit about markets: they usually grow in the most inconspicuous way. Not through fireworks, but through pipes; not through poetry, but through policy, filings, and the slow calming of institutional nerves.

So when someone asks whether cryptocurrency is ready to join the adult table, I hear a question from someone dressed in a gown but with practical shoes on their feet.

The "adult table" isn't reserved for the loudest believers, but for assets that don't require constantly inventing new rules to hold. Investors want to know what the rules are, who enforces them, and where the exits are when the room gets crowded. This last point is crucial. Liquidity is always welcome on a sunny day; the real "adult test" begins when the weather turns cloudy.

ETFs help, not because they work some kind of magic to sanctify assets, but because they translate assets into a language that institutions already understand. Even delayed regulation alleviates the famous excuse of "we're waiting for clarity." Custody and operational standards, though dry, have become a watershed between curiosity and actual allocation.

The story extends beyond Bitcoin. Stablecoins are quietly proving they are more than just convenient tools for cryptocurrencies; they are becoming the backbone of real-world payments. Tokenization is moving from pilot projects into the future, no longer resembling a marketing stunt, but rather infrastructure.

Will 2026 be more demure? No. Cryptocurrency still loves grand entrances; it may dress in a sequined gown at an adult's table. But the seating arrangement has changed. The guest list now includes more rule-followers, more long-term allocators, and more capital that won't panic at the first signs of volatility.

This is how a market becomes difficult to destroy: not by becoming boring, but by becoming reliable enough to survive in its own excitement.

Is the AI model the star on top of a Christmas tree, or just a cheap decorative gold bar?

Nick Mersch's opinion:

If the past three years have been about breakthroughs in models, then 2026 may well be about what those models can actually do in the real world. Tech companies are shifting from a race to "build the biggest system" to a race to "deeply embed systems into workflows." This means agentic AI capable of handling multi-step tasks, multimodal systems that integrate text, images, audio, and video, and vertically tuned products that understand industry-specific language. The opportunity lies not just in sophisticated demonstrations, but in lasting productivity gains across white-collar jobs.

As we argued in July, the message for companies and investors is simple: adapt now or risk being left behind. We believe the winning organizations won't be those releasing the coolest models, but rather those quietly replacing manual processes with AI-first workflows, redesigning products around intelligent assistants, and building governance, security, and data quality pipelines. This is where high sticky revenue and higher switching costs come from.

For investors, we believe this will shift the focus to the upper layers of the stack. Model providers remain important, but value is likely to increasingly concentrate in three areas:

A platform for orchestration models and intelligent agents;

Application vendors that deliver specific business outcomes, such as increased sales productivity or reduced support costs;

Enables the deployment of secure, observable, and compliant infrastructure and tools.

In this world, the starlight at the treetop isn't about the size of the model, but about customer influence. If a company can demonstrate shorter cycle times, fewer complaints, higher conversion rates, or lower unit costs thanks to AI, we believe the market will reward it. Otherwise, even the most dazzling ornament will eventually lose its luster.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush